Updated November 21, 2023

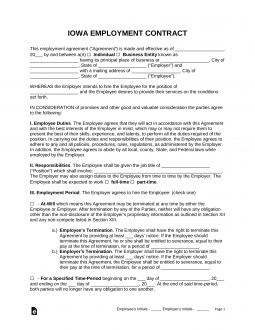

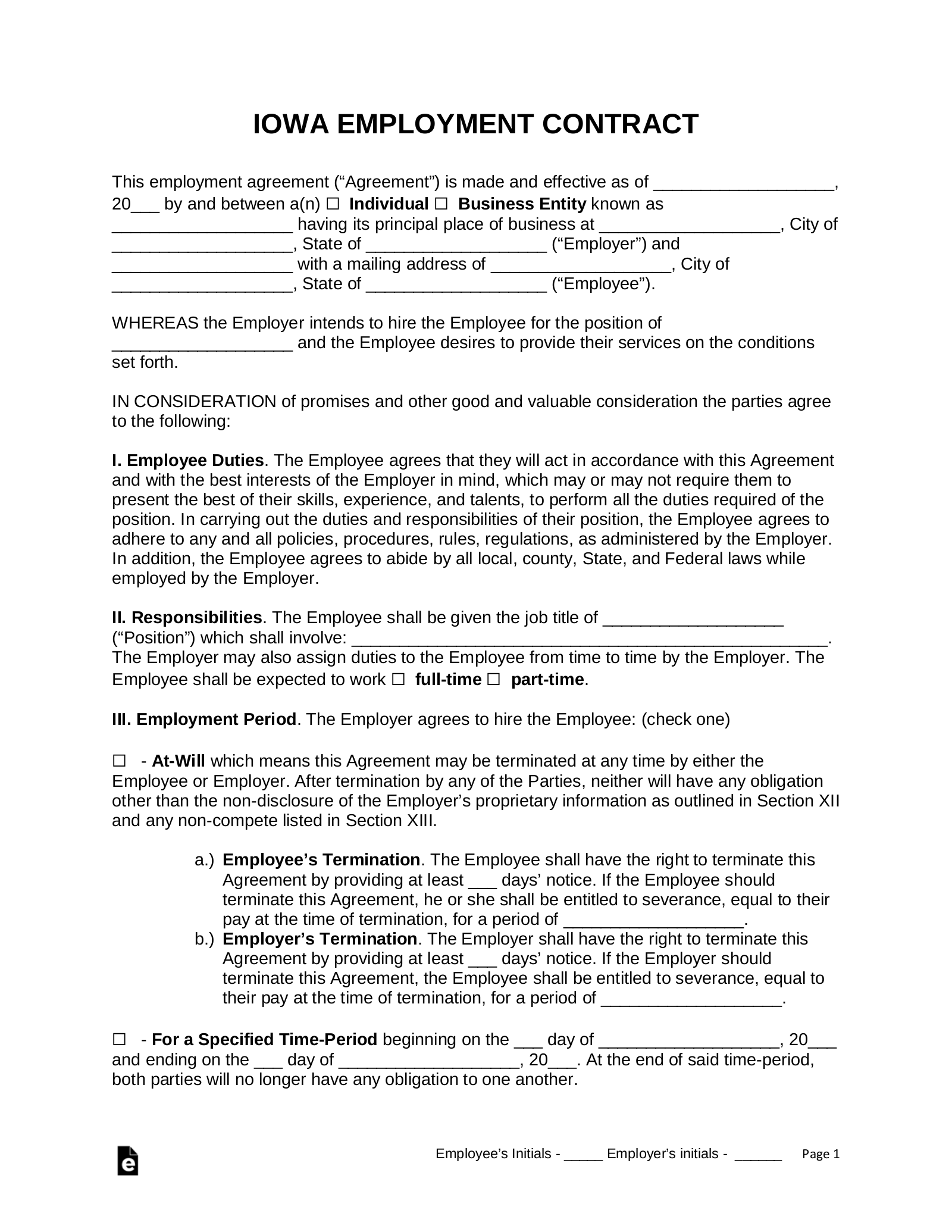

An Iowa employment contract agreement is a device used by employers to assist them in developing a working relationship with their employees. Through the application of a contract agreement, the employer introduces several provisions which dictate how the position shall be managed (e.g., frequency of payment, duration of employment, wage, operating schedule). An employer can also establish clauses to protect their assets should an employee wrongfully disseminate company information or engage in business ventures with other parties while employed. Once signed, the document will serve as a record of the employee’s compliance with the prescribed conditions and can in turn be used as evidence in the event of legal complications between parties.

By Type (4)

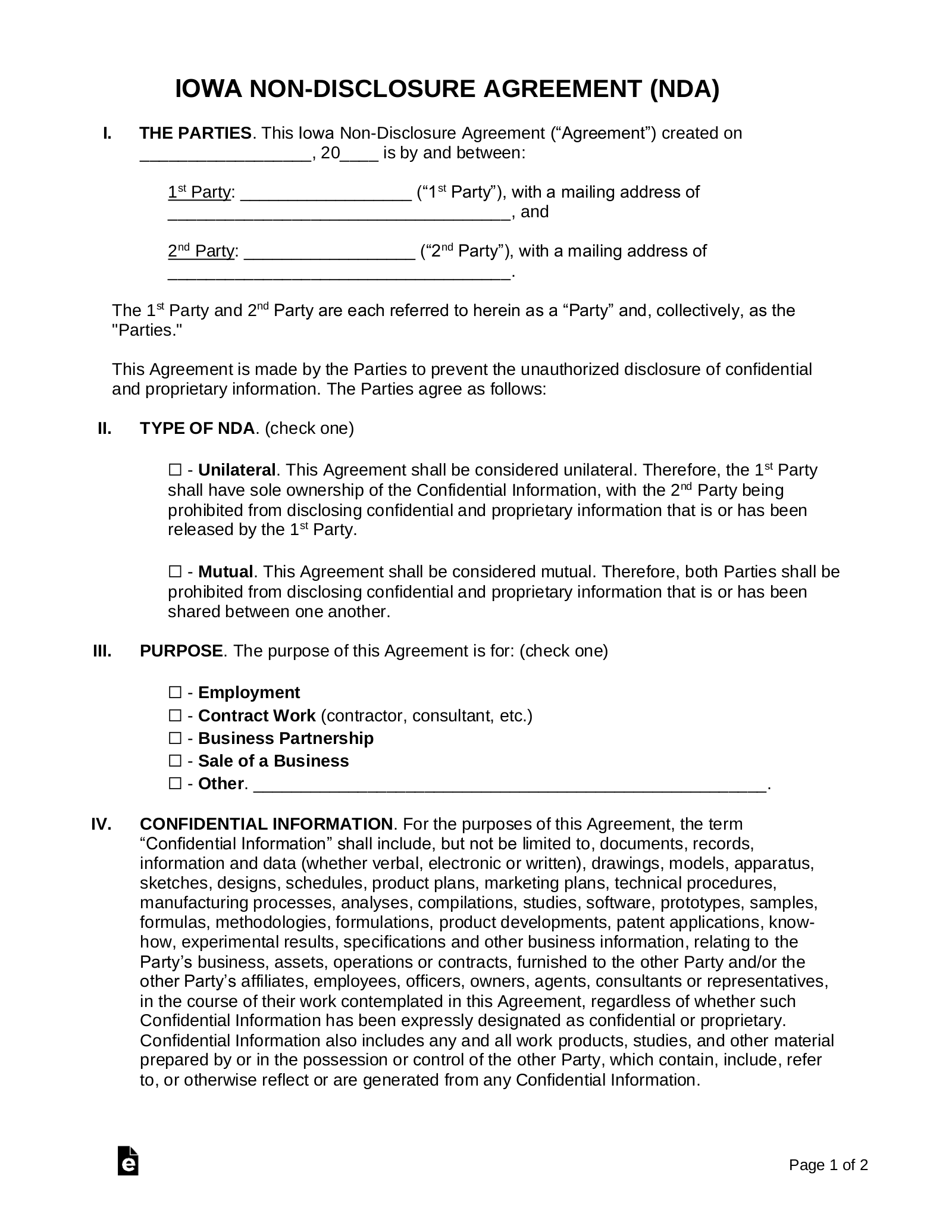

Employee Non-Disclosure Agreement (NDA) – A contract which binds an employee to secrecy regarding an employer’s proprietary and confidential business information.

Download: PDF, MS Word, OpenDocument

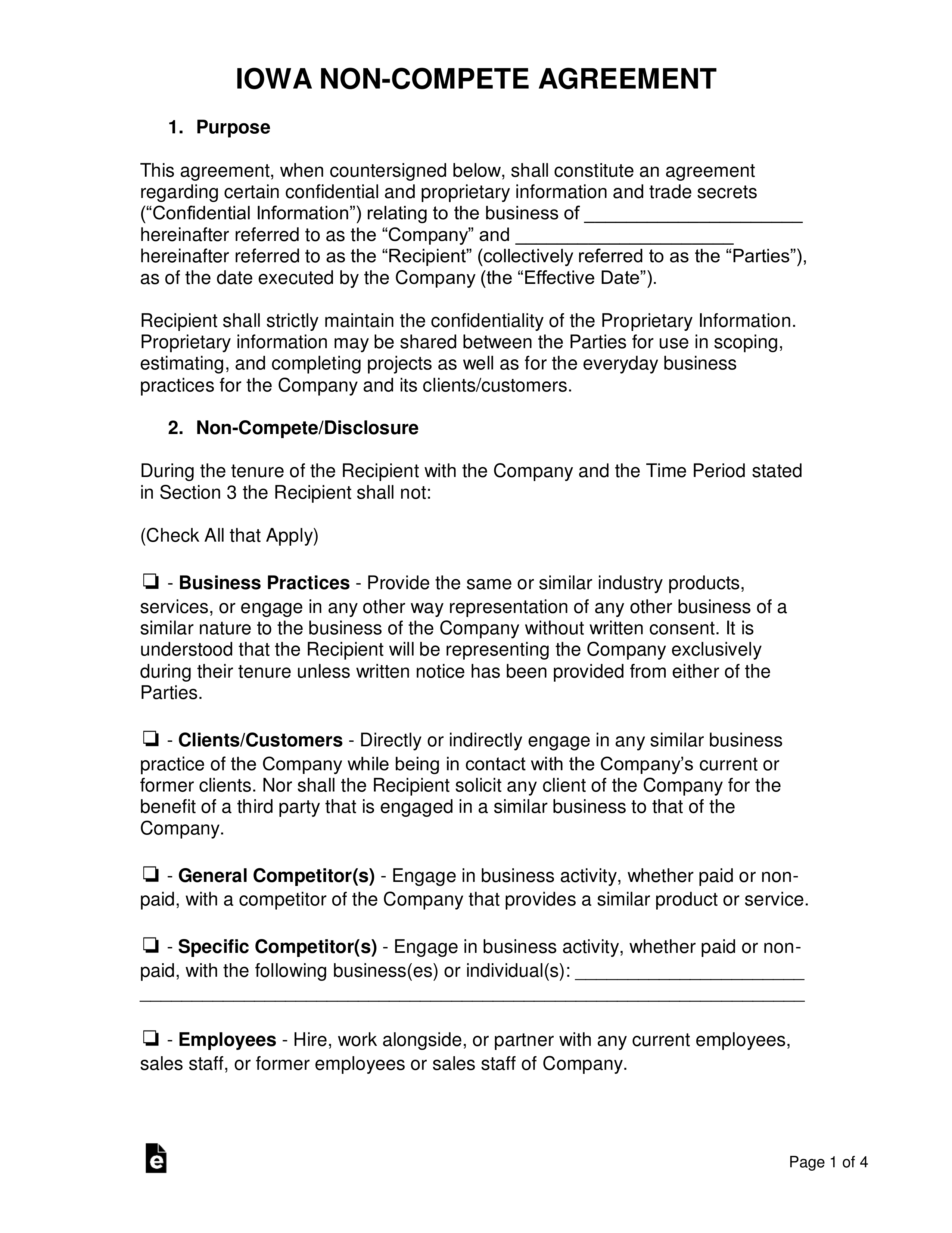

Employee Non-Compete Agreement – Prohibits an employee from engaging in business practices which might result in unwarranted competition for the employer.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Drafted by a client to specify their conditions when hiring an independent contractor.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – Indicates a contractor’s employment conditions to a subcontractor elected to satisfy a specific obligation that the contractor is expected to complete.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . means a natural person who is employed in this state for wages by an

employer. Employee also includes a commission salesperson who takes orders or performs services on behalf of a principal and who is paid on the basis of commissions but does not include persons who purchase for their own account for resale . . .”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contracts” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – .33% to 8.53%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25 ( – recognizes federal wage laws)[3]