Updated November 21, 2023

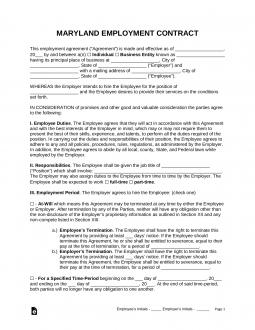

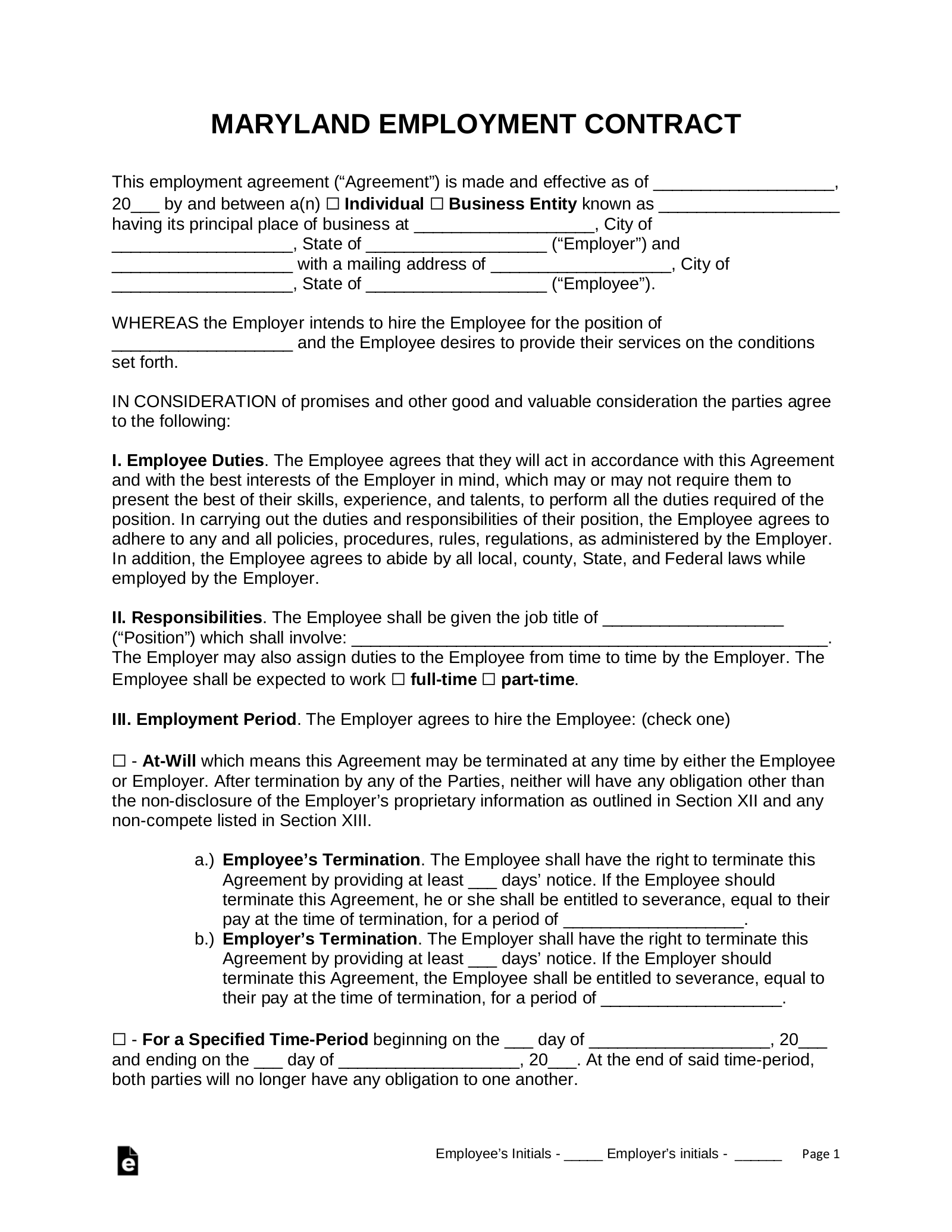

Maryland employment contracts are used to put the terms and conditions of employment into a written agreement between an employer and an individual. The length of time and the type of compensation that the employee agrees to work for will be specified in this document. Any employee benefits, days off, or paid leave that the employee is being given must also be included in the document. The employer may want to include non-compete and non-disclosure clauses to ensure that the employee will not use their work experience to compete directly against their businesses.

By Type (4)

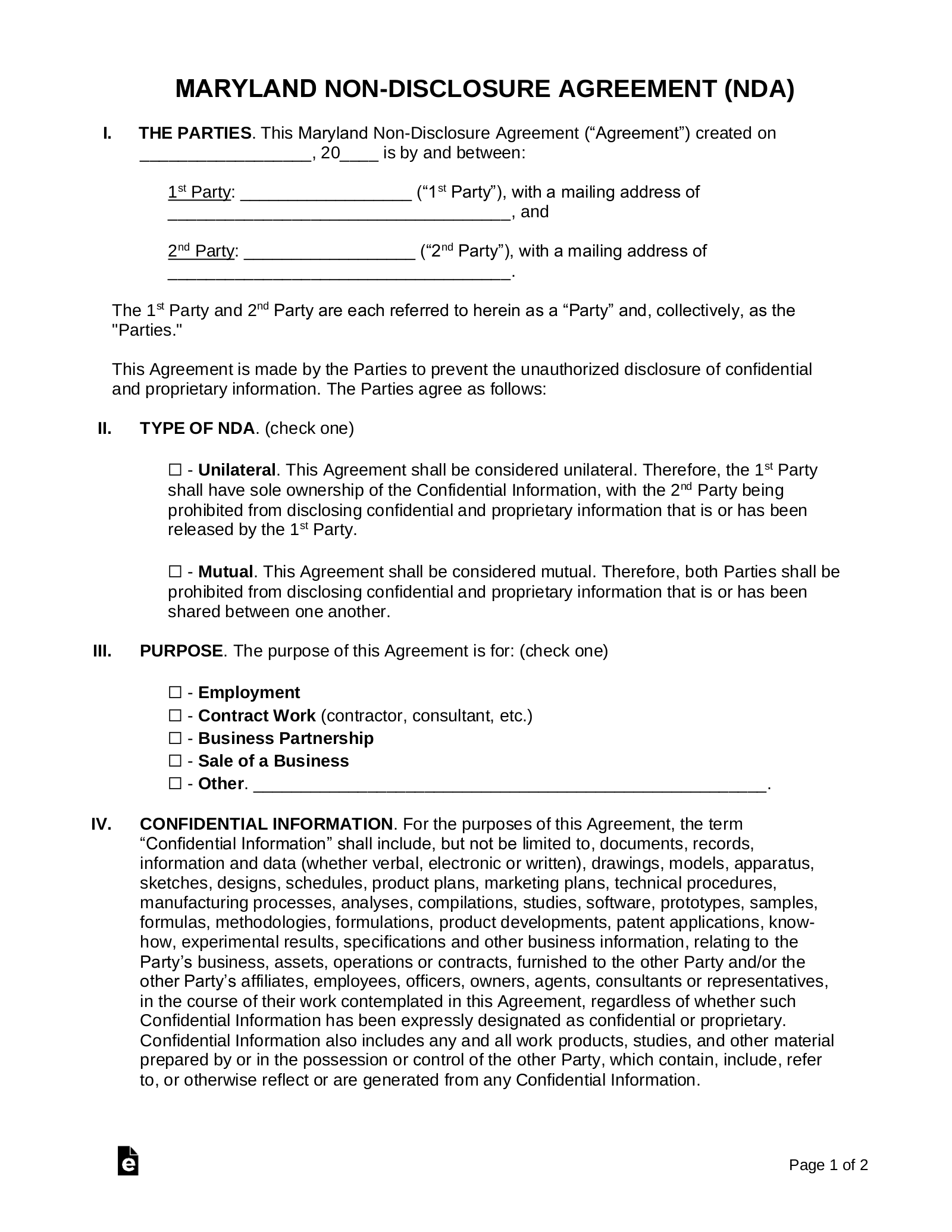

Employee Non-Disclosure Agreement – An agreement that prohibits the employee from sharing any business/trade secrets with industry competitors.

Download: PDF, MS Word, OpenDocument

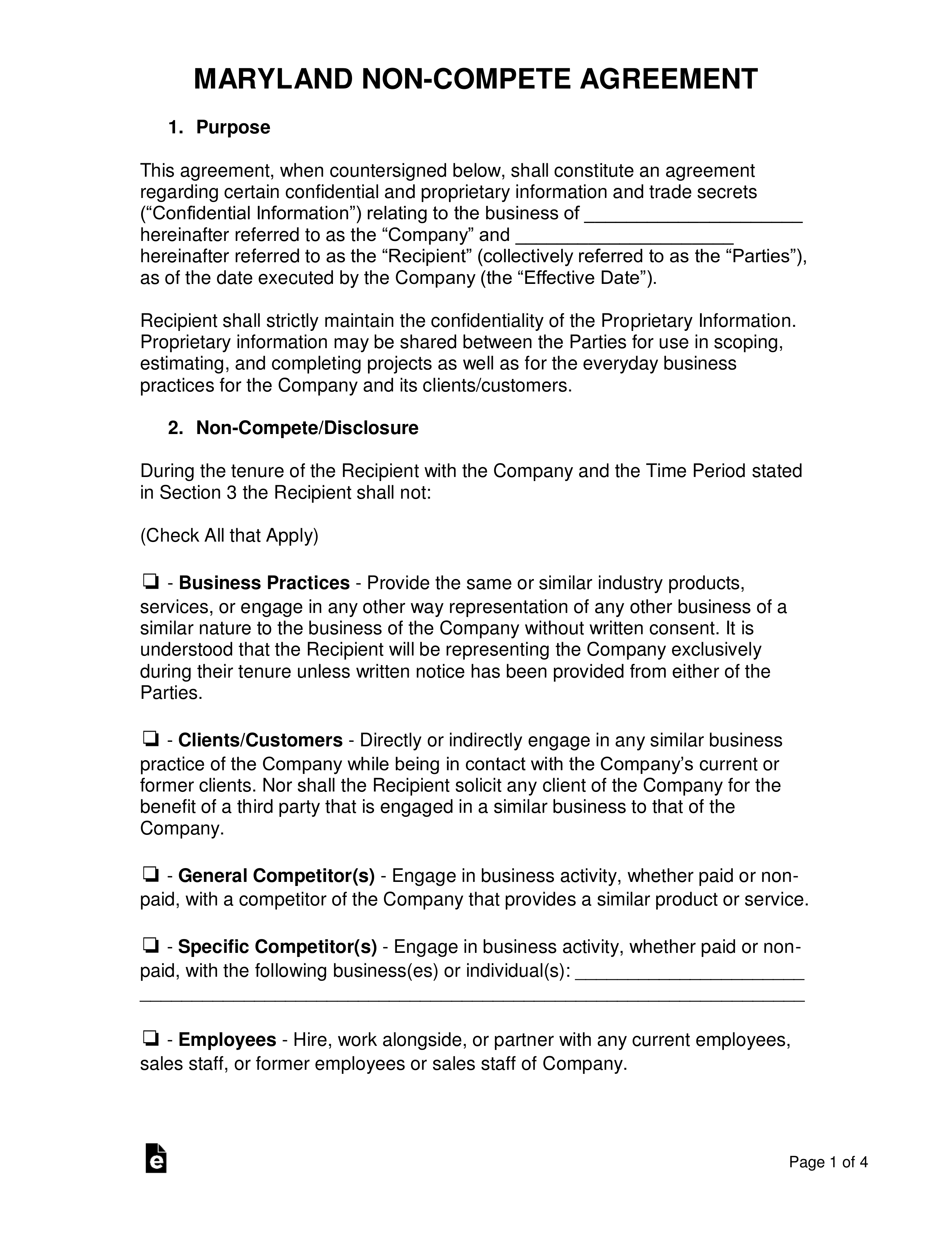

Employee Non-Compete Agreement – This document establishes terms prohibiting the employee from competing against the employer’s business for a specified period of time.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Used by an individual or business to hire an individual for a limited term for the completion of a project.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – A Prime Contractor will use this document in order to engage an individual to work on a specific aspect of an ongoing project.

Subcontractor Agreement – A Prime Contractor will use this document in order to engage an individual to work on a specific aspect of an ongoing project.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . means any individual who performs services for, or under the control of, a provider of wages or remuneration.”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 2% to 5.75%[2]

Minimum Wage ($/hr)

Minimum Wage – $11.00 State-Wide (wages vary in Montgomery County & Prince George’s County – Dept. of Labor)