Updated November 21, 2023

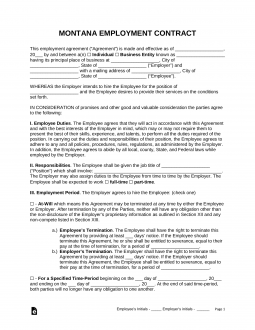

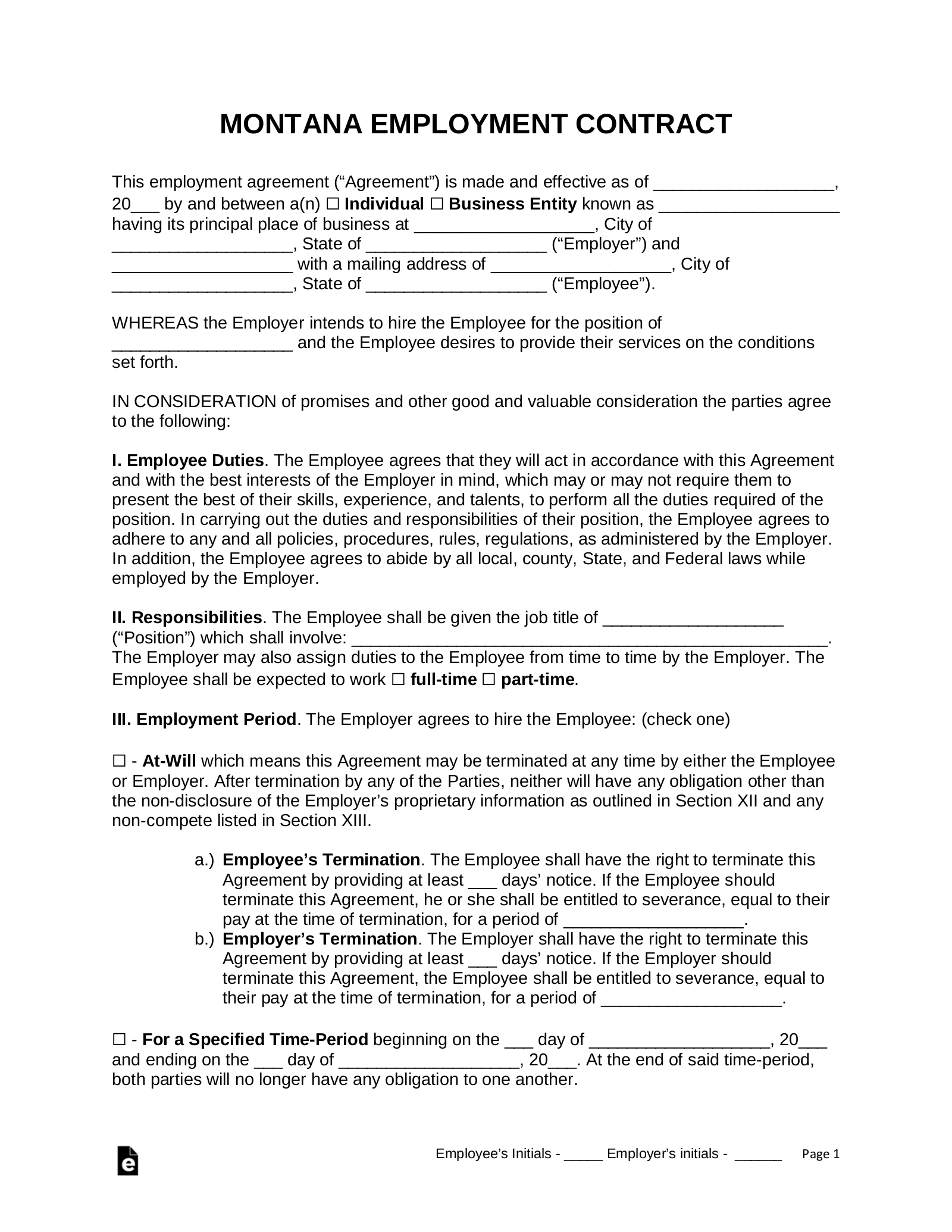

Montana employment contracts are written agreements between employers and employees that establish their working relationship. On the document, the employer will specify the responsibilities of the employee’s position, the amount of financial compensation, and the duration of employment. Furthermore, if the employee is being given any benefits, paid vacation, or sick days, these should also be stated in the contract. These contracts may be used for general employees, contractors, or subcontractors. The employer can also include additional non-disclosure and non-compete clauses to prevent the employee from sharing trade secrets and working in direct competition with the employer.

By Type (4)

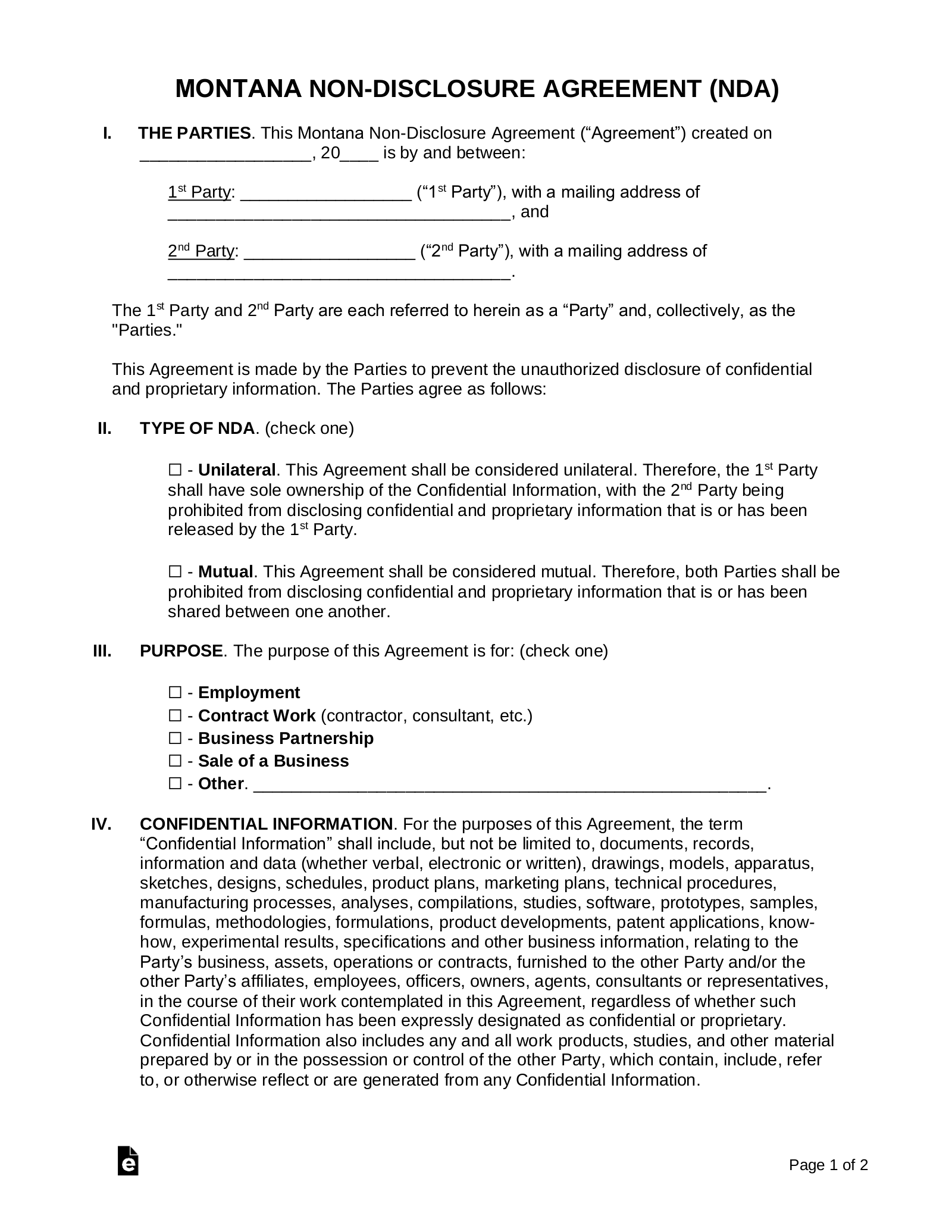

Employee Non-Disclosure Agreement – This contract prohibits the employee from revealing trade secrets to business competitors. Should such a circumstance arise, the agreement ensures that the employer will be able to recoup damages and hold the employee liable.

Download: PDF, MS Word, OpenDocument

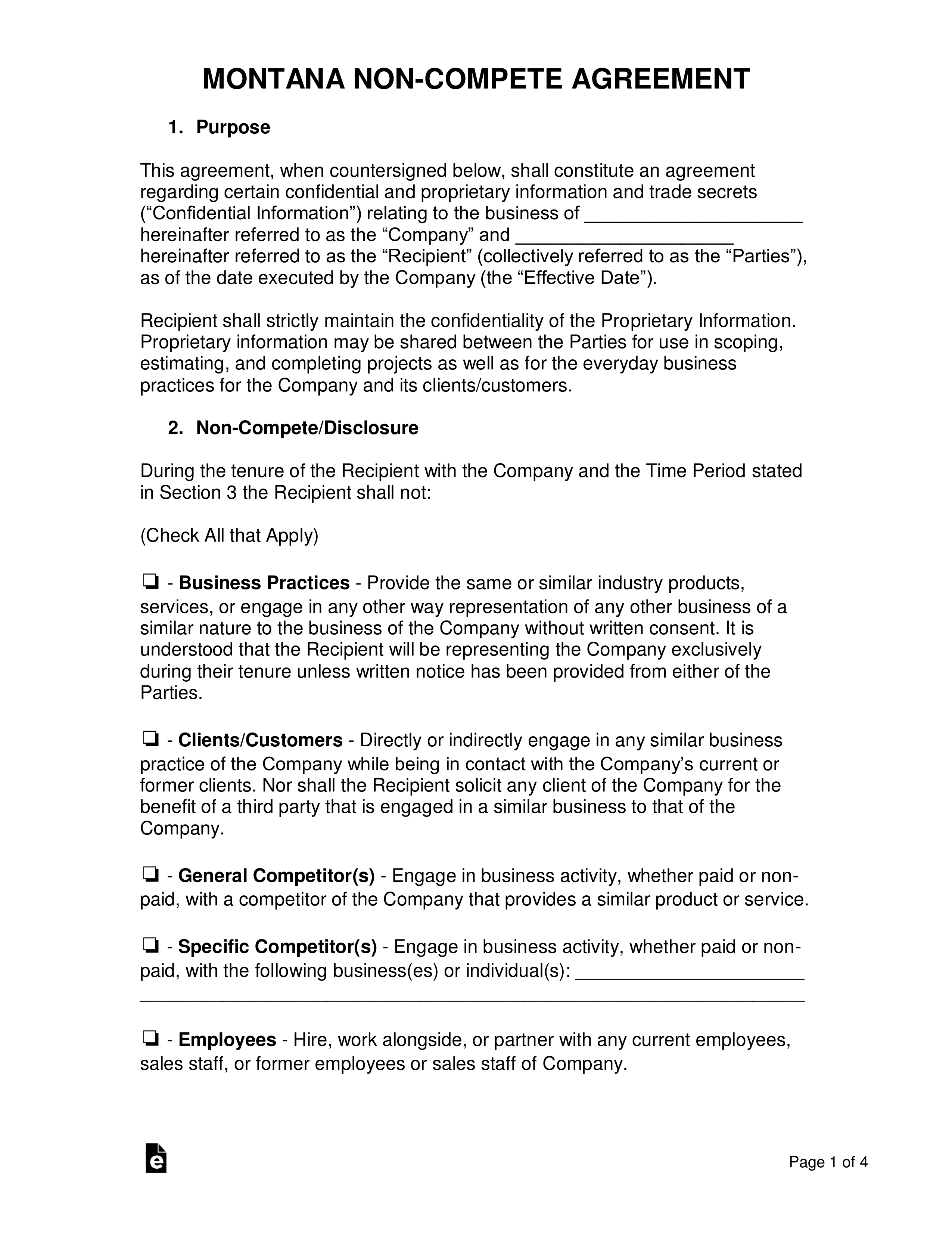

Employee Non-Compete Agreement – A contract that prohibits the employee, within reason, from working in competition against the employer’s business for a specific length of time. This document ensures that an employee will not prove to be a liability once they have terminated their employment.

Download: PDF, MS Word, OpenDocument

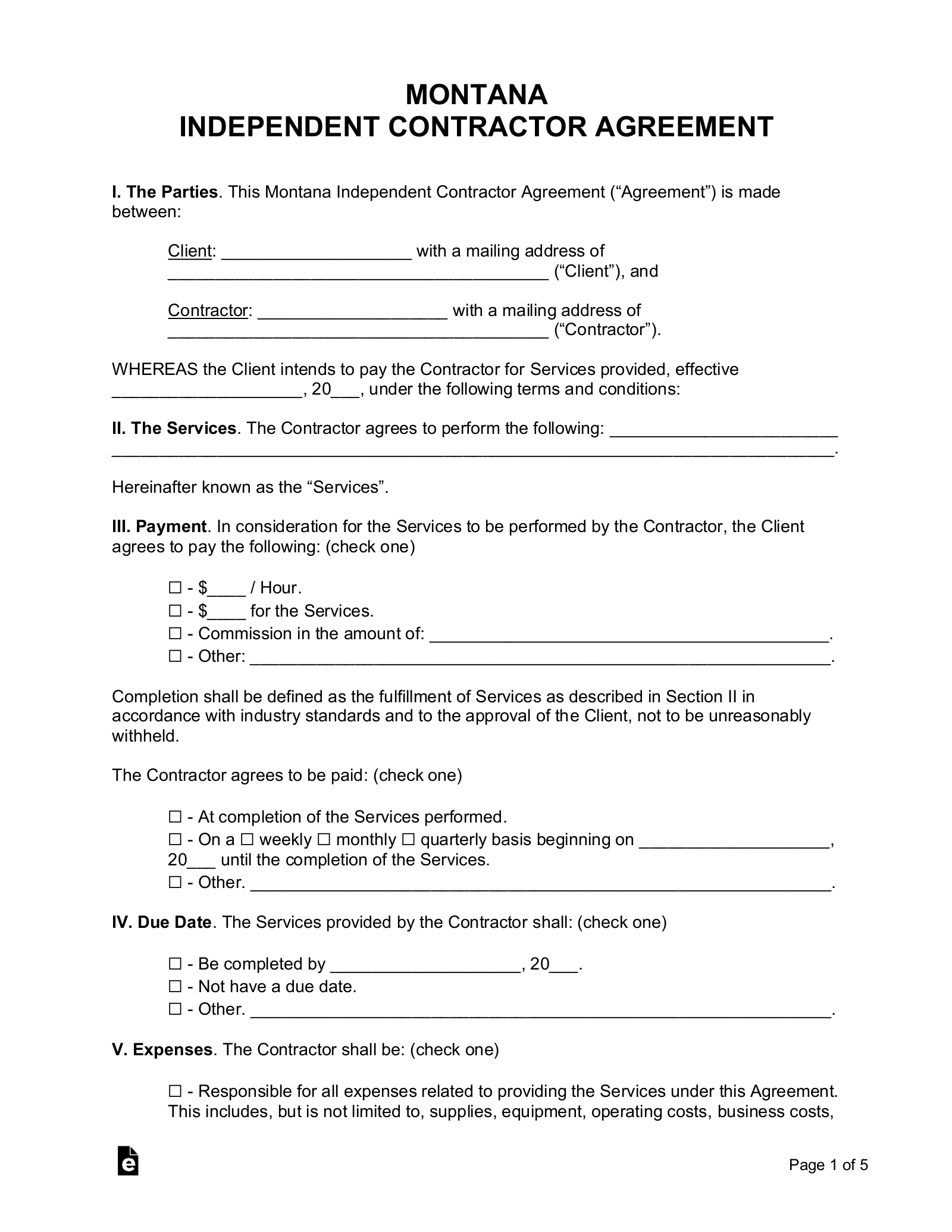

Independent Contractor Agreement – An agreement that establishes the particulars of a contractor’s engagement for a single project.

Download: PDF, MS Word, OpenDocument

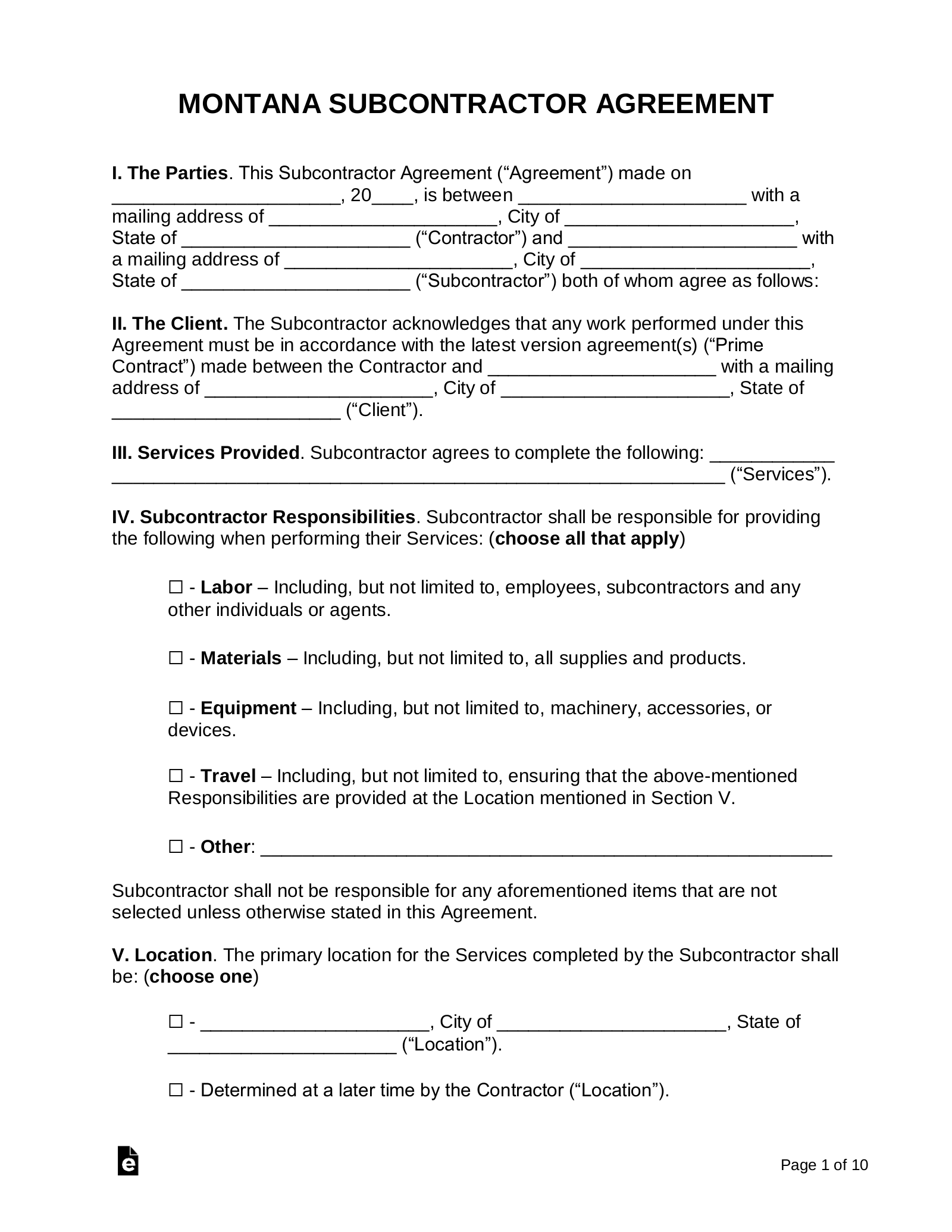

Subcontractor Agreement – Used by contractors to enlist an individual or entity to work on a project that the “prime contractor” has been hired to complete.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . means a person who works for another for hire. The term does not include a person who is an independent contractor.”

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” and “Good-Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 1% to 6.9%[2]

Minimum Wage ($/hr)

Minimum Wage – $8.65[3]