Updated April 17, 2023

A corporate resolution is a legal document that records an action made by the board of directors of a corporation. It serves as a legal record of the board’s decision and is a required document in certain circumstances, such as obtaining a line of credit for the corporation. All types of corporations use corporate resolutions, including S-corporations, C-corporations, and nonprofit entities.

Table of Contents |

When is a Corporate Resolution Required?

There are some instances in which a corporate resolution is required, such as:

1. Legal Purpose

It is legally required to create a corporate resolution when:

- Seeking tax deductions (§ 1.547-2, Code of Federal Regulations) for a deficiency dividend (IRS Form 496); or

- If a corporation wants to enter into a relationship with another entity.

2. Banking

When a corporation needs to open an account for corporate funds, board members can authorize it through a vote. Corporate banking resolutions will typically identify the bank that will hold the account, the nature of the account being opened, and any restrictions that may be placed on the account.

3. Signing Authority

Signing authority can empower a person, usually, an officer like a company president or vice president, to sign and act on behalf of the corporation in particular instances, such as beginning large ventures or in anticipation of litigation. They can specify that the person’s signature and receipt of documents are akin to the corporation itself.

4. Other Uses

Whether or not it is required, creating corporate resolutions is a good practice. It maintains the “veil” of separation between a corporation and its owners, protecting them from liability in the case of lawsuits. Here are some other instances in which corporate resolutions are created:

- Stock buybacks debt issuance

- Beginning litigation

- New board members (Source: Cornell)

- Mergers

- Joint ventures

- Applying for federal benefits (Source: SBA)

- Changing employee benefits

How to Write a Corporate Resolution

Corporate resolutions are typically written and signed by the corporation’s secretary or another corporate officer. The fundamental components are:

- Identifying information about the corporation itself, including the state in which it is incorporated

- Explanations of what action the board is taking, typically preceded by the word “Resolved.”

- Explanations of the circumstances or reason the board is taking the action, known as a preamble. Preamble statements are typically preceded by “Whereas.”

Board Meeting vs. Written Consent

The resolution must state the circumstances under which the board reached its decision. Traditionally this could only happen at a meeting of the board of directors, one at which a quorum of directors were present and voted for the resolution under the margin required in the corporation’s bylaws.

But advances in communications technology have hastened the speed of business, and sometimes action is needed before a quorum can be assembled. All states now allow resolutions to be passed by written consent of the board members, so long as they are also permitted under the corporation’s bylaws and articles of incorporation.

States generally follow Delaware’s requirement (§ 116) that written consent may be delivered electronically or on paper, but that it must be unanimous. Before proceeding, it’s best to check the corporation’s code in the state where the company is incorporated to ensure a resolution by written consent complies with requirements.

Omnibus Resolution

Sometimes resolutions will include an “omnibus resolution.” These empower the people who will carry out the action that is the subject of a corporate resolution. For example, a corporate resolution deciding to enter into a joint venture with another corporation may contain an omnibus resolution empowering officers of the corporation to do what is necessary to bring the joint venture into effect.

Filing

Corporate resolutions are not required to be filed with any government agency (unless they are requested as part of an application or investigation). But because they form part of a corporation’s official records, companies should maintain and keep track of them.

Meeting Minutes

Resolutions that are approved at a board meeting may be included in the corporate meeting minutes. Keeping them in the company’s “minute book” leaves them available for later use or inspection.

Resolutions that are not approved at a board meeting may be retroactively noted in minutes of a subsequent meeting, or otherwise made a part of the company’s official records.

Do Corporate Resolutions Have to Be Notarized?

Corporate resolutions need not be notarized to be included in a company’s minute book or internal records. Some corporations have their own “seal” that can be obtained when they file articles of incorporation and which may be affixed to resolutions, but this is not typically required. Some entities may require corporate resolutions submitted as part of a grant or benefit program to be notarized.

Resolution for an LLC

Limited liability companies, or LLCs, use something similar to corporate resolutions. It’s sometimes called a “board resolution” and uses slightly different terminology. Important decisions for LLCs are made by “members” rather than directors, and they must be consistent with the LLC’s operating agreement rather than a corporation’s bylaws.

Sample

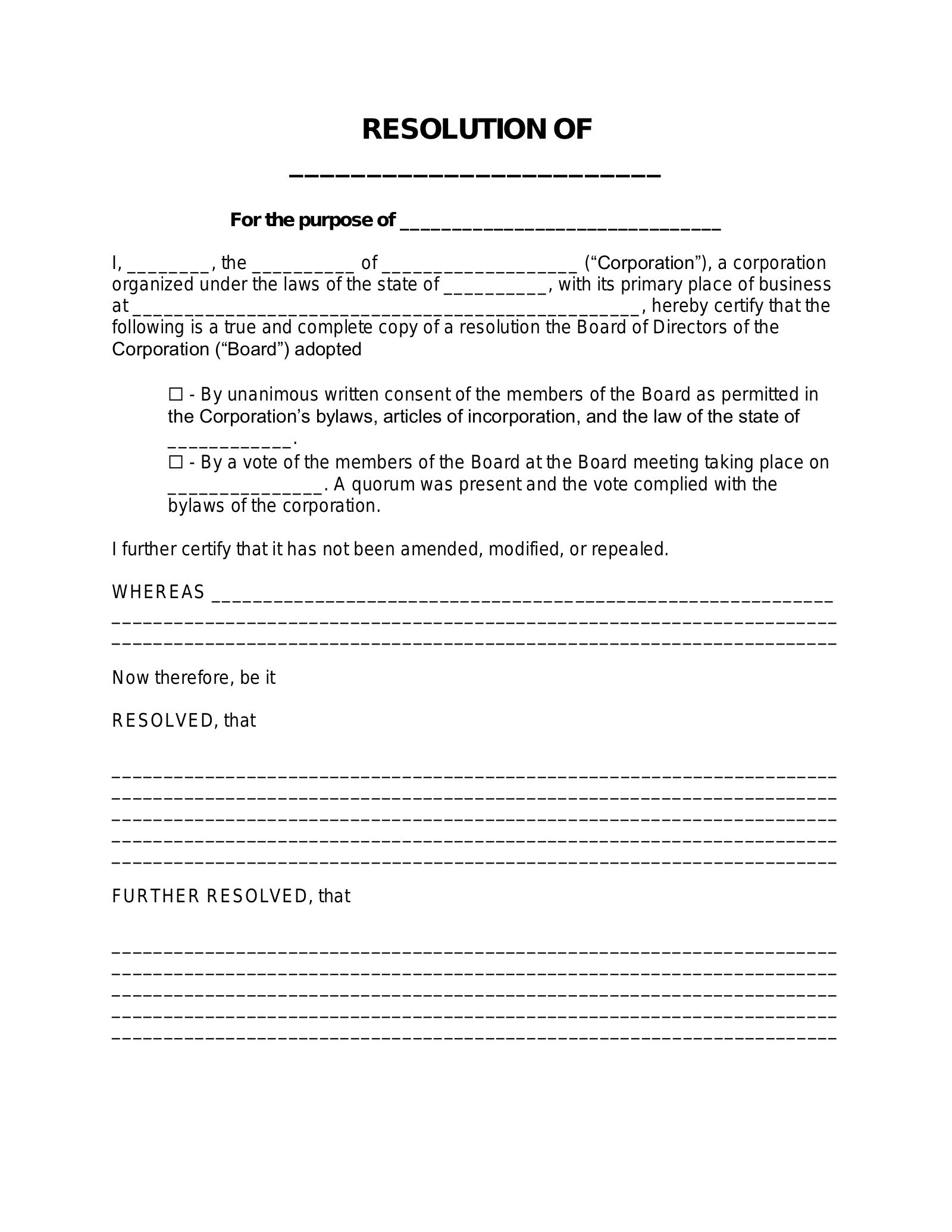

RESOLUTION

OF

[NAME OF CORPORATION]

For the purpose of [DESCRIBE PURPOSE OF RESOLUTION]

I, [NAME], the [TITLE] of [NAME OF CORPORATION] (“Corporation”), a corporation organized under the laws of the state of [STATE], with its primary place of business at [BUSINESS ADDRESS], hereby certify that the following is a true and complete copy of a resolution the Board of Directors of the Corporation (“Board”) adopted

☐ – By unanimous written consent of the members of the Board as permitted in the Corporation’s bylaws, articles of incorporation, and the law of the state of [STATE].

☐ – By a vote of the members of the Board at the Board meeting taking place on [DATE OF MEETING]. A quorum was present and the vote complied with the bylaws of the corporation.

I further certify that that it has not been amended, modified, or repealed.

[PREAMBLE, IF ANY]

Therefore, be it

RESOLVED, that

[DESCRIBE RESOLUTION].

FURTHER RESOLVED, that

[DESCRIBE RESOLUTION].

In witness whereof, I have set my hand on behalf of the Corporation on [DATE].

By: ___________________________________

Print Name: _____________________________

Title: __________________________________