Updated January 05, 2024

A North Dakota employment contract agreement is used to establish the terms governing the relationship between an employer and an employee. Employment agreements are essential in defining the responsibilities of the employee, duration of employment, wages (including commission and bonuses), and various other aspects relating to the exchange of services. Negotiating employment conditions through the execution of a contract agreement assures an employer that the employee is fully aware of what is to be expected of them going forward, thus avoiding complications should future legal matters arise.

By Type (4)

Employee Non-Disclosure Agreement – Prohibits an employee from releasing sensitive company information that might be used to their benefit.

Download: PDF, MS Word, OpenDocument

Employee Non-Compete Agreement – Prevents employees from exercising business activities with competitors.

Download: PDF, MS Word, OpenDocument

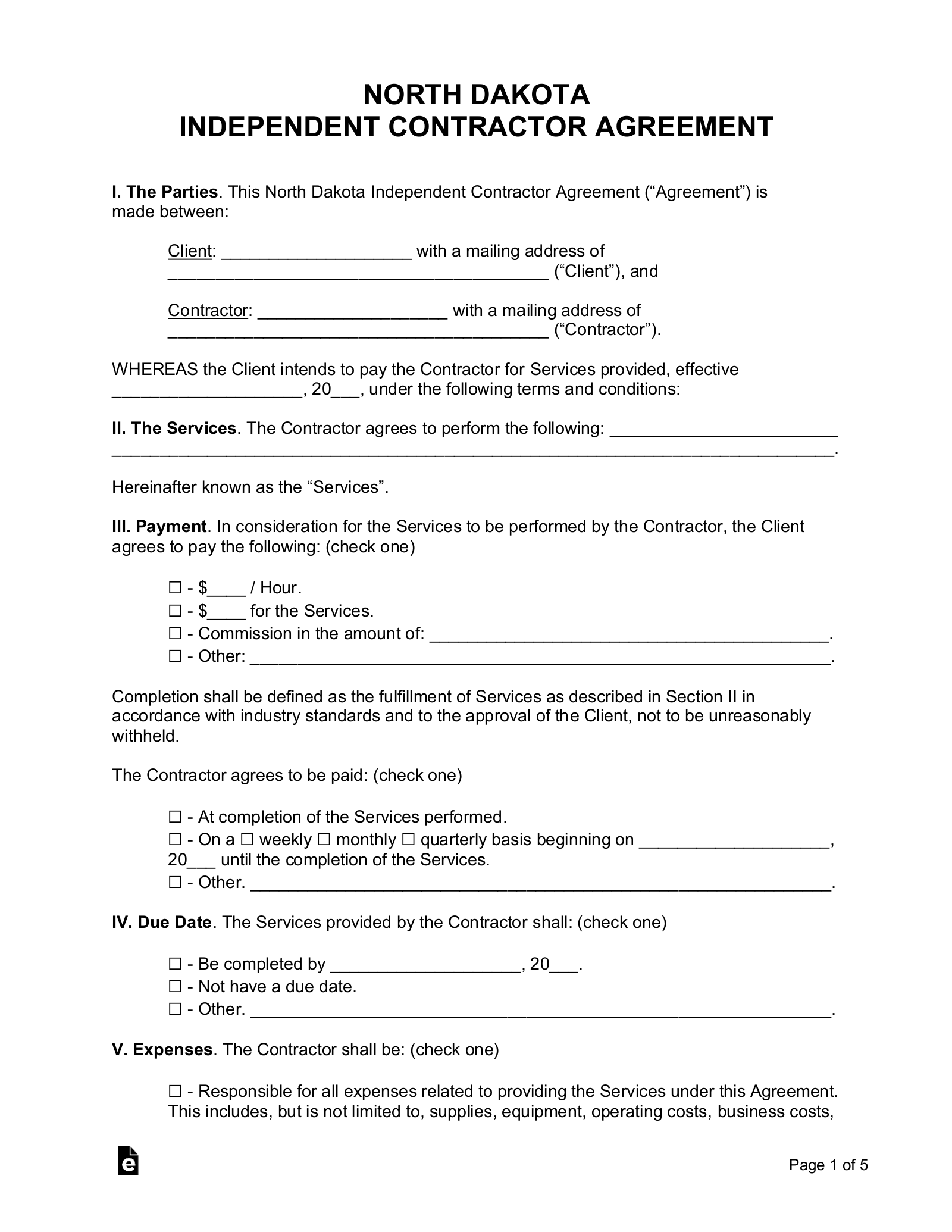

Independent Contract Agreement – Used to establish the terms for an independent contractor hired by an individual or entity to complete a task.

Download: PDF, MS Word, OpenDocument

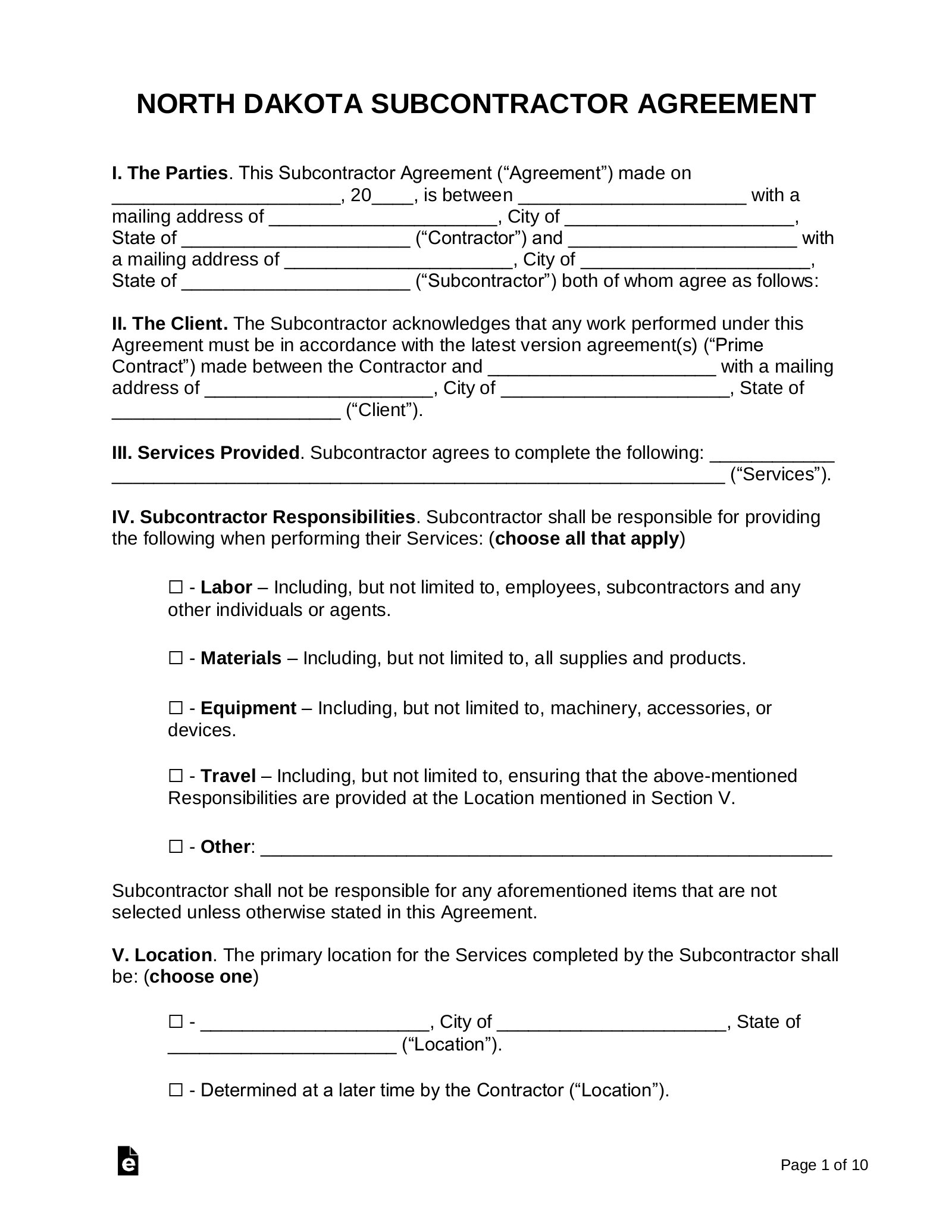

Subcontractor Agreement – Used when an independent contractor employs the services of another individual to assist them in completing specific tasks.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . includes any individual employed by an employer. However, an individual is not an “employee” while engaged in a ridesharing arrangement, as defined in section 8-02-07. The term does not include a person engaged in firefighting or sworn law enforcement officers for a political subdivision of the state.”

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 1.10% to 2.90%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25[3]