How to Form an LLC

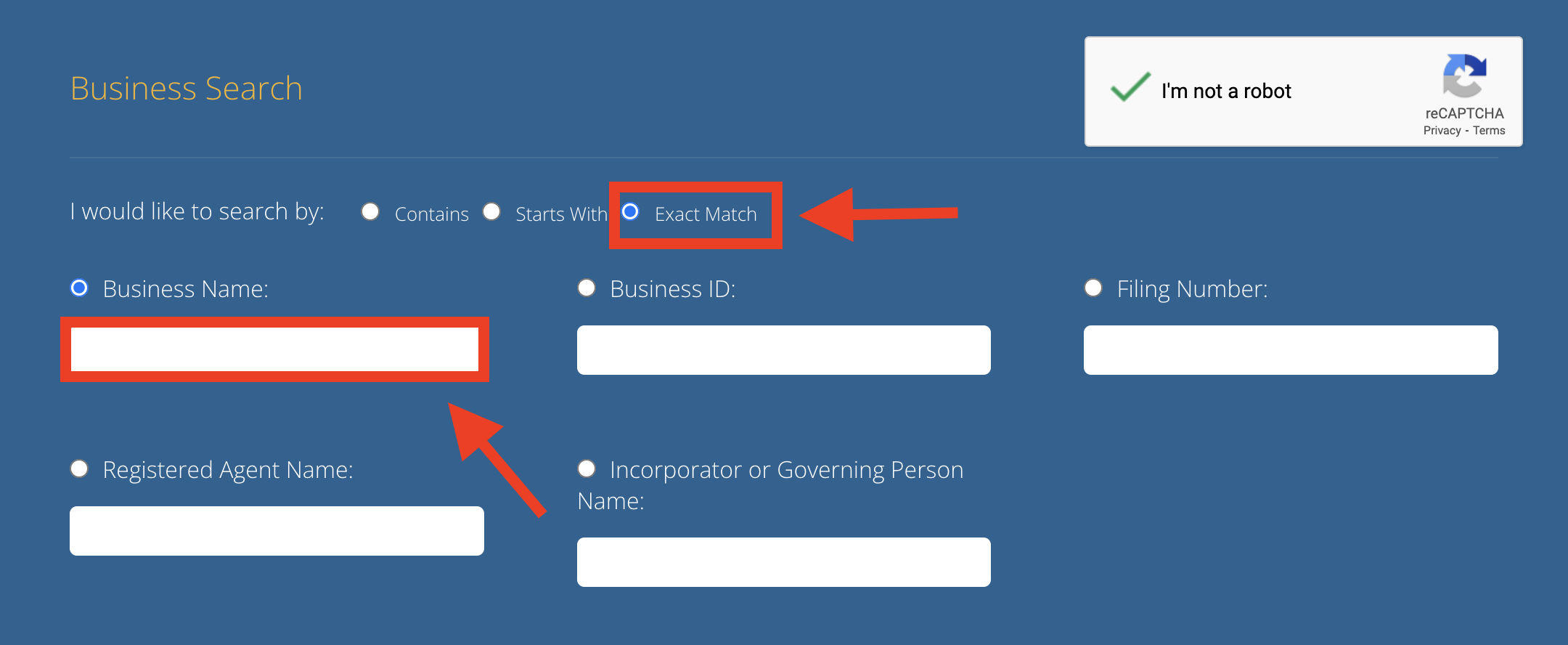

1. Find a Business Name

- Business Search: bsd.sos.in.gov

After selecting the option to search for an exact match, enter your desired business name in the indicated field. Click “Search” at the bottom of the page. If the words “No Data Found” appear, the business name is likely available for use.

The name of a limited liability company must contain the phrase “limited liability company” or the abbreviation “L.L.C.” or “LLC.”[3]

2. Designate a Registered Agent

Both domestic and foreign LLCs in Indiana are required to designate and maintain a registered agent in the state.[4] The designated registered agent will receive important legal documents on behalf of the business.

3. Register the LLC

There are two ways to apply for the registration of your LLC: online or by mail.

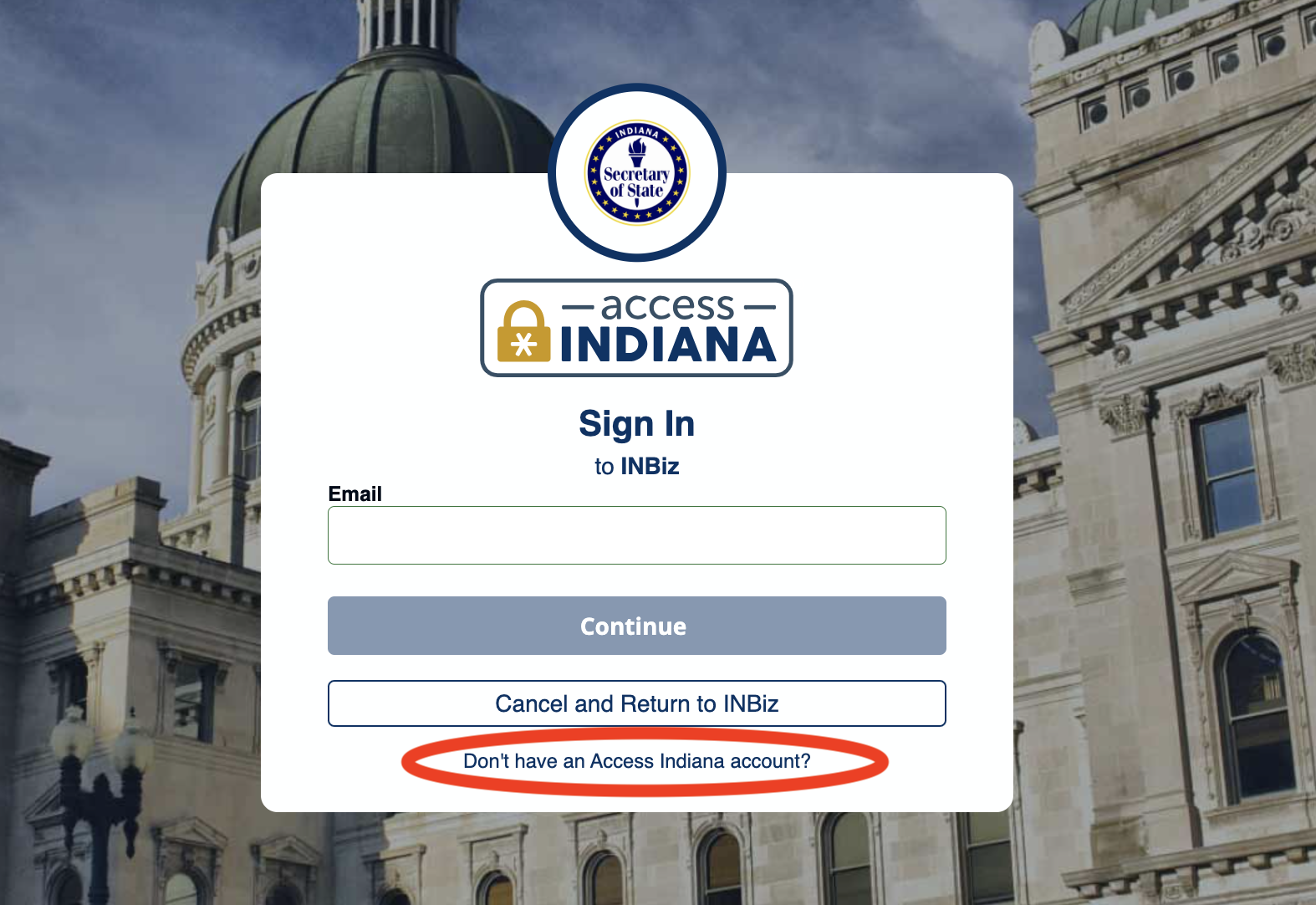

Option 1: File Online

Go to inbiz.in.gov to access the state’s online filing system.

You will be prompted to enter an email address for verification and provide basic information, including your name and phone number, to create an account.

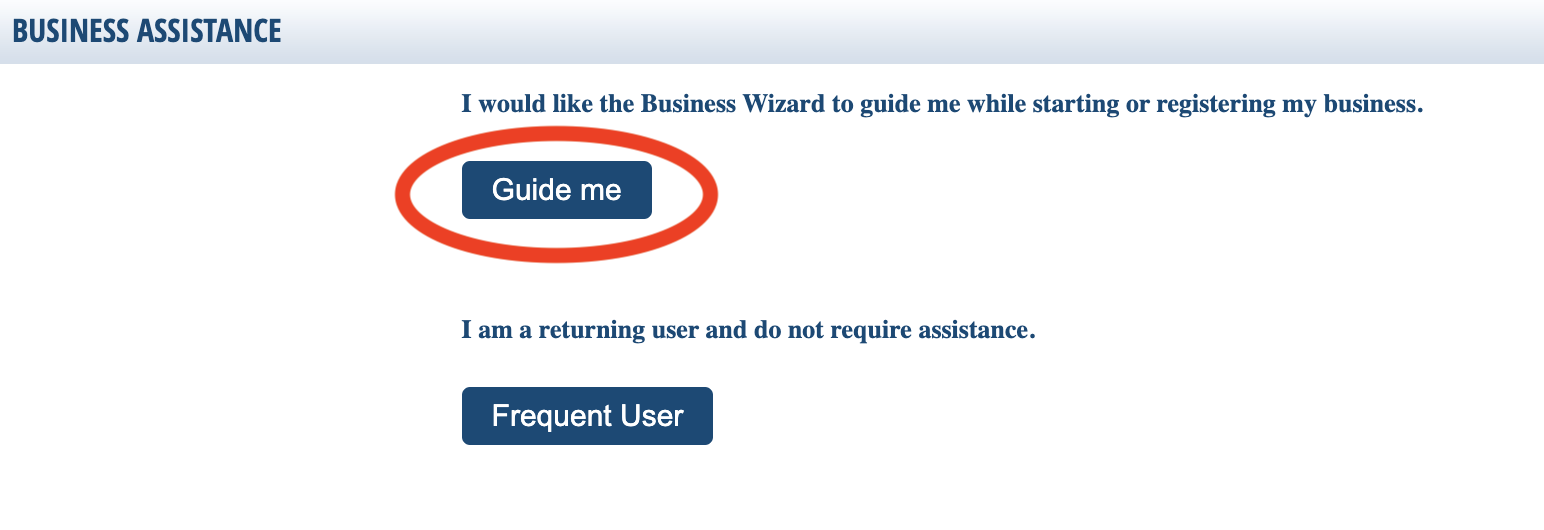

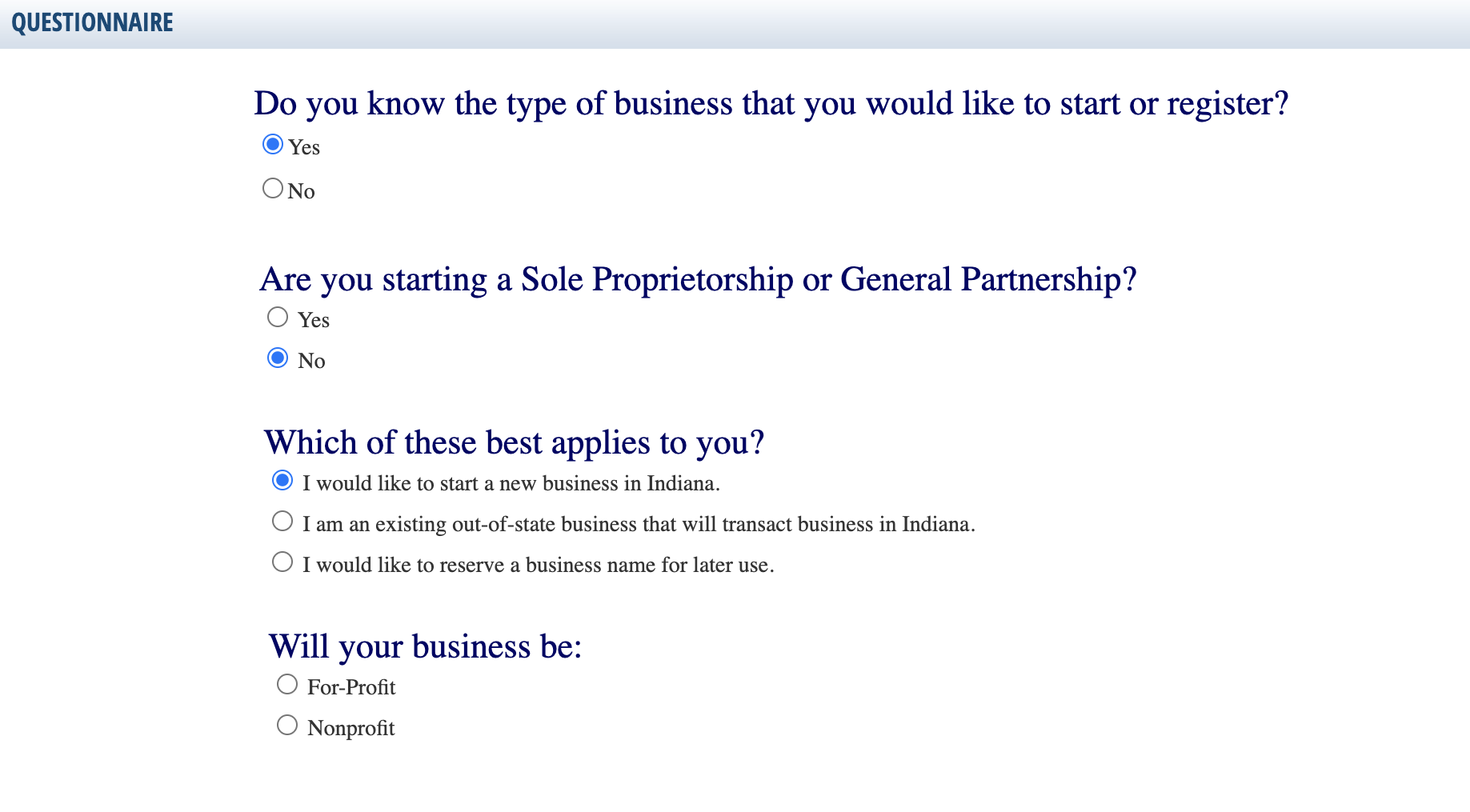

Click the following button and follow the questionnaire to indicate the type of business you want to start or register.

You will be prompted to answer the questions one by one.

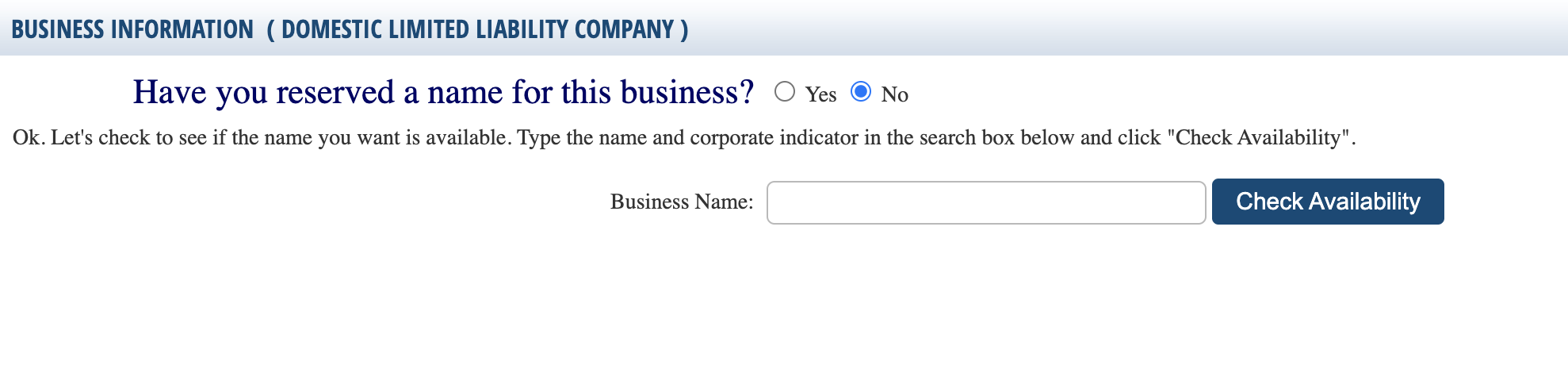

Type the name and click “Check Availability.”

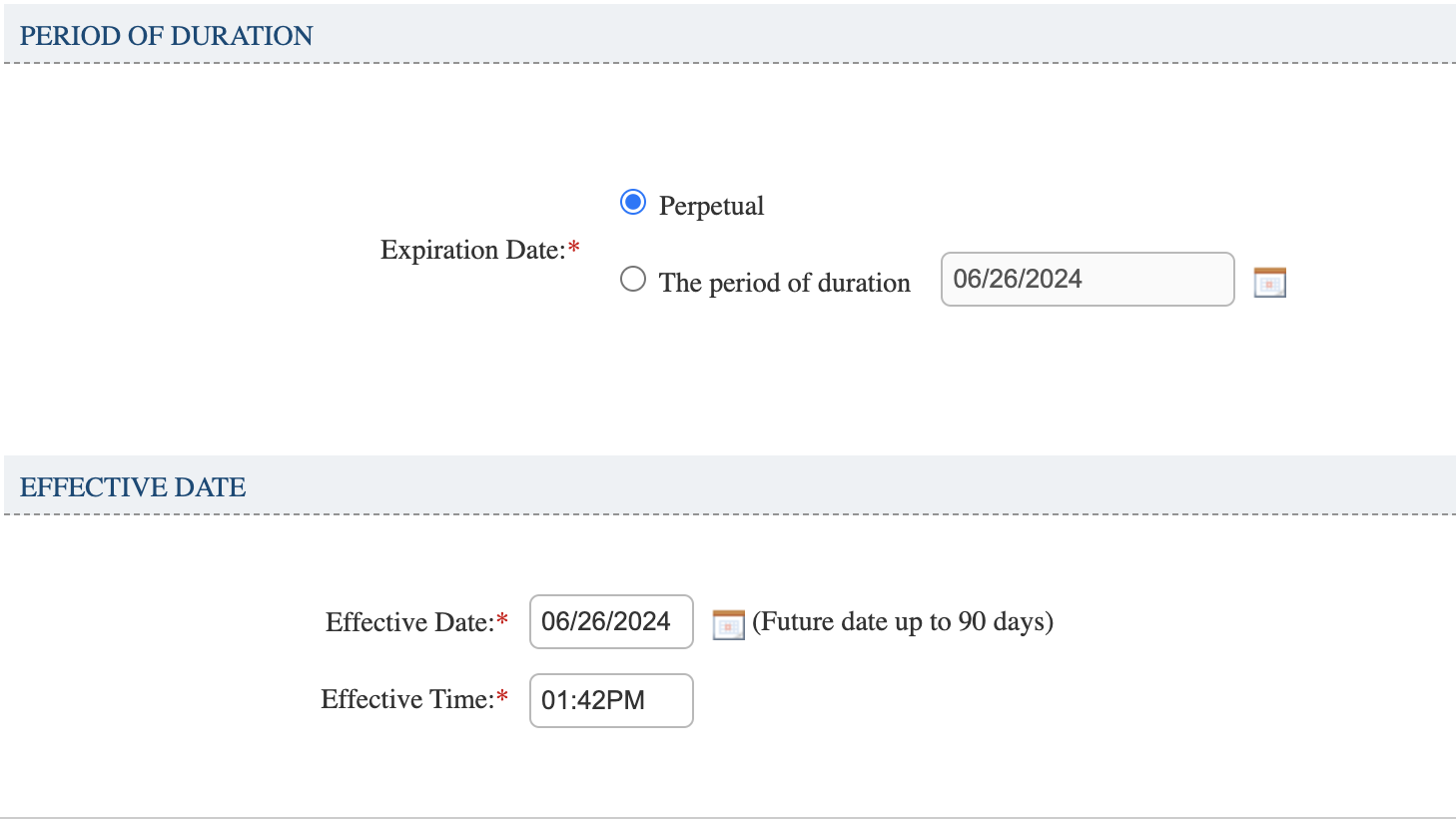

For LLCs, the period of duration will likely be “perpetual.” The effective date indicates when the articles of organization will become valid.

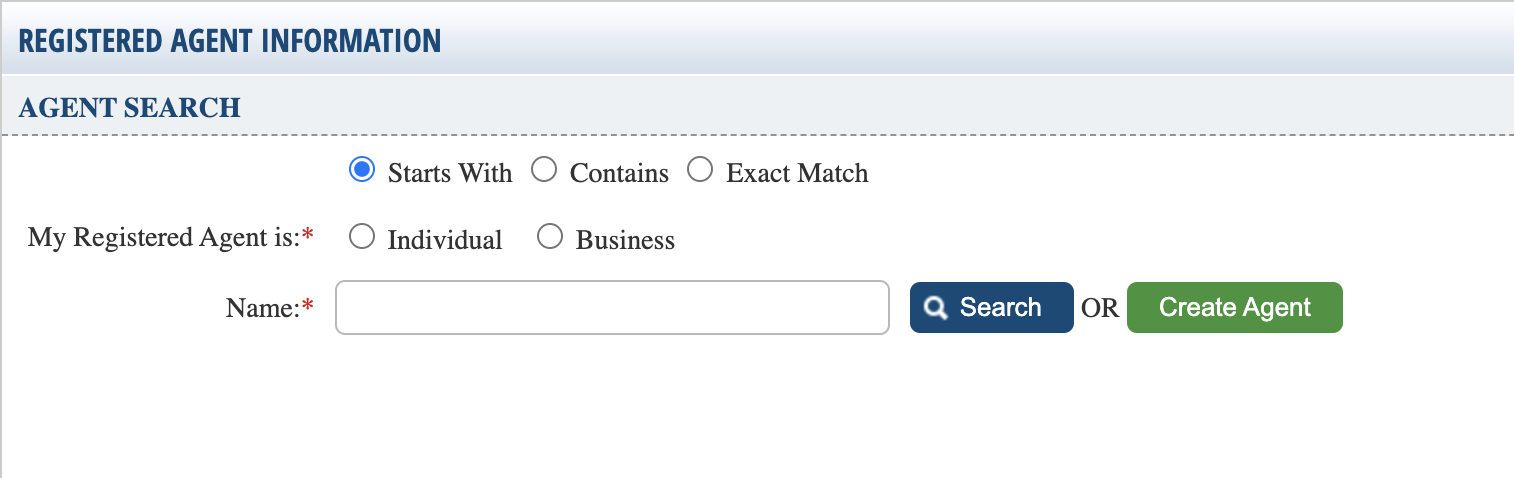

If your registered agent is already in the system, you can search by their name. If they’re not already in the system, click “Create Agent” and enter their name and address.

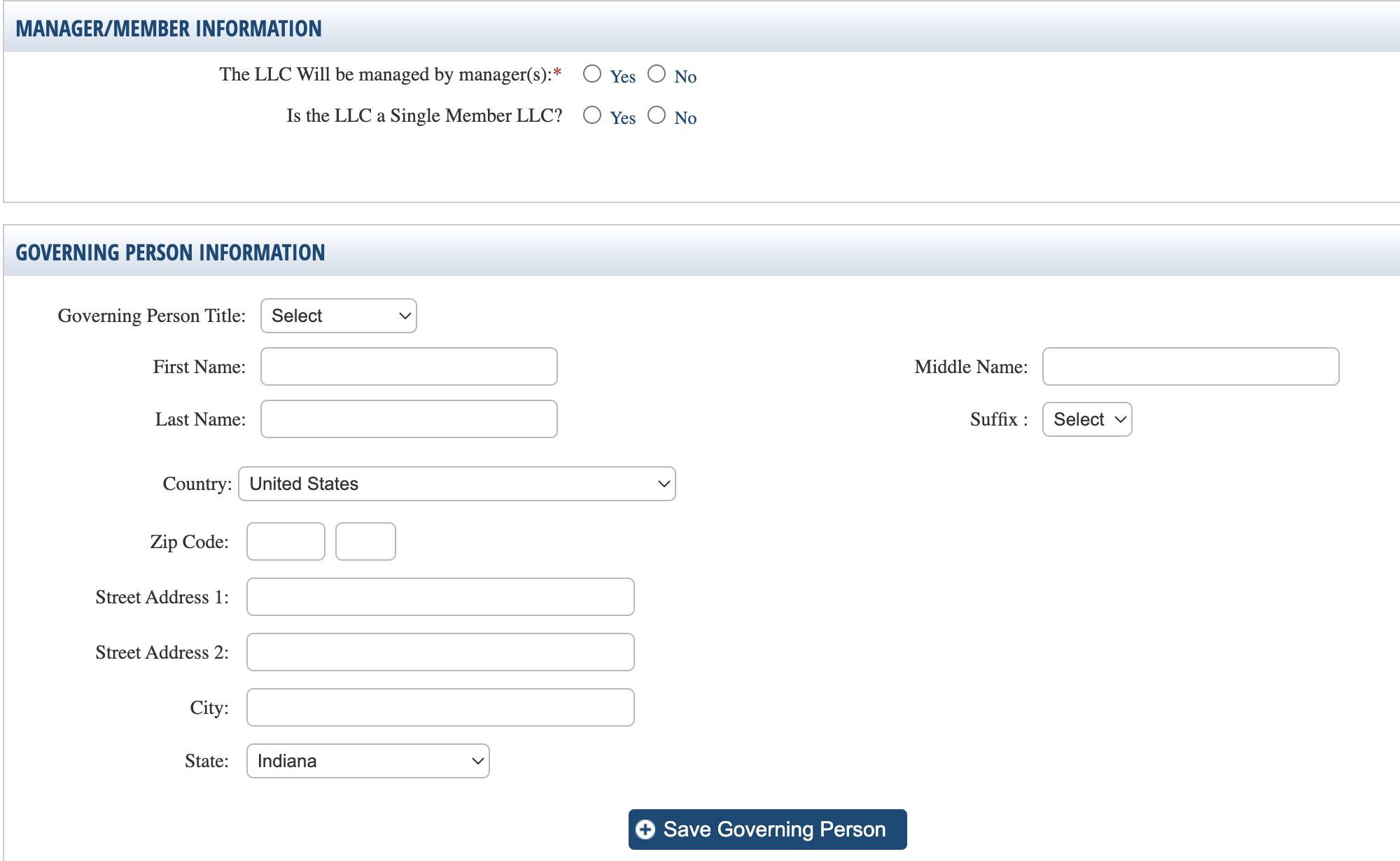

Indicate whether your LLC will be managed by a manager or member. Provide the name and address of the business’s governing person.

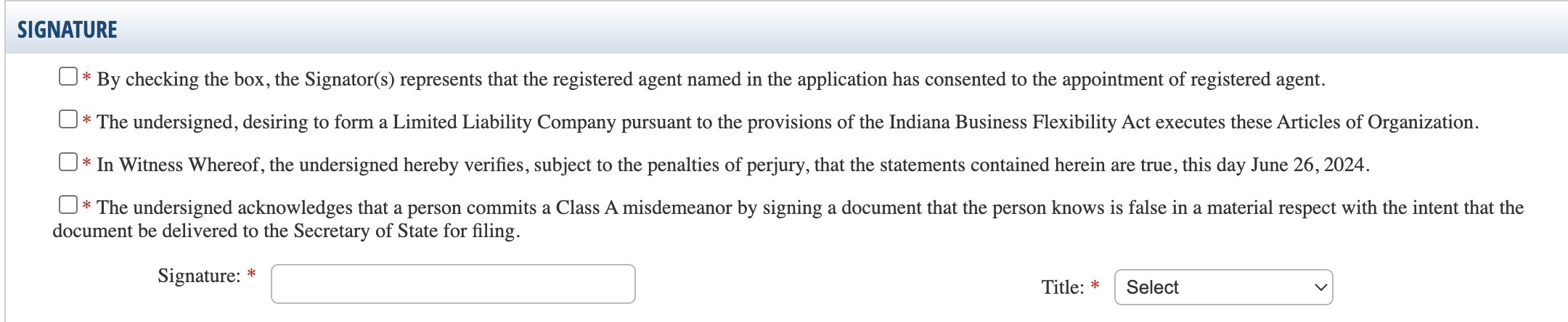

After reviewing the document, you will be prompted to agree to the terms and sign your name. On the next page, provide your payment information to pay the filing fee of $95.

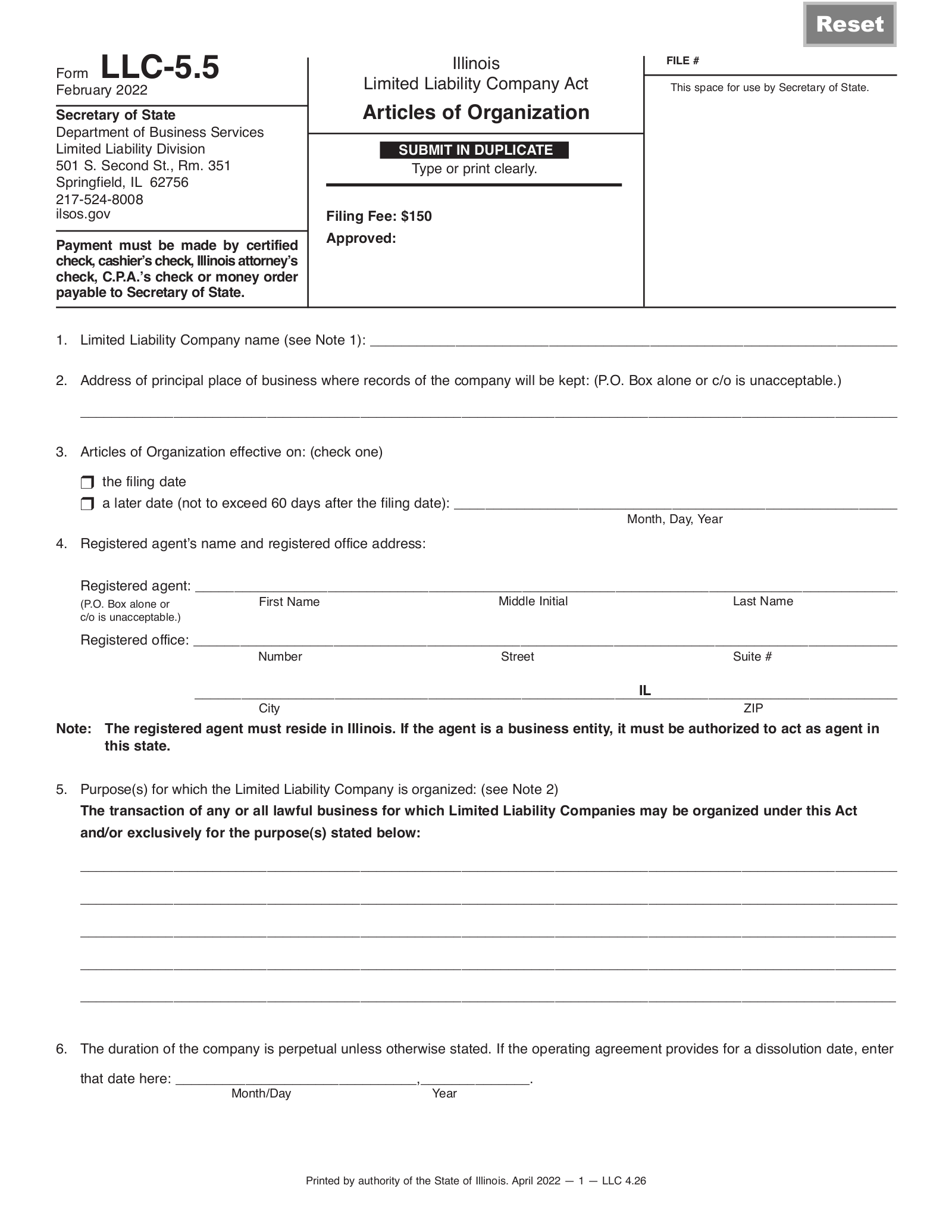

Option 2: File By Mail

Complete the form and send the document to the provided address with an enclosed payment.

Articles of Organization for Domestic LLC – For in-state entities.

Articles of Organization for Domestic LLC – For in-state entities.

Filing fee: $100 check or money order payable to the Secretary of State

Mailing address: Business Services Division, Secretary of State, 302 West Washington St. Room E-018, Indianapolis, IN 46204

Foreign Registration Statement (Foreign LLC) – For out-of-state entities.

Filing fee: $75-250 check or money order payable to the Secretary of State. The filing fee varies by type of LLC.

Mailing address: Business Services Division, Secretary of State, 302 West Washington St. Room E-018, Indianapolis, IN 46204

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

Every LLC must apply for an Employer Identification Number (EIN), which is a nine-digit tax number assigned to each business.

5. Write an Operating Agreement

LLCs in Indiana are not required to draft an operating agreement. However, it is recommended that one be created to help structure the business.

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification

Below are the most common types of LLC tax classification:

- LLC – By default, an LLC is formed as a sole proprietorship (one member) or a partnership (two or more members) in which every owner or partner must individually pay income tax on the profits.

- S-Corporation – An S-corp sends all business profits and losses to the shareholders, who must pay income tax on the profits. To file as an S-corp, an LLC must file IRS Form 2553 within 75 days of formation.

- C-Corporation – A C-corp files taxes as a separate corporate entity. To file as a C-corp, an LLC must file IRS Form 8832 within 75 days of formation.

7. File Business Entity Report

Every business must file a Business Entity Report with the Secretary of State. The first report is due two years after the business is formed or registered, and the following reports are due every other year thereafter.[5]