Updated November 05, 2023

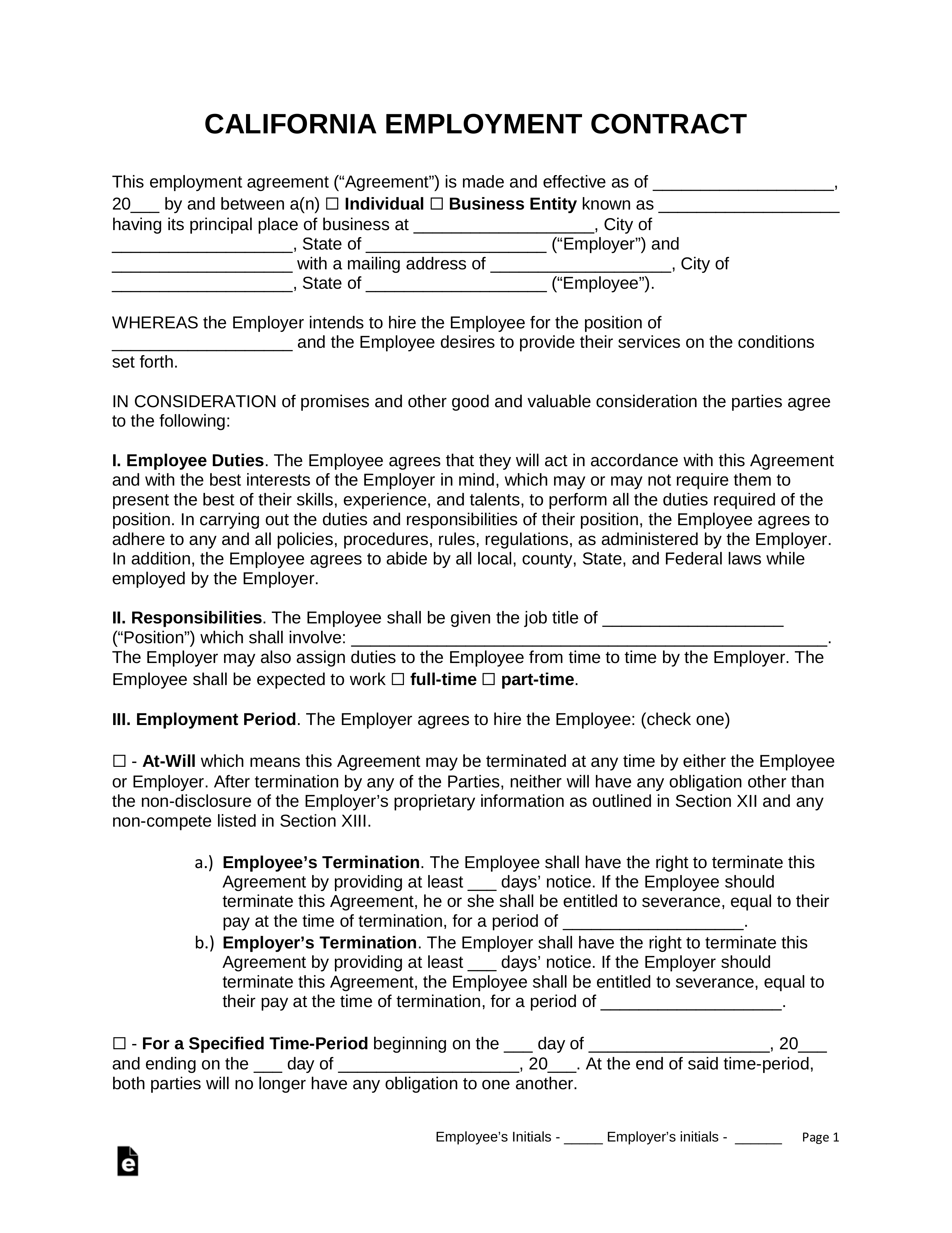

A California employment contract is a written agreement between an employer and their employee that outlines the terms and conditions of a job. An employment agreement typically includes clauses such as income, benefits, sick days, vacation, duties, employment period, and related items.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Agreement intended to safeguard an employer’s confidential information and trade secrets.

Employee Non-Disclosure Agreement (NDA) – Agreement intended to safeguard an employer’s confidential information and trade secrets.

Download: PDF, MS Word, OpenDocument

Employee Non-Solicitation Agreement – Agreement prohibiting an employee to use the employer’s information and trade secrets to start a business or aid an existing business within the same field with the intent of directly competing with the employer.

Employee Non-Solicitation Agreement – Agreement prohibiting an employee to use the employer’s information and trade secrets to start a business or aid an existing business within the same field with the intent of directly competing with the employer.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Agreement summarizing the rights and obligations of a client and a hired independent contractor.

Independent Contractor Agreement – Agreement summarizing the rights and obligations of a client and a hired independent contractor.

Download: PDF, MS Word, OpenDocument

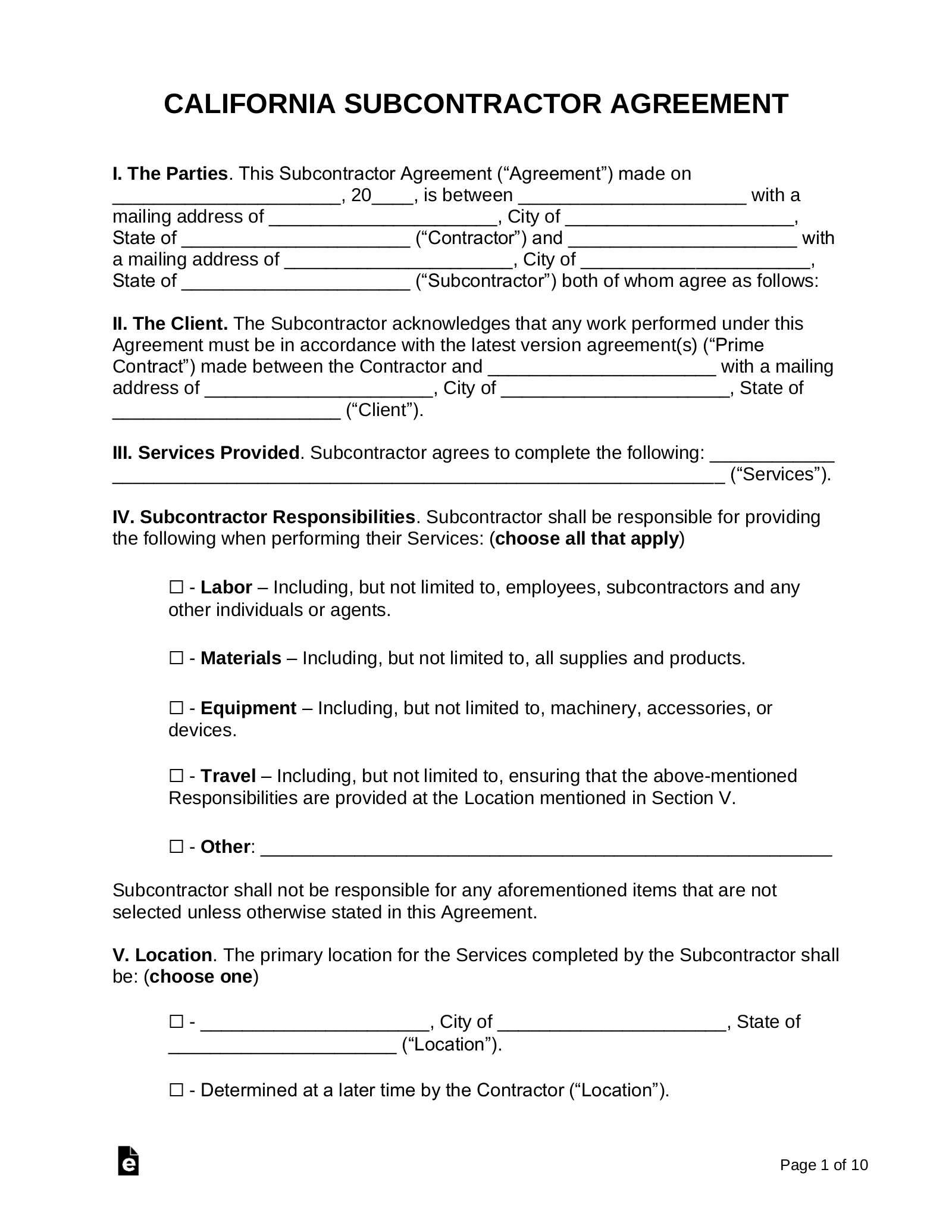

Subcontractor Agreement – Agreement summarizing the rights and obligations of a contractor and a hired subcontractor.

Subcontractor Agreement – Agreement summarizing the rights and obligations of a contractor and a hired subcontractor.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – Any person in the service of an employer “under any appointment or contract of hire or apprenticeship, express or implied, oral or written, whether lawfully or unlawfully employed.”[1]

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy,” “Implied Contracts,” and “Good-Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 1% to 9.3%[2]

Minimum Wage ($/hr)

Minimum Wage – $11.00 – $14.00[3]

For any employer who employs 26 or more employees, the minimum wage is as follows:

- From January 1, 2019, to December 31, 2019: $12.00

- From January 1, 2020, to December 31, 2020: $13.00

- From January 1, 2021, to December 31, 2021: $14.00

- From January 1, 2022, and until adjusted by subdivision (c): $15.00

For employers with 25 or fewer employees, the minimum wage is as follows:

- From January 1, 2019, to December 31, 2019: $11.00

- From January 1, 2020, to December 31, 2020: $12.00

- From January 1, 2021, to December 31, 2021: $13.00

- From January 1, 2022, to December 31, 2022: $14.00

- From January 1, 2023, and until adjusted by subdivision (c): $15.00