Updated December 02, 2023

A Utah employment contract agreement is a document that states an employer’s terms and conditions to potential employees. Employment contracts are essential to the working relationship of both parties as they must agree upon the compensation offered to the employee for the duties they perform. The contract also provides clarity into the schedule, or “employment period,” in which the designated duties must be executed. Through the completion of the agreement, the employer protects their assets and removes themselves from certain liabilities in the event of a legal claim filed against them by an employee.

Table of Contents

- Utah Employment Contracts: By Type (4)

- What is an Employee?

- At-Will Employment

- Income Tax Rate (Individual)

- Minimum Wage ($/hr)

- Sources

By Type (4)

Employee Non-Disclosure Agreement (NDA) – An NDA holds employees liable if they fail to keep company information confidential.

Download: PDF, MS Word, OpenDocument

Employee Non-Compete Agreement – Prohibits an employee from transacting certain business with clients other than their current employer.

Download: PDF, MS Word, OpenDocument

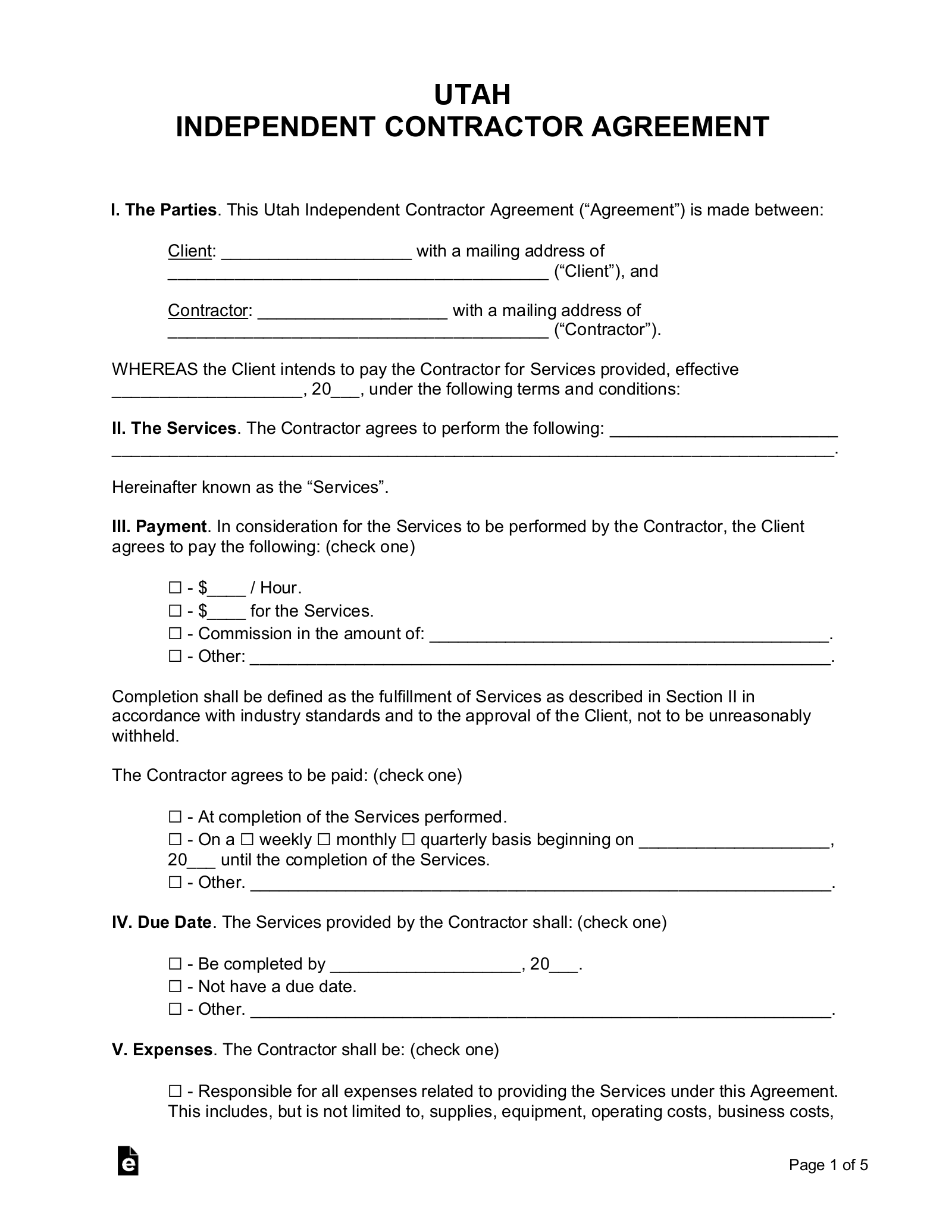

Independent Contractor Agreement – An agreement catered to the hiring of an independent contractor.

Download: PDF, MS Word, OpenDocument

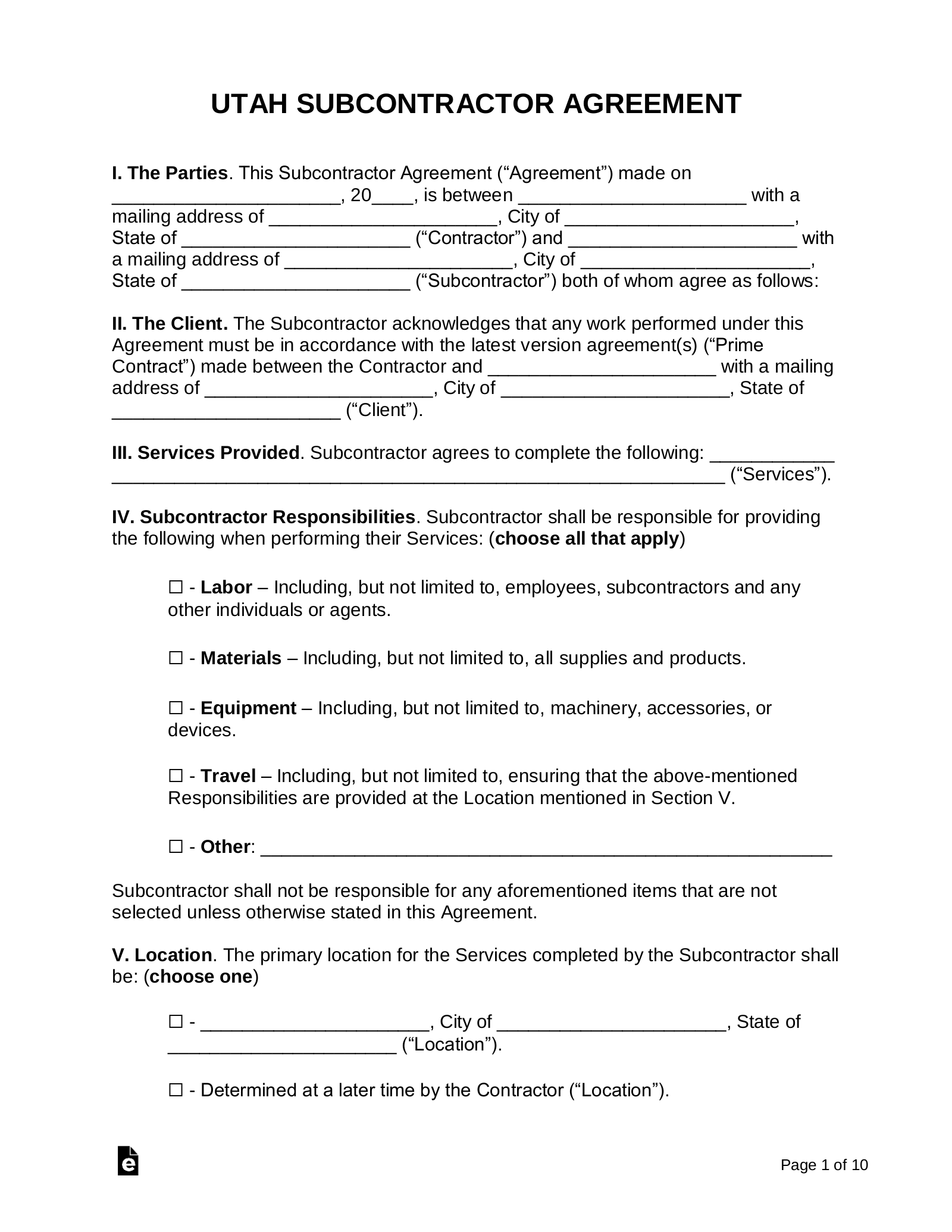

Subcontractor Agreement – Establishes a working relationship with a subcontractor who has been hired to complete a specific task in part of a larger contract.

Download: PDF, MS Word, OpenDocument

What is an Employee?

“Employee” Definition[1]

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy,” “Implied Contracts,” and “Good-Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 4.95%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25[3]