Updated December 02, 2023

A Texas employment contract agreement is a medium through which an employer can establish a working relationship between them and an employee. The agreement serves as a record of the employee’s compliance with the terms and conditions specified by the employer in the contract. Should an employee agree to the contract agreement and either fail to uphold their obligations or dispute certain provisions, the employer can simply reference the contract to neutralize any confusion. An employer can further protect their assets by establishing a non-compete or non-disclosure clause that prohibits the employee from releasing company information for their benefit, or from conducting business with similar companies.

By Type (4)

Employee Non-Disclosure Agreement (NDA) – Ensures that a company’s trade secrets are kept confidential by employees.

Download: PDF, MS Word, OpenDocument

Employee Non-Compete Agreement – Used to establish clauses that restrict an employee from working in related professions or from transacting business with specific parties.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Details the terms under which an independent contractor must operate in exchange for payment.

Download: PDF, MS Word, OpenDocument

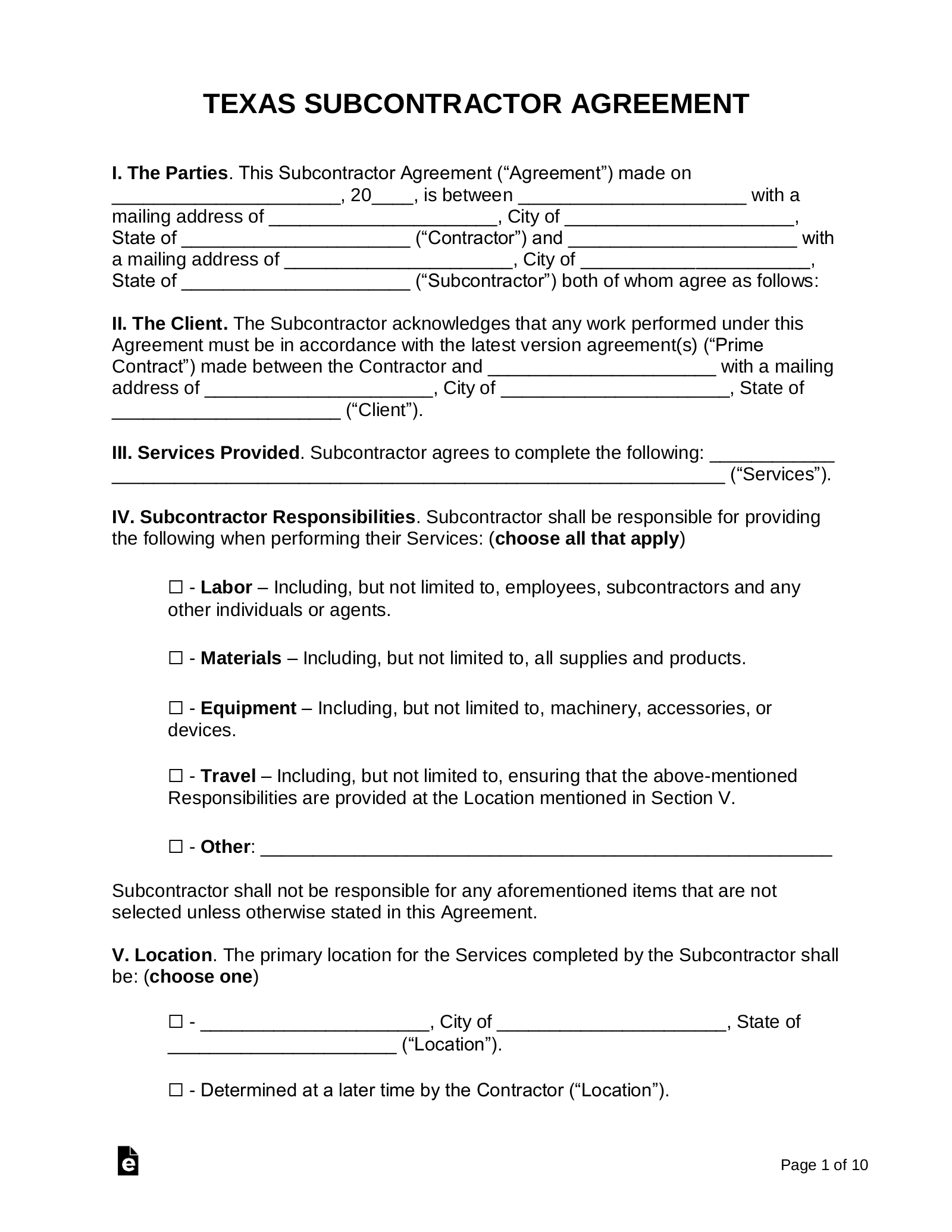

Subcontractor Agreement – A contract that a business may use when outsourcing work to another contractor.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . means an individual employed by an employer, including an individual subject to the civil service laws of this state or a political subdivision of this state, except that the term does not include an individual elected to public office in this state or a political subdivision of this state.”

At-Will Employment

At-Will Employment – Allowed with the exception of any “Public Policy” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 0%

Minimum Wage ($/hr)

Minimum Wage – $7.25[2]