Updated March 21, 2024

A Kansas transfer on death deed, or TOD deed for short, is a form that can be used to ensure that real estate is transferred directly to a successor following its owner’s death. It provides a way to avoid probate for real estate. The actual transfer of ownership does not occur until the death of the owner. The owner can revoke the transfer on death deed at any time during his or her life.

Table of Contents |

Requirements

- Notary: Required (§ 59-3502)

- Recording: Must be recorded with the register of deeds in the county where the property is located (§ 59-3502)

- Witnesses: Not required

Legal Description

To complete a TOD deed in Kansas, a legal description of the respective property is needed. This legal description delineates the tract’s exact location using longitude and latitude, distances from landmarks, a block number, and more.

Legal descriptions of properties in Kansas can be found on property tax statements or the current deed. The register of deeds should also have access to legal descriptions.

Example

“Lot 12, Block 6, of Hidden Forest Subdivision, according to map or plat thereof as recorded in Plat Book 10, Page 12, of the Public Records of Johnson County, Kansas.”

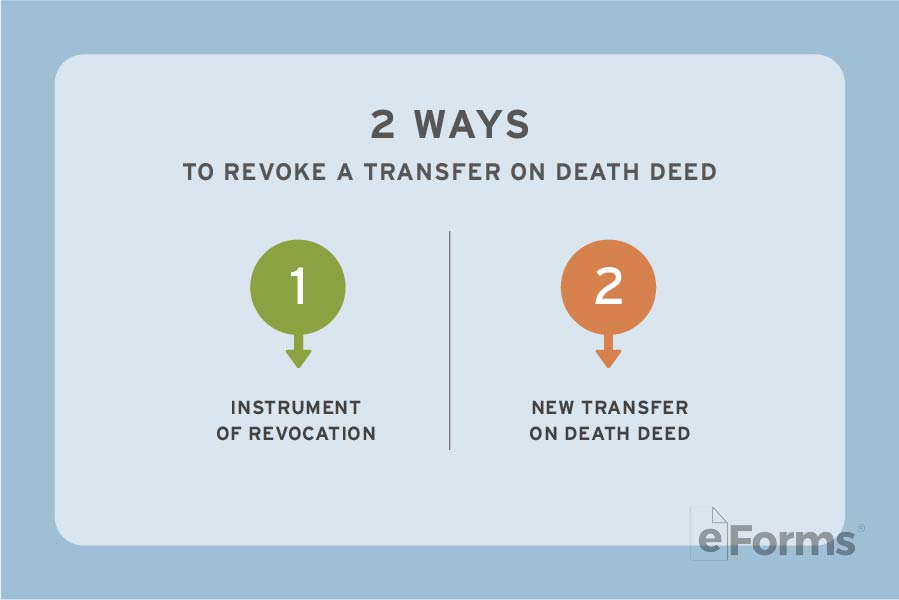

Revocation

In Kansas, a transfer on death deed can be revoked in one of two ways (§ 59-3503):

- Complete an instrument of revocation and get it notarized; or

- Complete and acknowledge a new transfer on death deed.

Each of these documents must be recorded with the register of deeds before the transferor’s death to be valid.

Where to Record

The original document should be recorded with the register of deeds in the county where the property is located. Every county may have specific instructions, additional requirements, and recording fees.