Updated December 12, 2023

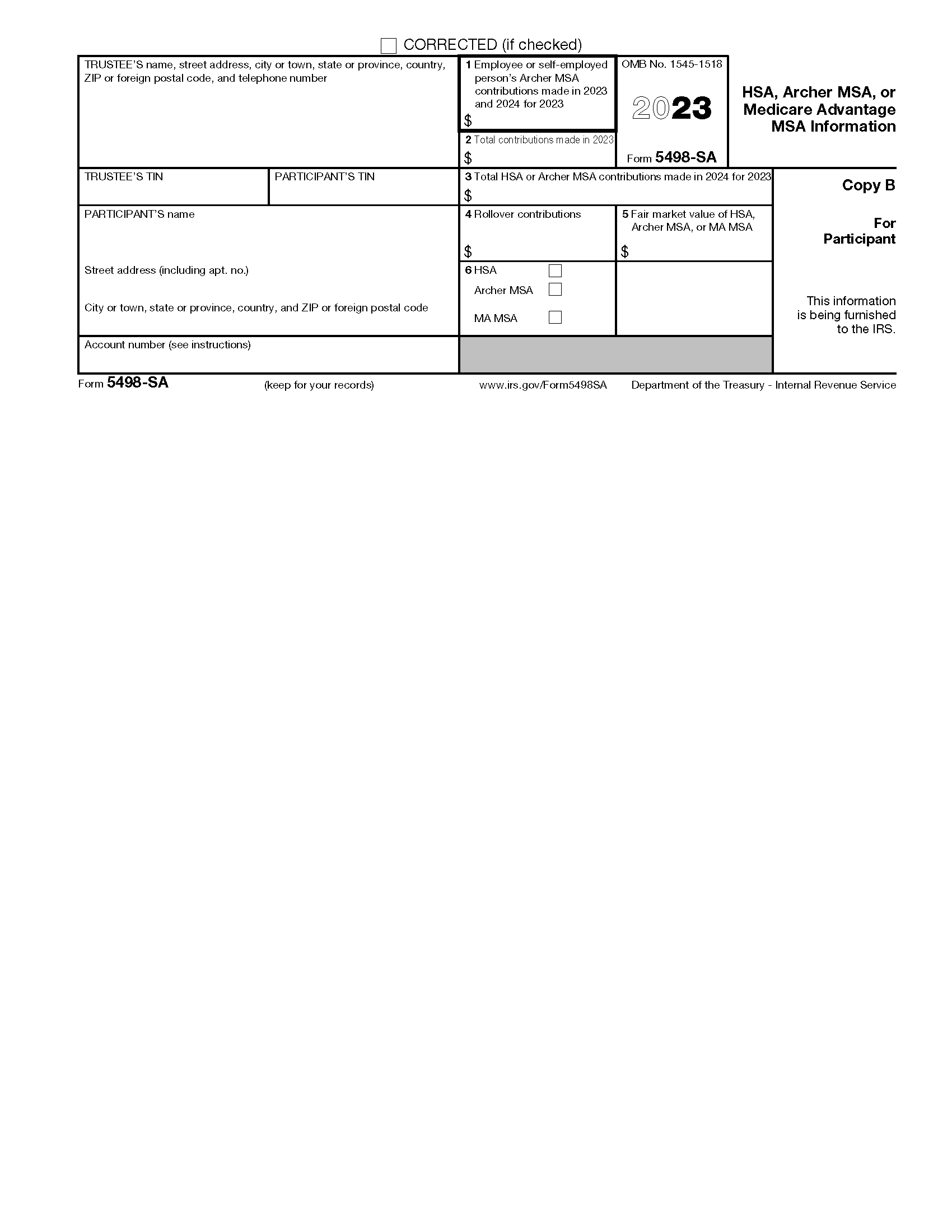

Form 5498-SA is an IRS tax document used to report information on health savings accounts (HSAs), Archer medical savings accounts (Archer MSAs), and Medicare Advantage MSAs (MA MSAs). 5498-SA must be filed each year with the IRS, even if no reportable contributions were made to the account.

Who Must File?

The trustee or custodian of an HSA, Archer MSA, or MA MSA must file 5498-SA for each person for whom they maintained an account. A separate form is required for each different type of account held by the same person.

Table of Contents |

Who Gets a 5498-SA?

In most cases, the trustee must provide a copy of 5498-SA to the account participant. However, if no contributions were made to the account for the year, and the trustee furnishes a separate statement of the account’s fair market value (FMV) to the participant, then the trustee is not required to provide the participant with Copy B of Form 5498-SA.[1]

Death of Account Holder

In the year that an account holder dies, the trustee generally must file 5498-SA with the IRS and furnish a copy to the decedent. If the surviving spouse is the designated beneficiary, then they become the new account holder (unless the account is an MA MSA).[2]

Deadlines

The deadline to file 5498-SA with the IRS is May 31 of the following year. May 31 is also the deadline for when Copy B must be furnished to the participant.[3]

2024 Deadlines

- May 31, 2024 (both the IRS and the participant)

Form Parts (13)

Box 1: Employee or Self-Employed Person’s Archer MSA Contributions

If the participant is an employee or self-employed person who contributed to their own Archer MSA for the calendar year, enter the amount of those contributions in this box. Include excess contributions in this amount, even if these contributions were withdrawn.

If the participant did not contribute to their own Archer MSA for the calendar year, leave this box blank.[4]

Box 2: Total Contributions Made in the Calendar Year

Enter the total amount of contributions made to an HSA or Archer MSA in the calendar year. Do NOT include rollover contributions, excess employer contributions that were withdrawn by the employer, or contributions made in the following year that were designated for the calendar year.

Include in this amount any contributions that were made in the calendar year that were designated for the prior year (e.g., contributions made in 2023 that were designated for 2022).[5]

Box 3: Total HSA or Archer MSA Contributions Made in the Following Year

Enter the total amount of contributions made to an HSA or Archer MSA during the following year that were designated for the calendar year.

For example, if you are filing 5498-SA for calendar year 2023, enter in this box the amount of contributions made in 2024 designated for 2023.[6]

Box 4: Rollover Contributions

Enter the amount of rollover contributions made to an HSA or Archer MSA during the calendar year.

Be sure not to include this amount in box 2.[7]

Box 5: Fair Market Value of HSA, Archer MSA, or MA MSA

Enter the fair market value of the account as of December 31 of the calendar year.[8]

Box 6: Checkbox

Check the corresponding box to indicate whether the account is an HSA, an Archer MSA, or an MA MSA.[9]

Identifying Information (6 Entries)

On the left side of Form 5498-SA, six boxes require information that identifies the trustee and the participant, including:

- Trustee information – name, full address (including country), and telephone number

- Trustee TIN – taxpayer identification number

- Participant’s TIN – normally an SSN/ITIN or EIN

- Participant’s name – full name

- Participant’s street address – number and street only

- Participant’s remaining address – city/town, state/province, country, Zip/postal code

The participant’s TIN must be entered in XXX-XX-XXXX (SSN or ITIN) or XX-XXXXXXX (EIN) format on Copy A of this form.[10]

Account Number

The account number field is generally provided for the trustee’s reference and for internal recordkeeping. An account number is required if there are multiple accounts for a recipient for whom you are filing more than one 5498-SA.

The IRS encourages you to designate an account number for each 5498-SA that you file. Note that the account number must be unique and cannot appear anywhere else on Form 5498-SA.[11]

How to File

Form 5498-SA can be filed using online fillable forms or with paper copies printed off of the IRS website.

- Collect W-9s from each participant

- Choose a filing method (online with FIRE, by mail, or with third-party software. Skip ahead to step 5 if you are filing online.)

- Complete Form 1096 along with Copy A if you are filing by mail

- Mail Form 1096 and Copy A to the appropriate IRS address

- Send Copy B to the participant

- Retain Copy C for your records

Frequently Asked Questions

What is the difference between 5498-SA and Form 1099-SA?

Whereas 5498-SA is used to report contributions to and other information on HSAs, Archer MSAs, and MA MSAs, Form 1099-SA is used to report distributions from these accounts.[12]

Do I need to report the information from 5498-SA on my tax return?

How contributions are treated on your income tax return varies based on the account type and who made the contribution. Contributions to your HSA or Archer MSA are generally deductible on your return. Refer to Forms 8889 and 8853 for more information.[13]

Do I need to file 5498-SA for a total distribution?

Generally, if a total distribution was made from an HSA or Archer MSA during the year, and no contributions were made for that year, then you are not required to file 5498-SA.[14]

Sources

- IRS – Statements to Participants

- IRS – Death of Account Holder

- IRS – Guide to Information Returns

- IRS – Employee Archer Contributions Box Instructions

- IRS – Total Contributions Made in 2023 Box Instructions

- IRS – Contributions Made in 2024 for 2023 Box Instructions

- IRS – Rollover Contributions Box Instructions

- IRS – FMV Box Instructions

- IRS – Checkbox Instructions

- IRS – Participant TIN Format

- IRS – Account Number Box on Forms

- IRS – Instructions for Forms 1099-SA and 5498-SA

- IRS – Form 5498-SA Instructions for Participant

- IRS – Total Distribution, No Contributions