Updated April 03, 2024

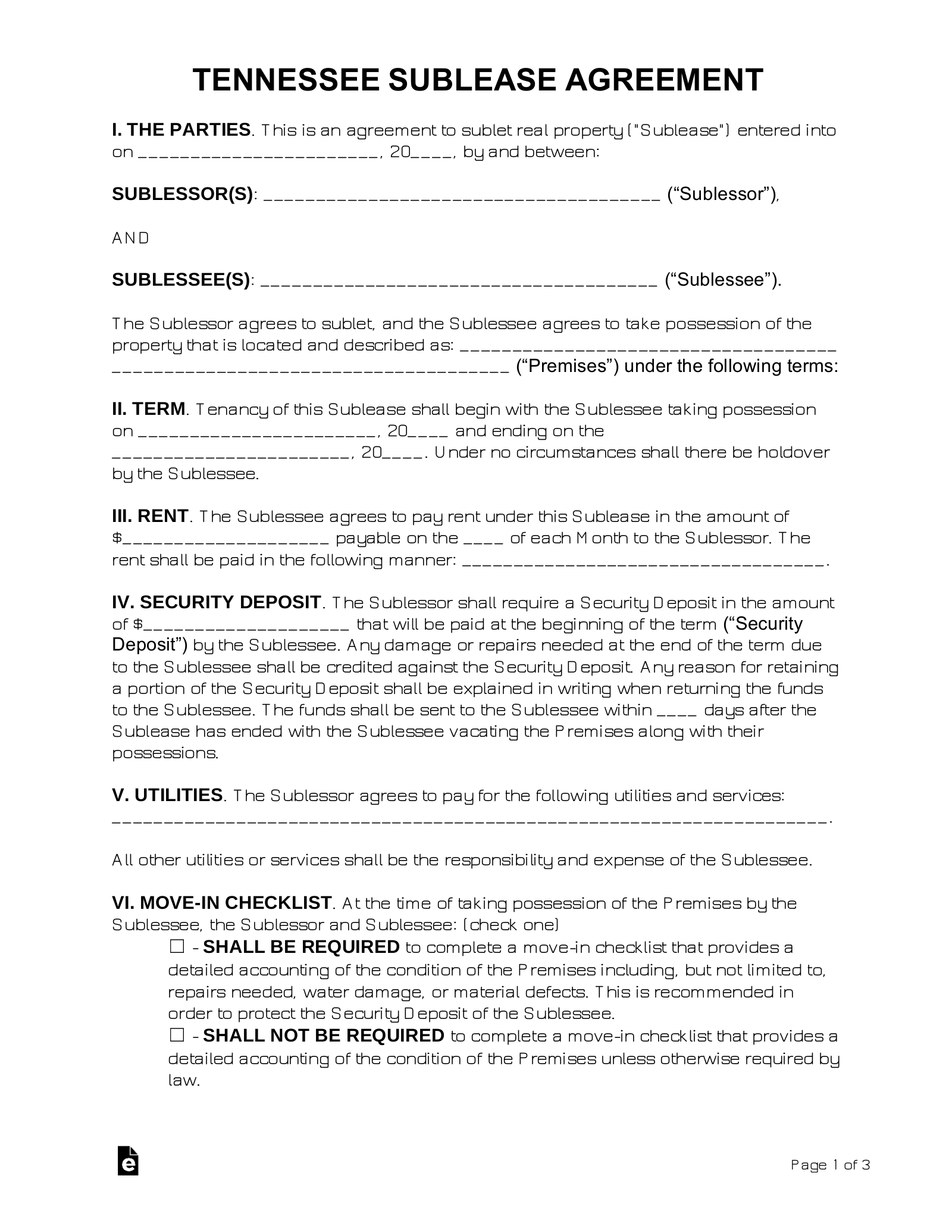

A Tennessee sublease agreement is used when a tenant wants to lease part or all of their rented home to another person. The tenant may wish to take on a roommate or move out entirely before their lease expires. In a sublease arrangement, the tenant (sub-lessor) acts as the landlord to the additional renter (sub-lessee) while remaining responsible for the original lease for the remainder of its duration.

Right to Sublet

Tennesse law does not automatically grant a tenant the right to sublet. Typically, the lease will state that the landlord’s permission is required before a sublease arrangement can occur. If the lease is unclear about subleasing or does not address the subject, it is recommended that the tenant contact their landlord for more information.

When a landlord’s permission to sublease is required, a Landlord Consent Form is a simple way to get it in writing.

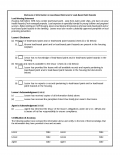

Short-Term (Lodgings) Tax

In Tennessee, several taxes apply to accommodations like rooms, homes, cabins, and condominiums that are rented to transient guests for a period of less than 90 days. The overall effective tax rate on these short-term rentals will vary by location because local taxes differ between cities.

Tennessee short-term rental taxes:[1]

- 7% state sales tax

- 1.5%-2.75% local sales tax (varies by city)

- State Business Tax (on rentals of less than 180 days)

- Local Business Tax (if imposed by the municipality)

Local Occupancy Taxes may also be imposed by individual municipalities but only if the rental is being offered through a short-term rental unit marketplace for a duration of fewer than 30 continuous days.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF