Updated November 08, 2023

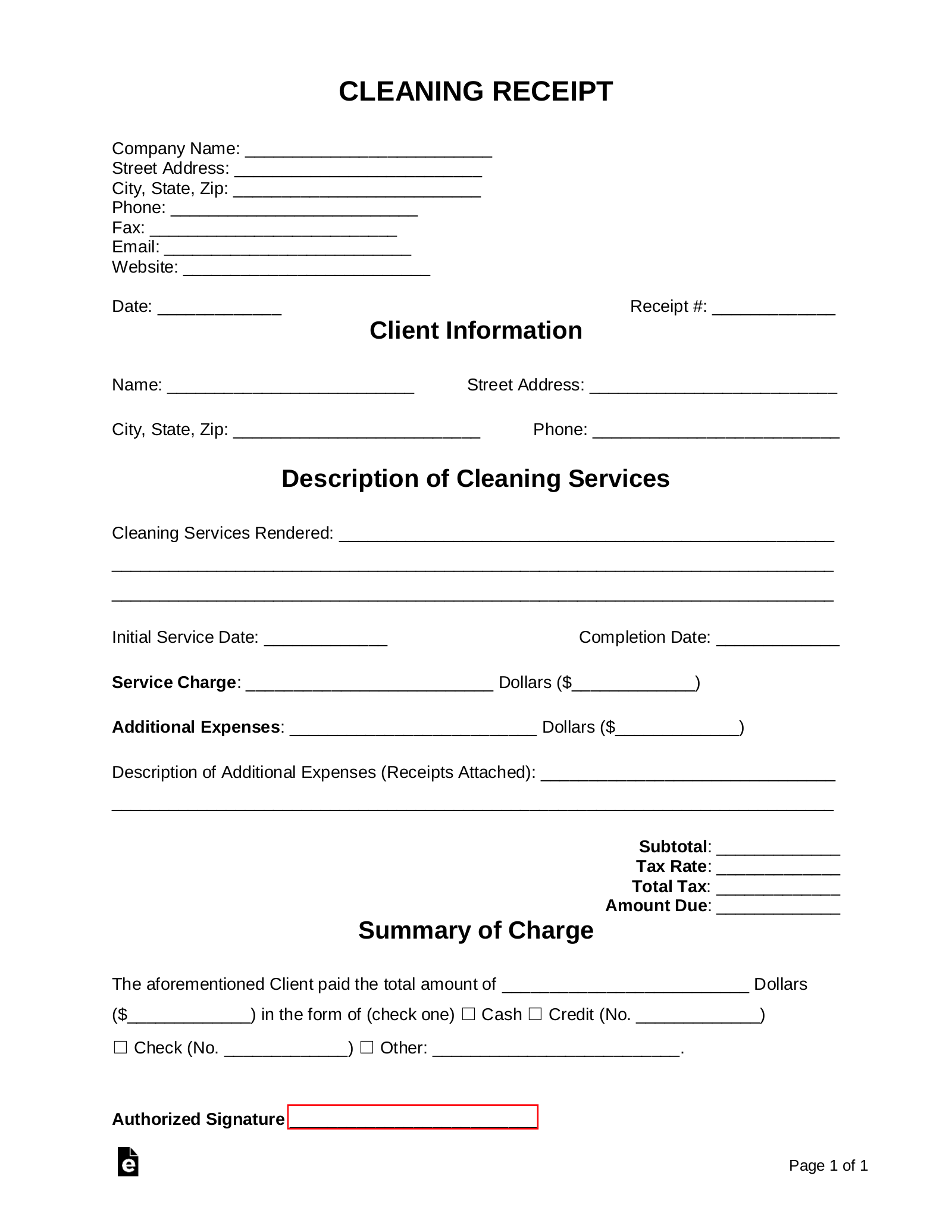

A cleaning receipt template is submitted to a client after receiving a successful payment for cleaning services. An individual or business may issue the receipt for a variety of residential or commercial services (more specific receipts types are available below). Clients will require the receipt should they wish to deduct the cost of the transaction when issuing their personal or business income tax reports. It would also benefit the client to maintain the original receipt should they wish to demand a refund.