Updated December 02, 2023

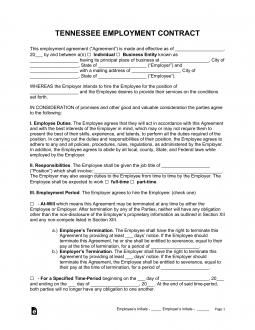

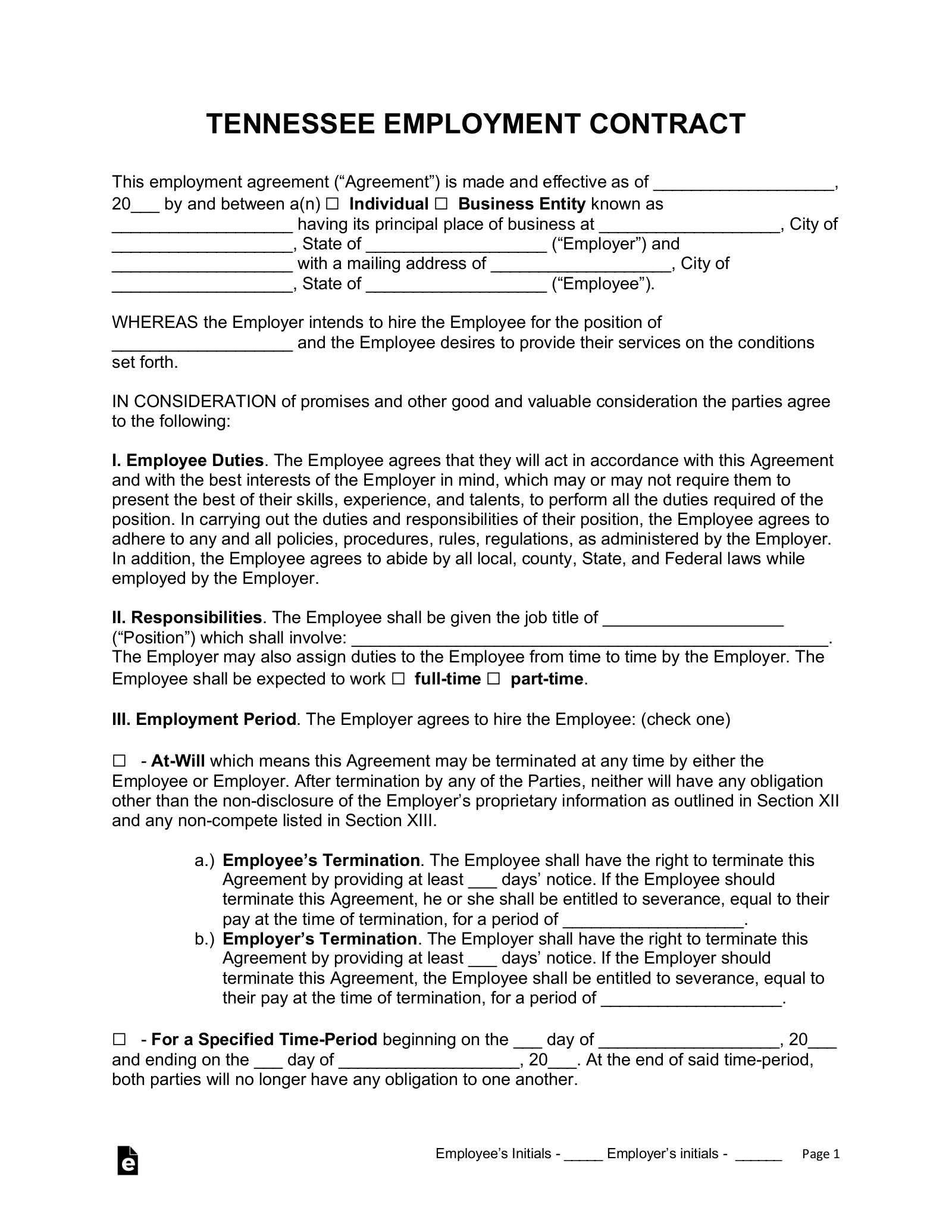

A Tennessee employment contract agreement is a tool implemented at the initial stages of a working relationship to define an employer’s conditions for employment. When negotiating terms with the employee, the employer should outline the stipulations in a contract agreement that they will both sign. As a result, the employer will have documentation of the designated salary, schedule, responsibilities, and any other provisions the employer elects to prescribe. This process greatly decreases the possibility of confusion as each party must agree upon the information set forth in the contract.

By Type (4)

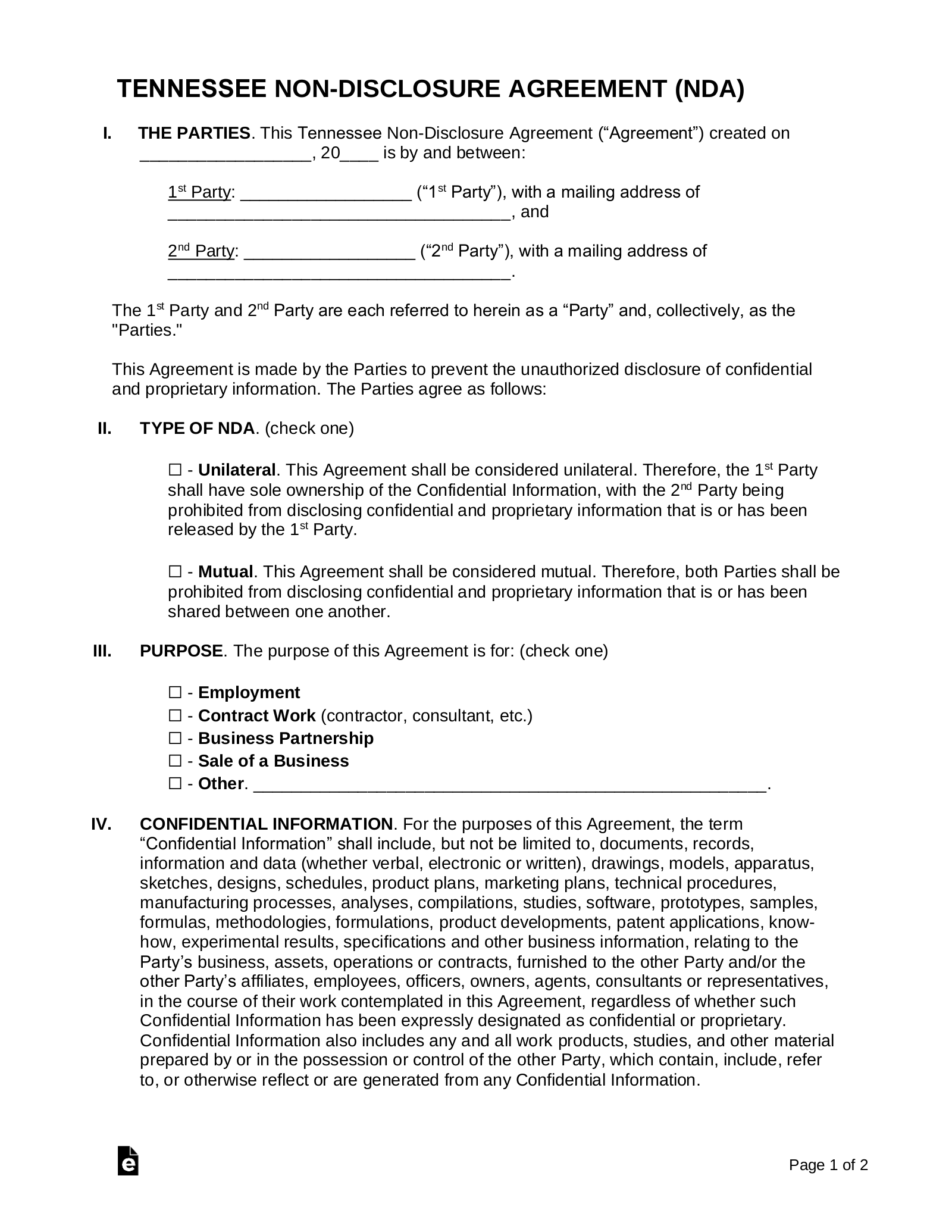

Employee Non-Disclosure Agreement (NDA) – Protects a business by preventing employees from releasing company information to unauthorized parties.

Download: PDF, MS Word, OpenDocument

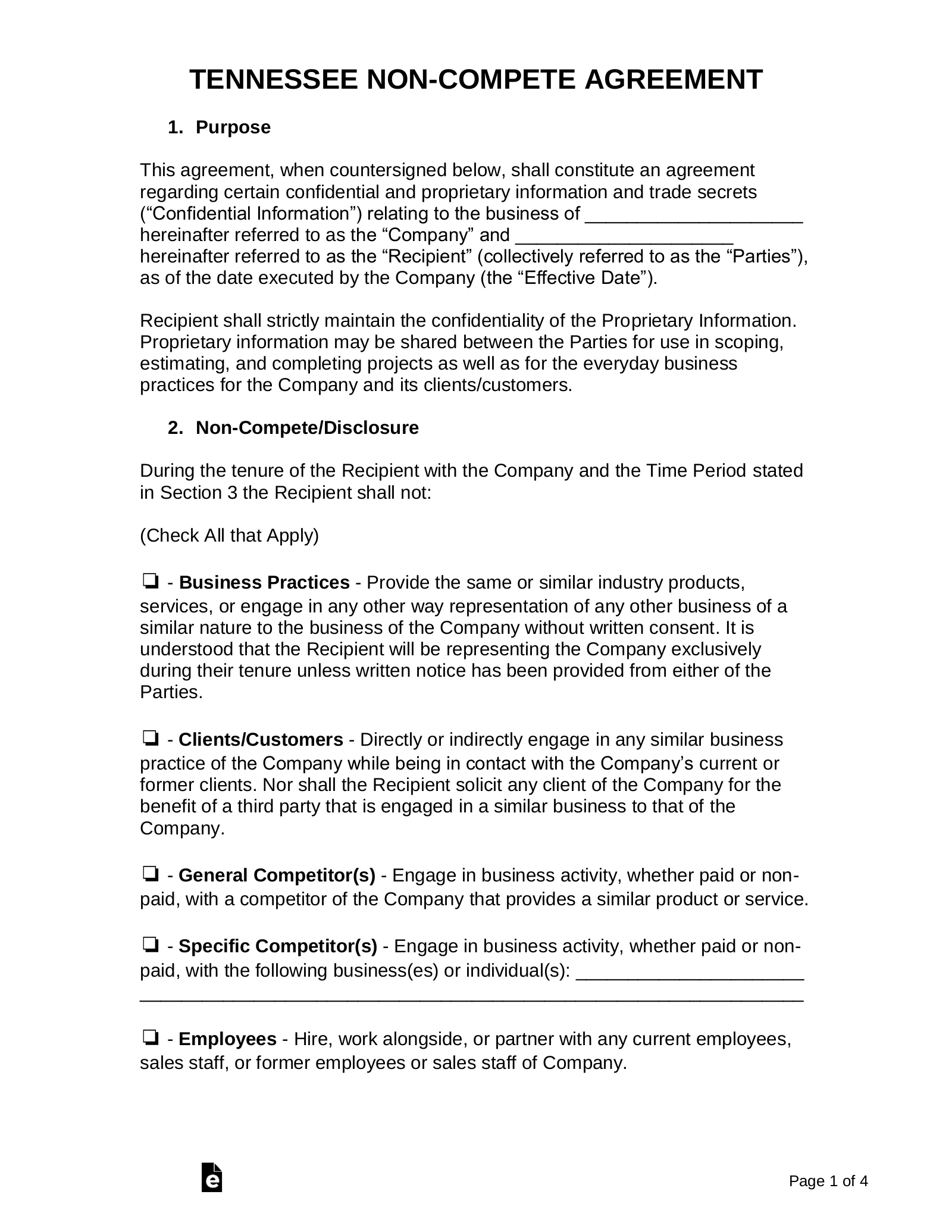

Employee Non-Compete Agreement – Outlines the extent to which an employee is permitted to transact business activity with other companies or individuals.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – A document that sets forth the employment conditions for a contractor operating independently.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – Used to create a working relationship between a contractor and a subcontractor.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . means any individual for whom an employer must complete a Form I-9 pursuant to federal law and regulations, and does not include an independent contractor as defined by 8 U.S.C. § 1324a and its regulations;”

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 1% on interest and dividends only[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25 (no State minimum, federal law applies)