Updated August 02, 2023

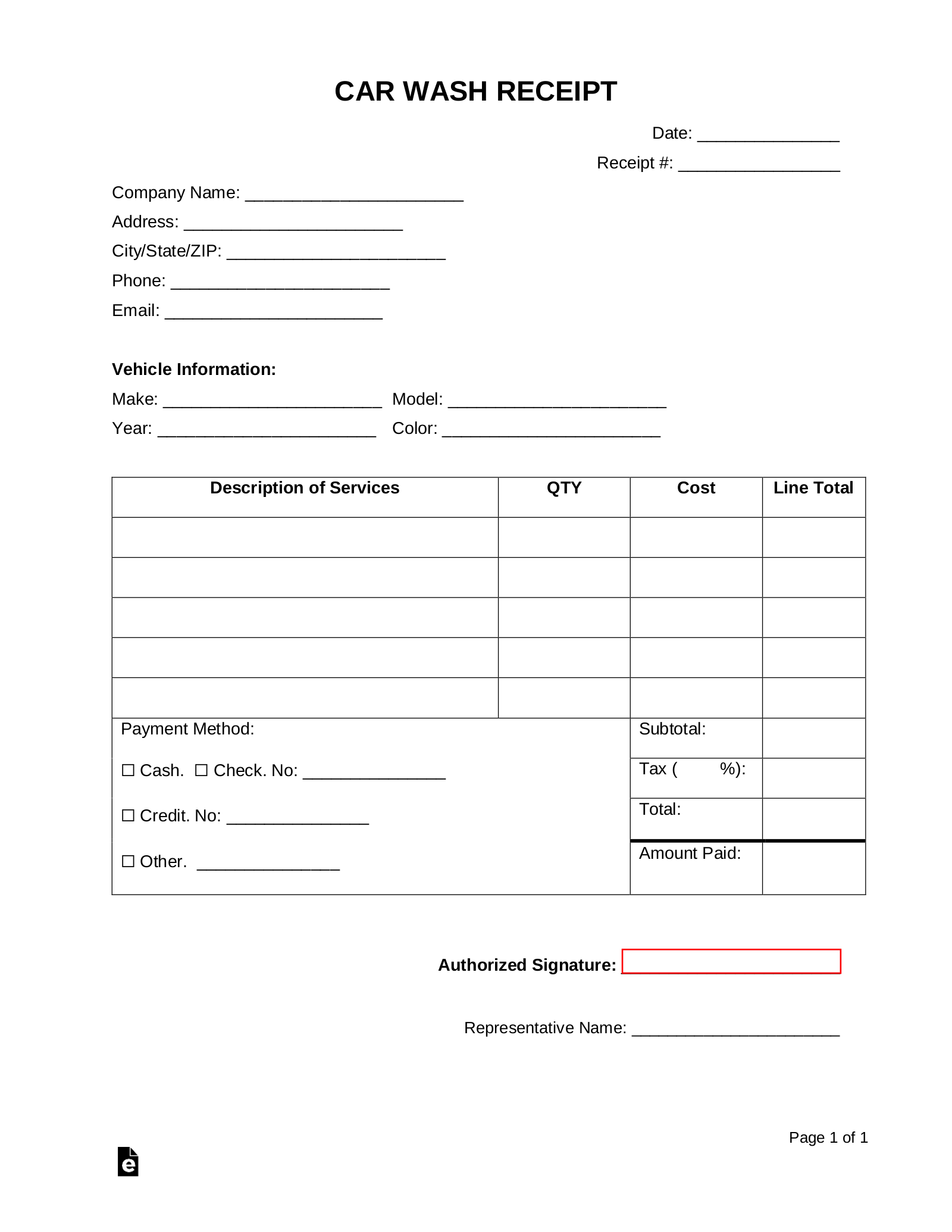

A car wash receipt can be supplied by any car cleaning service following the full payment of the amount due. A full description of each service provided by the company as well as the individual cost of each can be calculated using the template.

Often such a receipt is useful should the car be required for business purposes and the driver wishes to deduct the total amount owed from their annual income tax return.

Car Detailing Receipt – For extra work that is requested after a vehicle is washed.