Updated September 26, 2023

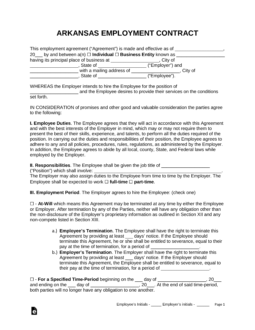

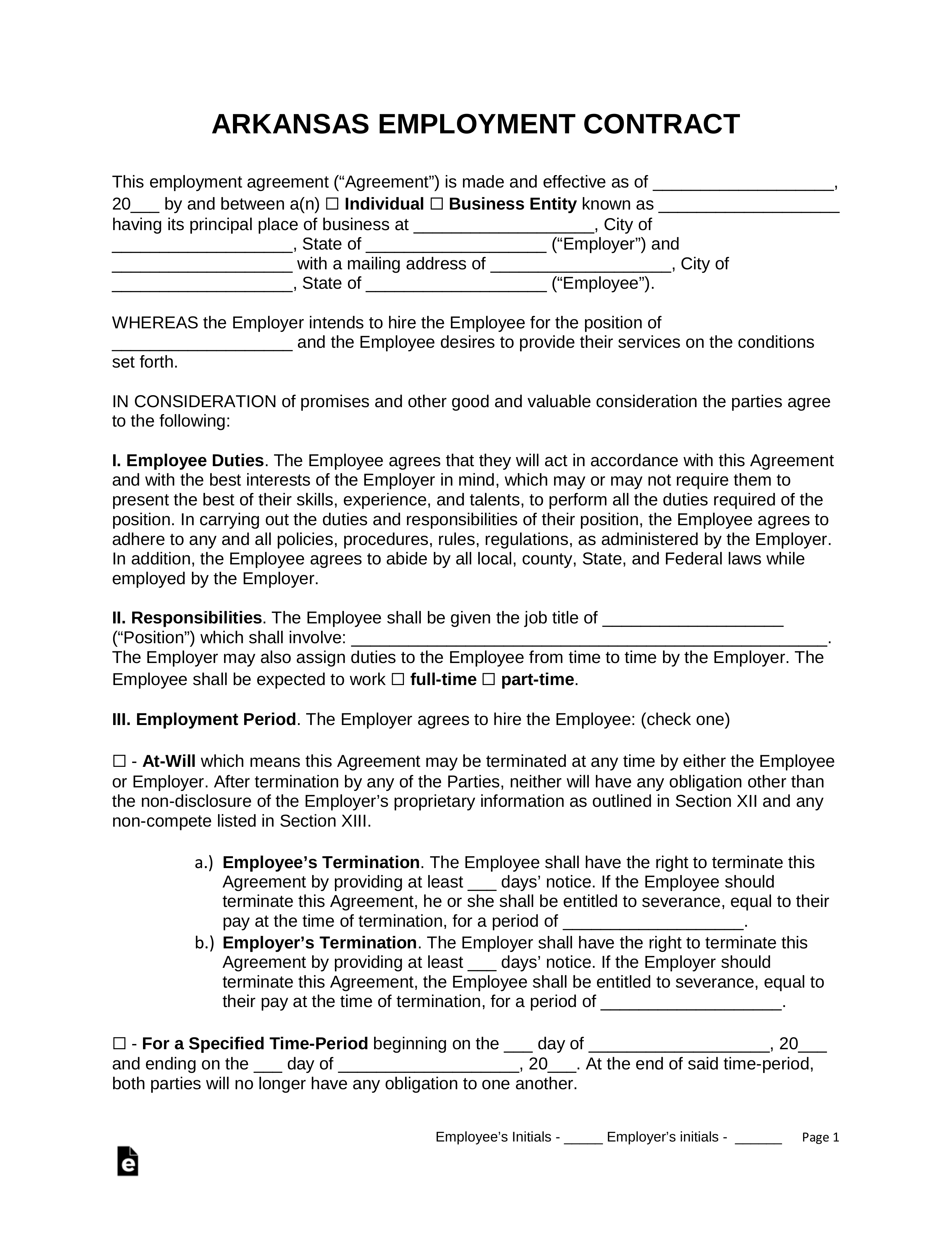

An Arkansas employment contract agreement is a document that governs the rights and obligations of an employee who is employed by a company or business. Typically used in cases where employees are in a high-level position, an employment agreement outlines an employee’s responsibilities and duties and establishes guidelines in regards to benefits, income, vacation time, and other elements of employment. Furthermore, this type of contract can help maintain the confidential nature of the employer’s information and protect their business from competing companies. Employment contracts can also be used in cases where an individual/business hires an independent contractor or subcontractor.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Protects employer’s proprietary information and trade secrets from employee disclosure.

Employee Non-Disclosure Agreement (NDA) – Protects employer’s proprietary information and trade secrets from employee disclosure.

Download: PDF, MS Word (.docx), OpenDocument

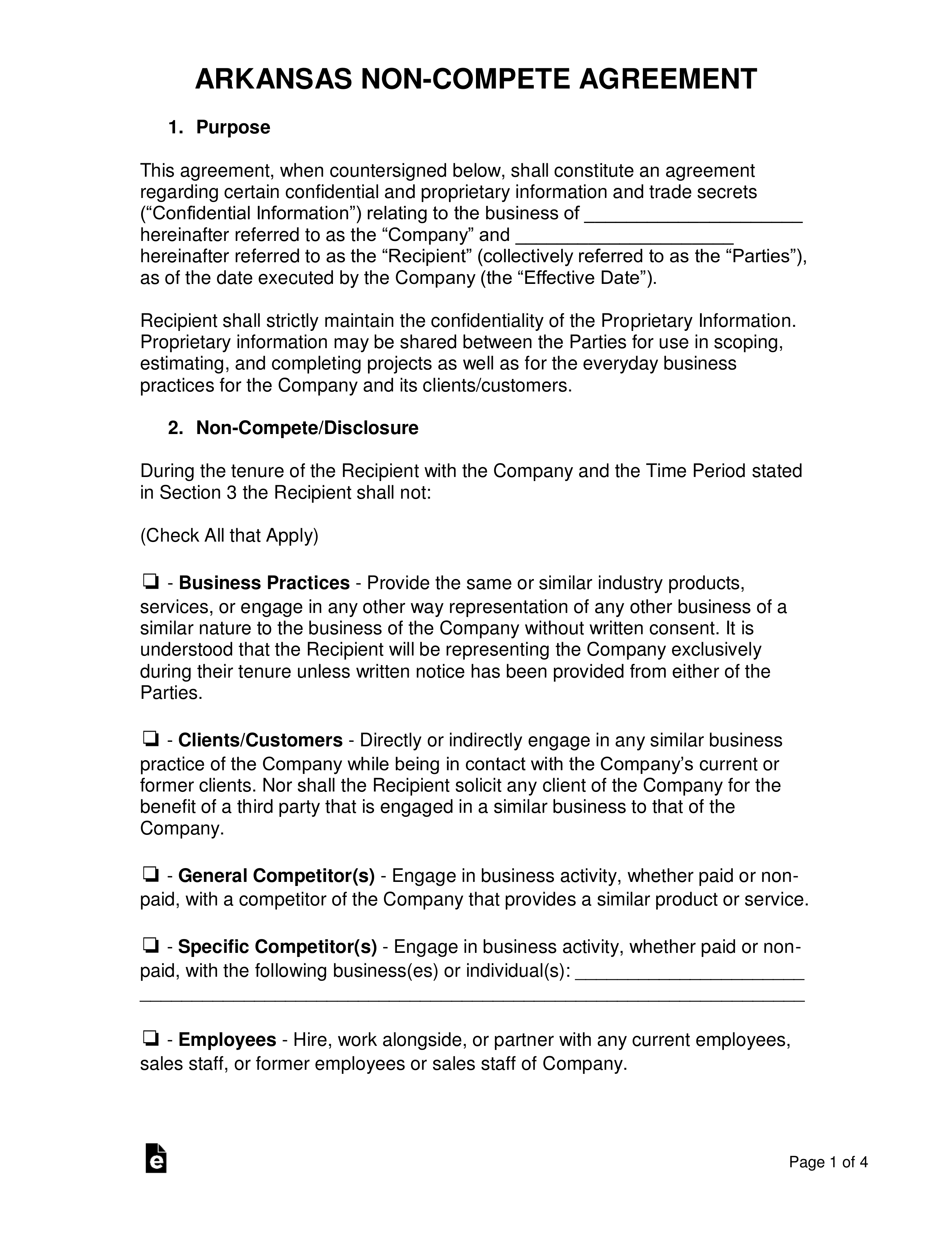

Employee Non-Compete Agreement – Protects employer’s business interests from competition directly or indirectly pursued by employee.

Download: PDF, MS Word (.docx), OpenDocument

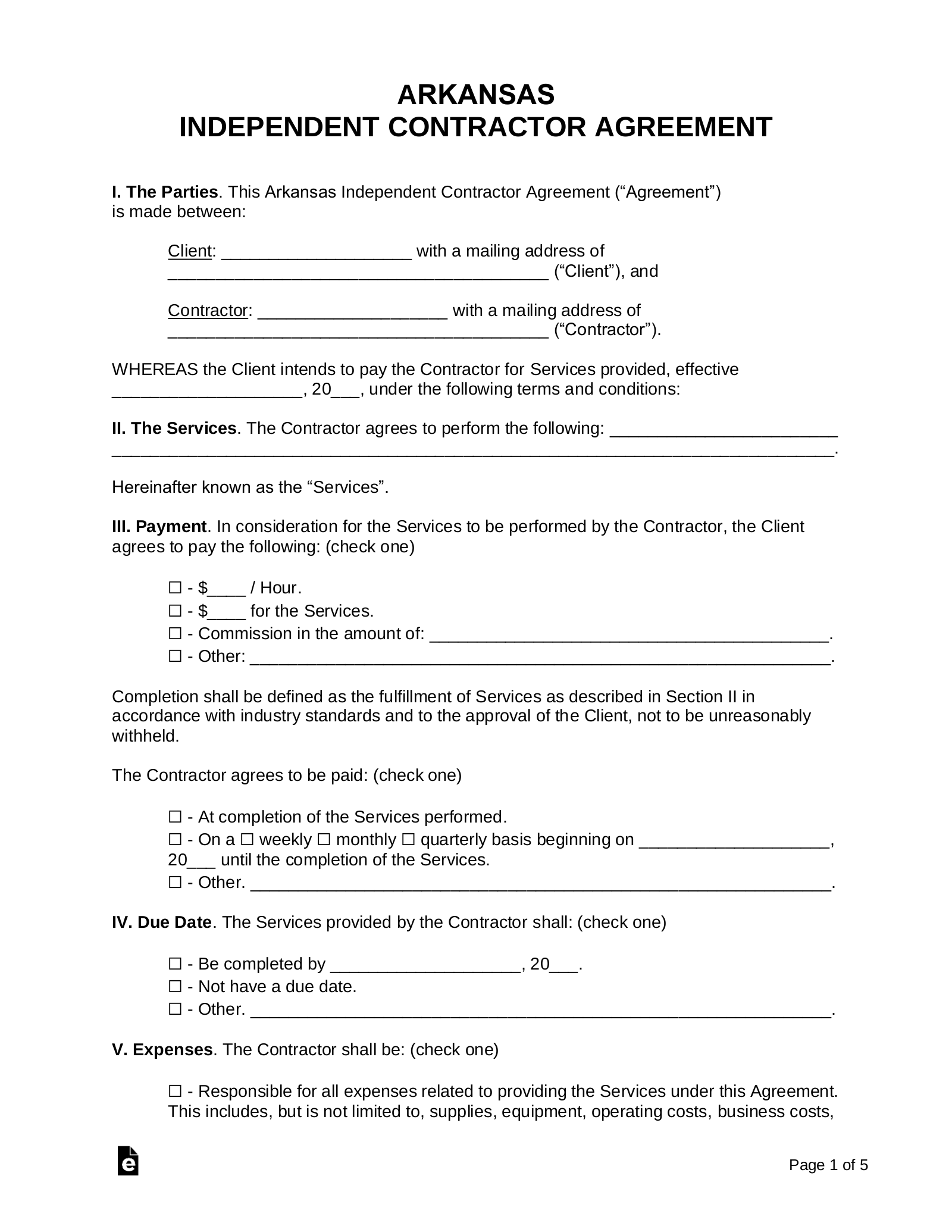

Independent Contractor Agreement – Outlines the terms of a business relationship between a client and a contractor.

Independent Contractor Agreement – Outlines the terms of a business relationship between a client and a contractor.

Download: PDF, MS Word (.docx), OpenDocument

Subcontractor Agreement – Outlines the terms of a business relationship between a contractor and a subcontractor.

Subcontractor Agreement – Outlines the terms of a business relationship between a contractor and a subcontractor.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – A person “performing or seeking to perform work or service of any kind or character for compensation.”[1]

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contracts” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 2% to 6.60%[2]

Minimum Wage ($/hr)

Minimum Wage – $10.00[3]