Updated December 02, 2023

A Washington employment contract agreement is executed by an employer to hire an employee or other individual receiving payment in exchange for the services they provide. A contract agreement enables employers to create a clear and detailed description of the job including any duties the position involves. The contract should also mention the compensation the individual can expect as well as the rate at which payments will be administered. Apart from general provisions, an employment agreement can also include a confidentiality disclosure or a non-compete clause which provides an employer with protection if an employee wrongfully releases company information or transacts unauthorized business during or following their employment.

Table of Contents |

By Type (4)

Employee Non-Disclosure Agreement (NDA) – An employer can use an NDA to protect themselves in the event that an employee discloses company information to a third party or the public.

Download: PDF, MS Word, OpenDocument

Employee Non-Compete Agreement – Created to prevent employees from working for other similar entities.

Download: PDF, MS Word, OpenDocument

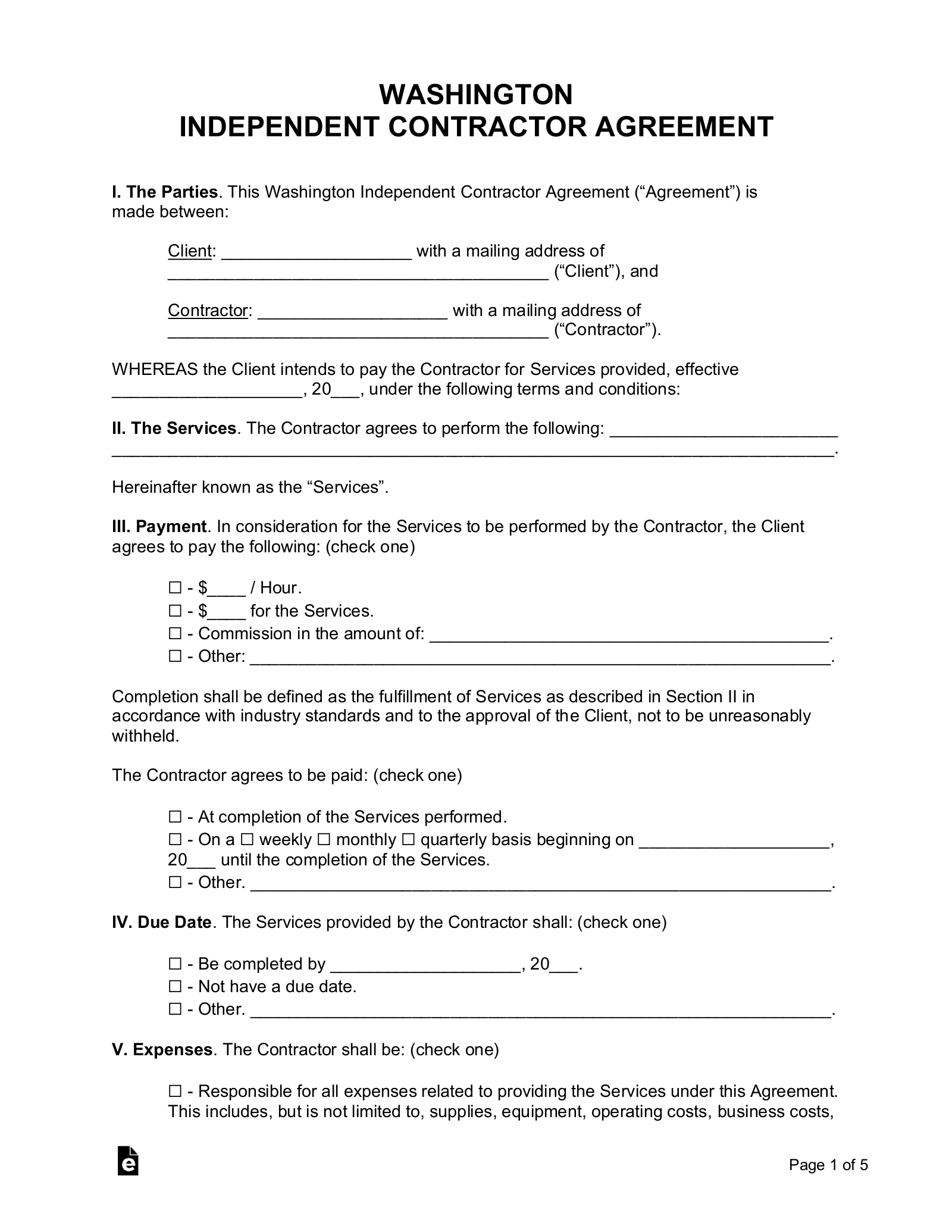

Independent Contractor Agreement – Outlines the working conditions for an independent contractor.

Independent Contractor Agreement – Outlines the working conditions for an independent contractor.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – Implemented by a contractor when outsourcing work to another individual or business.

Download: PDF, MS Word, OpenDocument

What is an Employee?

“Employee” Definition[1]

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 0%

Minimum Wage ($/hr)

Minimum Wage – $13.50[2]

Wage Rate Exceptions: