Updated September 25, 2023

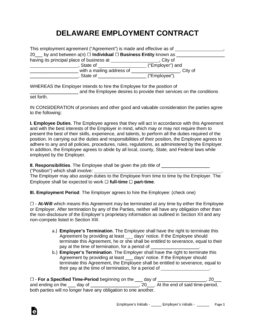

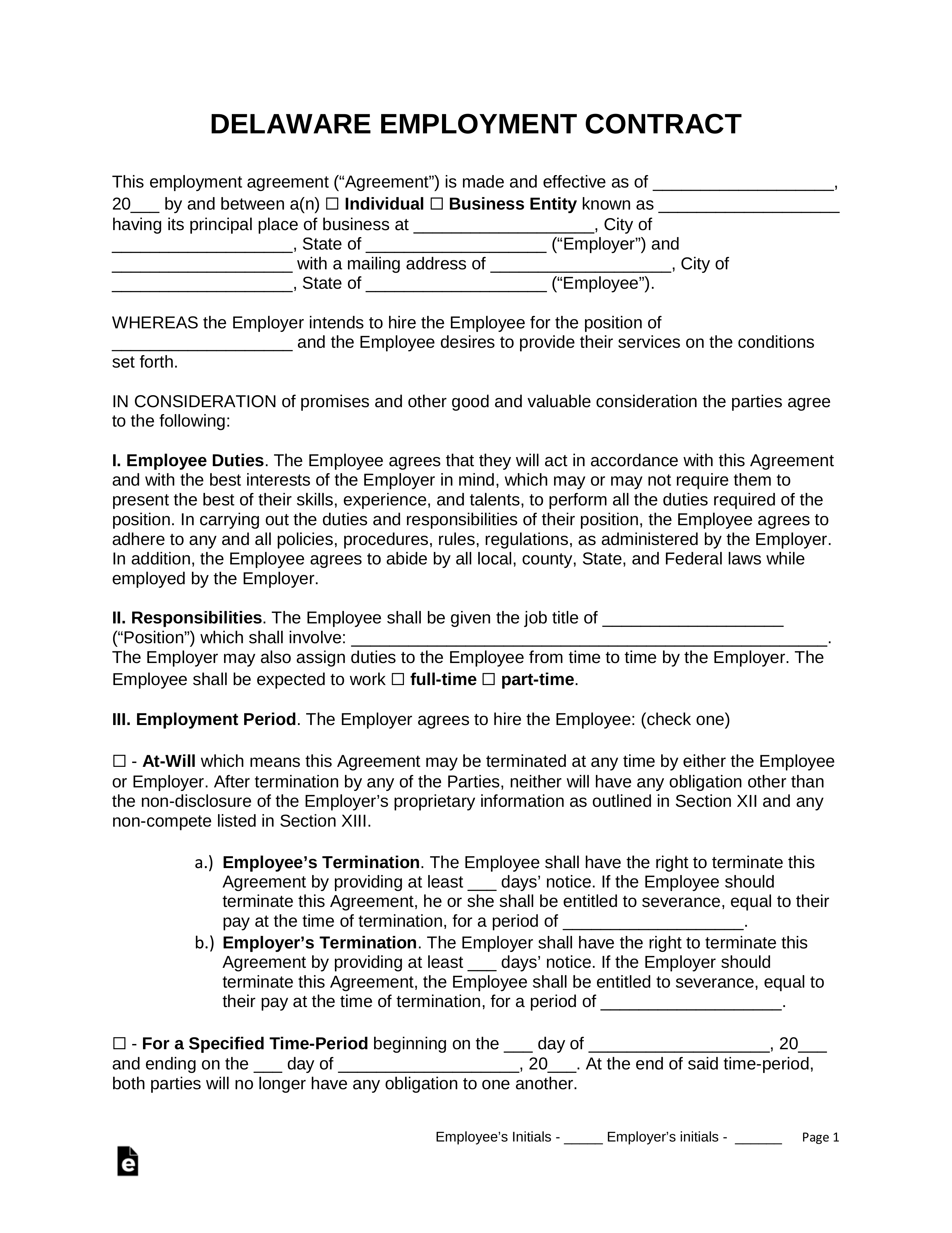

A Delaware employment contract agreement is a legal tool negotiated by an employer and an employee that outlines the terms of employment. In most cases, an employment agreement is used by employers hiring contractors, freelancers and individuals in high-level positions, but an agreement of this nature can be applied to almost any position. Once signed by both parties, this document is legally binding. It’s important that both parties (particularly the employee) understand and agree to all provisions drafted in the agreement. An employment contract often includes such provisions as employee income, benefits, duties and responsibilities, employment period, and conditions of termination (for both parties). In addition, an employer may choose to add non-disclosure and/or non-compete clauses to protect their business model and confidential information.

By Type (4)

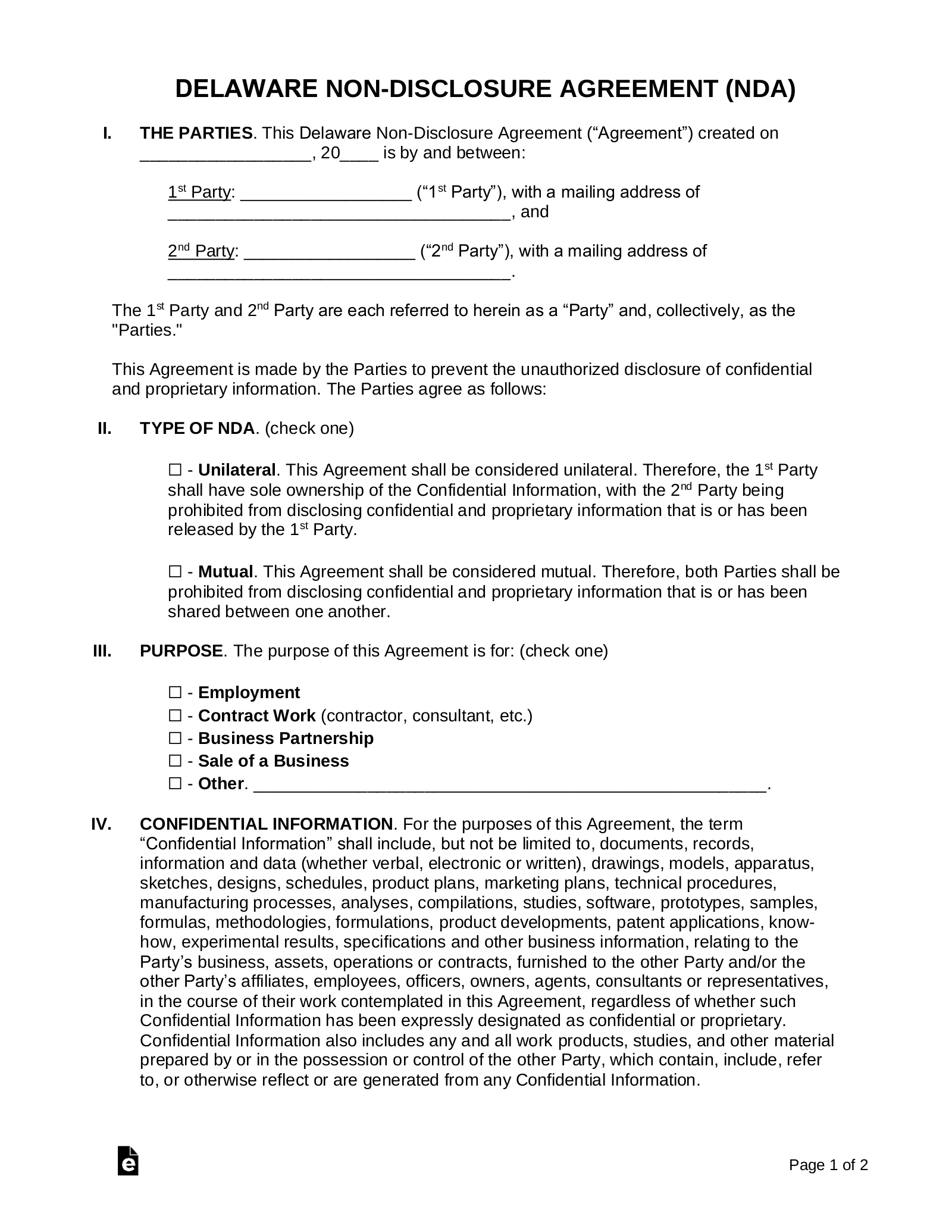

Employee Non-Disclosure Agreement (NDA) – Employee agrees never to disclose confidential information or trade secrets during and after employment.

Employee Non-Disclosure Agreement (NDA) – Employee agrees never to disclose confidential information or trade secrets during and after employment.

Download: PDF, MS Word (.docx), OpenDocument

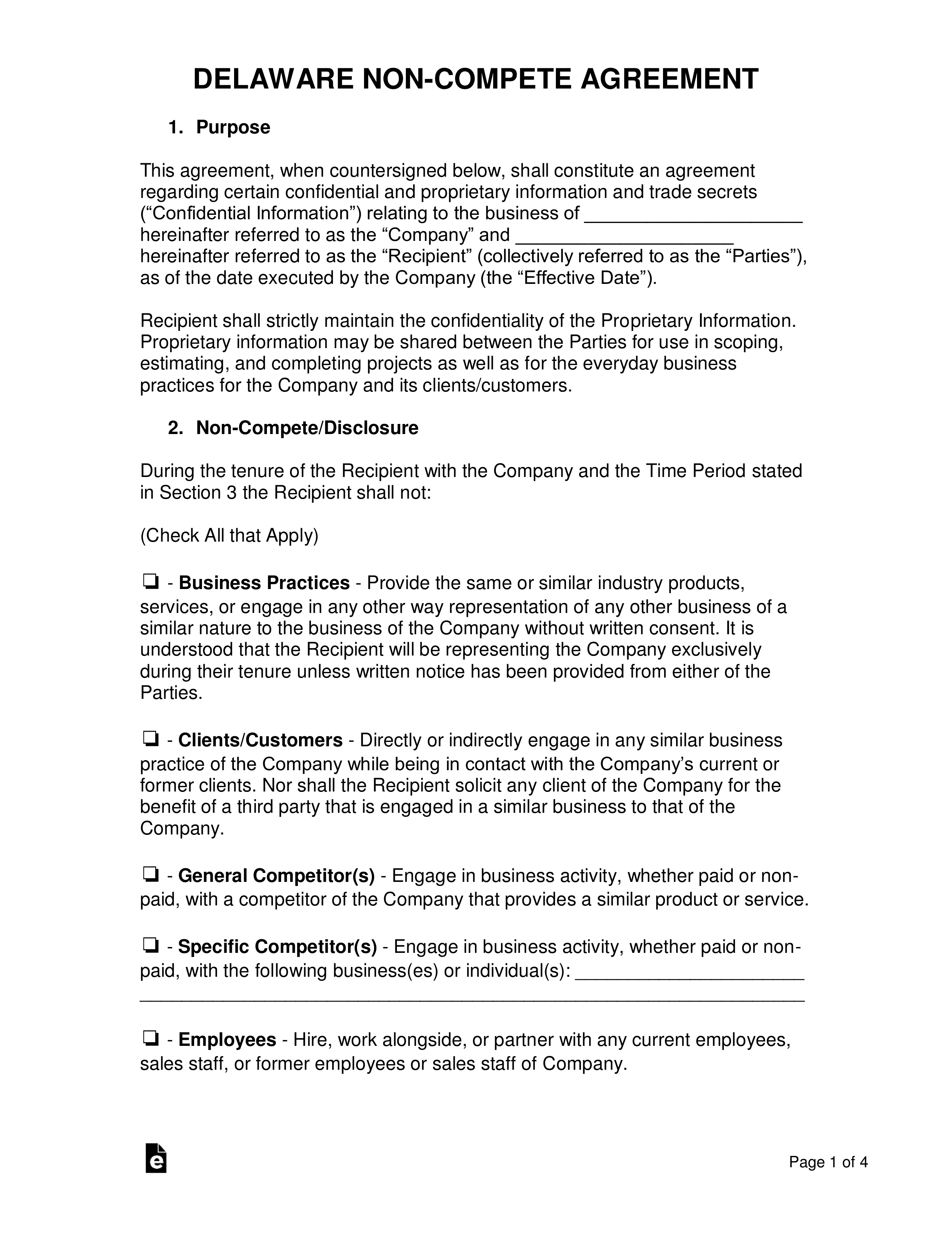

Employee Non-Compete Agreement – Employee agrees never to compete with the employer in the same business field by starting a new company or aiding an existing company.

Employee Non-Compete Agreement – Employee agrees never to compete with the employer in the same business field by starting a new company or aiding an existing company.

Download: PDF, MS Word (.docx), OpenDocument

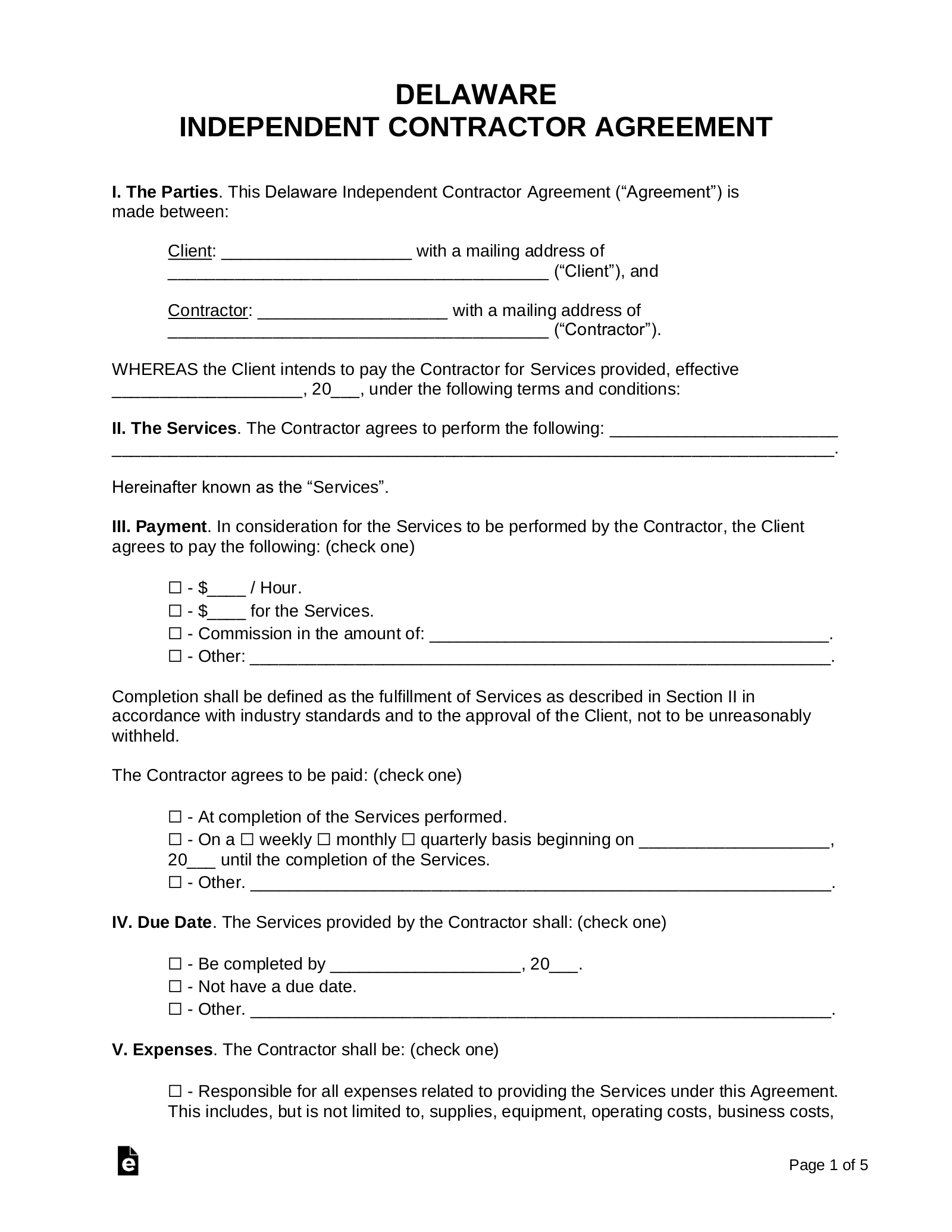

Independent Contractor Agreement – The contractor agrees to complete a job/task for a client for financial compensation in accordance with the terms and conditions relayed in this agreement.

Independent Contractor Agreement – The contractor agrees to complete a job/task for a client for financial compensation in accordance with the terms and conditions relayed in this agreement.

Download: PDF, MS Word (.docx), OpenDocument

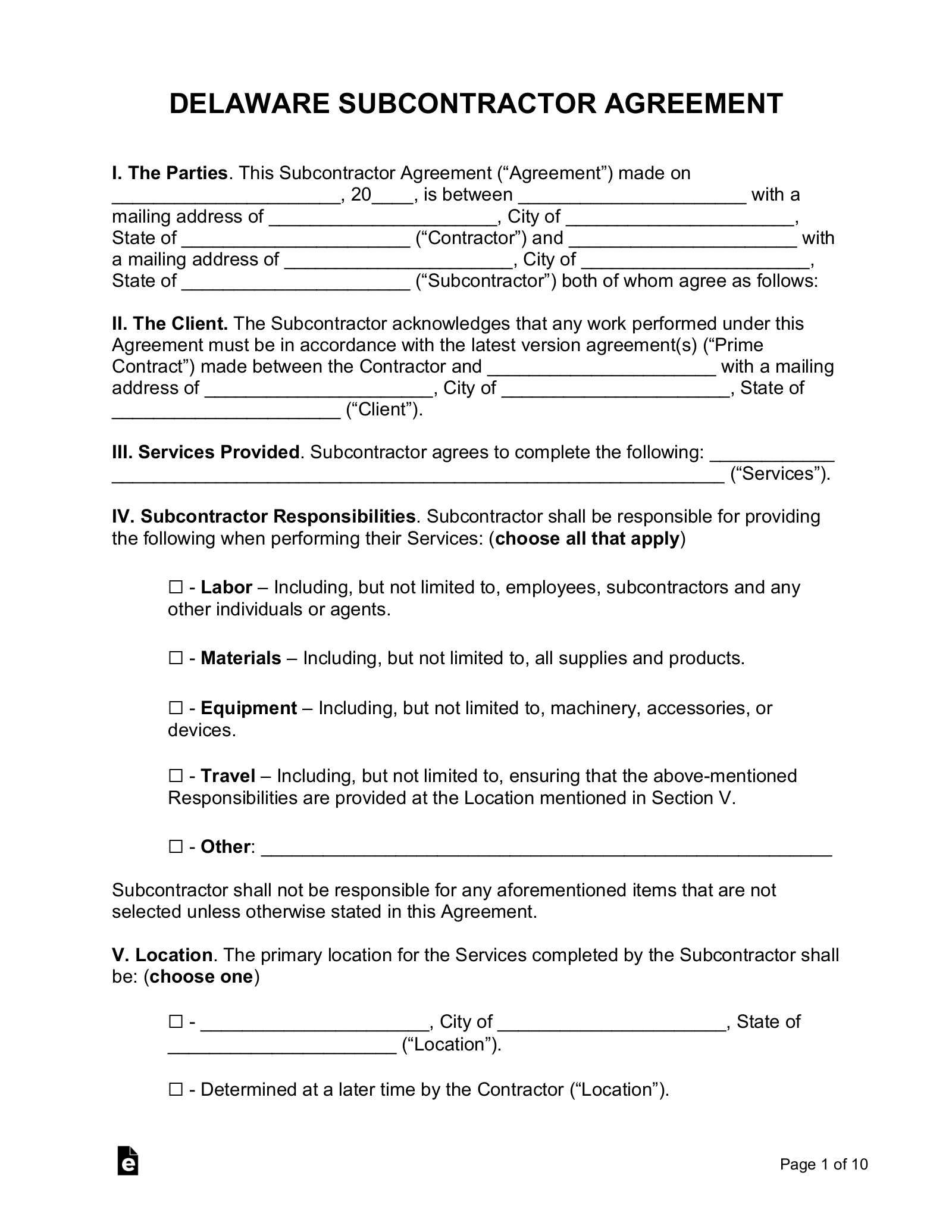

Subcontractor Agreement – The subcontractor agrees to complete a job/task for a contractor for financial compensation in accordance with the terms and conditions relayed in this agreement.

Subcontractor Agreement – The subcontractor agrees to complete a job/task for a contractor for financial compensation in accordance with the terms and conditions relayed in this agreement.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

. . . means any person suffered or permitted to work by an employer under a contract of employment either made in Delaware or to be performed wholly or partly therein. This chapter does not apply to employees of the United States government, the State of Delaware or any political subdivision thereof.

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” and “Good Faith” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 2.2% – 6.6%[2]

Minimum Wage ($/hr)

Minimum Wage – $9.25[3]