Updated September 25, 2023

An Idaho employment contract agreement is a formal written arrangement negotiated between two parties in order to establish an employment relationship. A contract sets forth specific terms/provisions that outline what is expected from the employee regarding their duties and responsibilities and what is expected from the employer regarding payment, benefits, and termination. A termination clause can be one of the main benefits for the employee as they often prohibit the employer from terminating employment at any given time without reasonable cause. An employment agreement may also include non-confidentiality and non-disclosure clauses to protect the employer’s proprietary information and business interests.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Agreement used to prevent dissemination of employer’s confidential information and trade secrets.

Employee Non-Disclosure Agreement (NDA) – Agreement used to prevent dissemination of employer’s confidential information and trade secrets.

Download: PDF, MS Word (.docx), OpenDocument

Employee Non-Compete Agreement – Agreement used to prevent an employee from competing with an employer in the same field of business.

Employee Non-Compete Agreement – Agreement used to prevent an employee from competing with an employer in the same field of business.

Download: PDF, MS Word (.docx), OpenDocument

Independent Contractor Agreement – Agreement used to define terms and conditions of employment between contractor and client.

Independent Contractor Agreement – Agreement used to define terms and conditions of employment between contractor and client.

Download: PDF, MS Word (.docx), OpenDocument

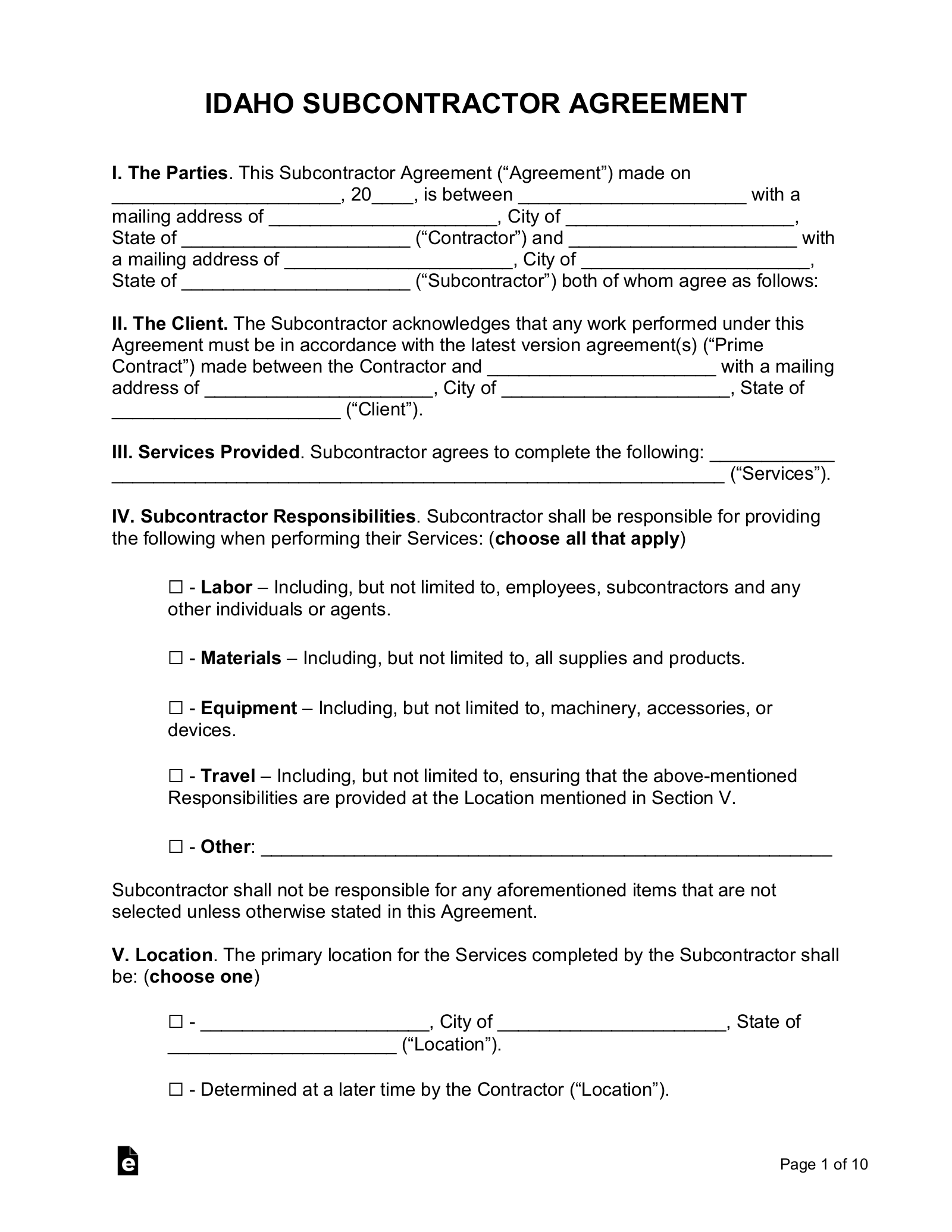

Subcontractor Agreement – Agreement used to define terms and conditions of employment between subcontractor and contractor.

Subcontractor Agreement – Agreement used to define terms and conditions of employment between subcontractor and contractor.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – Any person, with certain exceptions, who “has entered into the employment of, or who works under contract of service or apprenticeship with, an employer.” According to Idaho state law, “employee” is synonymous with “workman.”[1]

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy,” “Implied Contracts” and “Good-Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 1.125% – 6.925%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25[3]