Updated March 20, 2024

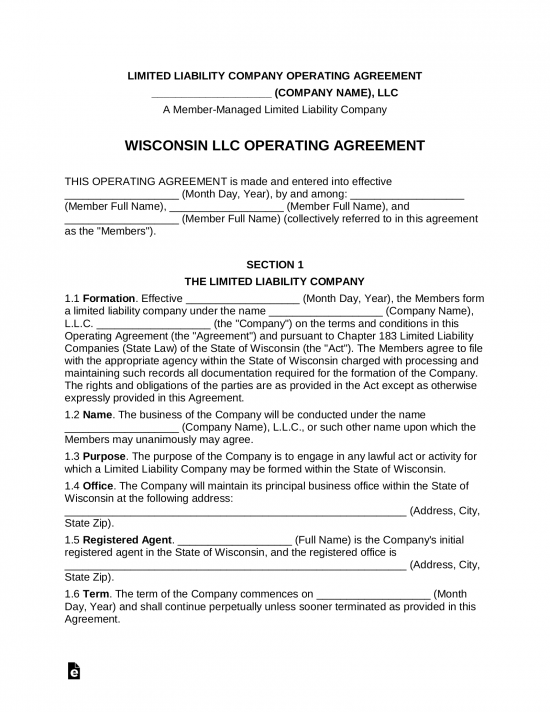

A Wisconsin LLC operating agreement is a document that holds the rules for the day-to-day activities of the business and its members. The agreement should include the rights of members, ownership, and the appointment of officers. All terms must be agreed to and signed by all the members of the company. It is the responsibility of each member to hold a copy of the operating agreement; the document is not filed with the Dept. of Financial Institutions.

Is an Operating Agreement REQUIRED in Wisconsin?

No — the State of Wisconsin does not legally require businesses to adopt an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – Should this be a single ownership entity, this is the proper document to integrate and create a single-member LLC.

Single-Member LLC Operating Agreement – Should this be a single ownership entity, this is the proper document to integrate and create a single-member LLC.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – This is the appropriate form to be used if the business has more than just one (1) member.

Multi-Member LLC Operating Agreement – This is the appropriate form to be used if the business has more than just one (1) member.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

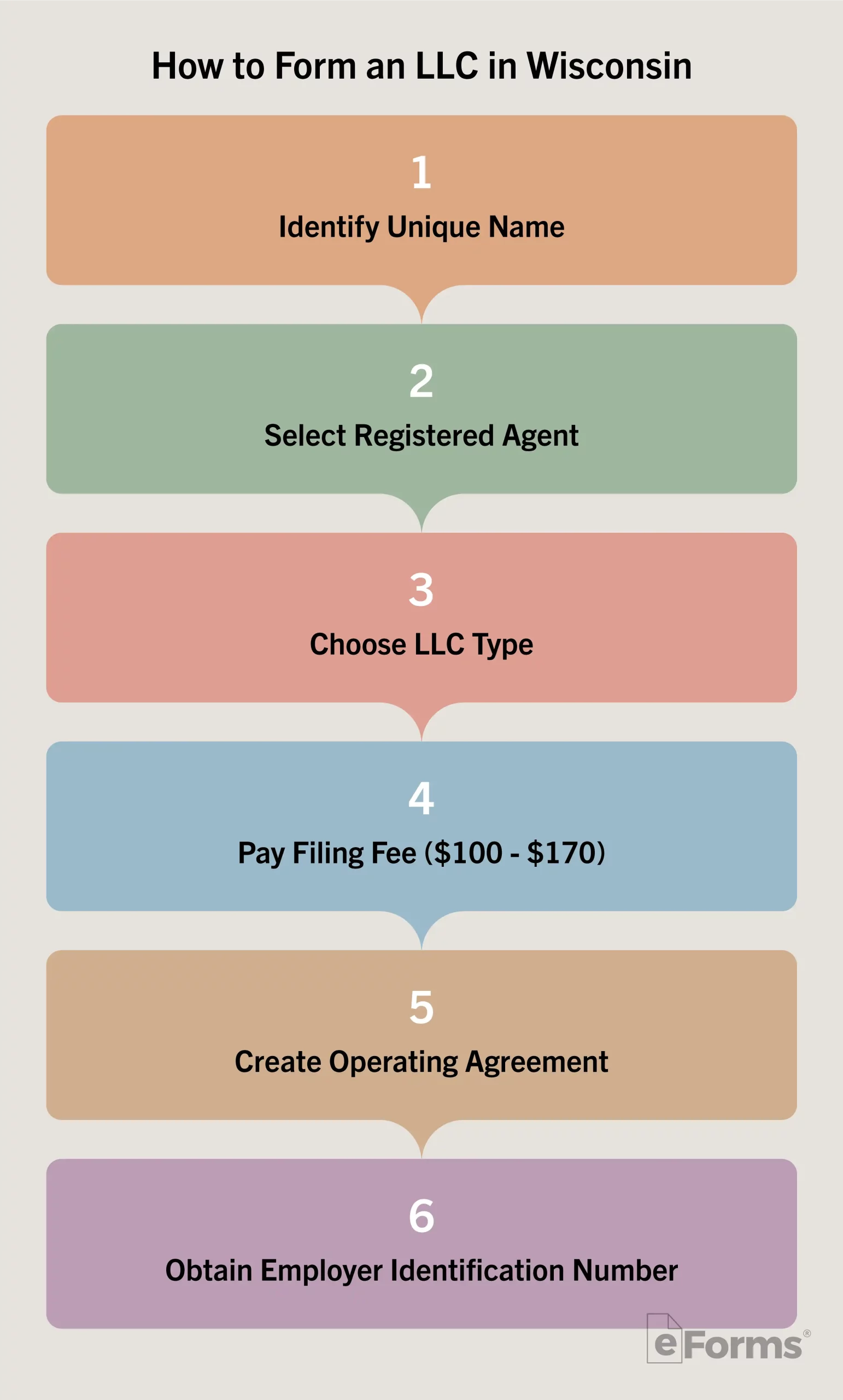

How to Form an LLC in Wisconsin (5 steps)

- Choose a Registered Agent

- Which LLC Type

- Pay the Fee

- Operating Agreement

- Employer Identification Number (EIN)

You are encouraged to search for your business name in the State’s Records prior to filing to ensure that the name is unique and available for use; the State will not accept any duplicate or similar names. Proceed onto the filing steps below only after confirming the availability of your business name.

1. Choose a Registered Agent

The managing member(s) of the LLC must elect a Registered Agent for the purpose of forwarding service of process and legal notices to the company.

In Wisconsin, the Registered Agent shall be one of the following:

- A person residing in the State

- A business legally operating in the State

2. Which LLC Type

Select your LLC type from the following options and fill in the corresponding application:

- Domestic – Articles of Organization

- Online – select Click here to start filing

- PDF (Form 502)

- Foreign – Certificate of Registration

- Online – select Start

- PDF (Form 521)

3. Pay the Fee

With your application filled in, you will need to supply the fee before your filings can be processed. The exact fees are as follows:

- Domestic LLC

- Online – $130

- PDF – $170

- Foreign LLC

- Online – $100

- PDF – $100

Note:

- Online applications will be complete once payment has been accepted

- If filing a paper application, enclose a check made out to the ‘Department of Financial Institutions’ and send all items to the following address:

State of WI Dept. of Financial Institutions, Box 93348, Milwaukee, WI 53293-0348

5. Employer Identification Number (EIN)

An Employer Identification Number is a nine-digit identifier that the Internal Revenue Service issues to businesses for the purpose of reporting income tax information. It will be necessary to obtain an EIN if your business plans on hiring staff, opening company bank accounts, or partaking in any financial transaction/maneuver under the company name.

Laws

- Wisconsin Statutes: Limited Liability Companies – Chapter 183

“Operating Agreement” Definition

“Operating agreement” means an agreement in writing, if any, among all of the members as to the conduct of the business of a limited liability company and its relationships with its members.”