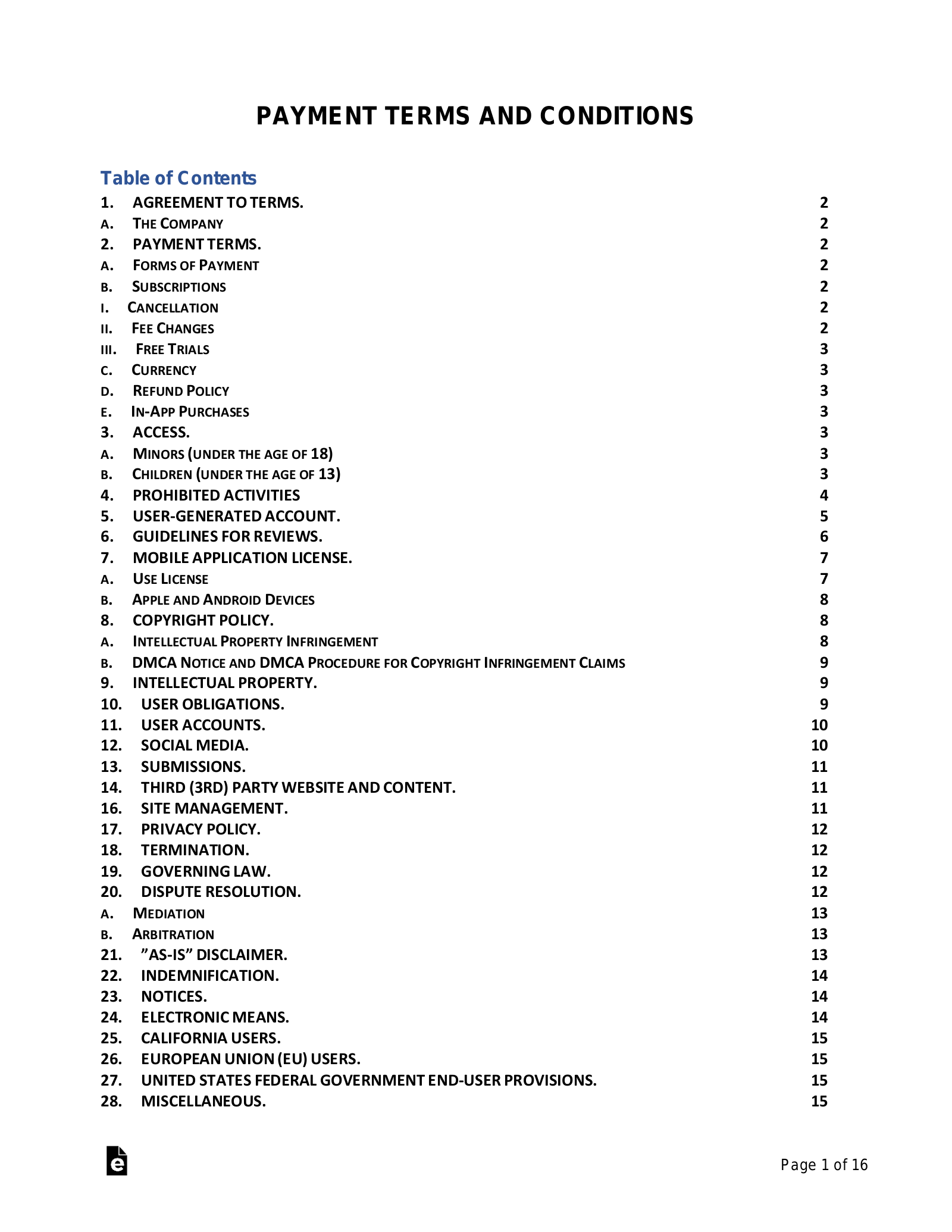

Updated January 25, 2023

Payment terms and conditions disclose a website’s payment policies regarding its products and services. The terms will be referred to if there is a dispute related to warranties, returns, and when payments are due.

For the terms to be legally binding with a user, the terms must be agreed to with a checkbox or ‘click requirement through a clickwrap agreement.

Main Purpose

Payment terms are generally made part of more extensive terms and conditions that covers other items such as liability, intellectual property, and governing law.

What to Include (5 Parts) |

1. Return Policy

A return policy outlines the terms and the process for returning a product, including:

- Return instructions;

- Pre-paid labels;

- Number (#) of days required;

- Condition of item;

- Shipping requirements;

- Restocking fees; and

- Redeemable for cash or store credit.

2. Refunds

The refund policy should be clearly defined if a website has products, services, or software as a service (SaaS). The policy should mention the reasons allowed for a refund and the process to receive it.

3. Warranties

- Products – Most companies will offer a set number (#) of days for returns in case of a defective product or if the product was not what was expected. If not, the website should clearly state that products are offered on an “as is, where is, and as available” basis.

- Services – Any labor provided should guarantee that it will be completed to the “customer’s satisfaction.” This implied warranty lets the customer feel safe and know that the company stands by the service provided.

- Software-as-a-Service (SaaS) – Due to users’ different needs for software, it should be offered on an “as-is, where-available” basis.

4. Payment Policy

- Credit Cards – The types of accepted cards, including American Express, since they typically charge 1 percent more than Visa and Mastercard and occasionally not offered.

- Currency – A website will commonly request to be paid in the currency where it is located. Although, most credit cards will still work and automate the conversion calculation.

- Pricing – Well-documented pricing should be mentioned or referenced via a URL. Additionally, it should be noted that the pricing terms are subject to change.

- Deposits – For service requests, a partial payment is generally required with the total balance to be paid upon completion.

- Partial Payments – If accepted, the term of the loan must be fully disclosed, including the terms, interest rates, and when payment is due (e.g. weekly, monthly, etc.).

5. Processing Fees

The website (merchant) typically pays the credit card processing fees when selling products and services.

Common payment methods include:

- ACH – ACH payments are commonly free since there is no fee charged by banks upon receiving, unlike bank wires.

- Crypto – Any crypto payment, via Bitcoin or other types, is charged to the buyer when sent to a merchant. There are no fees generally charged for crypto-related payments.

- Credit Cards – A merchant can charge a consumer for credit card processing in the 40 states that allow surcharges (view state laws).

- Debit Cards – Under the Durbin Amendment made effective on October 1, 2011 (§ 1693o–2), it prohibits merchants from accepting surcharges for debit card payments.

- Wires – If bank wires are accepted, a fee may be assessed per transaction.