Updated March 21, 2024

An Indiana transfer on death deed, or TOD deed for short, is used to transfer real property to a designated beneficiary upon the property owner’s death. This document allows the transfer to bypass probate proceedings. A TOD deed can be revoked at any time.

Table of Contents |

Requirements

- Notary: Required (§ 32-17-14-12)

- Recording: Must be recorded with the recorder of deeds in the county where the property is located before the transferor’s death (§ 32-17-14-11 (a)(2))

- Witnesses: One disinterested witness (§ 32-17-14-12 (a)(3))

Legal Description

A legal description of the property is necessary for completing a transfer on death deed in Indiana. This information specifies the property’s exact location and may not be readily available online.

To locate a legal description, reference property tax statements or the current deed. The recorder of deeds may also have this information on file.

Example

“Lot 82, Block 2, of Littlejohn Mountain Subdivision, according to map or plat thereof as recorded in Plat Book 90, Page 10, of the Public Records of Marion County, Indiana.”

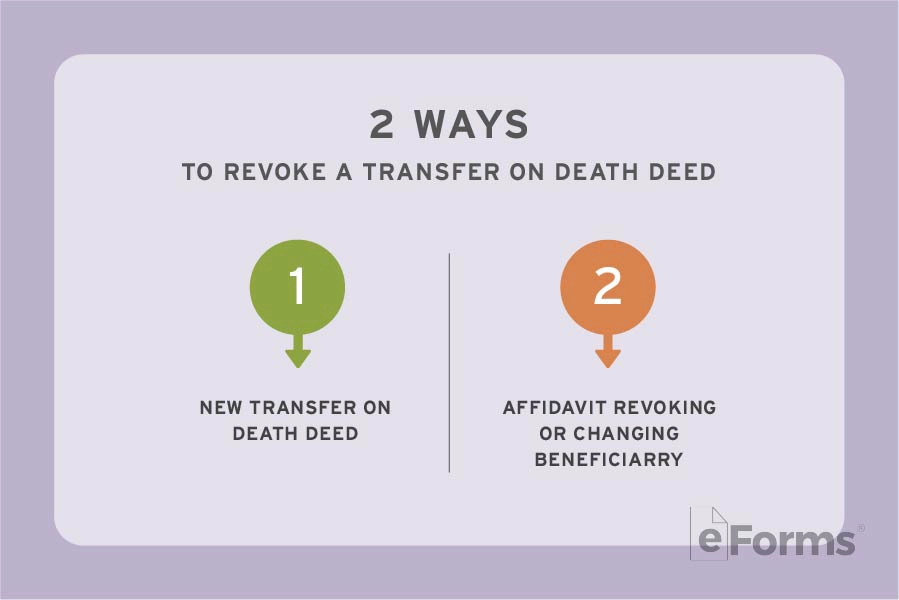

Revocation

A transfer on death deed can be revoked at any time prior to the property owner’s death. To revoke a TOD deed, a property owner may choose to (§ 32-17-14-16):

- Complete a new transfer on death deed; or

- Create an affidavit that revokes or changes the beneficiary designation.

Both of these documents must be notarized and recorded before the property owner’s death to be considered valid.

Where to Record

A transfer on death deed is considered void if it isn’t recorded with the recorder of deeds in the county where the property is located before the transferor’s death (§ 32-17-14-11 (a)(2)). Recording fees may apply.