Updated September 25, 2023

A Georgia employment contract agreement is a legal contract signed by an employer and an employee to establish a working relationship with one another. Benefits for the employee include clear definitions regarding their income, vacation time, and benefits as well as how they can/cannot be terminated and why. Without an employment agreement, employees may be terminated at will, meaning with or without cause and at any point during employment. This type of contract is not without benefits for the employer as they often include provisions prohibiting the employee from disclosing confidential information or pursuing business in the same field (even after the employee has been terminated).

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Employee understands and agrees not to disclose or use employer’s confidential information or trade secrets for any reason other than for the employer’s benefit.

Employee Non-Disclosure Agreement (NDA) – Employee understands and agrees not to disclose or use employer’s confidential information or trade secrets for any reason other than for the employer’s benefit.

Download: PDF, MS Word (.docx), OpenDocument

Employee Non-Compete Agreement – Employee understands and agrees not to go into competition with the employer either by starting a new business or aiding an existing business in the same market/field.

Employee Non-Compete Agreement – Employee understands and agrees not to go into competition with the employer either by starting a new business or aiding an existing business in the same market/field.

Download: PDF, MS Word (.docx), OpenDocument

Independent Contractor Agreement – A written agreement between client and contractor outlining terms and conditions of services rendered in exchange for financial compensation.

Independent Contractor Agreement – A written agreement between client and contractor outlining terms and conditions of services rendered in exchange for financial compensation.

Download: PDF, MS Word (.docx), OpenDocument

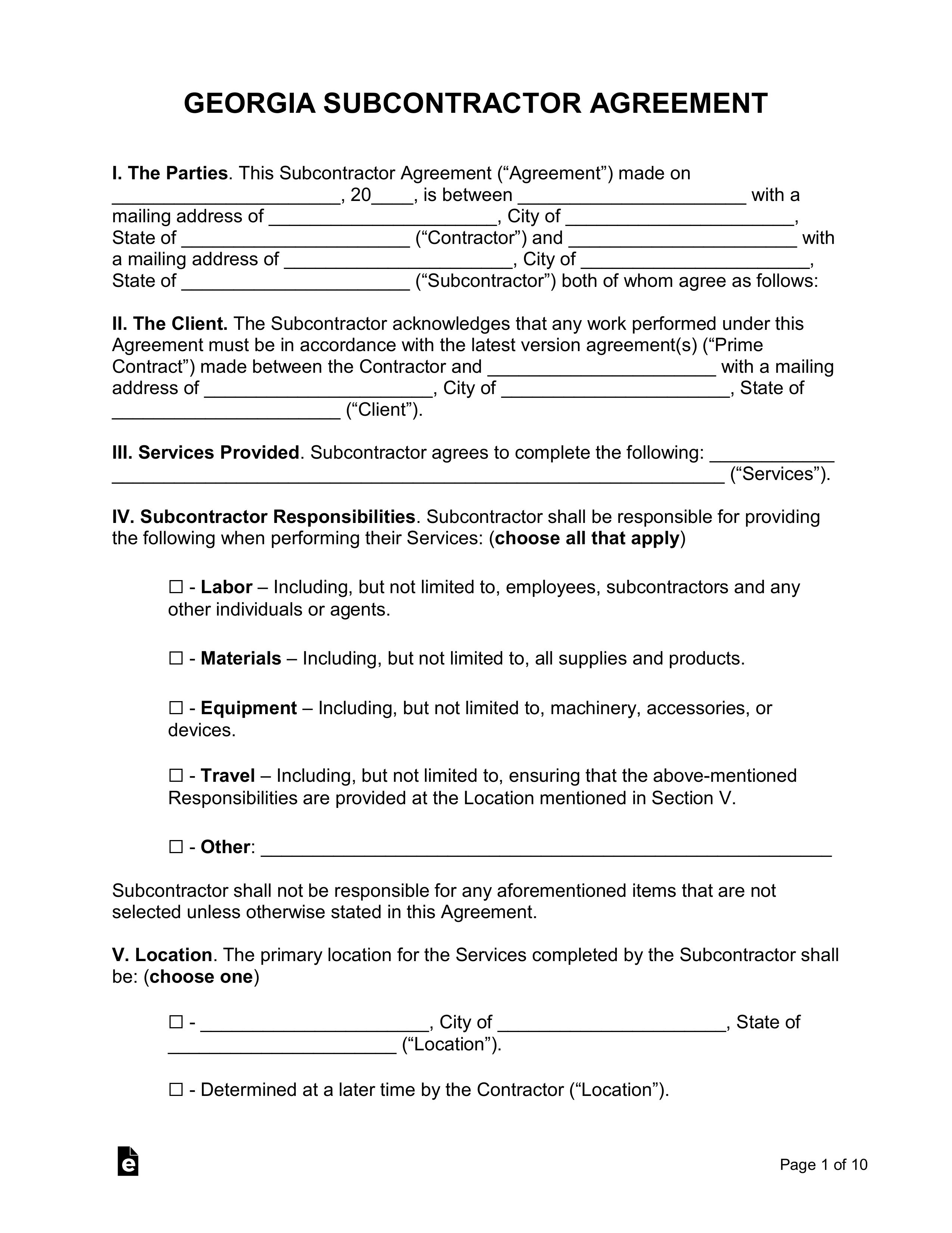

Subcontractor Agreement – A written agreement between contractor and subcontractor outlining terms regarding a job/position for compensation.

Subcontractor Agreement – A written agreement between contractor and subcontractor outlining terms regarding a job/position for compensation.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – A person who, with certain exceptions, is “in the service of another under any contract of hire or apprenticeship, written or implied.”[1]

At-Will Employment

At-Will Employment – No state exceptions.

Income Tax Rate (Individual)

Individual Income Tax Rate – 1% – 5.75%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25[3]