Updated April 22, 2024

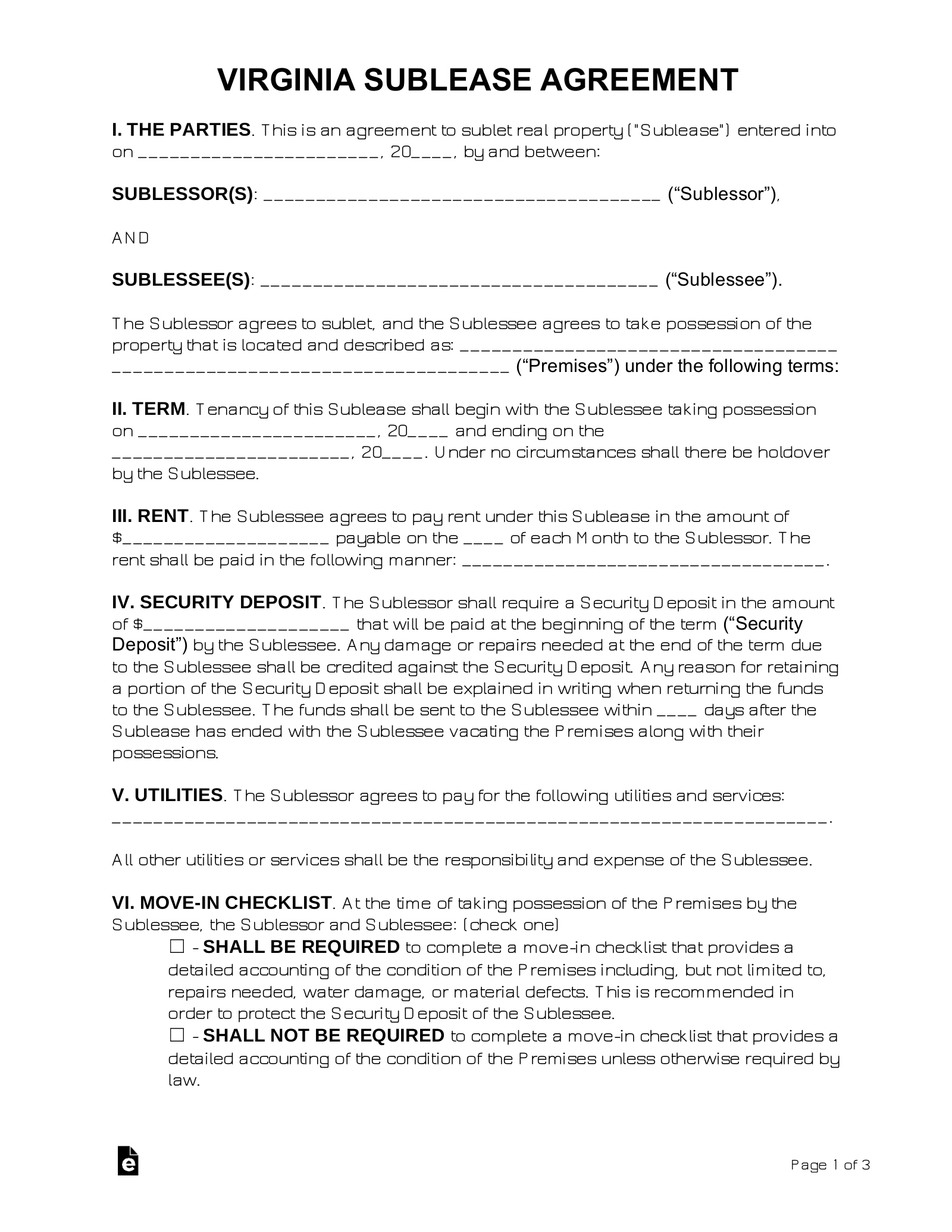

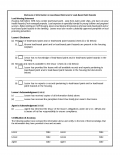

A Virginia sublease agreement is a contract used when a renter (sub-lessor) leases their residence to another person (sub-lessee). The sub-lessee might be a roommate or may take over the entire residence. The original tenant will act as a landlord to the sub-lessee while remaining legally responsible for the original lease until it ends.

Right to Sublet

Because Virginia law does not explicitly grant a tenant the right to sublet, the lease will determine whether subletting is permitted and what conditions might apply. Leases often require the tenant to obtain their landlord’s permission before subleasing.

If a lease is unclear on the matter, it is best to contact the landlord for more information. When the landlord’s permission to sublease is required, consider using a Landlord Consent Form.

Short-Term (Lodgings) Tax

In Virginia, accommodations rented out for fewer than 30 consecutive days are subject to state and local sales taxes, and local transient occupancy tax.

Virginia short-term rental taxes:

- 5.3% state sales tax[1]

- Applicable local sales tax (varies by county/state)

- Applicable transient occupancy tax (varies by county)[2]

The State Department of Taxation website offers a sales tax rate lookup by entering an address.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF