Filing Fees

- Domestic: $150 (online); $150 (paper)

- Foreign: $150 (online); $150 (paper)[1]

How to Form an LLC

1. Find a Business Name

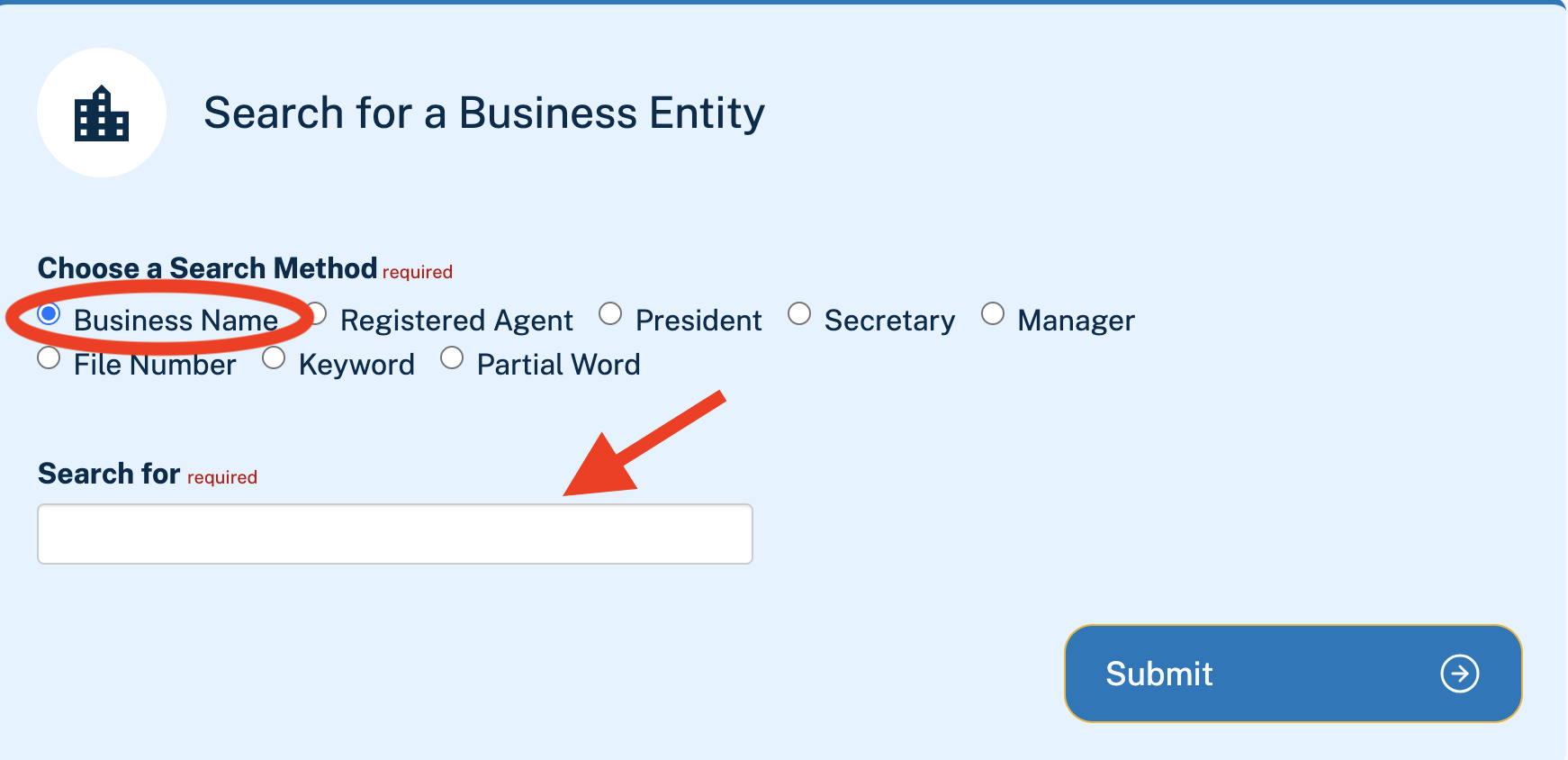

- Business Search: apps.ilsos.gov

Under Search Method, select “Business Name” and enter your desired business name to check if it is already being used. If the words “No results found” appear, it is most likely available.

The name of your business must contain the terms “limited liability company,” “L.L.C.”, or “LLC.”[2]

2. Designate a Registered Agent

Both domestic and foreign LLCs in Illinois must maintain a registered agent and registered office. The agent must be a resident of Illinois or a person who is authorized to transact business in the state.[3]

3. Register the LLC

There are two ways to apply for the registration of your LLC: online or by mail.

Option 1: File Online

Go to apps.ilsos.gov to access the state’s online filing system.

In most cases, it will be the first option – forming a standard limited liability company.

Be sure to double-check the state’s business search engine to ensure the name is still available.

This is the principal place of business for your LLC.

Provide the registered agent’s name and the address of the registered office in Illinois.

Enter the names and addresses of the LLC’s managers and members with authority. You can enter as many as eight.

Provide the business organizer’s name and address. By providing this information, the organizer is attesting to the accuracy of the document.

After reviewing the document for accuracy, indicate whether you want the document under standard processing or expedited processing for an additional fee.

Provide your payment information to pay the filing fee of $150.

Option 2: File By Mail or Email

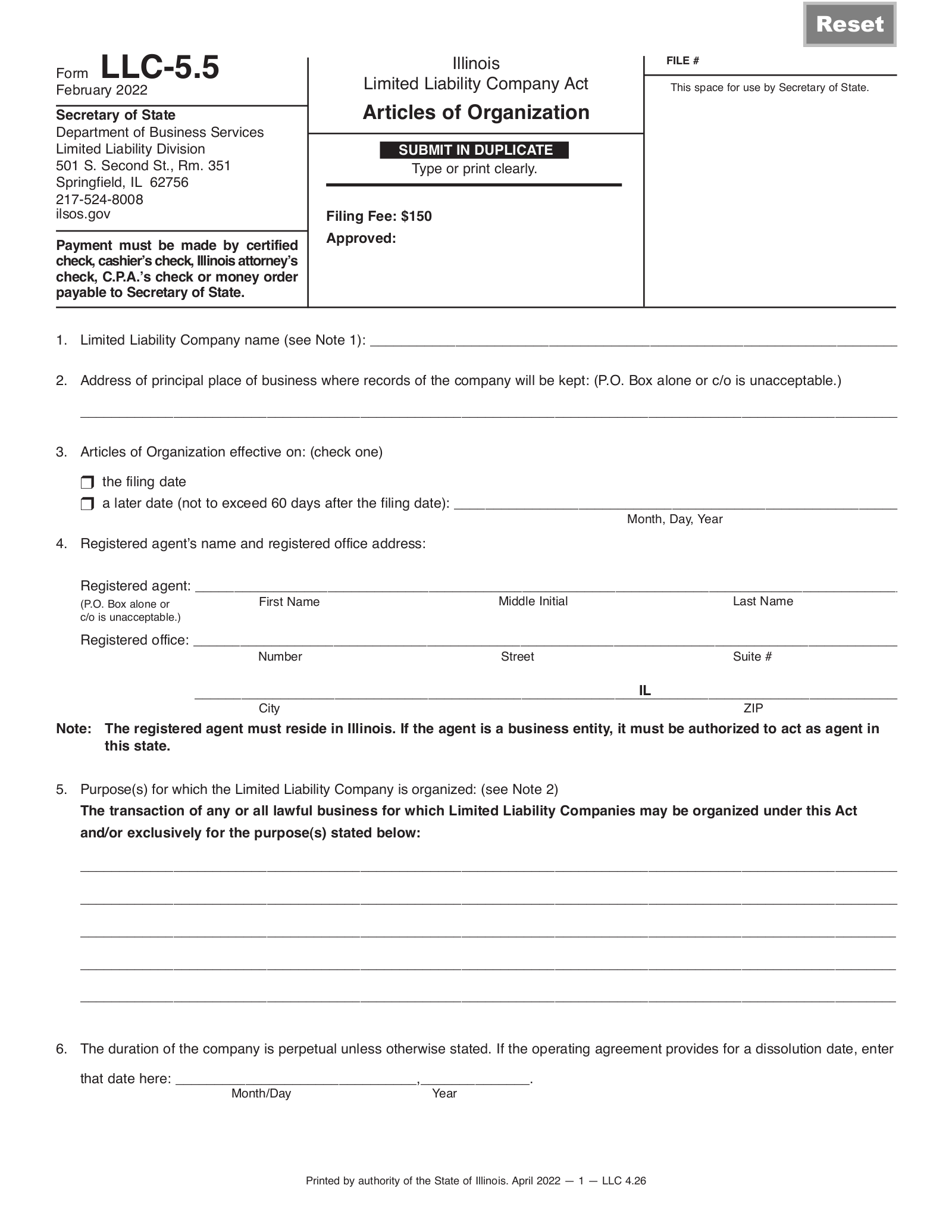

Complete the form and send the document to the provided address with an enclosed payment.

Articles of Organization (Form LLC-5.5) – For in-state entities.

Filing fee: $150 certified or cashier’s check made payable to the Secretary of State

Mailing address: Department of Business Services, Limited Liability Division, 501 S. Second St., Rm. 351, Springfield, IL 62756

Application for Admission to Transact Business (Form LLC-45.5) – For out-of-state entities.

Filing fee: $150 certified or cashier’s check made payable to the Secretary of State

Mailing address: Department of Business Services, Limited Liability Division, 501 S. Second St., Rm. 351, Springfield, IL 62756

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

Every LLC must apply for an Employer Identification Number (EIN) — a unique nine-digit number assigned to each business for tax purposes.

5. Write an Operating Agreement

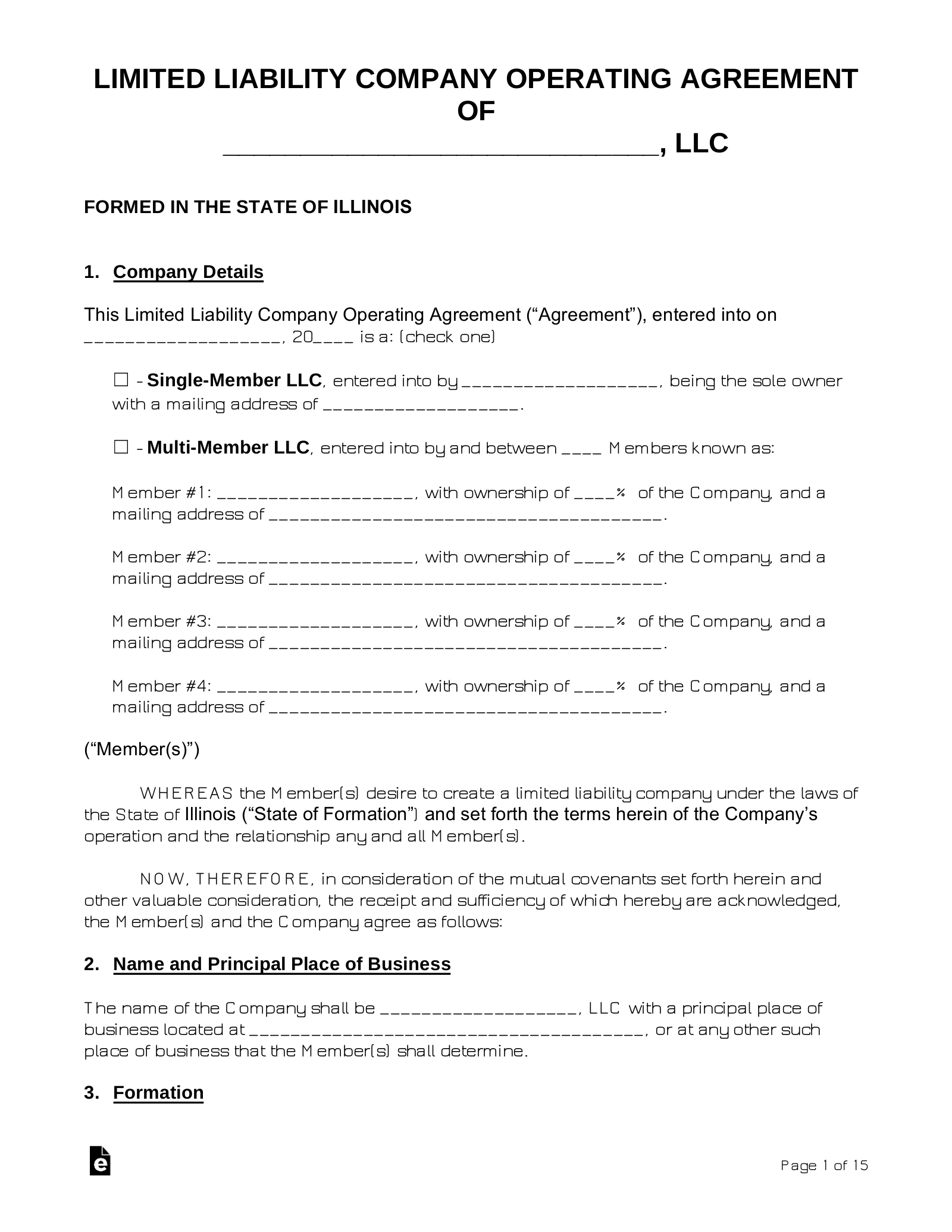

In Illinois, LLCs are not required to draft an operating agreement. However, it is recommended to create one to help structure the business.

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification

Below are the most common types of LLC tax classification:

- LLC – An LLC is, by default, formed as a sole proprietorship (one member) or a partnership (two or more members). Each owner or partner must individually pay income tax on the profits.

- S-Corporation – An S-corp sends all business profits and losses to the shareholders, who must pay income tax on the profits. To file as an S-corp, an LLC must file IRS Form 2553 within 75 days of formation.

- C-Corporation – A C-corp files taxes as a separate corporate entity. To file as a C-corp, an LLC must file IRS Form 8832 within 75 days of formation.

7. File Annual Report

Each domestic or foreign LLC in the state is required to file an annual report with the Secretary of State. It must be filed within 60 days of the first day of the anniversary month.[4] It can be filed via the Secretary of State’s online business services.