Updated March 07, 2024

A financial hardship letter is written by an individual to request temporary relief from an obligation due to extreme financial circumstances. Commonly used after a job loss, illness, death, or other unforeseen event, this letter explains to a lender why the individual can no longer make regular payments on a mortgage, loan, rent, or any other bill.

By Type (8)

- College (Financial Aid)

- Landlord (Rent)

- Loan Modification

- Medical Bills

- Mortgage

- Jury Duty

- Short Sale

- VA (Veterans Affairs)

Table of Contents |

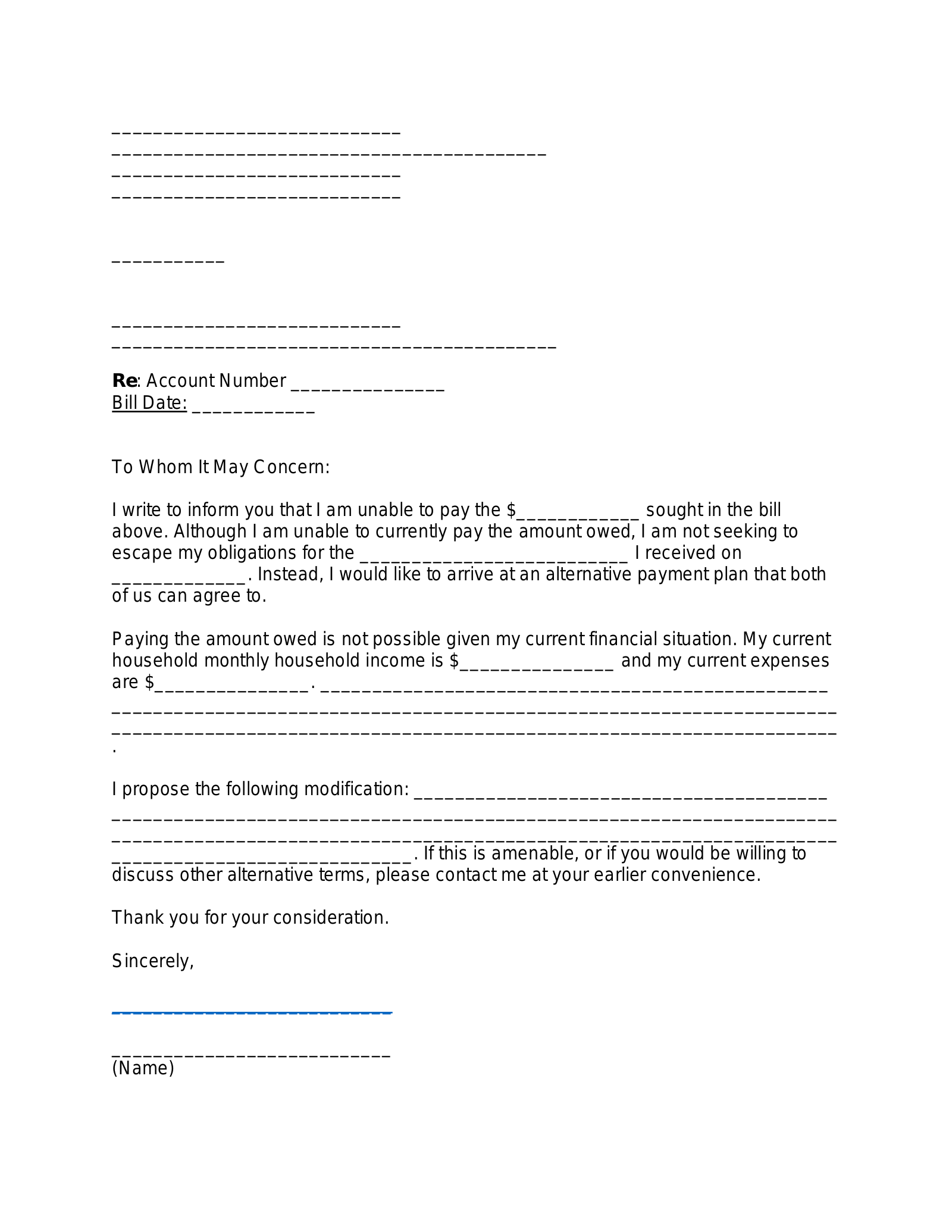

How to Write a Financial Hardship Letter (5 steps)

- State the Purpose of Your Letter

- Explain the Hardship You are Facing

- Describe the Financial Impact of this Hardship

- Propose a Specific Alternative Payment Plan

- Provide Evidence

4. Propose a Specific Alternative Payment Plan

Put forward a specific and time-limited modified payment plan that will allow you to recover from the financial hardship you are currently facing. This could be an extension on the date a bill is due, reduced monthly payments, or a waiver on certain fees.

Sample

Janet Franklin

500 W Arlington Ave, Apt 701

Chicago, IL 60614

jfrankli@yahoo.com

(212) 804-1692

Jan. 22, 2024

Bank of America

100 N Michigan Ave, Suite 1000

Chicago, IL 60601

Re: Loan Modification for Janet Franklin

To Whom It May Concern:

I am writing this letter to request a modification of the mortgage for the property located at 500 W Arlington Ave, Apt 701, Chicago, IL, 60614. Although the unfortunate events described in this letter mean that I am unable to make the $2,000 monthly payment under the current terms of the mortgage, I am committed to staying at the property, and I believe that the modifications I suggest will provide the help I need to return to the terms of the agreement.

I am seeking assistance because I lost my job as a middle school teacher due to budget cuts across the school district last year. When I was initially approved for this loan in 2021, my gross monthly income was roughly $4,000. However, since losing my job, I have been living off of my savings and unemployment benefits, which collectively provide me with less than $1,800 each month. As evidence of my circumstances, I have attached my employment termination notice and recent bank statements to this letter.

Until I am able to secure a new teaching position in another school district, I propose the following modification: starting next month, instead of my normal mortgage payment of $2,000, I would make payments of $1,000 each month for the next 12 months. This would allow me enough time to find a new job and get my finances back in order. After this period of time, I would make up the amount owed by making larger monthly payments of $2,340 over the following three years.

Thank you for your time and consideration. Please feel free to contact me anytime.

Sincerely,

Janet Franklin

[Signature]