Updated April 08, 2024

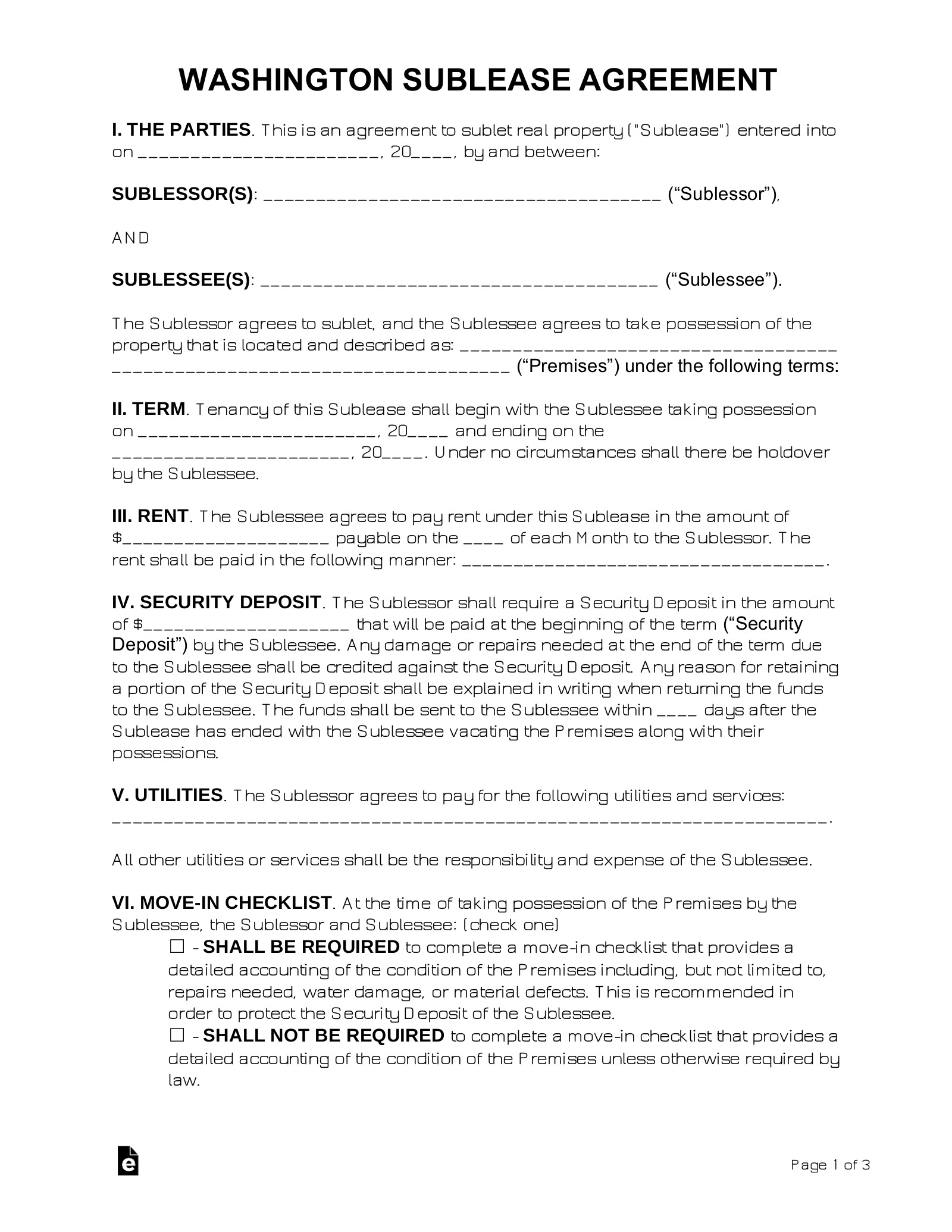

A Washington sublease agreement is a contract used when a tenant wants to rent part or all of their residence to another person. They might want a roommate or may need to relocate before the end of their lease. A sublease allows a tenant to accomplish this while still fulfilling their legal obligations under the original lease.

Right to Sublet

Washington’s laws do not directly address whether tenants may sublet or not. The lease itself will typically contain language about subletting and will often require that the tenant secure their landlord’s permission before doing so.

If the lease is unclear on the subject, the tenant is advised to contact their landlord for more information. When a landlord’s permission to sublet is required, a Landlord Consent Form can be used.

Short-Term (Lodgings) Tax

Generally, in the state of Washington, a short-term rental is defined as an accommodation that is offered for rent for fewer than 30 consecutive nights. Operators of a short-term rental must remit all applicable taxes, including occupancy, sales, and lodging taxes.[1]

Washington short-term rental taxes:[2]

- 6.5% state sales tax

- Applicable local sales tax

- Applicable 2% transient lodgings tax

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF