Updated November 21, 2023

The Kentucky employment contract agreement is used to outline the rights and responsibilities of both the employer and employee. The document will specify the period of work, financial compensation, and any benefits that the employee is entitled to. Some employers may also wish to include non-disclosure and/or non-compete clauses, which ensure that the employee will not reveal trade secrets or use insider knowledge to compete against the employer. By making a written agreement, both parties may protect their interests and ensure that the other person will uphold their obligations.

By Type (4)

Employee Non-Disclosure Agreement – Obligates the employee not to reveal any trade secrets to any of their employer’s competitors.

Employee Non-Disclosure Agreement – Obligates the employee not to reveal any trade secrets to any of their employer’s competitors.

Download: PDF, MS Word, OpenDocument

Employee Non-Compete Agreement – Often included with a non-disclosure agreement, in this contract, the employee agrees not to compete against their current employer in the same industry for a reasonable duration.

Employee Non-Compete Agreement – Often included with a non-disclosure agreement, in this contract, the employee agrees not to compete against their current employer in the same industry for a reasonable duration.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Used by a hiring party to engage a limited-term contract worker for the completion of a project.

Independent Contractor Agreement – Used by a hiring party to engage a limited-term contract worker for the completion of a project.

Download: PDF, MS Word, OpenDocument

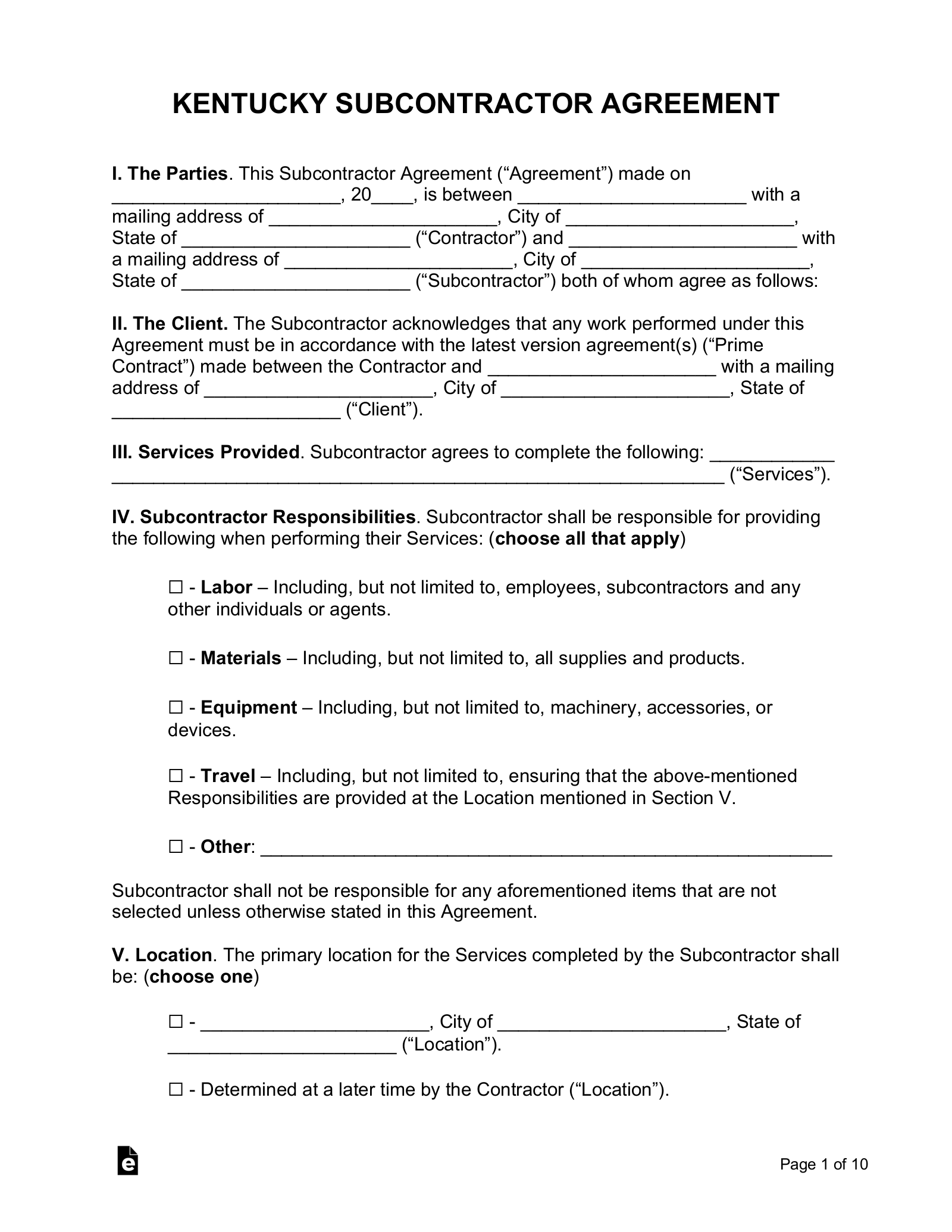

Subcontractor Agreement – Used by a contractor to engage a worker for an ongoing project.

Subcontractor Agreement – Used by a contractor to engage a worker for an ongoing project.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . Every person, including a minor, whether lawfully or unlawfully employed, in the

service of an employer under any contract of hire or apprenticeship, express or

implied, and all helpers and assistants of employees, whether paid by the employer

or employee, if employed with the knowledge, actual or constructive, of the

employer . . .”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contracts” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 5%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25 (recognizes federal wage laws)[3]