Updated August 28, 2023

A mortgage lien release, a document also known as the ‘satisfaction of mortgage’, is a document that is acquired from, and signed by a mortgage lender.This document is an acknowledgement, that states, that the (previous) borrower has completed a payment agreement and therefore the mortgage is recognized by all parties as “paid in full.” Once the satisfaction document has been filed and updated with the land registry or county registry, a clear title shall be returned to the new land owner.

State Specific Forms – Florida, New York, and Wisconsin.

What is Satisfaction of Mortgage?

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property. This means the borrower has completely repaid their loan to the lender as agreed upon (inclusive of late fees or other required payments by the lender).

How to Complete a Satisfaction of Mortgage (3 steps)

1. Identify the Parties

The appropriate parties should be documented on the Satisfaction of Mortgage. The two main parties are the mortgagor and the mortgagee. The mortgagor, the individual(s) or borrower(s) of funds to secure and pay for a home, whom utilized the home for collateral in order to secure the loan. The mortgagee, the financial institution or entity that provided the funds to the mortgagor, which were used to purchase the home.

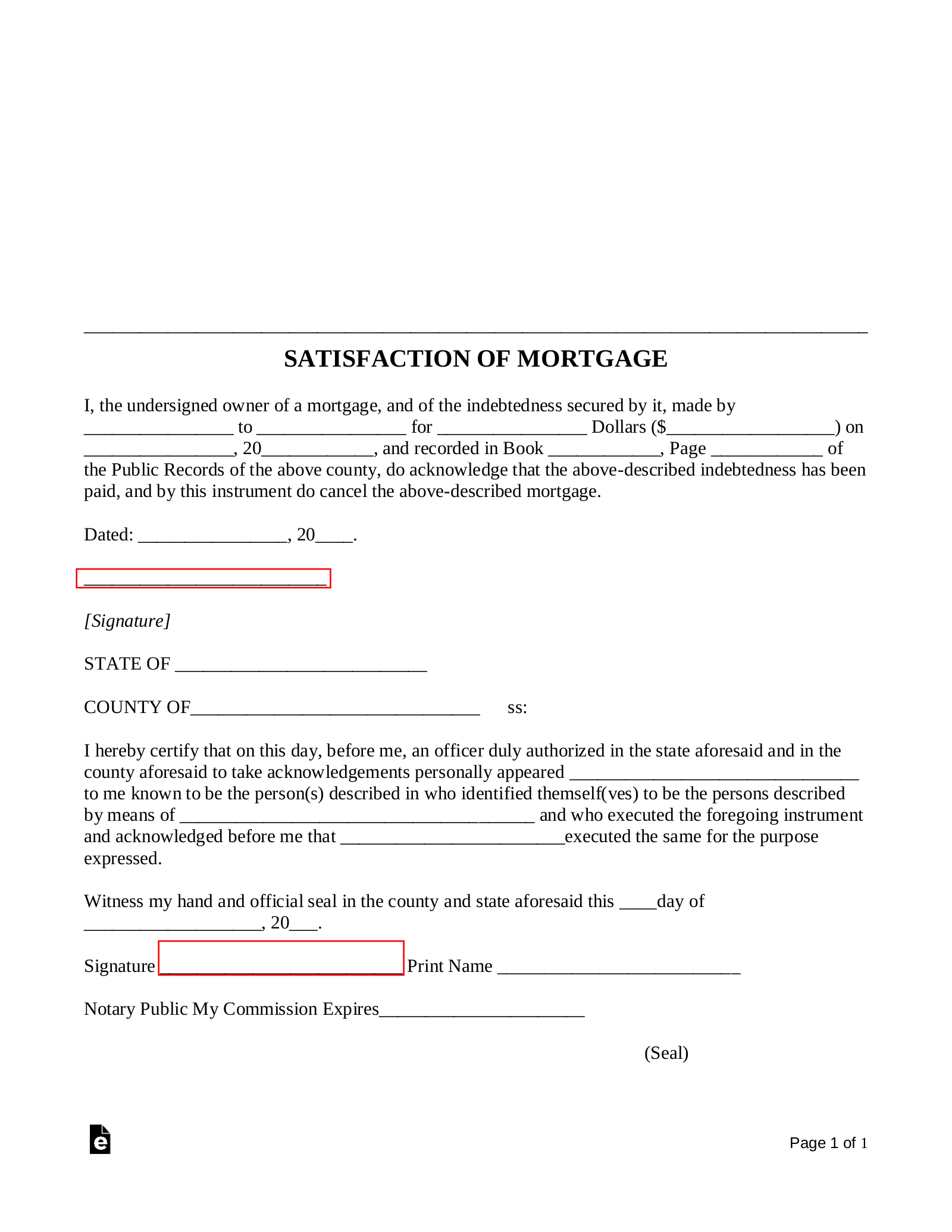

2. Fill and Sign

The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Some states will require witnesses to be present. In addition the following information should be included:

- The Payee Name

- The Owner(s) of the mortgage holder

- Total amount of mortgage

- Mortgage date of execution

- Full and legal description of the property to include tax parcel number

- Acknowledgement that all payments have been made in full

- Acknowledgement releasing the lender from filing a lien against the property

- Date signed and signature of all appropriate parties.

Consequences for Not Filing a Satisfaction of Mortgage

Each state has a different statutory limit in which the Satisfaction of Mortgage will be required to be filed by. In the event the lender or responsible financial party does not record and sign the Satisfaction of Mortgage, they will be liable for all damages and penalties paid to the borrower. In addition, the borrower may not be able to sell the property in the future if they cannot provide legal documentation that it was paid in full.

FAQs

Why does my Satisfaction of Mortgage form have a large blank header?

The Satisfaction of Mortgage will have a blank header that is necessary for the County Recorder. The County Recorder will in turn stamp the document with a filing number and any other form of information as deemed necessary, which will help identify and record the document. This space should be left blank and not tampered with.

What’s the difference between a Deed of Reconveyance and a Satisfaction of Mortgage?

The Deed of Reconveyance is a legal document that transfers the title of the property back to the mortgagor from the Trustee. The document is utilized to acknowledge that the borrower has fulfilled all duties and payment has been received in full under a Deed of Trust. Both documents serve the same purpose however some states utilize one over the other. Most commonly the Deed of Reconveyance is used when a borrower is refinancing a home mortgage loan.

Do I need to Notarize my Satisfaction of Mortgage?

Notarization of the Satisfaction of Mortgage should occur to ensure the document has been authenticated by a state-appointed official.

Where do I record my Satisfaction of Mortgage when complete?

The Satisfaction of Mortgage should be filed with the County Recorder or City Registrar. This will acknowledge and document, that the previously obtained mortgage has been paid in full and there is no longer a lien on the property. Required documentation is dependent on state, some states may call for a Deed of Reconveyance as opposed to the Satisfaction of Mortgage. If the Satisfaction of Mortgage is not recorded the lien will remain on the Title of the property.