Updated April 23, 2024

Forming an LLC in Arkansas can be completed online or by mail via the Secretary of State’s office. For online applications, it can take three to seven business days for the application to be processed, while paper filings can take seven to 10 business days.

How to Apply

How to form (7 steps) |

1. Find a Business Name

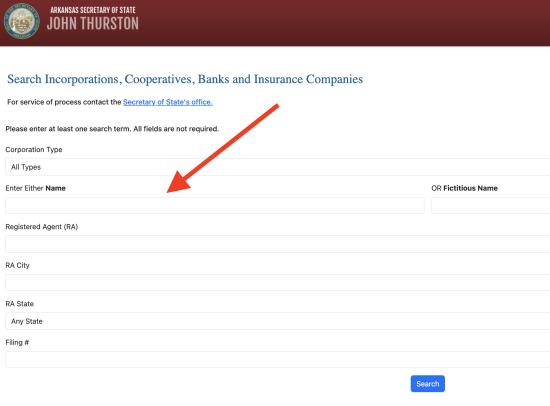

- Business Search: www.ark.org

Use the Arkansas Secretary of State’s business database to check whether your desired business name already exists. After selecting “Domestic Limited Liability Company” under Corporation Type, type in your desired business name and hit Search. If the words “No Results Found” appear, the business name is likely available.

The business name must contain the words “Limited Liability Company,” “Limited Company,” or the abbreviation “L.L.C.,” “L.C.,” “LLC,” or “LC.” The word “Limited” may be abbreviated as “Ltd.”, and the “Company” may be abbreviated as “Co.”

The business name must contain the words “Limited Liability Company,” “Limited Company,” or the abbreviation “L.L.C.,” “L.C.,” “LLC,” or “LC.” The word “Limited” may be abbreviated as “Ltd.”, and the “Company” may be abbreviated as “Co.”

Companies that perform a professional service must also include the word “Professional” or the abbreviation.[3]

2. Select a Registered Agent

Every limited liability company must designate a registered agent in the state who will act as the “mailbox” of the business. This means that they will receive any legal or official communication on its behalf.[4]

The designated registered agent may be an owner, shareholder, or officer of the corporation.[5] It is also common for a corporation to use their attorney or a professional corporate service company for this role.

3. Register the LLC

There are two ways to register your LLC: online or by mail.

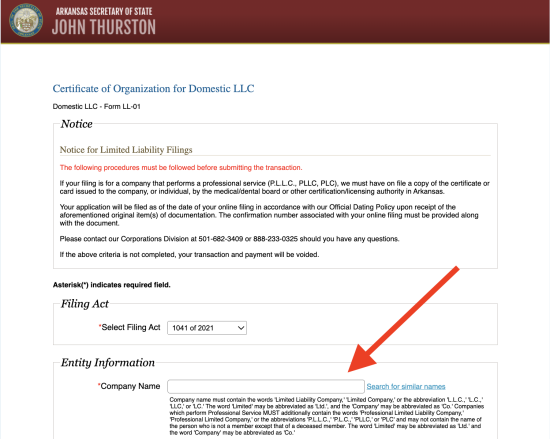

Option 1: File Online

- Go to www.ark.org to access the Arkansas Secretary of State’s Corporate Online Filing System.

For domestic LLCs, select the “Certificate of Organization for Limited Liability Company” form and click the “Start Form” button. For foreign LLCs, select the “Application for Certificate of Registration of Foreign Limited Liability Company” form and click the “Start Form” button.

- The desired name of the LLC

- Principal’s name, address, and contact info

- Registered agent’s name, address, and contact info

- Organizer/officer’s name, address, and contact info

- Form submitter’s name, address, and contact info

- Annual report contact info

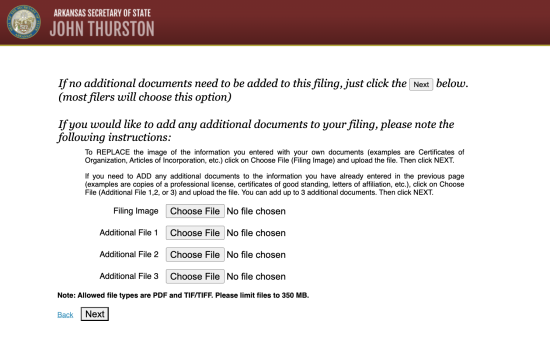

If your business will be performing a professional service (i.e. PLLC or PLC) — such as medical, accounting, etc. — you must upload a copy of the certificate or card issued to the company or individual by the medical/dental board or other certification/licensing authority in Arkansas.

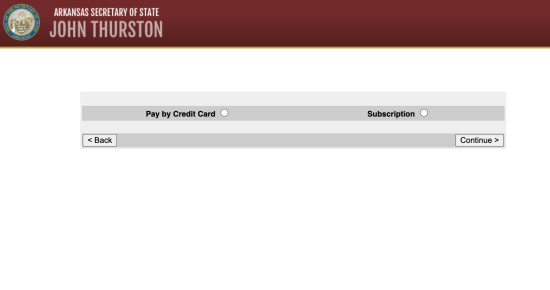

After reviewing your completed form, pay the filing fee of $45 by entering your credit card or subscription information.

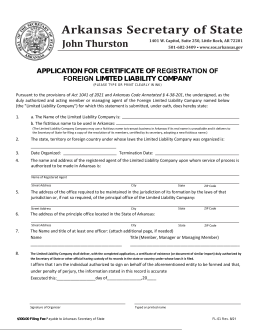

Option 2: File By Mail

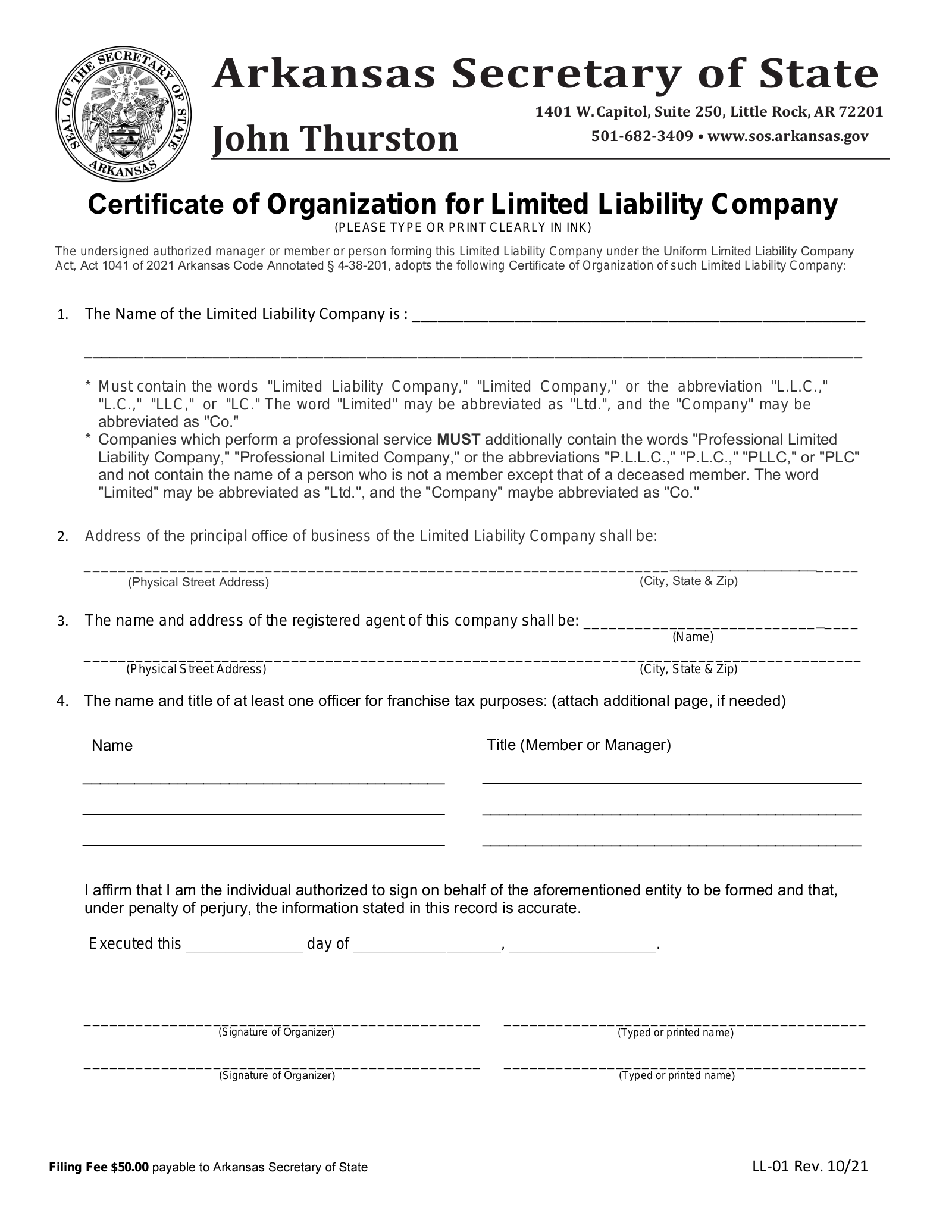

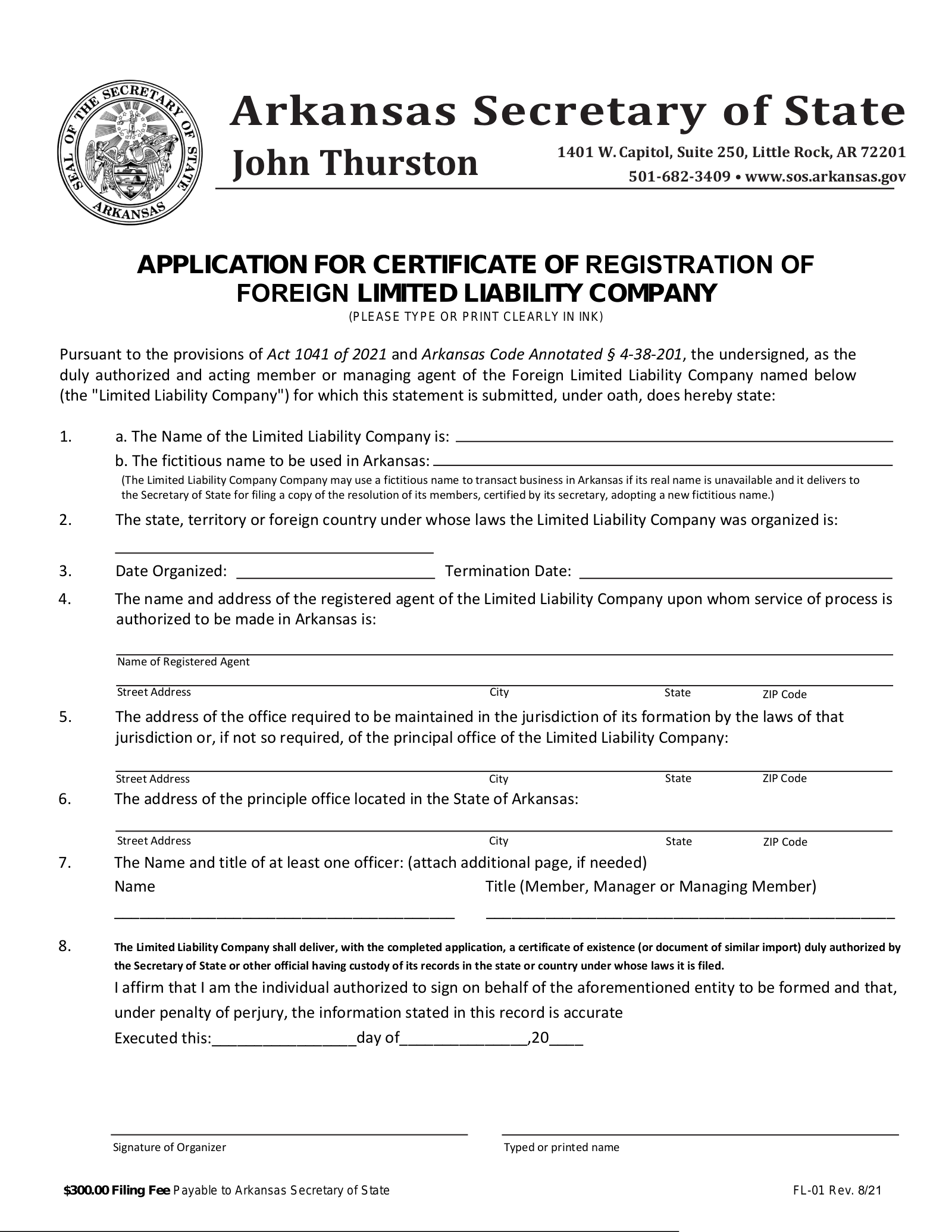

Select the appropriate form below. Complete the PDF and mail it to the listed address with an enclosed payment.

Certificate of Organization for Limited Liability Company – For in-state entities.

Certificate of Organization for Limited Liability Company – For in-state entities.

Filing fee: $300 check or money order made payable to the “Arkansas Secretary of State.”

Mailing address: Business & Commercial Services, 1401 W. Capitol Avenue Ste 250, Little Rock, AR 72201

Application for Certificate of Registration of Foreign Limited Liability Company – For out-of-state entities.

Application for Certificate of Registration of Foreign Limited Liability Company – For out-of-state entities.

Filing fee: $300 check or money order made payable to the “Arkansas Secretary of State.”

Mailing address: Business & Commercial Services, 1401 W. Capitol Avenue Ste 250, Little Rock, AR 72201

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

An Employer Identification Number (EIN) is used to identify a business entity. Also known as a Federal Tax Identification Number, an EIN must be obtained to open bank accounts, hire employees, and conduct business activities.[6]

5. Write an Operating Agreement

An operating agreement is not required for businesses in Arkansas. However, under state law, it becomes legally binding once it is created.[7]

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification

Below are the most common types of LLC tax classification:

- LLC (default) – By default, an LLC is taxed as a sole proprietorship (one member) or partnership (two or more members). All profits of the disregarded business entity pass through to each owner or partner, who must individually pay income tax on the profits.

- S-Corporation – An S-corporation passes business income, losses, deductions, and credits through to its shareholders for federal tax purposes. An LLC can elect to file as an S-corporation within 75 days of formation by filing IRS Form 2553.

- C-Corporation – A C-corporation files taxes as a corporate entity. An LLC can elect to file as a C-corporation within 75 days of formation by filing IRS Form 8832.

7. File Annual Reports

Businesses in Arkansas are legally required to file an annual report with the Secretary of State between January 1 and April 1 of each calendar year.[9] This can be filed online using Arkansas’ State Franchise Tax and Annual Report Filing System.

Sources

- Arkansas Secretary of State: Domestic Limited Liability Company (LLC) Forms / Fees / Records Requests

- Arkansas Secretary of State: Foreign Limited Liability Company (LLC) Forms / Fees / Records Requests

- Ark. Code § 4-27-401(a)(1)

- Ark. Code § 4-38-115(3)

- Arkansas Secretary of State: Business Services FAQ

- IRS (How to Apply for an EIN)

- Ark. Code § 4-38-106(a)

- IRS Publication 3402

- Ark. Code § 4-38-212