Updated April 05, 2024

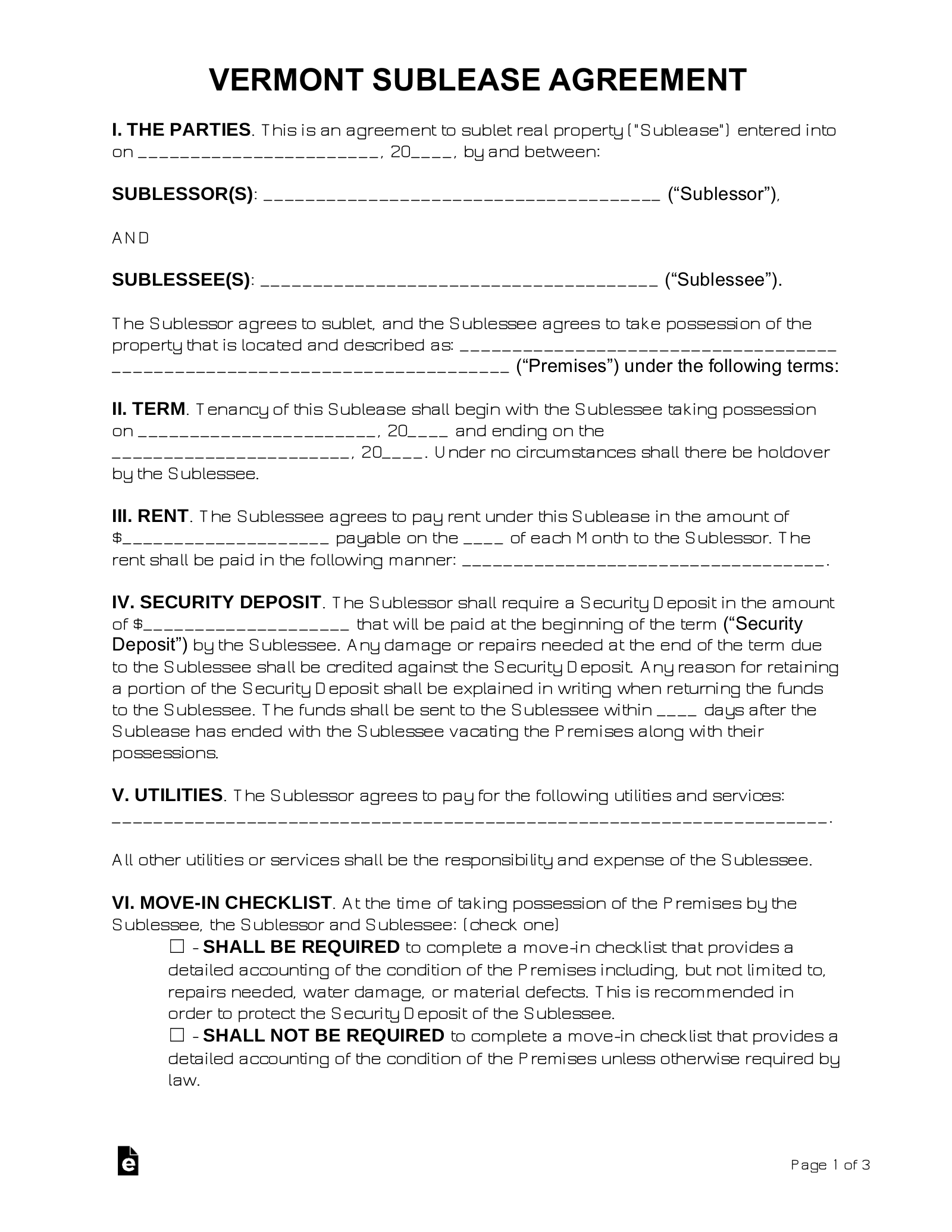

A Vermont sublease agreement is a rental contract used when an existing tenant leases some or all of their residence to an additional tenant before their lease has expired. It may be that the tenant wants to take on a roommate or even move out entirely. The sublease is made between the tenants, while the original tenant remains responsible for the original lease until it has ended.

Right to Sublet

Vermont state law allows landlords to condition or prohibit subletting as long as it is stated in the terms of a written rental agreement. Tenants may also be required to provide the name and contact information of any sublessee occupying the dwelling.[1]

If the lease is unclear about subleasing, tenants should contact their landlord for more information. When a landlord’s permission to sublet is required, consider using a Landlord Consent Form.

Short-Term (Lodgings) Tax

The Vermont Meals and Rooms Tax applies when a room or other type of lodging is rented for 15 or more days in a calendar year. However, these taxes do not apply if the rental is for 30 or more consecutive days.

Vermont short-term rental taxes:[2]

- 9% State Meals and Rooms Tax

- 1% Local Meals and Rooms Tax (if applicable)

Counties and cities may exercise the option to impose an additional 1% on the Meals and Rooms Tax. The Vermont Department of Taxes offers a list of cities and counties that levy the additional tax.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF