How to Apply

- Domestic: www.coloradosos.gov

- Foreign (based outside Colorado): Statement of Foreign Entity Authority

How to Form an LLC

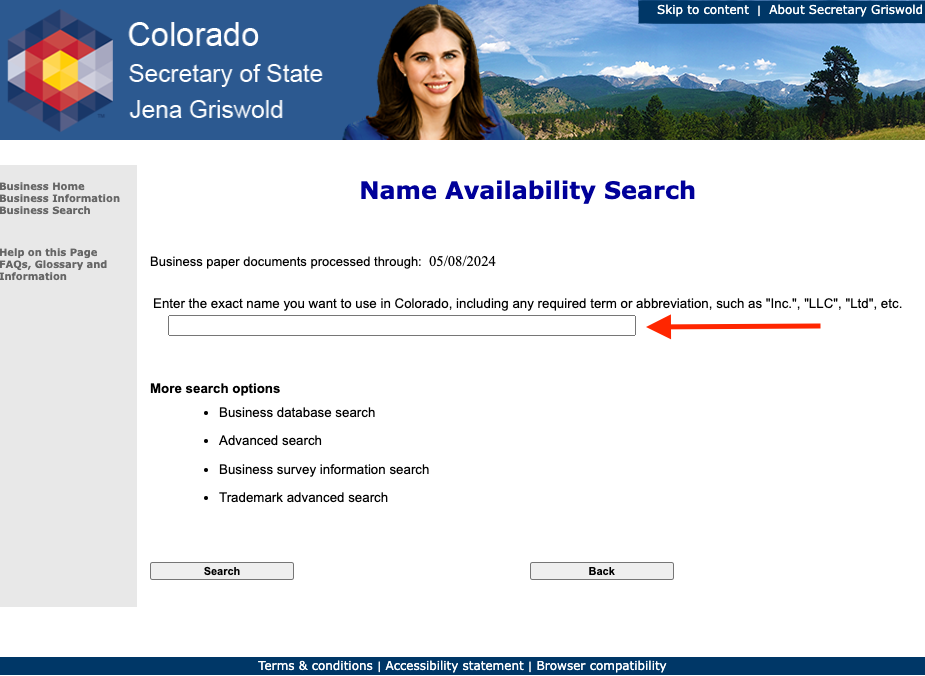

1. Choose a Business Name

- Name Availability Search: www.coloradosos.gov

Type your desired business name into the Colorado Secretary of State’s name search tool. “The name is available” indicates that the name is free for use, although searching the business database to check for existing entities with similar names is recommended.

LLCs are required by law to include, in uppercase or lowercase letters, one of the following terms within their official name:[2]

- Limited Liability Company

- Ltd. Liability Company

- Limited Liability Co.

- Ltd. Liability Co.

- Limited

- LLC

- L.L.C.

- Ltd.

2. Designate a Registered Agent

Colorado LLCs are required to appoint either an entity or an individual as the official point of contact for the business, known as a registered agent. If the registered agent is an individual, they must be at least 18 years of age and live in Colorado. Entities serving as registered agents must maintain a place of business in Colorado. An LLC can serve as its own registered agent.[3]

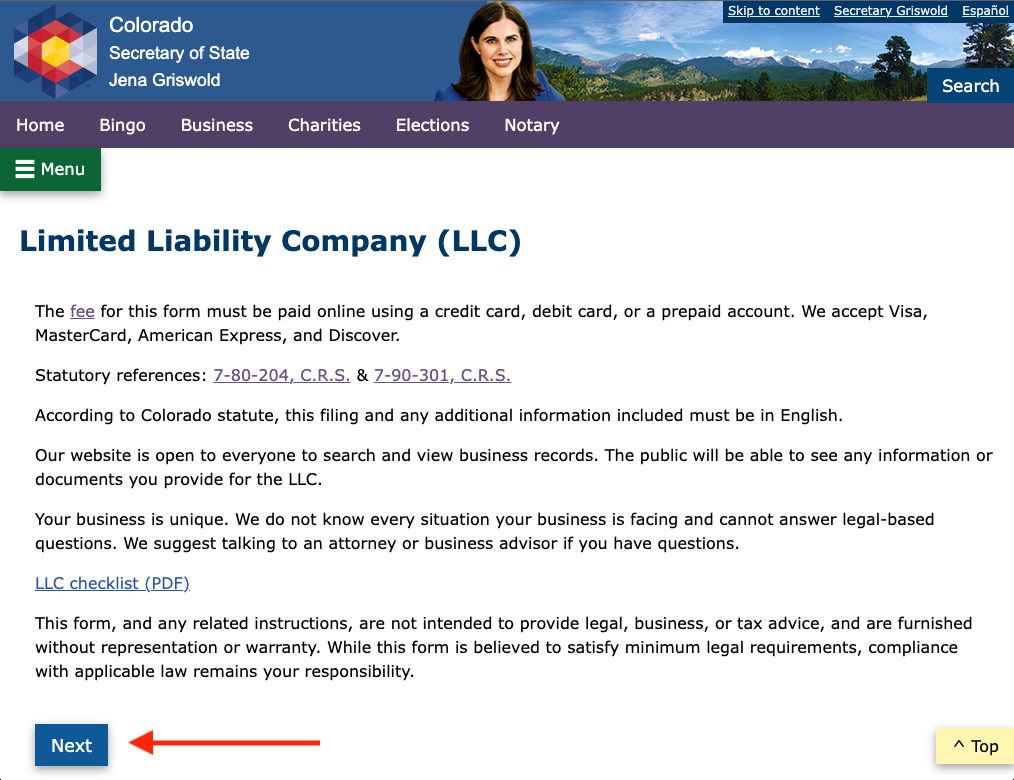

3. Register the LLC

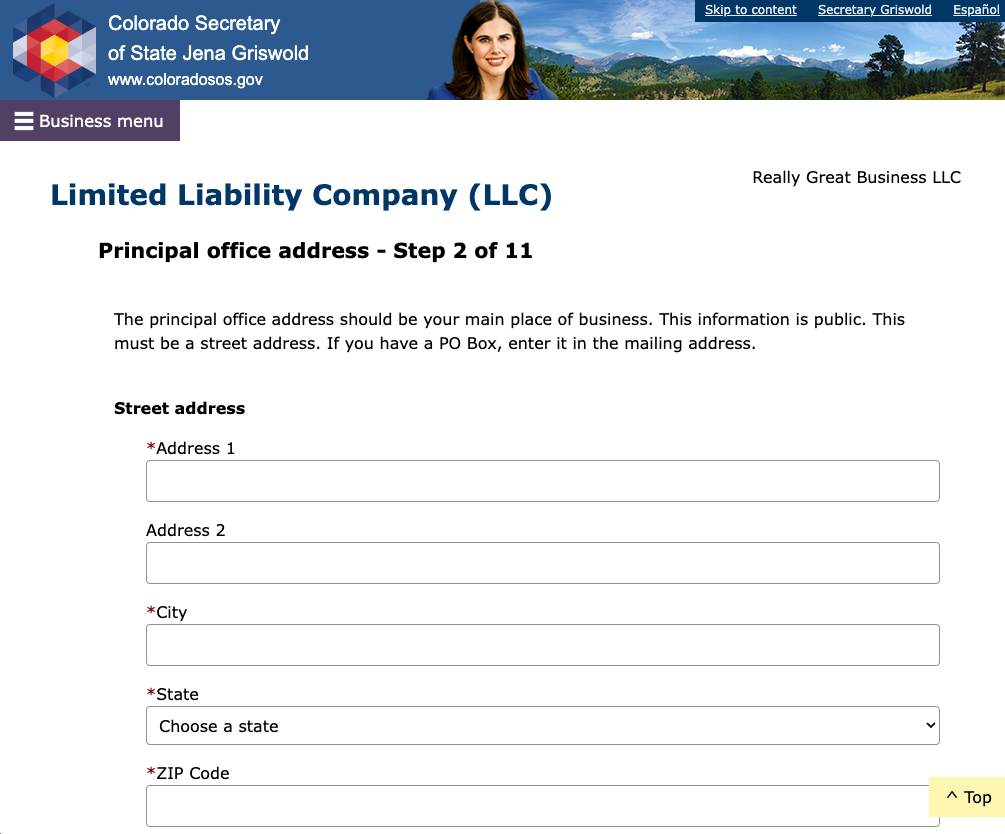

Visit www.coloradosos.gov to begin the process of filing your Articles of Organization.

Fill out the required information including business name, physical address, registered agent contact, member details, and the date the LLC is to become effective.

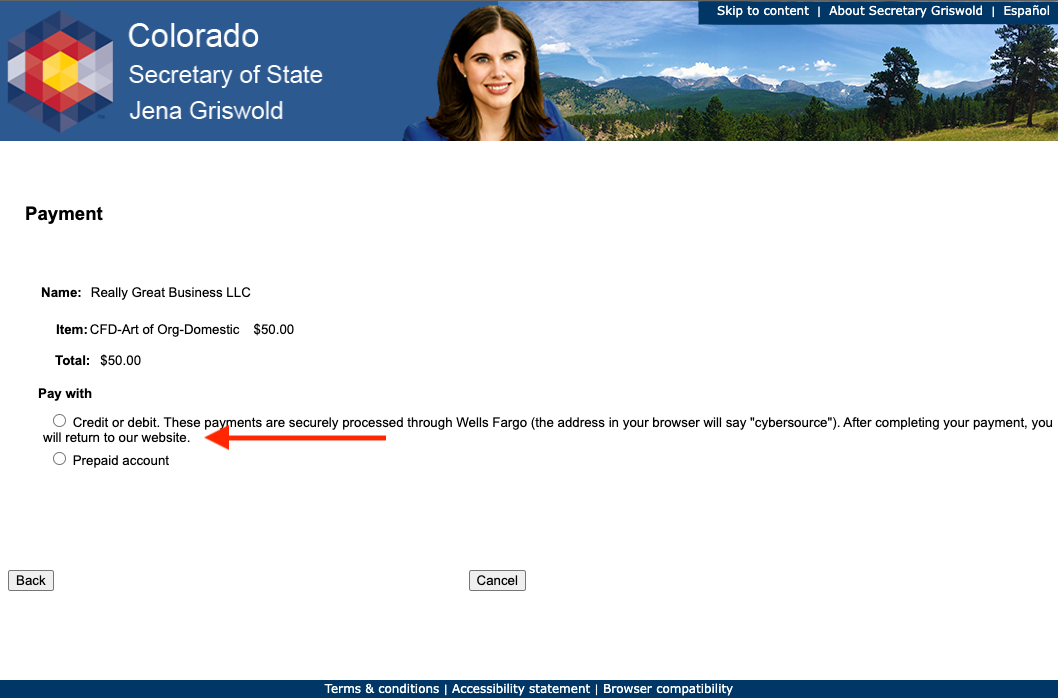

Use a credit card or debit card to pay the $50 filing fee.

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

An Employer Identification Number (EIN) is a nine-digit number assigned by the IRS for tax and legal purposes. Single-member LLCs with no employees can often use their Social Security Number in place of an EIN.[4]

5. Create an Operating Agreement

Colorado LLCs are not legally required to implement an operating agreement. However, using one can help clarify rights and responsibilities among members and serve as documentation of the entity’s legal structure.

Download: PDF, MS Word, OpenDocument

6. Select a Tax Classification

An LLC can elect to be classified as any of the following entities for federal tax purposes:

- LLC (default) – By default, LLCs with multiple members are classified as partnerships while single-member LLCs are taxed as sole proprietorships. No action is required to keep this classification. Both are taxed as disregarded entities whereby the profits pass through to the members, who then pay income tax.

- S-Corporation – An LLC can choose to be taxed as an S-Corp by filing IRS Form 2553 within 75 days of formation.

- C-Corporation – By filing IRS Form 8832 within 75 days of formation, an LLC can elect to be taxed as a C-Corp.

7. File Statement of Information

Each year, LLCs are required to file a Periodic Report with the Secretary of State to keep the business in good standing.