By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, D.C.

- West Virginia

- Wisconsin

- Wyoming

What is an Unsecured Promissory Note?

An unsecured promissory note acknowledges the liability of a debt that must be repaid without collateral. In an unsecured note, there is no collateral put forward in the event the borrower defaults on the loan.

An unsecured note relies heavily on the individual’s intent to pay as there is no security provided in case the borrower does not repay the loaned amount.

What Does It Include?

- Borrower’s name

- Lender’s name

- Loan terms

- Borrowed amount ($)

- Interest rate (%)

- Repayment period

- Late Fees (if any)

- Co-signer (if any)

- Prepayment penalty (if any)

How to Make an Unsecured Note (3 steps)

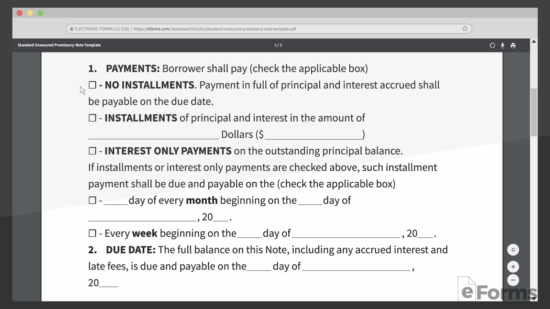

1. Repayment Type

The most important aspect of an unsecured promissory note is how the money will be paid back to the lender. Below are the following repayment types.

The most important aspect of an unsecured promissory note is how the money will be paid back to the lender. Below are the following repayment types.

- Installments – The most popular repayment schedule type. Gives the lender a good feel as to how the borrower is making good on their word. If there is a problem, the lender will know if the borrower misses an installment payment.

- Interest Only payments – Only select this repayment type if the borrower has a good reputation or credit score. The borrower will only make payments on the interest of the loan until the due date, in which the entire loan amount needs to be paid.

- Lump-Sum (Due Date) – Choose this repayment type if there are no plans for the borrower to pay interest or make installment payments.

2. Fees and Default

Even though this is an unsecured note, there still needs to be repercussions if the borrower misses a payment or fails to comply with the terms in any way.

Even though this is an unsecured note, there still needs to be repercussions if the borrower misses a payment or fails to comply with the terms in any way.

- Interest Fee – This note gives the borrower 15 days to correct a default before the lender can charge interest on the amount due.

- Late Fee – This allows the lender to set a customized day count after the date the payment is due. If the borrower fails to pay after said days, the lender can charge a late fee.

3. Conclude Agreement

Before signing the note, make sure to read the document in its entirety (only 3 pages long). If you want to make changes to the language in the document, download it in Word. The principal sum is the amount lent to the borrower, make sure this number is correct. When both parties are in agreement, sign the note and include 2 witnesses.

Before signing the note, make sure to read the document in its entirety (only 3 pages long). If you want to make changes to the language in the document, download it in Word. The principal sum is the amount lent to the borrower, make sure this number is correct. When both parties are in agreement, sign the note and include 2 witnesses.

Enforcing an Unsecured Promissory Note

Though an unsecured promissory note doesn’t have collateral attached to it, a lender can still collect from a defaulting borrower. You can send a demand for repayment to the borrower, file a suit in court, or enlist the help of a collection agency. An unsecured promissory note is still a legally-binding document after all.

The risk is that even if your party takes these measures to collect a payment, it often comes with additional fees that may cut into your investment. And even if you take these routes, there are no guarantees that the borrower can pay back the loan in full. So you might suffer a loss.

It’s important to be sure before signing an unsecured promissory note that the lender is willing to take the risk and that the borrower is capable of paying back the loan. When everything is prepared properly, an unsecured promissory note can make the loan filing process quick and efficient.

Sample

Download: PDF, MS Word, OpenDocument