Updated June 27, 2022

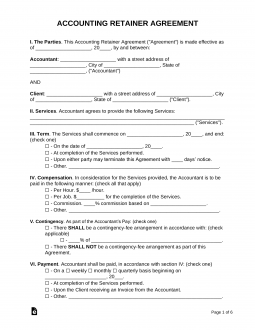

An accounting retainer agreement is for a client who hires an accountant and agrees to make an advance payment for services. The most common type of accounting retainer is when the client pays a portion or all of the services upfront. If the retainer is ‘pay for access’, it will allow the client to services on a recurring basis for a set number (#) of hours every month. The retainer payment is due immediately after the agreement is signed.

Accounting / Bookkeeping Engagement Letter – Simple letter confirming the services provided by an accountant or bookkeeper.

Accounting / Bookkeeping Services Agreement – Used for bookkeepers that are commonly unlicensed individuals performing financial services.

Video

How To Write

1 – Save The Accounting Retainer To Your Machine

Download the accountant contract displayed in the preview by selecting the “PDF” button, the “Word” Button, or the “ODT” button on this page.

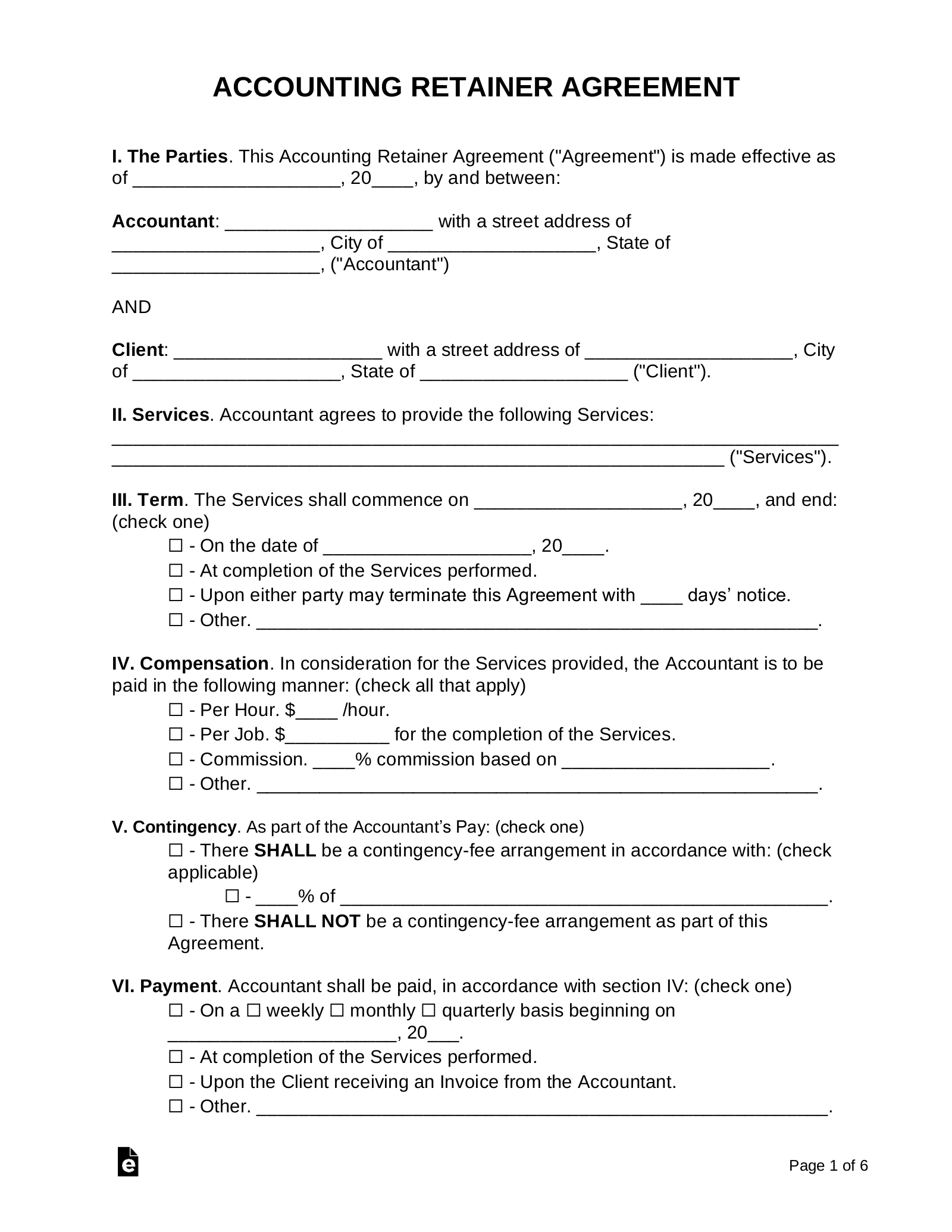

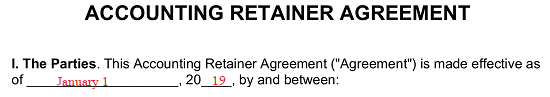

2 – Tie The Agreement’s Effective Date To The Parties Executing It

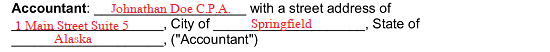

Before we proceed to discuss the parties involved and the obligations each one must live up to, we must solidify the first calendar date when this agreement will have power. Typically, this is the date when both signatures are presented however it can also be any date after this paperwork’s signing. The effective date agreed to by both parties should be documented using the first two blank lines in the article labeled “I. The Parties”  Once you’ve reported this document’s effective date, locate the first space after the label “Accountant.” This empty line is reserved for the full name of the Accountant or Accounting Firm that will be held on retainer through this paperwork. Furnish this entity’s identity accordingly then continue by producing the Accountant’s business address using the three spaces following the term “…With A Street Address” Notice that a separate line has been presented for the building number/street name/suite number, the city, and the state where the Accountant’s business receives mail.

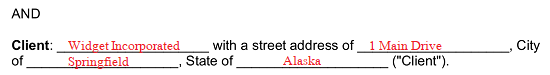

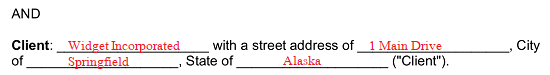

Once you’ve reported this document’s effective date, locate the first space after the label “Accountant.” This empty line is reserved for the full name of the Accountant or Accounting Firm that will be held on retainer through this paperwork. Furnish this entity’s identity accordingly then continue by producing the Accountant’s business address using the three spaces following the term “…With A Street Address” Notice that a separate line has been presented for the building number/street name/suite number, the city, and the state where the Accountant’s business receives mail.  The next portion of this sentence is attached to the bold label “Client” and thus requires a report on the party reserving the Accountant’s services. Use the first space after this label to present the full name of the hiring entity. Once you have done this use the next three spaces as a display area for this Client’s full address.

The next portion of this sentence is attached to the bold label “Client” and thus requires a report on the party reserving the Accountant’s services. Use the first space after this label to present the full name of the hiring entity. Once you have done this use the next three spaces as a display area for this Client’s full address.

3 – Discuss The Retained Services And Required Term

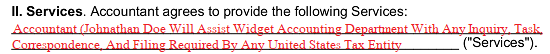

The document item titled “II. Services” seeks a clear description of the services the Accountant or Accounting Firm is agreeing to provide to the Client as a result of the payment(s) the Client supplies and this contract. If you need more room you can continue on an attachment that is labeled properly.

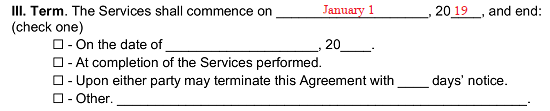

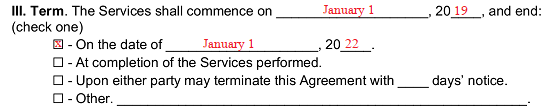

The third article which bears the label “III. Term,” expects a time period to be applied to this contract and will seek your selection from one of several checkbox statements for this definition. First, define the first day when the Accountant’s services must be made available if required by the Client on the first two blank spaces after the words “…Services Shall Commence On.”

The third article which bears the label “III. Term,” expects a time period to be applied to this contract and will seek your selection from one of several checkbox statements for this definition. First, define the first day when the Accountant’s services must be made available if required by the Client on the first two blank spaces after the words “…Services Shall Commence On.”  Now, it is time to define when and how the retainer agreement should end successfully. Three statements covering scenarios and one open-ended one will make up the available choices for the third article. The first choice will indicate this document will remain in effect until the calendar date you provide in the space provided.

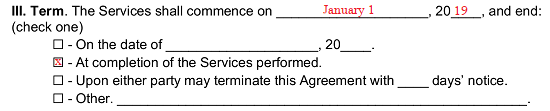

Now, it is time to define when and how the retainer agreement should end successfully. Three statements covering scenarios and one open-ended one will make up the available choices for the third article. The first choice will indicate this document will remain in effect until the calendar date you provide in the space provided.  If this agreement remains in effect until the retained services are completed then select the second checkbox statement

If this agreement remains in effect until the retained services are completed then select the second checkbox statement

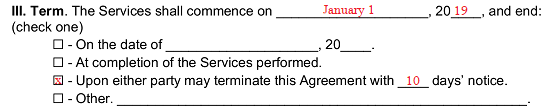

This contract may stay active indefinitely unless it is terminated by either the Accountant or Client. To set this as the method of termination, mark the third checkbox then report how many days’ notice the terminating party must give.  If none of these statements accurately define how or when the Client and Accountant wish this contract to end then select “Other” and define a successful termination on the line after the word “Other.”

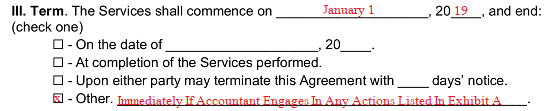

If none of these statements accurately define how or when the Client and Accountant wish this contract to end then select “Other” and define a successful termination on the line after the word “Other.”

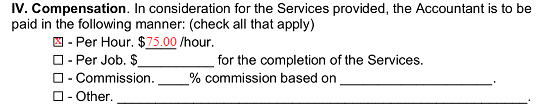

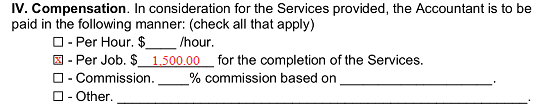

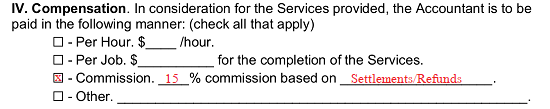

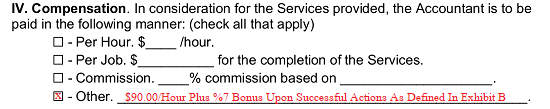

4 – Define The Money Required By The Accountant

The fourth article, “IV. Compensation,” expects a strict definition to the payment the Accountant will be entitled to receive from the Client as a result of this contract. Four checkbox statements will give you the opportunity to define this easily. You must mark only one checkbox. If the Accountant will receive an hourly wage, then mark the first checkbox and document how much money the Accountant must be paid for every hour of work on the concerned Client Project(s).  The second checkbox statement should be selected if the Accountant’s compensation will be based on the project. If he or she will be paid for a project only when that project is complete, then mark the second statement and indicate how much will be paid upon completion.

The second checkbox statement should be selected if the Accountant’s compensation will be based on the project. If he or she will be paid for a project only when that project is complete, then mark the second statement and indicate how much will be paid upon completion.  If the Accountant will be paid by “Commission” then mark the third checkbox. This choice requires a definition to the Commission as well as its source using the blank lines provided.

If the Accountant will be paid by “Commission” then mark the third checkbox. This choice requires a definition to the Commission as well as its source using the blank lines provided.  If none of these methods accurately define the compensation the Client will provide the Accountant, then select the fourth checkbox (“Other”). If you do select “Other” you must directly type in how the Accountant will be paid on the blank line this choice contains.

If none of these methods accurately define the compensation the Client will provide the Accountant, then select the fourth checkbox (“Other”). If you do select “Other” you must directly type in how the Accountant will be paid on the blank line this choice contains.  Some Clients and Accountants may wish to offer some mutual protection by setting a contingency fee. For example, this retainer may require the Accountant to seek money owed from a Tax Entity. Sometimes such a fee will be dependent on a particular goal or outcome of the project. We will need to define the status of contingency fees in the item labeled “V. Contingency.” If there is a contingency fee, mark the first checkbox, then use the blank lines presented to record the percentage and the source of this percentage.

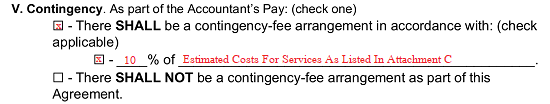

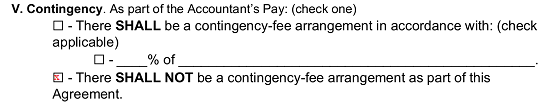

Some Clients and Accountants may wish to offer some mutual protection by setting a contingency fee. For example, this retainer may require the Accountant to seek money owed from a Tax Entity. Sometimes such a fee will be dependent on a particular goal or outcome of the project. We will need to define the status of contingency fees in the item labeled “V. Contingency.” If there is a contingency fee, mark the first checkbox, then use the blank lines presented to record the percentage and the source of this percentage.  If this agreement will not require a contingency-fee then choose the second statement.

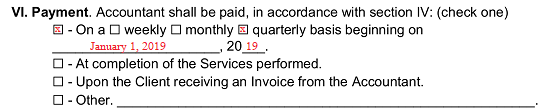

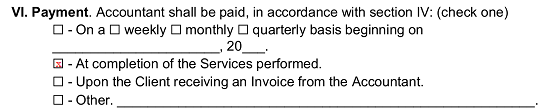

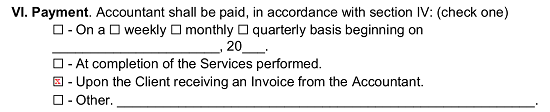

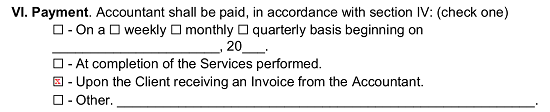

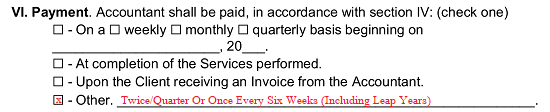

If this agreement will not require a contingency-fee then choose the second statement.  The sixth item, designated as “VI. Payment,” will present a similar checklist that is geared toward defining the schedule by which the Client will submit payment to the Accountant. If this will be a periodic pay schedule, then mark first checkbox statement as well as the “Weekly,” “Monthly,” or “Quarterly Basis…” before entering the first date of payment (see image below)

The sixth item, designated as “VI. Payment,” will present a similar checklist that is geared toward defining the schedule by which the Client will submit payment to the Accountant. If this will be a periodic pay schedule, then mark first checkbox statement as well as the “Weekly,” “Monthly,” or “Quarterly Basis…” before entering the first date of payment (see image below)  You may also indicate if payment will be submitted only when the Accountant has completed the services required (second checkbox).

You may also indicate if payment will be submitted only when the Accountant has completed the services required (second checkbox).  If payment is only required “Upon The Client Receiving An Invoice…” then select the third checkbox.

If payment is only required “Upon The Client Receiving An Invoice…” then select the third checkbox.  If none of these are an appropriate description then select the “Other” box and produce the payment schedule in the space provided.

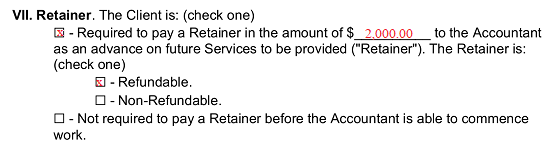

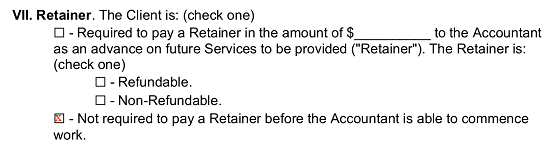

If none of these are an appropriate description then select the “Other” box and produce the payment schedule in the space provided.  Now, turn your attention to the next item “VII. Retainer.” If the Accountant must receive a dollar amount from the Client before beginning any work on the Client Project(s) then mark the checkbox attached to the words “Required To Pay A Retainer…” then input the exact retainer amount after the dollar sign. You will also need to indicate if this is “Refundable” or “Non-Refundable” by marking the appropriate checkbox. Notice in the example below, a refunable retainer of $2,000.00.

Now, turn your attention to the next item “VII. Retainer.” If the Accountant must receive a dollar amount from the Client before beginning any work on the Client Project(s) then mark the checkbox attached to the words “Required To Pay A Retainer…” then input the exact retainer amount after the dollar sign. You will also need to indicate if this is “Refundable” or “Non-Refundable” by marking the appropriate checkbox. Notice in the example below, a refunable retainer of $2,000.00. If no retainer is required for the Accountant to begin work on the Client Project(s) is required then select the statement “Not Required To Pay A Retainer” to solidify this.

If no retainer is required for the Accountant to begin work on the Client Project(s) is required then select the statement “Not Required To Pay A Retainer” to solidify this.

5 – Address Some Additional Concerns Then Sign This Paperwork

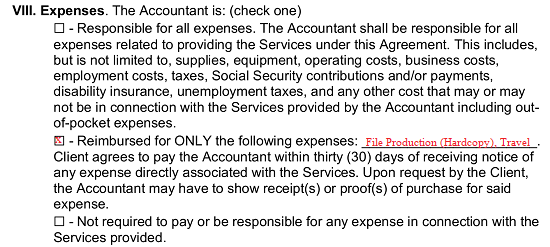

Before we finalize the accountant retainer being discussed we should produce documentation regarding one or two additional topics. The subject of “Expenses” will be at the focus of the eighth article. Occasionally, Client Projects require that money be paid to achieve a task. For instance, reproductions of property records and sales may be required or mass production of a company’s entire financial history may need to be produced in hardcopy. Regardless of the expense, many consider it wise to solidify who will pay for project expenses. To this end, select the first paragraph if the Accountant is “Responsible For All Expenses,” the second box if the Accountant will be “Reimbursed For…” certain expenses then list then on the blank space in this choice, or the third box if the Accountant is “Not Required To Pay Or Be Responsible For Any Connection With The Services Provided.” Notice in the example image, the Accountant will be reimbursed for all hard copy productions of Client Records and Travel.  Naturally, with any contract, the potential for future misunderstandings resulting in a dispute that threatens the agreement may arise. Therefore in the ninth article, we shall set a good faith arbitration method as a viable option to reach a resolution. However, in cases where this does not succeed the county and state jurisdiction where litigation will take place (if necessary) must be named on the two blank lines in article “IX. Disputes” before this document is signed by either party.

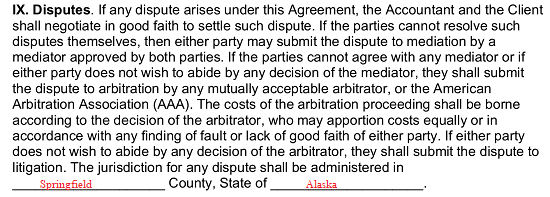

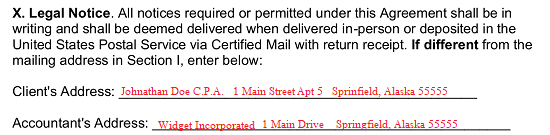

Naturally, with any contract, the potential for future misunderstandings resulting in a dispute that threatens the agreement may arise. Therefore in the ninth article, we shall set a good faith arbitration method as a viable option to reach a resolution. However, in cases where this does not succeed the county and state jurisdiction where litigation will take place (if necessary) must be named on the two blank lines in article “IX. Disputes” before this document is signed by either party.  In addition to naming the jurisdiction, we must solidify the official mailing address where both the Client and the Accountant expect legal notices sent when addressed directly. Locate the blank line labeled “Client’s Address” in the tenth article (“X. Legal Notice”) then document the exact mailing address that should be used by the Accountant if he or she must send the Client an official notice regarding this agreement.

In addition to naming the jurisdiction, we must solidify the official mailing address where both the Client and the Accountant expect legal notices sent when addressed directly. Locate the blank line labeled “Client’s Address” in the tenth article (“X. Legal Notice”) then document the exact mailing address that should be used by the Accountant if he or she must send the Client an official notice regarding this agreement.  Similarly, the “Accountant’s Address” line in “X. Legal Notice” expects the mailing address the Client should use if sending the Accountant a notice pertaining to this agreement.

Similarly, the “Accountant’s Address” line in “X. Legal Notice” expects the mailing address the Client should use if sending the Accountant a notice pertaining to this agreement.  The next item that requires your attention will be “XX. Governing Law” and requires you to report the state whose laws this agreement must abide by at all times. Produce this information to the line after the phrase “…State Of”

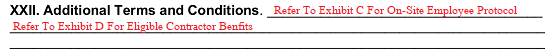

The next item that requires your attention will be “XX. Governing Law” and requires you to report the state whose laws this agreement must abide by at all times. Produce this information to the line after the phrase “…State Of” ![]() Every Client Project has the potential of requiring additional documentation to solidify any additions or limits that both parties wish to be a part of their agreement. Article “XXII. Additional Terms And Conditions” is an optional item that can be used to include all additional items required and agreed to by the Client and the Accountant to this agreement.

Every Client Project has the potential of requiring additional documentation to solidify any additions or limits that both parties wish to be a part of their agreement. Article “XXII. Additional Terms And Conditions” is an optional item that can be used to include all additional items required and agreed to by the Client and the Accountant to this agreement.  Now that we have completed this paperwork and made sure all attachments are present it will be time for both parties to review it. This must be an accurate account of the agreement each one is able and willing to adhere to. When this task is completed the Accountant must submit his or her signature to the “Accountant’s Signature” line then furnish his or her printed name below it. As soon as this act of signing is completed the Accountant must enter the current “Date” in the space provided

Now that we have completed this paperwork and made sure all attachments are present it will be time for both parties to review it. This must be an accurate account of the agreement each one is able and willing to adhere to. When this task is completed the Accountant must submit his or her signature to the “Accountant’s Signature” line then furnish his or her printed name below it. As soon as this act of signing is completed the Accountant must enter the current “Date” in the space provided  When the Client is ready to officially enter this contract, he or she must sign the “Client’s Signature” line and print his or her name underneath this signature. The “Date” line adjacent to these items must be satisfied with the current “Date.”

When the Client is ready to officially enter this contract, he or she must sign the “Client’s Signature” line and print his or her name underneath this signature. The “Date” line adjacent to these items must be satisfied with the current “Date.”