Updated August 28, 2023

A Kansas employment contract agreement is used to create conditions that dictate the manner in which a working relationship will progress and operate. An employer may find it beneficial to implement a contract agreement as it provides proof of an employee’s compliance with their terms. The employer’s terms may include but are not limited to details regarding disability leave, termination procedures, consequences of disclosing confidential information, employee benefits, and vacation time. More general items may be specified in the contract, such as the individual’s salary and operating schedule. If an employer determines that an employee has violated the agreement, they may seek repercussions to the farthest extent prescribed in the document.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – A document that an employer may use to ensure that employees do not disseminate company secrets to the public or third parties.

Employee Non-Disclosure Agreement (NDA) – A document that an employer may use to ensure that employees do not disseminate company secrets to the public or third parties.

Download: PDF, MS Word, OpenDocument

Employee Non-Compete Agreement – Prohibits an individual from engaging in business activity with other parties and safeguards the employer’s confidential information.

Employee Non-Compete Agreement – Prohibits an individual from engaging in business activity with other parties and safeguards the employer’s confidential information.

Download: PDF, MS Word, OpenDocument

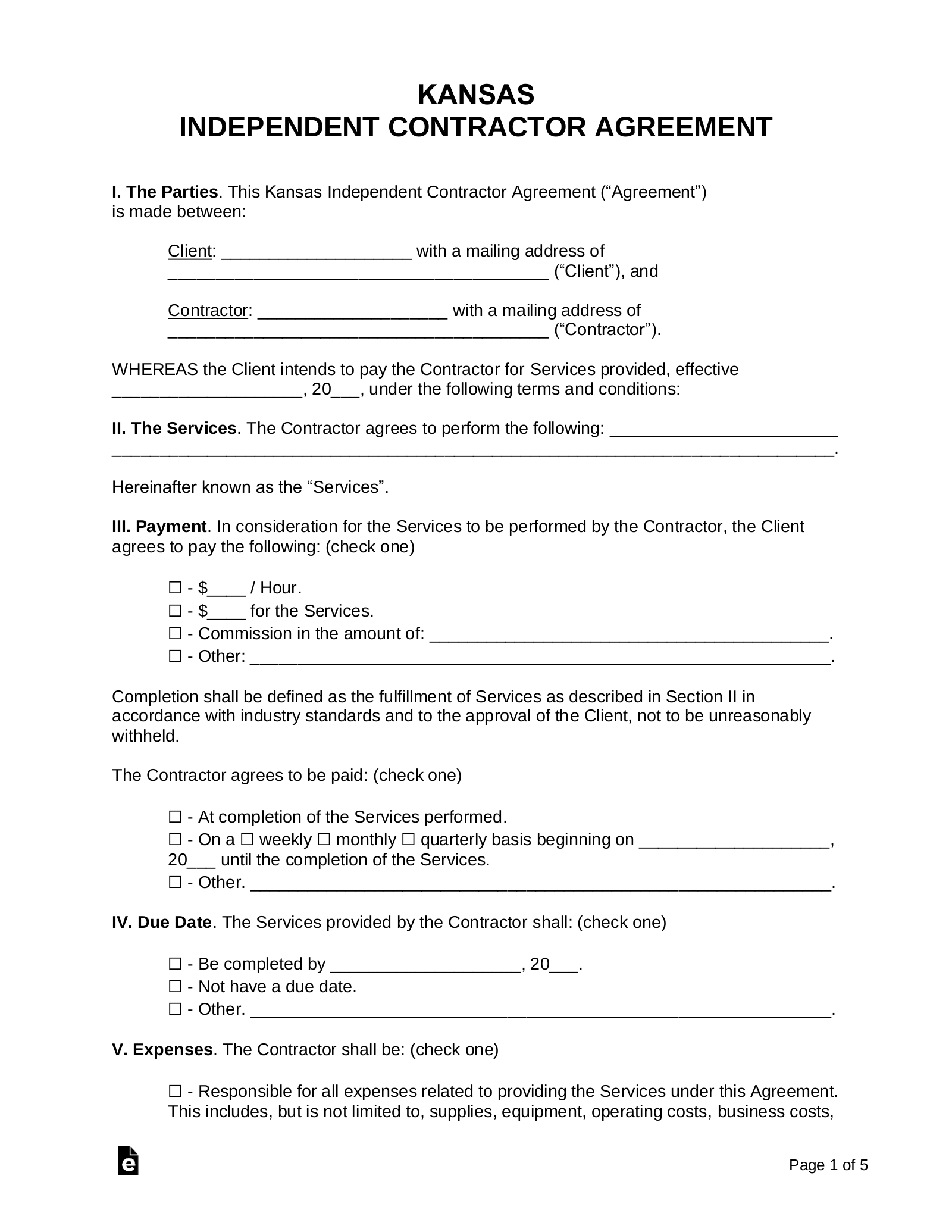

Independent Contractor Agreement – Determines an independent contractor’s salary, responsibilities, rights, and otherwise establishes the conditions of employment.

Independent Contractor Agreement – Determines an independent contractor’s salary, responsibilities, rights, and otherwise establishes the conditions of employment.

Download: PDF, MS Word, OpenDocument

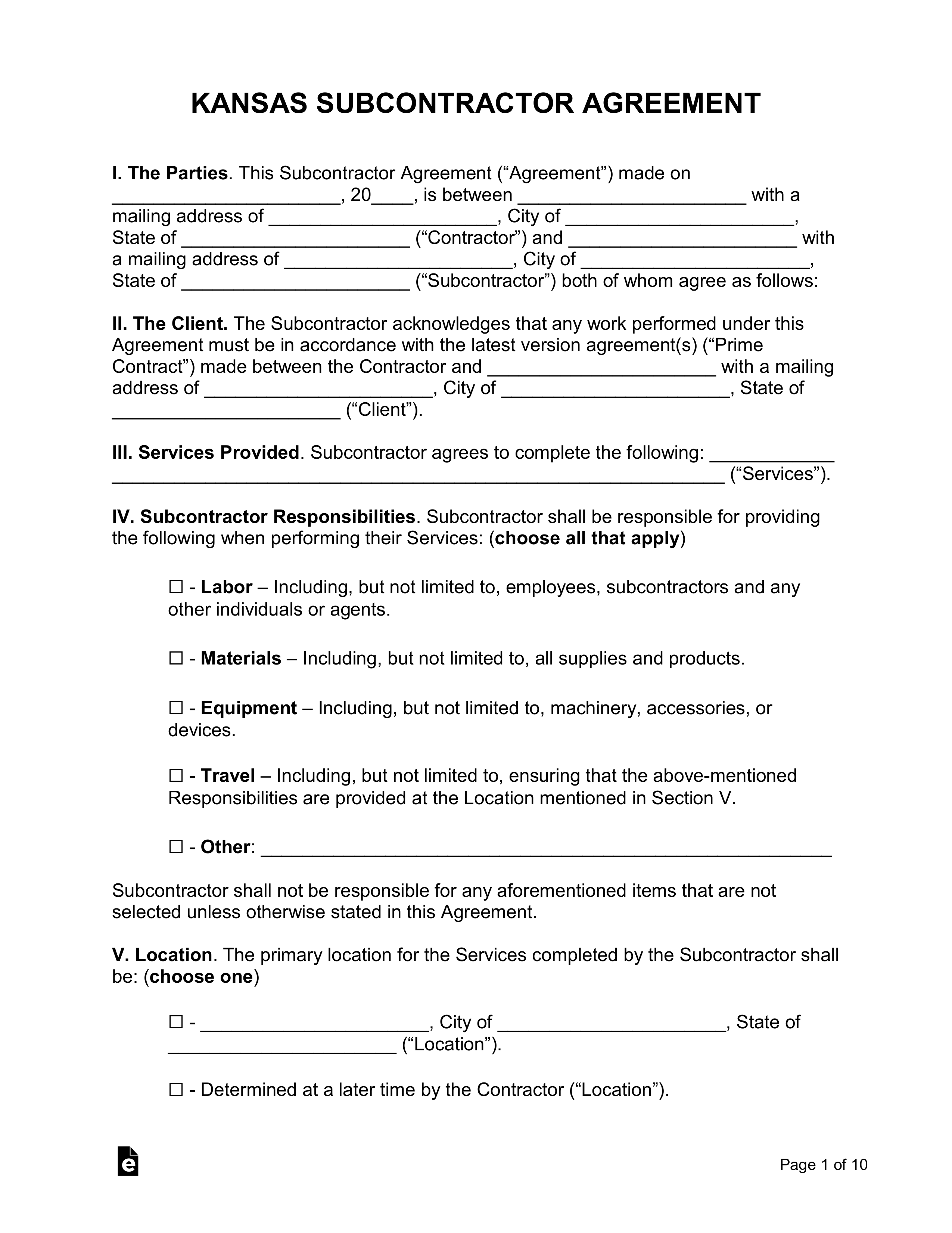

Subcontractor Agreement – A binding contract between a company and a subcontractor who has been employed by the company to assist them in completing a specific portion of a contractual obligation.

Subcontractor Agreement – A binding contract between a company and a subcontractor who has been employed by the company to assist them in completing a specific portion of a contractual obligation.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“… means any person who has entered into the employment of or works under any contract of service or apprenticeship with an employer.”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contracts” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 3.1% to 5.7%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25[3]