Updated August 23, 2023

Or use ContractsCounsel to hire an attorney!

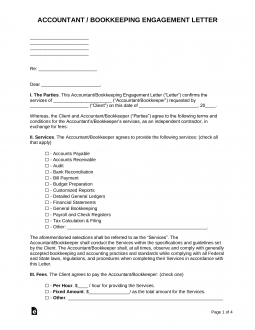

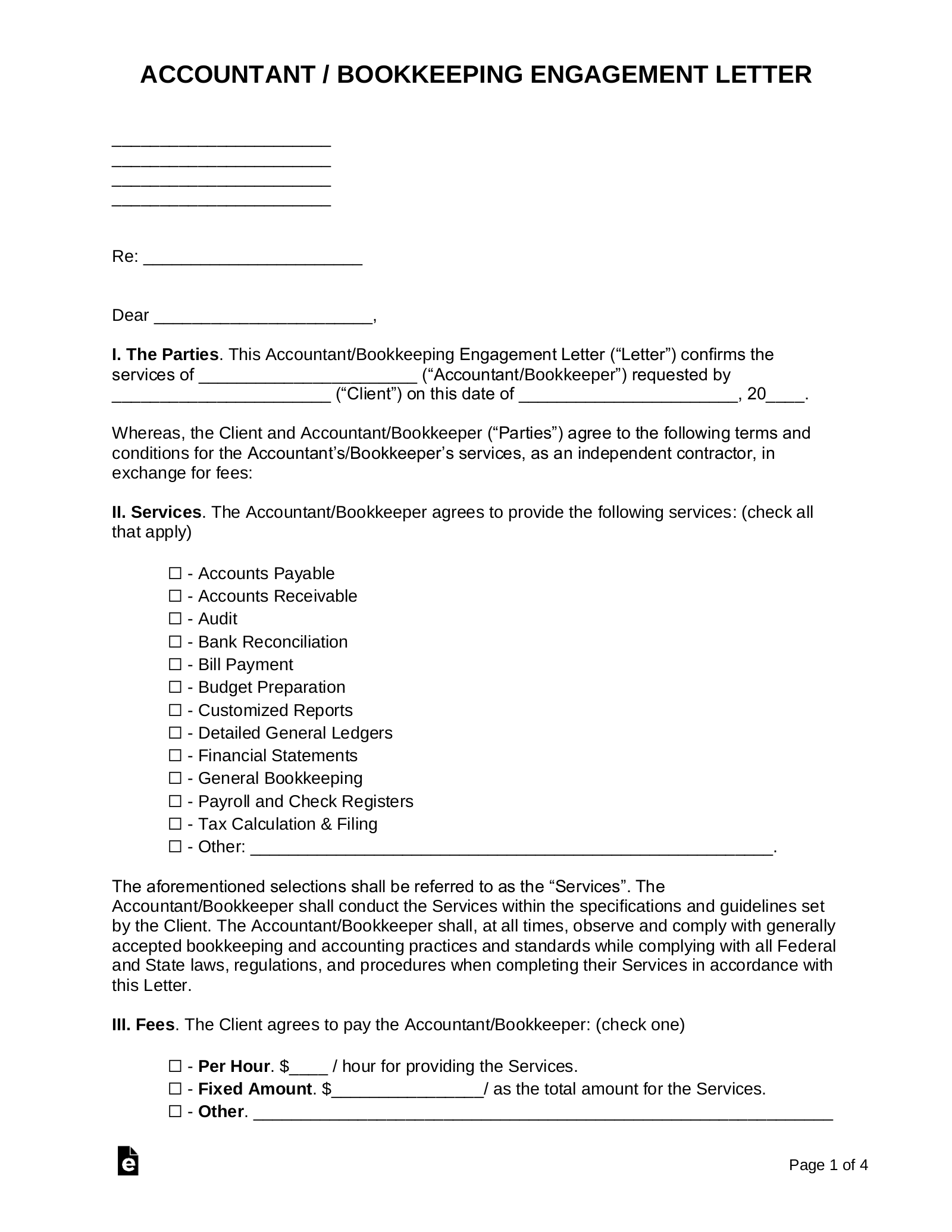

An accountant / bookkeeping engagement letter outlines the scope of work that a professional will provide for a client and typically includes details about compensation and the project timeline. Engagement letters are used primarily for filing taxes or audit services for an individual or business entity.

Accountants and bookkeepers are often required to have a signed engagement letter by all their clients before they can begin work as required by their professional liability insurance.

Table of Contents |

How to Hire an Accountant (5 steps)

To hire an accountant a simple agreement must be drafted that outlines the pay and scope of work provided. Due to the accountant having access to financial accounts, it’s highly recommended to use someone that is recommended by friends or family in order to know the person being hired is trustworthy.

1. Decide the Type of Accountant

In most cases, the client will be looking for a simple tax filing accountant to handle end of year records. Although, there are ten (10) types of accountants to choose from:

In most cases, the client will be looking for a simple tax filing accountant to handle end of year records. Although, there are ten (10) types of accountants to choose from:

- Tax Accountant

- Auditor

- Financial Advisor

- Project Accountant

- Staff Accountant

- Forensic Accountant

- Investment Accountant

- Cost Accountant

- Management Accountant

- Government Accountant

2. Ask Around

The best way to find a qualified accountant is to speak with friends, family, colleagues, and your attorney. An accountant will have access to all financial records and be responsible for filing taxes and organizing your financials. Therefore, it’s highly recommended to find someone trustworthy and proficient in their services.

The best way to find a qualified accountant is to speak with friends, family, colleagues, and your attorney. An accountant will have access to all financial records and be responsible for filing taxes and organizing your financials. Therefore, it’s highly recommended to find someone trustworthy and proficient in their services.

5. Sign an Engagement Letter

Download: PDF, Microsoft Word (.docx), Open Document Text (.odt)

Download: PDF, Microsoft Word (.docx), Open Document Text (.odt)

In order for the accountant to begin work, an agreement must be signed by the client. This is to protect both parties and is most often required by the accountant’s professional liability insurance. Once the engagement letter is authorized, the accountant may proceed to provide services to the client.

Sample Engagement Letters (3)

- Sample Audit Engagement Letter

- Sample Tax (Filing) Engagement Letter

- Sample Standard Engagement Letter

Sample – Audit Engagement Letter

Download: PDF

AUDIT ENGAGEMENT LETTER

Name of Client: [CLIENT’S NAME]

Address: [ADDRESS]

City, State, Zip: [CITY], [STATE], [ZIP]

Dear Client:

This letter will confirm the terms and limitations of the audit services our firm, [NAME OF FIRM], has agreed to perform for the Client for the year ending [DATE].

We will audit the consolidated balance sheet as of [DATE] and the related consolidated statements of income, retained earnings (deficit), and cash flows for the year then ended, for the purpose of expressing an opinion on them.

The financial statements are the responsibility of the Company management. Encompassed in that responsibility is the establishment and maintenance of effective internal control over financial reporting, the establishment and maintenance of proper accounting records, the selection of appropriate accounting principles, the safeguarding of assets and compliance with relevant laws and regulations. Management is also responsible for making all financial records and related information available to us.

Our responsibility is to express an opinion on the financial statements based on our audit and is limited to the period covered by our audit. If circumstances preclude us from issuing an unqualified opinion, we will discuss the reasons with you in advance. If, for any reason, we are unable to complete the audit or are unable to form or have not formed an opinion, we may decline to express an opinion or decline to issue a report as a result of the engagement.

We will conduct our audit in accordance with generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The term “reasonable assurance” implies a risk that material monetary misstatements may remain undetected and precludes our guaranteeing the accuracy and completeness of the financial statements. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

Our procedures will include obtaining an understanding of the company’s internal control structure and testing those controls to the extent we believe necessary. Our procedures will include tests of documentary evidence supporting the transactions recorded in the accounts, tests of physical inventories and direct confirmation of receivables and certain other assets and liabilities by correspondence with selected customers, creditors, legal counsel, and banks. At the conclusion of our audit, we will request certain written representations from you about the financial statements and matters related thereto.

Although the audit is designed to provide reasonable assurance of detecting errors and irregularities that are material to the financial statements, it is not designed and cannot be relied upon to disclose all fraud, theft, embezzlements or other illegal or dishonest acts. However, we will inform you of any material errors, and all irregularities or illegal acts, unless they are clearly inconsequential, that come to our attention. If you intend to publish or otherwise reproduce the financial statements and make reference to our firm, you agree to provide us with printers’ proofs or masters for our review and approval before printing. You also agree to provide us with a copy of the final reproduced material for our approval before it is distributed.

As part of our engagement for the year ending [DATE], we will review the federal and state income tax returns for the Client. Further, we will be available during the year to consult with you on the tax effects of any proposed transactions or contemplated changes in business policies. Assistance to be supplied by your personnel, including the preparation of schedules and analyses of accounts, is described in a separate attachment. Timely completion of this work will facilitate the completion of our audit.

Our fees will be billed as work progresses and are based on the amount of time required plus outof-pocket expenses. Invoices are payable upon presentation. We will notify you immediately of any circumstances we encounter that could significantly affect our initial estimate of total fees, which will range from $[AMOUNT] to $[AMOUNT] while being paid the hourly rate of $[AMOUNT] / hour.

The working papers for this engagement are the property of our firm and constitute confidential information and will be retained by us in accordance with our policies and procedures. If any dispute arises (between/among) the parties hereto, the parties agree first to try in good faith to settle the dispute through non-binding mediation. The costs of mediation shall be shared equally by the parties. The parties agree that, if any dispute cannot be settled through mediation, the dispute may then be brought before a court of competent jurisdiction, but the matter will ultimately be decided by the court, sitting without a jury. The parties recognize they have knowingly and voluntarily agreed to waive all rights to have any such dispute determined by a jury, but otherwise retain all rights afforded under the applicable civil justice system.

This Agreement, and the rights and obligations of the Parties hereunder, shall be governed by and construed in accordance with the laws located in the State where the services are being provided.

This Agreement is fully and voluntarily entered into by the Parties. Each Party states that he, she, or it has read this Agreement, has obtained advice of counsel if he, she, or it so desired, understands all of this Agreement, and executes this Agreement voluntarily and of his, her, or its own free will and accord with full knowledge of the legal significance and consequences of this Agreement.

If this letter correctly expresses your understanding, please sign the enclosed copy where indicated and return it to us.

We appreciate the opportunity to serve you and trust that our association will be a long and pleasant one.

Sincerely,

______________________ Date: ________

Auditor’s Signature

_______________________ Date: ________

Client Signature

Sample – Tax (Filing) Engagement Letter

Download: PDF

TAX PREPARATION ENGAGEMENT LETTER

Name of Accountant/Bookkeeper: [NAME]

Mailing Address: [ADDRESS]

City, State, Zip: [CITY, STATE, ZIP]

Website: [WEBITE]

Phone: [PHONE NUMBER]

Thank you for choosing our firm, [NAME OF FIRM/ACCOUNTANT] (“Accountant”) to assist you with your tax returns. This letter confirms the terms of my engagement with you and outlines the nature and extent of the services I will provide.

I will prepare your federal and state income tax returns. I will depend on you to provide the information I need to prepare complete and accurate returns. I may ask you to clarify some items but will not audit or otherwise verify the data you submit. I may or may not provide a checklist to help you collect the data required for your return, and will help you avoid overlooking important information.

Information you provide will be kept confidential. I restrict access to your information and maintain physical, electronic and procedural safeguards to protect your information.

I will perform accounting services only as needed to prepare your tax returns. My work will not include procedures to find defalcations or other irregularities. Accordingly, our engagement should not be relied upon to disclose errors, fraud, or other illegal acts, though it may be necessary for you to clarify some of the information you submit. I will, of course, inform you of any material errors, fraud, or other illegal acts I discover. The law imposes penalties when taxpayers underestimate their tax liability. Please contact me if you have concerns about such penalties.

Should I encounter instances of unclear tax law, or of potential conflicts in the interpretation of the law, I will outline the reasonable courses of action and the risks and consequences of each. I will ultimately adopt, on your behalf, the alternative you select.

My fee will be based on the complexity of the return, and will be quoted in advance of my work. The number of hours it will take to complete the return is not guaranteed but the hourly rate I charge is $[AMOUNT] / hour. However, if complications are discovered in the process of preparing your tax return, I may need to adjust the fee. Before proceeding with preparation of the return, I will generally contact you in advance if my original quote requires significant revision due to the amount of work involved. Invoices are due and payable upon presentation. To the extent permitted by state law, an interest charge may be added to all accounts not paid within thirty (30) days.

I will return your original records to you at the end of this engagement. You should securely store these records, along with all supporting documents, canceled checks, etc., as these items may later be needed to prove accuracy and completeness of a return. I will electronically retain copies of your records and our work papers for your engagement for seven years, after which these documents will be destroyed. If your tax return is selected for audit by the IRS or by the state tax authorities, I am available to represent you or to prepare materials in response to correspondence. However, these are additional expenses not included in my tax preparation fees and I will render additional invoices for the time and expense incurred. Please let me know right away if you receive any letters from the IRS or any other tax agency. I will correct your return for free and pay any penalties if I am at fault. However, I am not responsible for payment of any taxes owed.

TAX FILING ENGAGEMENT LETTER

My engagement to prepare your tax returns will conclude with the delivery of the completed returns to you (if paper-filing), or your signature and our subsequent submittal of your tax return (if e-filing). If I am not able to e-file your returns, you will be solely responsible to file the returns with the appropriate taxing authorities. Review all tax-return documents carefully before signing them. This letter can apply to future years of tax preparation services unless the agreement is terminated or amended in writing.

To affirm that this letter correctly summarizes your understanding of the arrangements for this work, please sign the enclosed copy of this letter in the space indicated and return it to me in the envelope provided, or electronically.

I appreciate your confidence in me. Please call if you have any questions.

Sincerely,

__________________ Date: ______

Print Name: ____________________

I, the Client, agree to the aforementioned terms and conditions with my hand and signature below:

____________________ Date: ______

Print Name: _____________________

Sample – Standard Engagement Letter

Download: PDF

STANDARD ACCOUNTANT ENGAGEMENT LETTER

Accountant/Firm: [NAME]

Address: [ADDRESS]

City, State, Zip: [CITY, STATE, ZIP]

Phone: [PHONE NUMBER]

Website: [WEBSITE]

RE: [SUBJECT]

Dear [CLIENT’S NAME],

The purpose of this letter is to confirm, based on our conversation of [DATE], that [NAME OF FIRM] (“Firm”) will provide bookkeeping services related to the following matter: [LIST].

We will provide the following services: [LIST].

Our fee is $[AMOUNT] / hour for the aforementioned services performed by our Firm.

Our expectations of you are to provide all documentation in an accurate and clear manner. Your primary contact for this matter will be [NAME]. If you have any questions about your case, you should contact him/her directly.

In an effort to provide you with an estimate of the total costs involved in pursuing this matter, an estimate of fees and expenses is provided below. Please keep in mind that this is only an estimate and that, depending upon the time required and the complexity of the action, actual costs may exceed this estimate.

Estimate of Costs: $[AMOUNT] to $[AMOUNT].

Sincerely,

___________________ Date _______

Accountant’s Name:_____________

With my signature below, I agree to the aforementioned terms included in the this letter:

___________________ Date _______

Client’s Name: _____________

Related Agreements

Accountant Retainer Agreement – A full-service agreement outlining payment and any retainer paid by the client.

Bookkeeping Services Agreement – For a bookkeeper to provide general services related to organizing and submitting financial records.

If no one is recommended then it’s best to use qualified and reviewed accountants from the following websites:

If no one is recommended then it’s best to use qualified and reviewed accountants from the following websites:

After finding an accountant that meets your needs, it’s best to have a meeting and negotiate the services and the price. The accountant will usually charge an hourly rate ($/hr) and in some cases will give a price for the entire project.

After finding an accountant that meets your needs, it’s best to have a meeting and negotiate the services and the price. The accountant will usually charge an hourly rate ($/hr) and in some cases will give a price for the entire project.