Updated July 11, 2023

A partnership resolution is a legal document that records important decisions made by the individuals or entities that make up a business partnership. This written agreement is typically reserved for significant business decisions like opening a line of credit or appointing a top-level executive. Many different types of partnerships use resolutions, including general partnerships, limited partnerships, limited liability partnerships, and limited liability limited partnerships.

Table of Contents |

What is a Partnership Resolution?

A partnership resolution is a legal document chronicling key decisions made by the members of a business partnership. This report includes information about the partners who voted on the decision, how they voted, and the voting method used.

Partnership resolutions effectively act as a paper trail, providing corroboration in the event of audits or legal proceedings.

These documents are used by all types of partnerships, including:

- General partnerships: Under this arrangement, two or more individuals or entities share the financial and legal liabilities of a business.

- Limited liability partnerships: Commonly used by professionals like lawyers and medical practitioners, limited liability partnerships ensure that if one member is sued, the assets of other members are protected.

- Limited partnerships: In a limited partnership, a general partner oversees day-to-day business operations and assumes full liability for the company. Meanwhile, a limited partner assumes a more hands-off role and assumes liability up to the amount of their investment.

- Limited liability limited partnerships: A newer type of partnership structure, a limited liability limited partnership shields both general and limited partners from personal liability in the event of financial or legal issues.

Partnership vs. Corporate vs. Board

Partnership resolutions are used to record key business decisions made by the individuals or entities that constitute a partnership.

Comparatively, corporate resolutions are used to document decisions made by the board of directors of a corporation. Board resolutions serve a similar function but are used by the members, or owners, of a limited liability company (LLC).

All three types of resolutions follow a similar format and structure but with slightly different terminology.

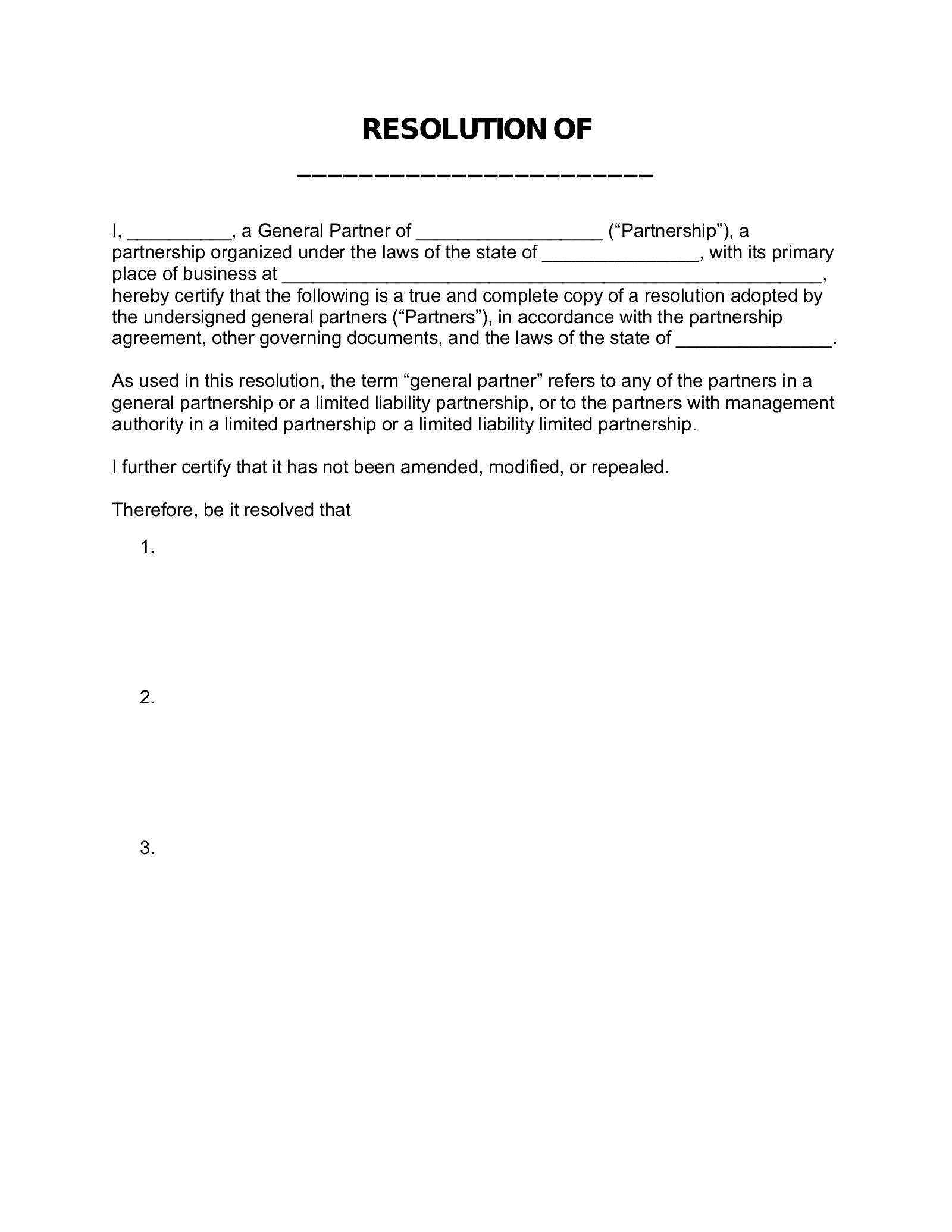

What Should Be Included?

A partnership resolution should include these key elements:

- Date: A partnership resolution should include the date on which members approved the decision.

Resolution number: Assigning each resolution a reference number can help keep records organized. - Title: Partners should give the resolution a title that refers to its contents. For example, “Resolution to Adjust the 2020 Operating Agreement.”

- Votes: The resolution should detail who voted on the decision, and how.

- Recitals: Recitals offer context for a specific decision.

- Resolutions: This section notes the agreed-upon decision.

- Signature: To make the resolution valid, a partner with signing authority must sign and date the resolution.

What are Recitals?

Found in the first section of a resolution, recitals are statements that provide the reader with background information on a specific decision. These statements begin with the term WHEREAS. For example: “WHEREAS, the partners of Neumann & Knotch LLP recognize the increased demand for services…”

What are Resolutions?

This section of the resolution describes the agreed-up decision. Resolutions typically begin with BE IT RESOLVED. For example: “BE IT RESOLVED that Neumann & Knotch LLP execute an agreement to partner with Walter Industries…”

Signing Authority

Who holds signing authority depends on the type of partnership and the powers it grants to its partners.

In partnerships with general partners, this individual or entity must sign on the partnership’s behalf. Limited partners may have certain signing authority in such cases, but it depends on the partnership’s terms.

In limited liability partnerships, all partners are recognized as having agency authority. Because of this, the partnership may issue a resolution to assign a specific partner signing authority.

Recording

Resolutions are typically recorded in a partnership’s meeting minutes, which are notes taken during a meeting. Meeting minutes document which members were at the meeting, which were not, and business discussed.

How Long to Keep Resolutions on File

According to IRS recommendations, partnerships should keep business records on file for two to seven years. However, certain business documents should be kept for the life of the partnership.