Filing Fees

- Domestic: $50 (online); $50 (paper)

- Foreign: $100 (online); $100 (paper)[1]

How to Form an LLC

1. Find a Business Name

- Business Search: sos.iowa.gov/business

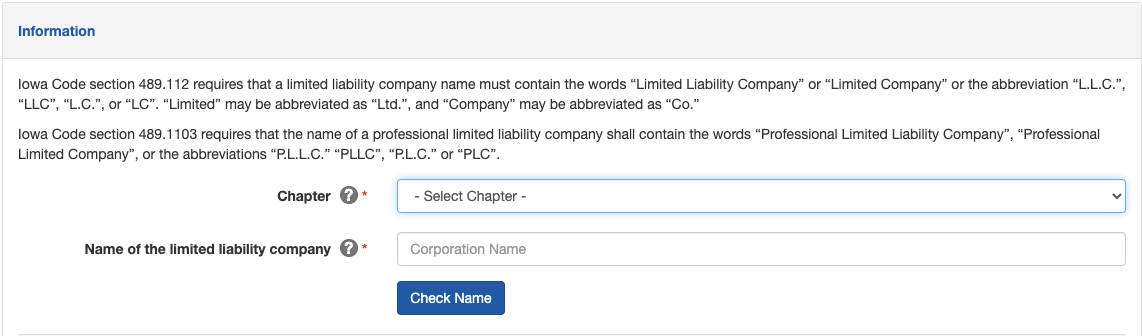

Enter your desired business name in the search field. If it is available, no results will appear on the search page. The name of your business must contain the terms “limited liability company,” “L.L.C.”, or “LLC.” “Limited” may be abbreviated as “Ltd.”, and “company” may be abbreviated as “Co.”[2]

2. Designate a Registered Agent

Both domestic and foreign LLCs in Iowa must appoint and maintain a registered agent and registered office. The agent must have a place of business in the state.[3]

3. Register the LLC

There are two ways to apply for the registration of your LLC: online or by mail.

Option 1: File Online

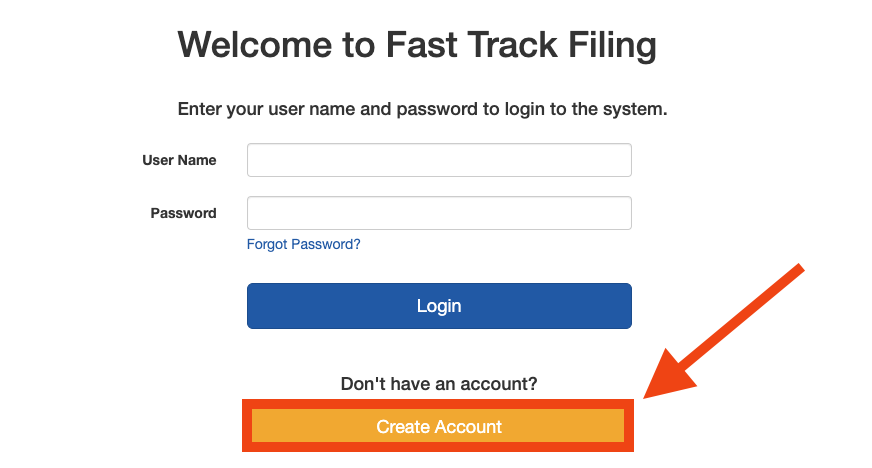

Go to filings.sos.iowa.gov to access the state’s online filing system.

Enter your name, mailing address, email address, and a new password. After signing up, you will receive a verification email.

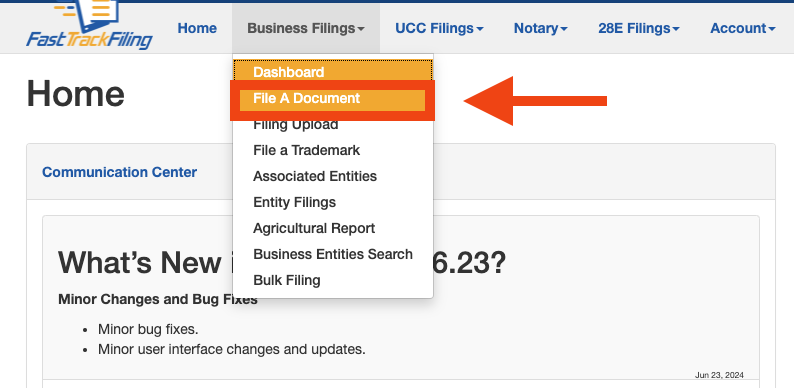

This dropdown menu is found under “Business Filings” on the dashboard. On the following page, select the appropriate link for the type of LLC you want to form.

Under “Chapter,” indicate whether your LLC will be a standard or professional entity.

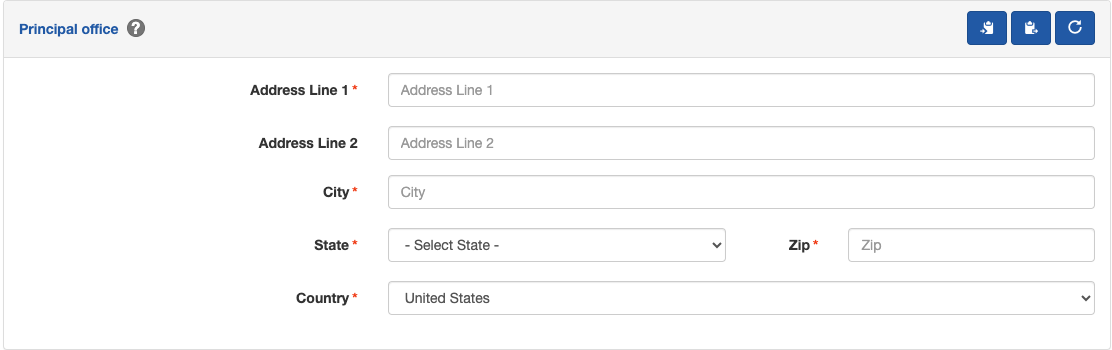

You must also provide a mailing address for your principal office if it’s different from the physical address.

Make sure to include all the required information on the form, including LLC name, principal office address, and more.[4]

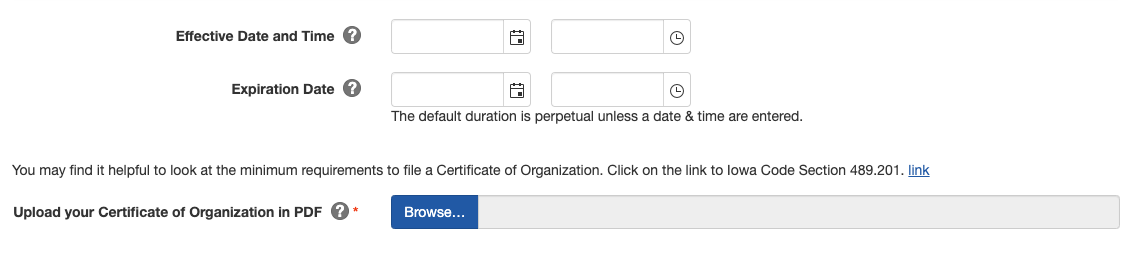

Enter an effective date and expiration date, if any.

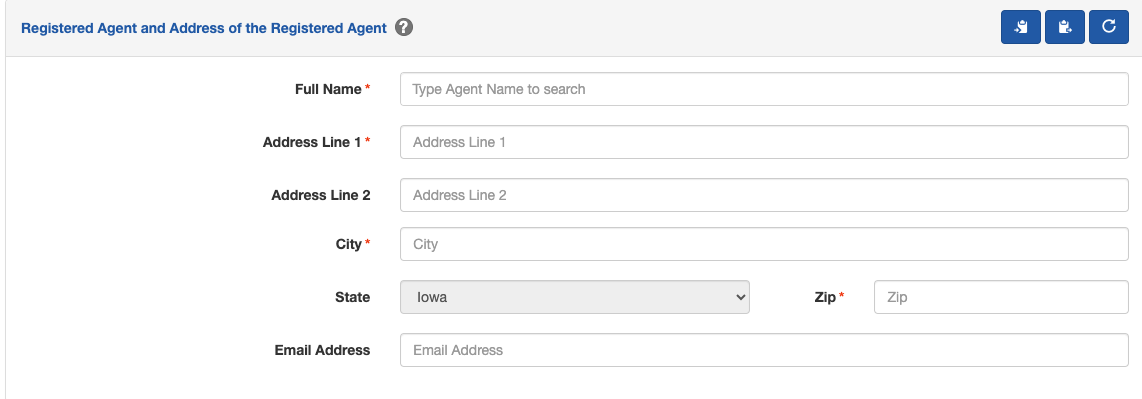

Provide the registered agent’s name, address, and email address. If their mailing address is different from the physical address, you must provide that as well.

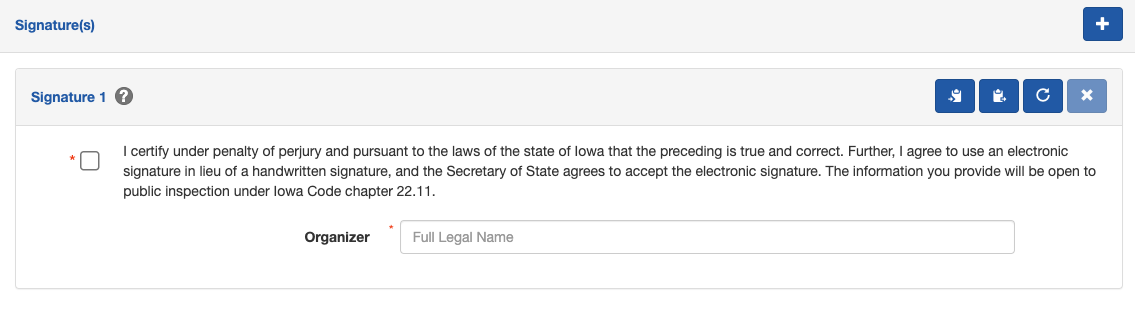

By signing your name, you are attesting under penalty of perjury that all the information provided is accurate.

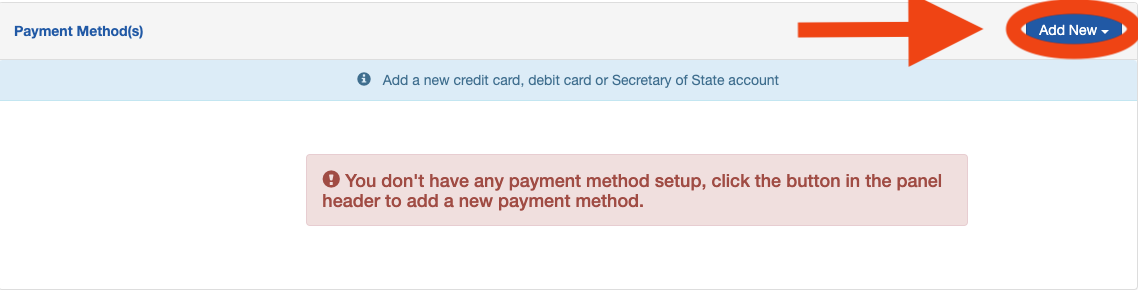

Provide your payment information to pay the filing fee of $50 (for domestic LLCs).

Option 2: File By Mail

Complete the appropriate form and mail it to the provided address with an enclosed payment.

The State of Iowa does not provide a template for a domestic LLC Certificate of Organization.

The State of Iowa does not provide a template for a domestic LLC Certificate of Organization.

Filing fee: $50 certified or cashier’s check made payable to the Secretary of State

Mailing address: Business Services Division

Lucas Building, 1st Floor, Des Moines, IA 50319

LLC Foreign Registration Statement – For out-of-state entities.

Filing fee: $100 certified or cashier’s check made payable to the Secretary of State

Mailing address: Business Services Division

Lucas Building, 1st Floor, Des Moines, IA 50319

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

Every LLC is required to apply for an Employer Identification Number (EIN) for tax identification purposes.

5. Write an Operating Agreement

In Iowa, LLCs are not required to draft an operating agreement. However, it is still recommended that one be drafted for internal organization.

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification

Below are the most common types of LLC tax classification:

- LLC – By default, an LLC is either a sole proprietorship (one member) or a partnership (two or more members). Income tax must be paid by each owner or partner.

- S-Corporation – In an S-corp, all business profits and losses are sent to the shareholders, who must pay income tax on the profits. To file as an S-corp, an LLC must file IRS Form 2553 within 75 days of formation.

- C-Corporation – In a C-corp, taxes are filed as a separate corporate entity. To file as a C-corp, an LLC must file IRS Form 8832 within 75 days of formation.

7. File Biennial Report

Every business entity in Iowa must file a report once every two years. It can be filed online for $30 or by mail or in person for $45.[5]