Updated February 01, 2024

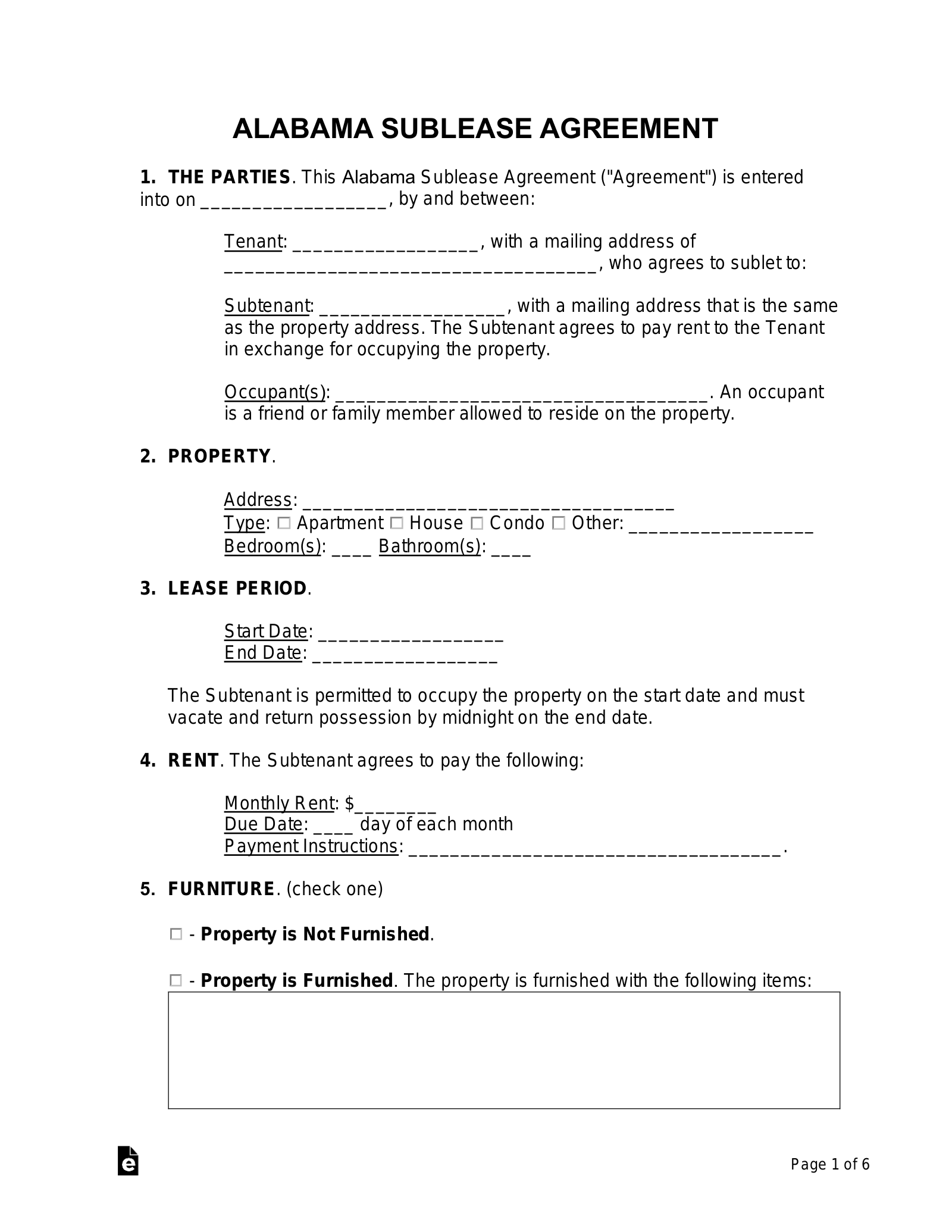

An Alabama sublease agreement allows a subtenant to occupy space based on the current tenant’s rental contract with their landlord. The subtenant is responsible for abiding by the rules and provisions set forth by the landlord in the master lease, which should be attached to the sublease and any disclosures.

Right to Sublet

There are no laws regarding a tenant’s right to sublet in Alabama. Therefore, a tenant’s current lease determines whether or not subletting is allowed. If a tenant is prohibited, the landlord’s written permission is required (use a Landlord Consent Form).

Short-Term (Lodgings) Tax

A tenant is subject to the lodgings tax if they sublet a property for any period of less than 180 continuous days.[1]

If renting on a short-term basis, Alabama charges a 5% rate on the counties of Blount, Cherokee, Colbert, Cullman, DeKalb, Etowah, Franklin, Jackson, Lauderdale, Lawrence, Limestone, Madison, Marion, Marshall, Morgan, and Winston. All other counties are charged a 4% rate.[2] This excludes county or city-imposed taxes (see Local Sales and Use Tax Rates).

State taxes are due each month, on or before the 20th day,[3] unless the taxpayer elects to file quarterly, bi-annually, or annually by February 20 of said tax year. Such election is permitted if:

- Quarterly filings allowed: If the total lodging taxes for the previous year are less than $2,400;

- Semi-annual filings allowed: If the total lodging taxes for the previous year are less than $1,200 or if the taxpayer provided no more than two 30-day accommodations in the preceding year;

- Annual filings allowed: If the total lodging taxes for the previous year are less than $600 or if the taxpayer provided no more than one 30-day accommodation in the preceding year.[4]

Making Payments – Payments of the lodgings tax can be made at the Alabama Dept. of Revenue. If using a third-party booking company (like Airbnb), payments are commonly made through the platform without requiring the taxpayer to file or register with the Dept. of Revenue.[5]

Related Forms

Download: PDF

Download: PDF, MS Word, OpenDocument