Updated February 09, 2024

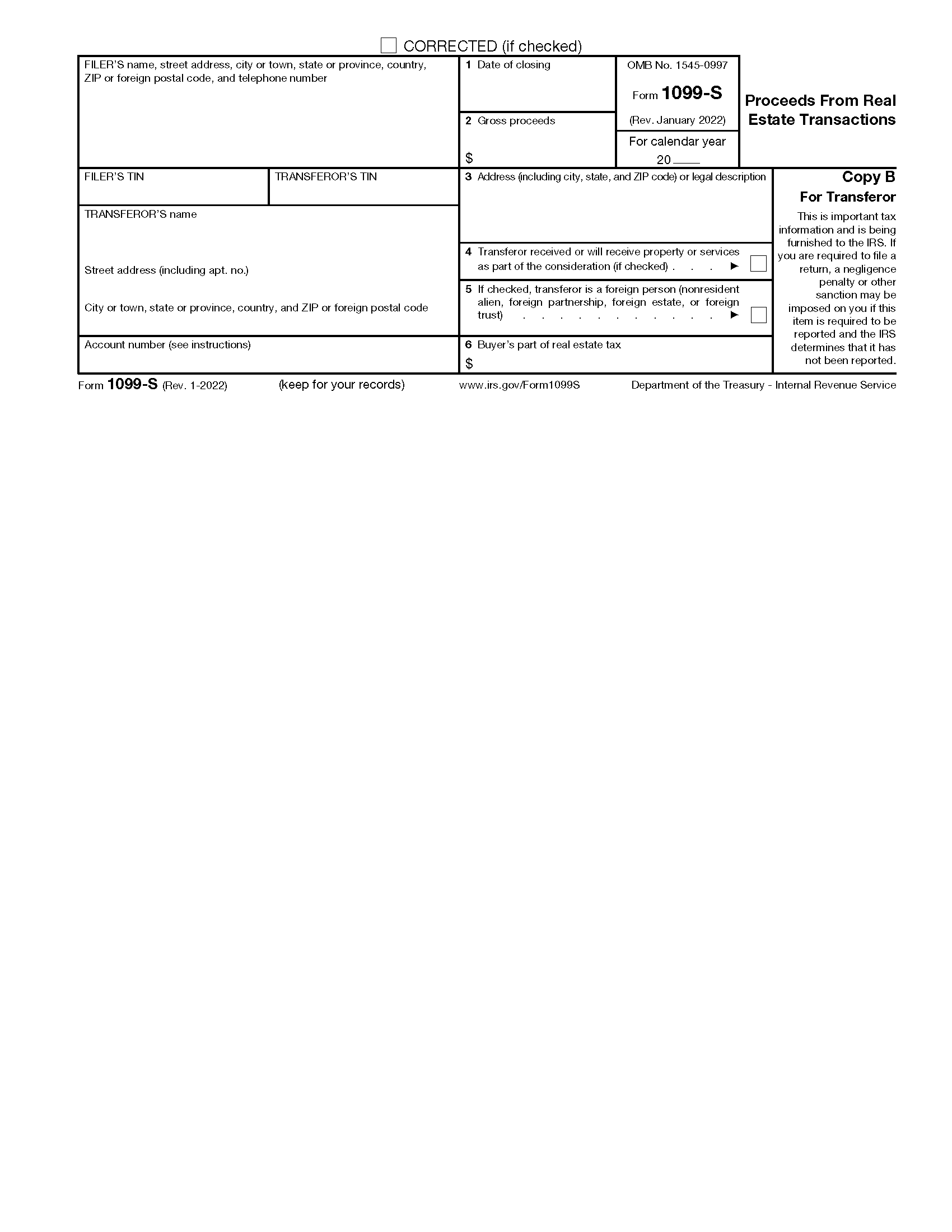

A 1099-S form is an IRS tax document used to report the sale or exchange of real estate. With certain exceptions, the person who closes the transaction is typically responsible for filing a 1099-S for each transferor (seller) of the property.

Useful to Know

To avoid uncertainty, the transferor and transferee can use a written agreement to designate a qualified third party as the person who must file 1099-S.

Table of Contents |

Who Must File 1099-S

Generally, the person responsible for closing the transaction is required to file 1099-S. This is usually the settlement agent listed on the Closing Disclosure, but it may also be the transferee’s or transferor’s attorney, the mortgage lender, or the title or escrow company.[1] See the IRS instructions for more specific details on filing responsibility.

Designation Agreement

At or before the time of closing, the transferring parties can enter a written agreement with a qualified third party to designate that person as responsible for filing 1099-S. The third party must be either the person closing the transaction, the transferee’s or transferor’s attorney, the title or escrow company, or the mortgage lender.[1]

Reporting Requirements

Real estate transactions that must be reported on 1099-S include the sale or exchange of:[2]

- Land (improved or unimproved)

- Permanent structures

- Condominium units

- Stock in a cooperative housing corporation

- Any non-contingent interest in standing timber

You are not required to report the sale or exchange of a residence for $250,000 or less, nor any real estate transaction in which the transferor is a corporation.[3]

Deadlines

The deadline to file Form 1099-S with the IRS is February 28 of the following year, or March 31 if filing electronically. If the deadline falls on a weekend or federal holiday, the deadline to file is extended to the next business day. However, the filer must furnish Copy B to the transferor on or before February 15.[4]

2024 Deadlines

- February 15, 2024 (recipient)

- February 28, 2024 (IRS – Filing by Paper)

- March 31, 2024 (IRS – Filing Electronically)

Form Parts (13)

1. Date of Closing

Enter the closing date for the transaction.

2. Gross Proceeds

Enter the gross proceeds from the sale or exchange of the real estate, including cash, a note or mortgage paid off at settlement, and/or a liability assumed by the transferee. Gross proceeds do not include the value of exchanged property or services other than the real estate property, or separately stated cash received for personal property.[5]

If you are reporting a like-kind exchange of property for which there are no reportable gross proceeds, enter a “0” in box 2 and enter an “X” in the checkbox in box 4.

3. Address

Enter the address of the property, including the city, state, and ZIP code. Include a legal description (such as section, lot, or block) if necessary.[6]

4. Property or Services Checkbox

Enter an “X” in this checkbox if the transferor will receive property or services as part of the transaction other than the real estate property. Property received does not include any cash or considerations included in box 2.[7]

5. Foreign Transferor Checkbox

Enter an “X” in this checkbox if the transferor is a foreign person.

6. Buyer’s Part of Real Estate Tax

For a real estate transaction involving a residence, enter the real estate tax paid in advance that is allocable to the buyer. This is the amount of tax paid in advance that is proportionate to the remainder of the calendar year following the date of closure.[8]

7. Identifying Information (6 Entries)

On the left side of the 1099-S, a total of 6 boxes require information that identifies the filer and the transferor, including:

- Filer information – name, full address, and phone number

- Filer’s TIN – taxpayer identification number

- Transferor’s TIN – normally an SSN/ITIN or EIN

- Transferor’s name – full name

- Transferor’s street address – number and street only

- Transferor’s remaining address – city/town, state/province, country, Zip/postal code

The transferor’s TIN must be entered in XXX-XX-XXXX (SSN or ITIN) or XX-XXXXXXX (EIN) format on Copy A of this form.[9]

8. Account Number

The account number field is generally provided for the filer’s reference and for internal recordkeeping. It is required if there are multiple accounts for a recipient who is receiving more than one 1099.

The IRS encourages you to designate an account number for all 1099-S forms that you file. Note that the account number must be unique and cannot appear anywhere else on Form 1099-S.[10]

How to File

If filing 1099-S by mail, do not file forms that you print off of the IRS website. Only submit official forms ordered from the IRS.[11]

- Collect W-9s from each transferor

- Choose a filing method (by mail, online with IRIS or FIRE, or with third-party software. Skip to step 5 if you are filing electronically.)

- Complete Form 1096 and Copy A on official IRS documents

- Mail Form 1096 and Copy A to the appropriate IRS address

- Send Copy B to the transferors (these can be printed copies from the IRS website)

- Retain Copy C for your records

Frequently Asked Questions (FAQs)

How do I report 1099-S income on my taxes?

How you report income from a real estate transaction depends on the type of property that was sold. Use Form 8949 to determine how the income reported on your 1099-S must be reported on Schedule D (Form 1040) when you file your taxes.

What if there are multiple transferors involved in a transaction?

For multiple transferors of the same real estate, you generally must file a separate Form 1099-S for each transferor. However, if the transferors were spouses at the time of closing, and they held the property jointly, then only one Form 1099-S is required.[12]

Is a real estate agent responsible for filing 1099-S?

If the agent is working for a brokerage or other agency as an employee, then only the employer, and not the agent, may be the reporting person.[13]

Sources

- IRS – Who Must File

- IRS – Reportable Real Estate

- IRS – Exceptions

- IRS – Guide to Information Returns

- IRS – Gross Proceeds Box Instructions

- IRS – Address Box Instructions

- IRS – Property or Services Checkbox Instructions

- IRS – Real Estate Tax Box Instructions

- IRS – Transferor TIN Format

- IRS – Account Number Box on Forms

- IRS Form 1099-S

- IRS – Multiple Transferors

- IRS – Employees, Agents, and Partners