Updated March 01, 2024

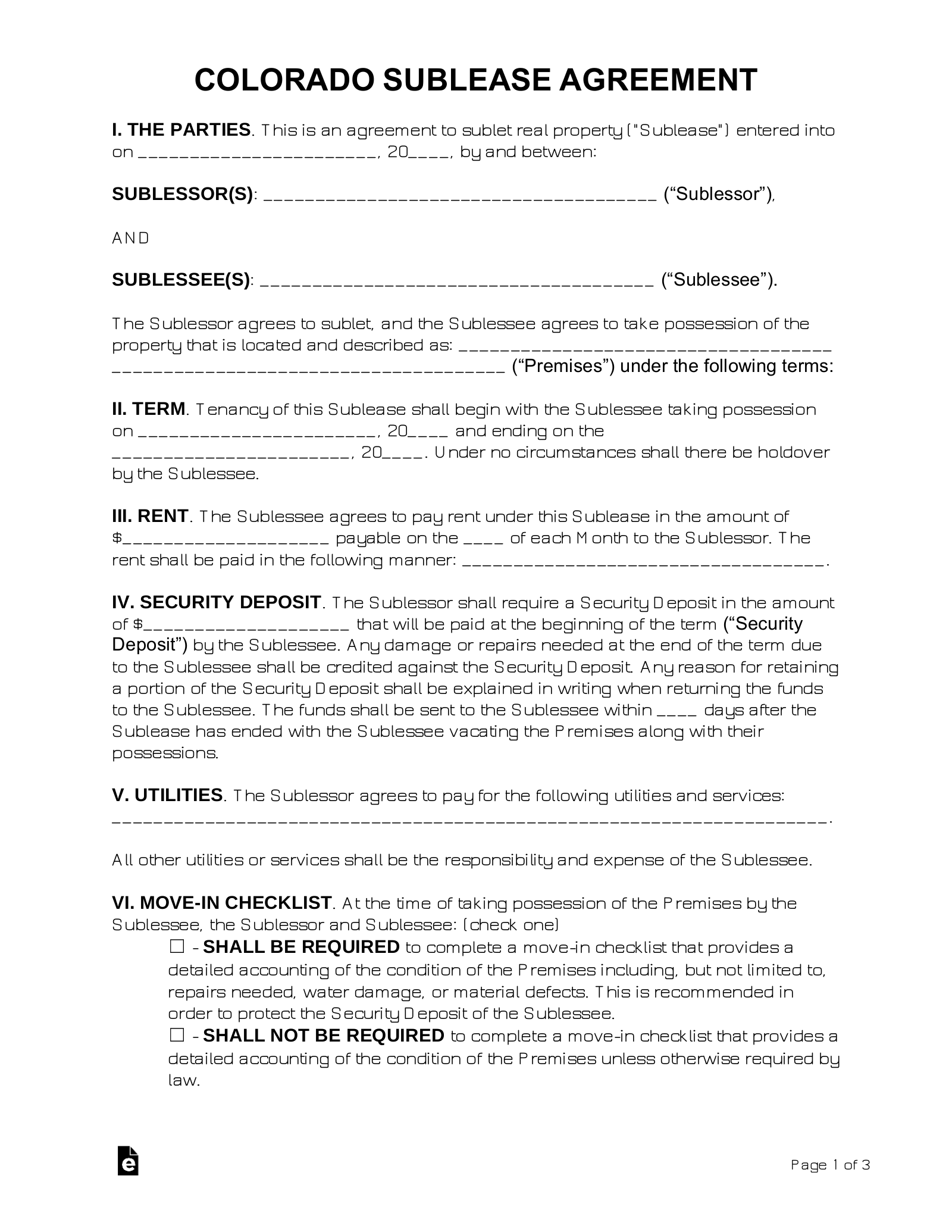

A Colorado sublease agreement binds the terms of an arrangement in which the property’s current tenant and landlord allow for a third party (sub-lessee) to reside at the property for a designated period of time. The original lease will remain in effect and dictate the terms of the tenancy.

Right to Sublet

Colorado state law doesn’t specifically address a tenant’s right to sublet. The city of Boulder provides a Landlord-Tenant Handbook that clarifies many topics, including subleasing.

Typically, the original lease will include language that either allows or prohibits subleasing. If the lease does not explicitly prohibit subleasing, the landlord cannot reasonably withhold permission to sublet.

When seeking permission to sublet, consider using a Landlord Consent Form.

Short-Term (Lodgings) Tax

In Colorado, a short-term rental (STR) is generally defined as a rental of 30 days or less. In 2020, the Colorado General Assembly passed HB 20-1093, which granted counties the right to regulate STRs.[1] Local requirements vary greatly within the state of Colorado. Some municipalities have banned STRs entirely, while others have limited them by capping the number of available permits.

Short-term rentals are subject to a number of taxes levied by the state, county, and city if the property is within city limits.

Colorado short-term rental taxes that may apply:

- 2.9% State sales tax[2]

- County sales tax

- City sales and lodgings tax

- County lodgings tax

- City marketing district tax

In some cases, a special permit or business license may be required if the property is located within city limits. License applications typically start with the city clerk.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF