Updated October 02, 2023

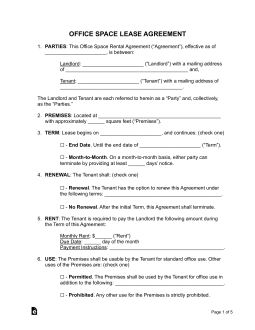

An office lease agreement is a legal document between a landlord that rents dedicated space, suites, or shared workspace for office-related use. Rent is usually figured on a price per square foot ($/SF), with the obligations of the landlord and tenant to be negotiated.

It is commonly prohibited for retail or residential use.

Table of Contents |

How to Rent Office Space (6 steps)

- Finding a Tenant / Looking for Space

- Tenant Schedules a Showing

- Negotiate the Terms of the Lease

- Landlord Verifies the Tenant

- Signing the Office Lease

- Taking Occupancy

1. Finding a Tenant / Looking for Space

Whether you are the landlord attempting to find a suitable tenant or a tenant searching for the perfect space it’s best to use the internet to view available properties. The most popular websites, depending on the type of office space, are the following:

Advertising Office Space

These sites are for traditional landlord-tenant relationships where the tenant signs a lease with a start and end date. The responsibilities of each party are also identified along with responsibilities related to taxes, insurance, and common area maintenance (CAM’s).

- LoopNet – most popular

- Co-Star

- SquareFoot

- InstantOffices

Office Sub-Leasing (Co-Working) Companies

If the tenant is solely looking for a month-to-month arrangement or a setup where the facilities and utilities will be fully taken care of by the landlord, then office sub-leasing company may be a viable option. The tenant may pay more under this arrangement but will have the peace of mind that they will never have to worry about the utilities on the premises. In addition, these leases are often month to month meaning the tenant can cancel at any time with just thirty (30) days’ notice. Although, a tenant will often get a better deal on the monthly rate if they commit to 6 months or a full year lease.

2. Tenant Schedules a Showing

Once the tenant has found a few properties in their area that meets their needs, it’s in their best interest to schedule an appointment with the landlord or property manager to visit the property. At the showing, the landlord, or their agent, will give all necessary details about the property including move-in dates, monthly rent, how much space is available, and any other details of the property.

3. Negotiate the Terms of the Lease

Upon the tenant deciding which space works best for them, the negotiations will begin between the landlord and tenant. A common strategy is for the tenant to narrow it down to two (2) properties and play the landlords against one another. This will allow the tenant to get the best possible rate. Of course, this strategy only works when there are vacancies in the area.

If there are little to no vacancies in the area, the tenant will be subject to paying the market rate including any premium if the space they are seeking requires special accommodation.

Four (4) Types of Office Leases

- Co-Working Lease Agreement

- Landlord: Covers all expenses and utilities.

- Tenant: No responsibilities.

- Gross Lease

- Landlord: Covers real estate taxes, property insurance, and common area maintenance (CAM’s).

- Tenant: Covers their utilities and services.

- Modified Gross Lease

- Landlord: Shared costs (negotiated)

- Tenant: Shared costs (negotiated)

- Triple Net (NNN) Lease

- Landlord: Ensures the roof and parking lot are in good standing.

- Tenant: Covers real estate taxes, property insurance, and common area maintenance (CAM’s) and their utilities and services.

4. Landlord Verifies the Tenant

Once a verbal agreement is made between the parties, the landlord will most likely want to verify the tenant is who they claim to be with a Rental Application. This will involve the landlord obtaining the tenant’s financial statements, Secretary of State records, and any other necessary documents. If the tenant is an individual, a standard credit and background check may be required along with 2-3 years of past individual income returns with the Internal Revenue Service (IRS).

5. Signing the Office Lease

There are three (3) ways to sign:

- Handwritten Signature (in-person) – The traditional way of printing out the document and authorizing with all parties present.

- Notary Acknowledgment (recommended) – For large-scale lease agreements, it should be authorized in the presence of a notary public. This is done by attaching a notary acknowledgment to the lease and ensures that each individual has authorized the agreement with the notary verifying each person’s identification.

- eSignature – Also known as a digital signature, obtains an electronic record of the person’s device to ensure that he or she is signing the document.

After the lease is signed the tenant will be obligated to pay the security deposit (if any) and the first (1st) month’s rent.

6. Taking Occupancy

If the property needs to be built-to-suit to the tenant’s needs then the occupancy date will have to wait until the construction is complete. If the property is ready immediately the landlord will be required to hand over all access to the premises, including, but not limited to, common areas, mailboxes, parking areas, and any other areas permitted under the lease agreement.

If the tenant is responsible for any services on the property such as internet, cable, water/sewer, electricity, or any other utilities. The tenant will be required to place them in their name.

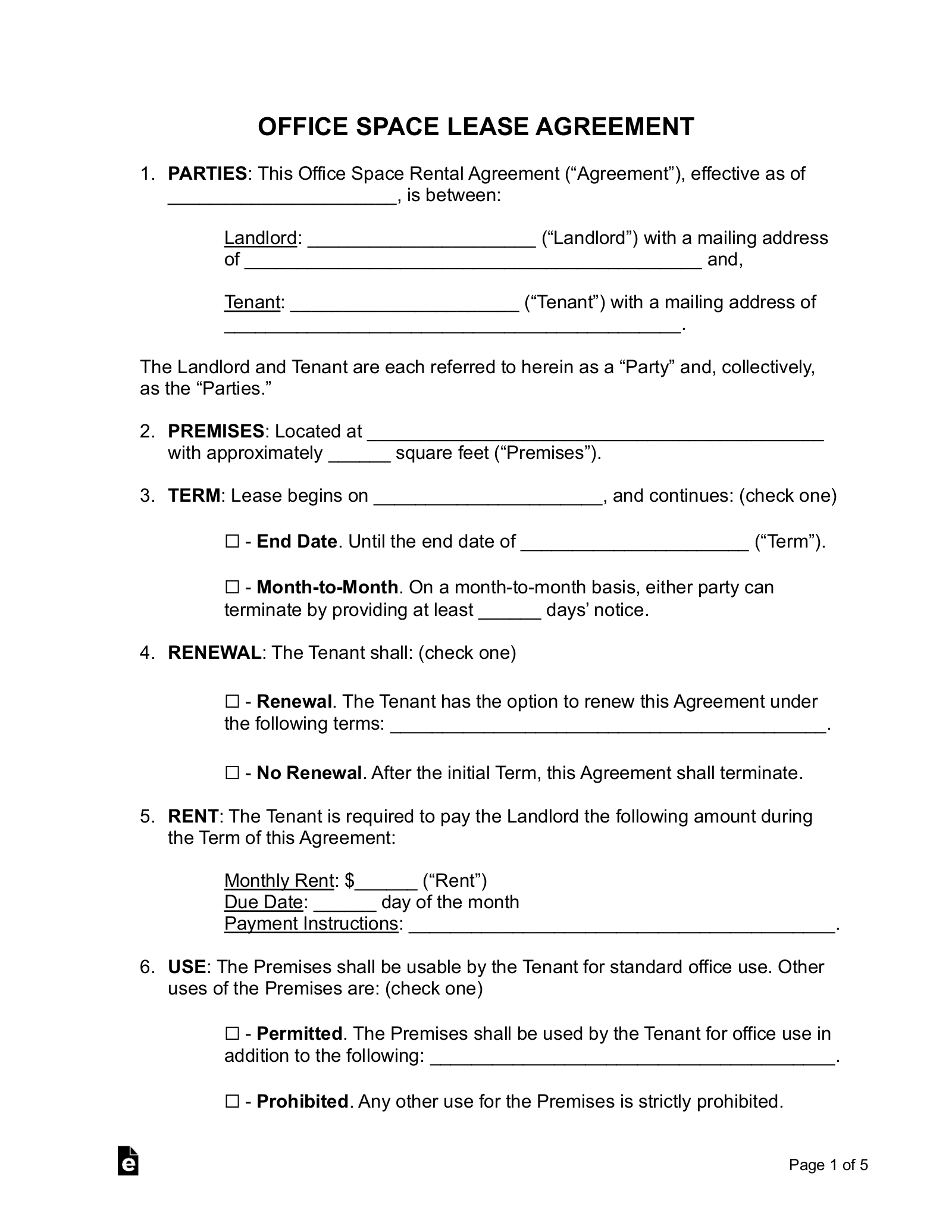

Sample Office Lease Agreement

Download: PDF, MS Office, OpenDocument