Updated November 22, 2023

A North Carolina employment contract agreement is a document that an employer may draft in order to specify the terms and conditions under which a new employee must operate. In addition to describing the amount and frequency of payment, the form also describes any benefits that the employee will be entitled to as a part of their agreement. This contract may be used to cover both long-term and short-term employment. It may also be used to hire someone for a supervisory position with the power to hire additional employees. Furthermore, there are multiple clauses that the employer can include to prevent certain liabilities from occurring, such as non-disclosure and non-compete clauses which prevent the employee from acting in direct competition with their business.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Prohibits one (1) or two (2) parties from revealing trade secrets and other confidential business information with direct industry competitors.

Download: PDF, MS Word, OpenDocument

Employee Non-Compete Agreement – A contract that restricts the employee from entering into competition with the employer’s business. This type of contract may only prevent an employee’s professional activity covering a “reasonable” duration of time and geographical area. Unreasonable terms for such agreements are generally unenforceable and illegal in the State.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Drafted by an individual or entity when hiring an independent contractor to establish terms for the completion of a specific project.

Download: PDF, MS Word, OpenDocument

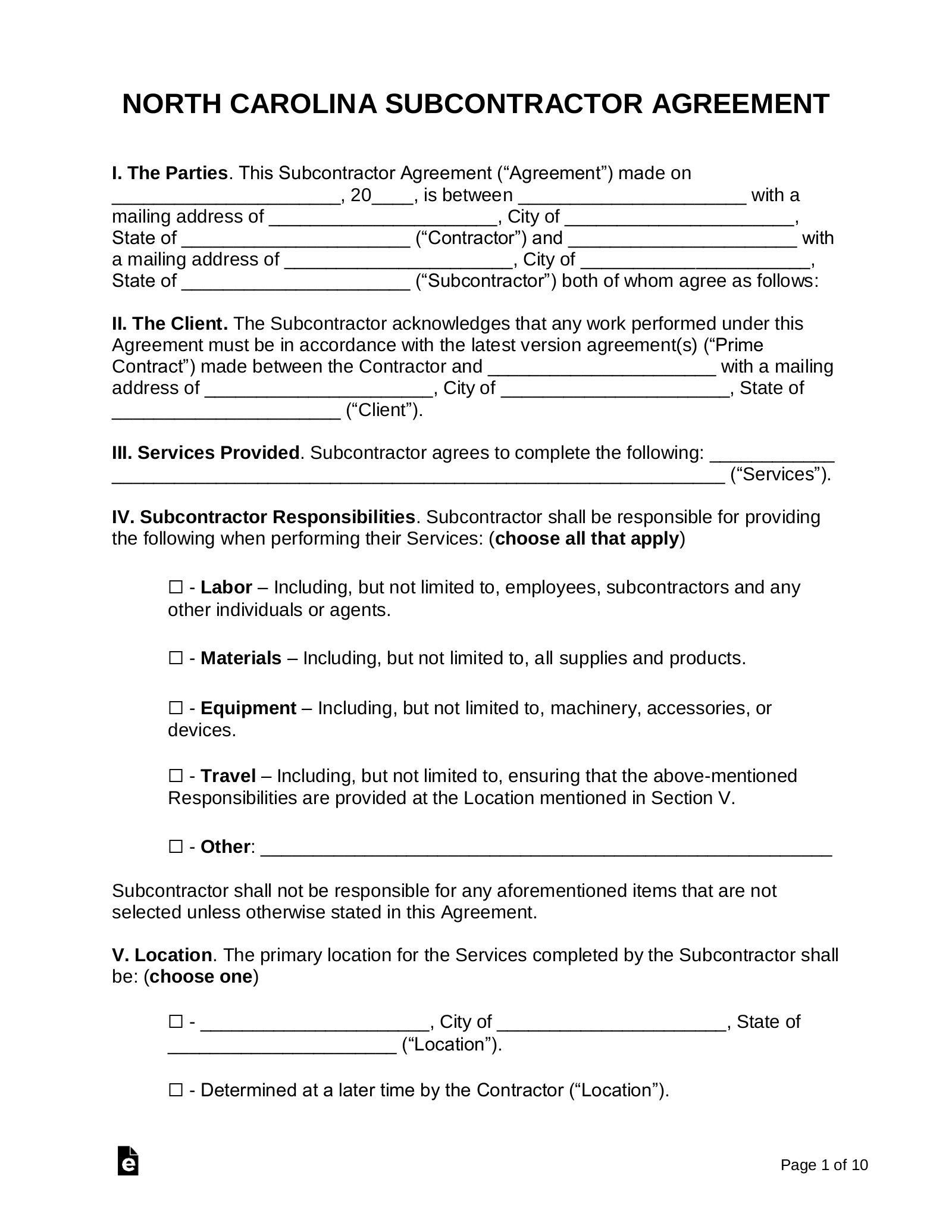

Subcontractor Agreement – Used by a prime contractor to specify the agreed-upon compensation and duration of employment for a subcontractor.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . includes any individual employed by an employer.”

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 5.25%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25 (federal law applies)[3]