Updated February 14, 2024

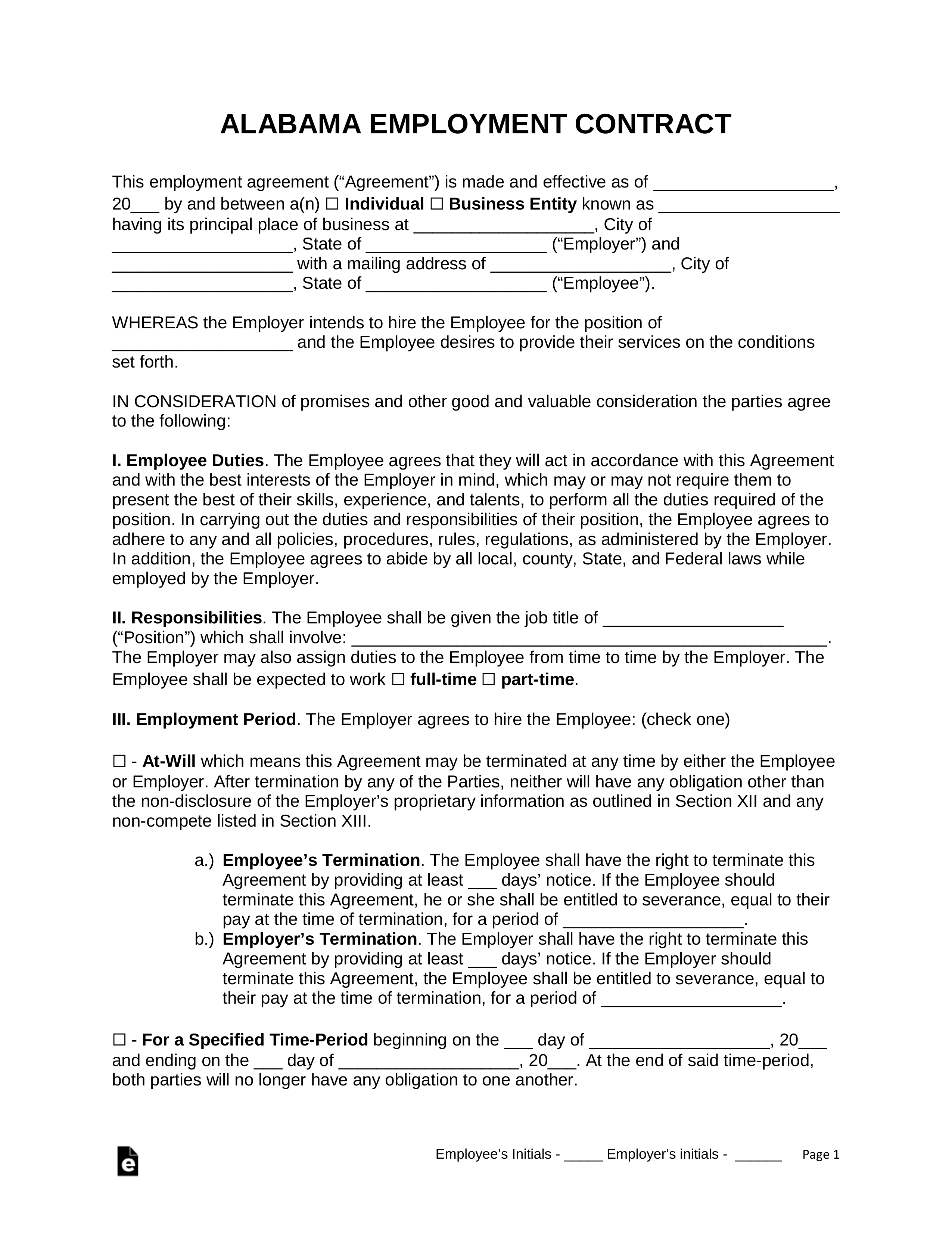

Alabama employment agreements are used to establish a relationship between an employer and another party for the payment of services. Depending on the type of employment relationship, the party performing the service may either be an employee, an independent contractor, or a subcontractor. An agreement is important for establishing a payment plan for services rendered, but it can also protect the employer through the inclusion of non-disclosure, non-compete, and liability clauses.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Withholds an employee from being able to disclose or use employer’s information for their own benefit.

Employee Non-Disclosure Agreement (NDA) – Withholds an employee from being able to disclose or use employer’s information for their own benefit.

Download: PDF, MS Word, OpenDocument

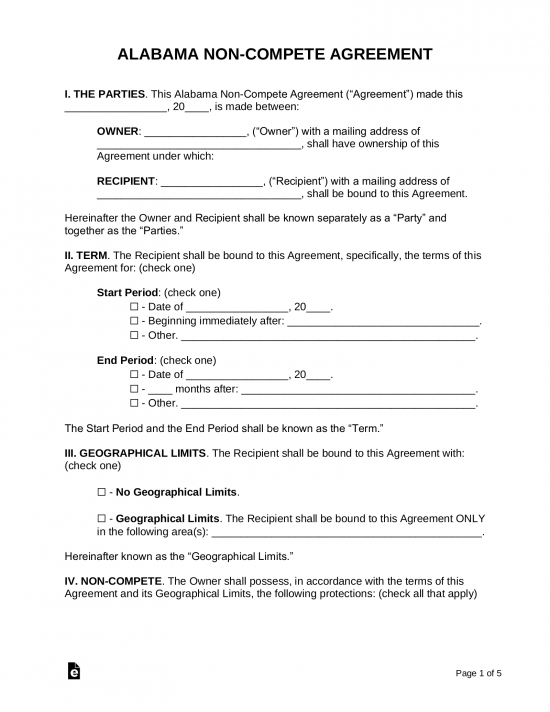

Employee Non-Compete Agreement – Prohibits an individual from being able to work for competitors or start their own business in the same (or similar) market.

Employee Non-Compete Agreement – Prohibits an individual from being able to work for competitors or start their own business in the same (or similar) market.

Download: PDF, MS Word, OpenDocument

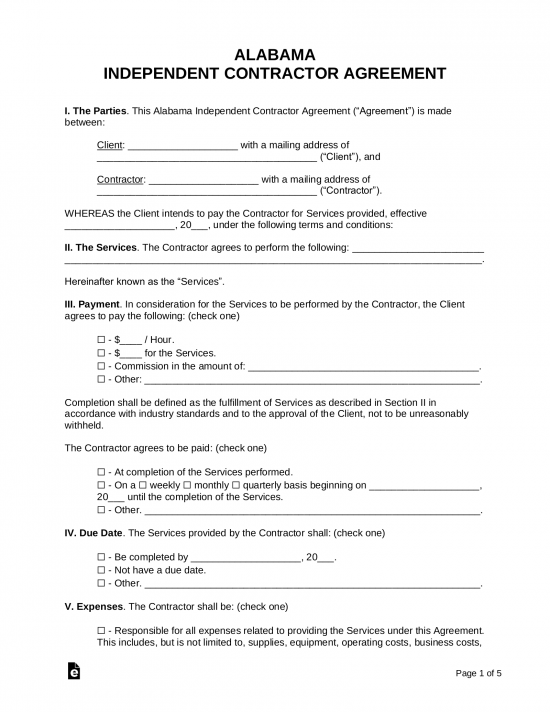

Independent Contractor Agreement – Allows an individual or business to provide services for payment as a 1099 independent contractor.

Independent Contractor Agreement – Allows an individual or business to provide services for payment as a 1099 independent contractor.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – Contract made between a company that uses another’s services to complete a project.

Subcontractor Agreement – Contract made between a company that uses another’s services to complete a project.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition – Any individual employed by an employer, in which employment “the relationship of master and servant” exists between the employer and the employee.[1]

At-Will Employment

Allowed with the exception of any “Implied Contracts” and “Good-Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 2% to 5%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25 (no State minimum, federal law applies)[3]