Updated April 23, 2024

Forming an LLC in California is a simple process that can be completed online or by mail through the Secretary of State’s office. Online applications take approximately 10 days to be processed, while paper filings can take up to three weeks. In California, a limited liability company may not provide professional services that require certification or licensing.[1]

How to Apply

How to form (7 steps) |

1. Find a Business Name

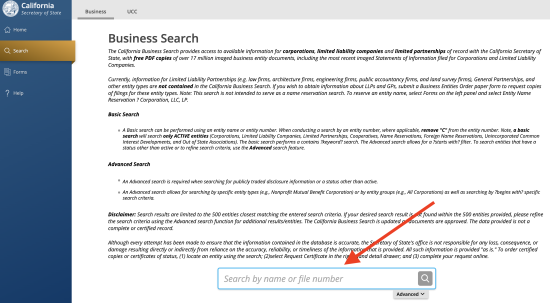

- Business Search: www.bizfileonline.sos.ca.gov

Use the California Secretary of State’s business search to check whether your proposed business name is available. If the words “No Results Were Found” appear, the business name is most likely free for use.

The name of a limited liability company must contain the words “limited liability company,” or the abbreviation “L.L.C.” or “LLC.” “Limited” may be abbreviated as “Ltd.,” and “company” may be abbreviated as “Co.”[4]

2. Designate an Agent for Service of Process

Every limited liability company in California is legally required to have an agent for service of process.[5] The designated registered agent may be an owner, shareholder, or officer of the corporation. It is also common for a corporation to use their attorney or a professional corporate service company for this role.

3. Register the LLC

There are two ways to register your LLC: online or by mail.

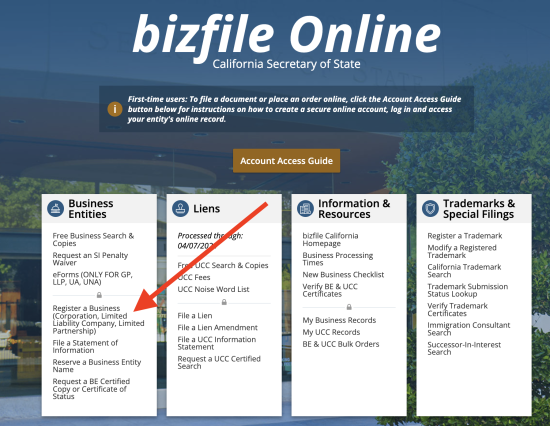

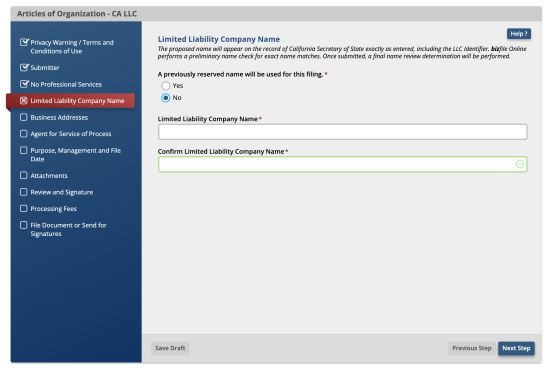

Option 1: File Online

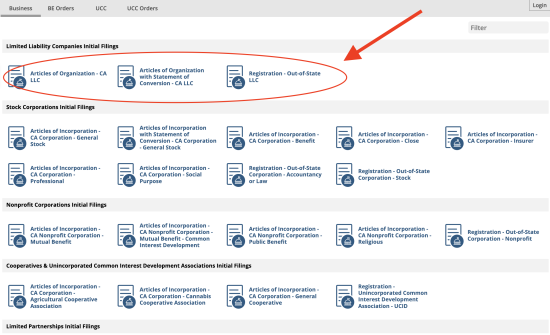

Go to www.bizfileonline.sos.ca.gov to access the state’s Online Business Filing System.

If your business will be in-state, use the first form. For an out-of-state business, use the third form.

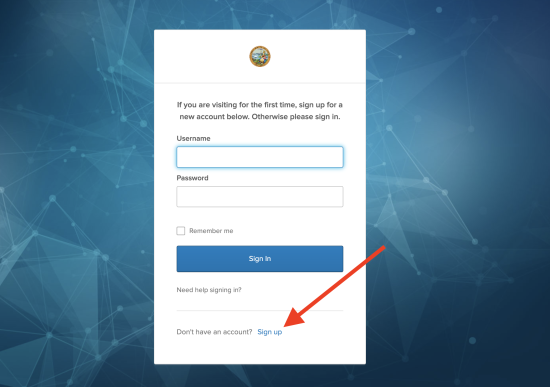

Click “Sign Up” to create a new account if you do not already have one.

This includes entering your proposed LLC name, business address, designated agent information, and more.

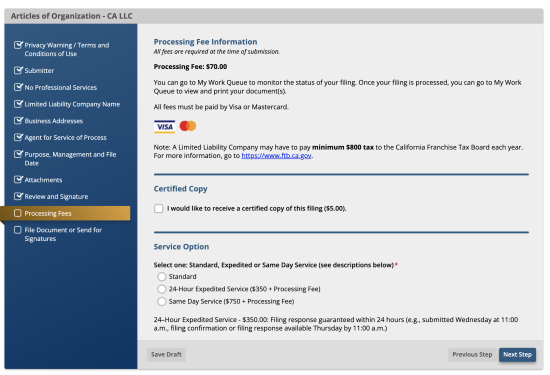

Payments must be submitted on a Visa or Mastercard. To receive a certified copy of the filing, you must pay an additional $5 fee.

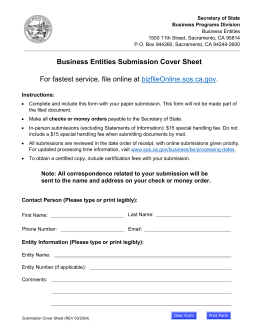

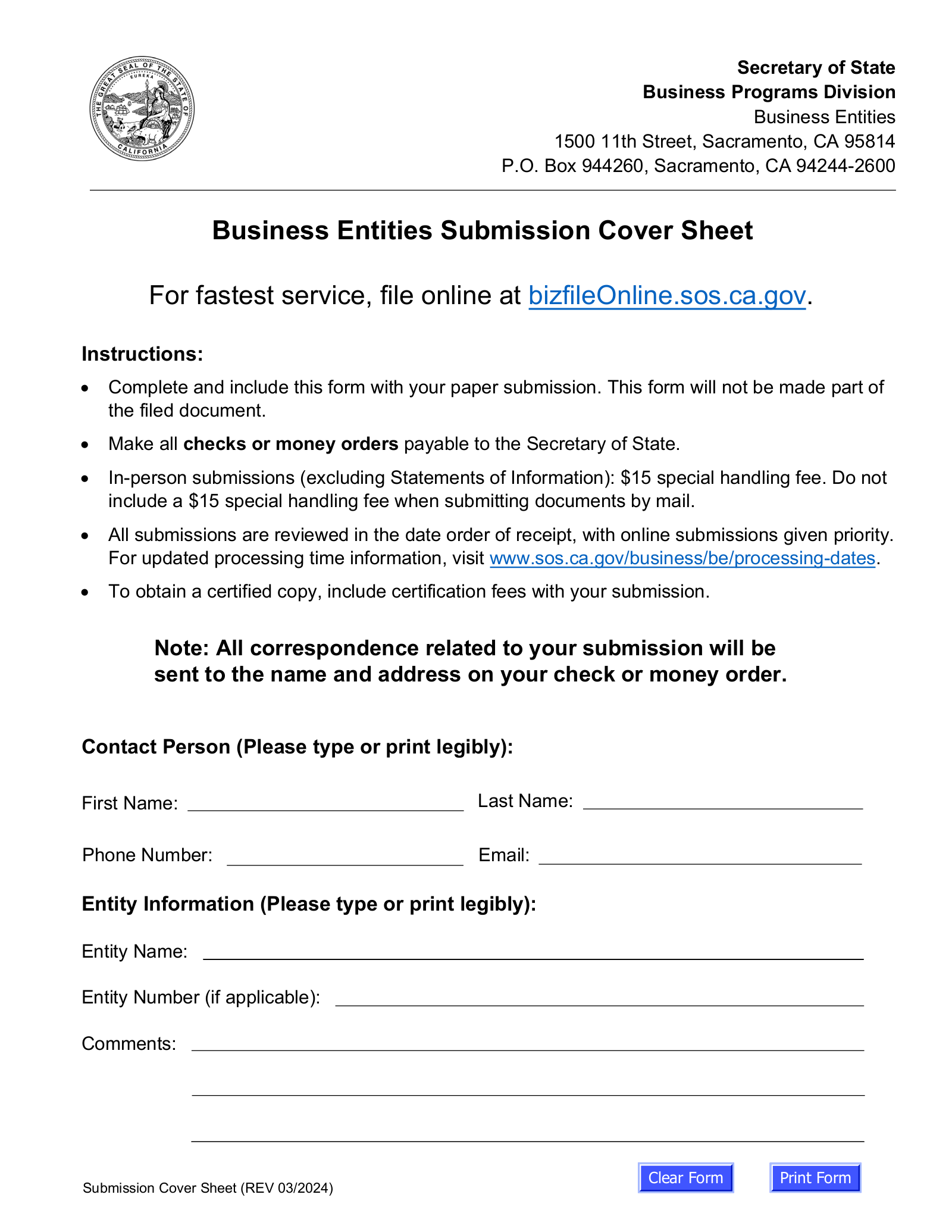

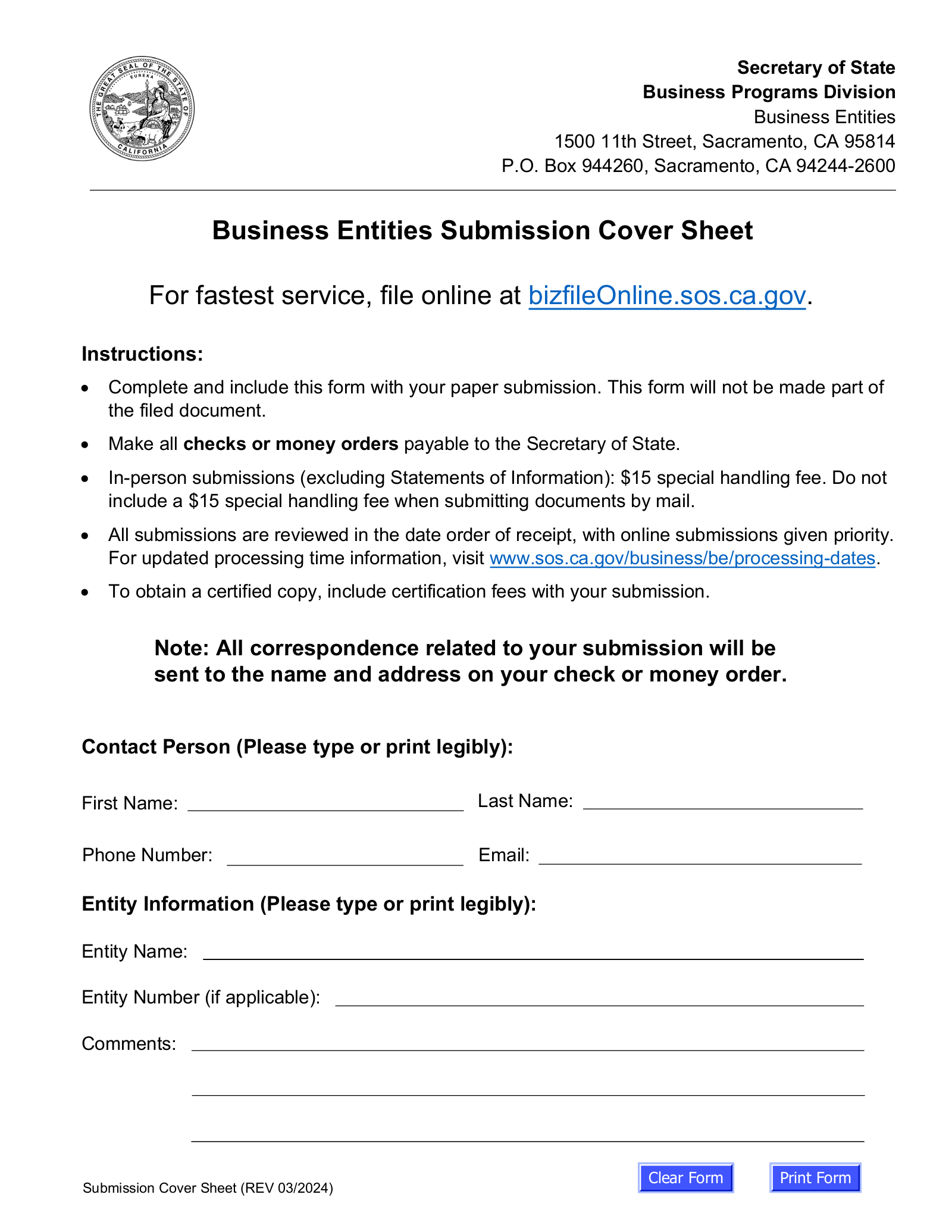

Option 2: File By Mail

Select the appropriate form below. Complete the PDF and mail it to the listed address with an enclosed payment.

Articles of Organization – Limited Liability Company (LLC) – For in-state entities.

Articles of Organization – Limited Liability Company (LLC) – For in-state entities.

Filing fee: $70 check or money order made payable to the “California Secretary of State.”

Mailing address: Secretary of State, Business Entities, P.O. Box 944260, Sacramento, CA 94244-2600

Application to Register a Foreign Limited Liability Company (LLC) – For out-of-state entities.

Application to Register a Foreign Limited Liability Company (LLC) – For out-of-state entities.

Filing fee: $70 check or money order made payable to the “California Secretary of State.”

Mailing address: Secretary of State, Business Entities, P.O. Box 944260, Sacramento, CA 94244-2600

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

An Employer Identification Number (EIN) is a unique number assigned to each business for tax and other purposes, such as opening a business bank account.[6]

5. Write an Operating Agreement

California legally requires a written operating agreement to be maintained for LLCs.[7]

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification

Below are the most common types of LLC tax classification:

- LLC (default) – An LLC is taxed as a sole proprietorship (one member) or partnership (two or more members). All profits of the disregarded business entity pass through to each owner or partner, who must individually pay income tax on the profits.

- S-Corporation – An S-corp is a pass-through entity that sends all business profits and losses to the shareholders. To file as an S-corp, an LLC must file IRS Form 2553 within 75 days of formation.

- C-Corporation – A C-corp files taxes as a separate corporate entity. To file as a C-corp, an LLC must file IRS Form 8832 within 75 days of formation.

7. File Statement of Information

Businesses in California are required to file a Statement of Information with the Secretary of State. The initial statement must be filed within 90 days of registering the LLC.[8] It must be filed once every two years thereafter during the designated filing period.

Sources

- Cal. Corp. Code § 17701.04(e)

- California Secretary of State: Limited Liability Companies – California (Domestic)

- California Secretary of State: Limited Liability Companies – Foreign (Out-of-State or Out-of-Country)

- Cal. Corp. Code § 17701.08(a)

- Cal. Corp. Code § 17701.13(a)(2)

- IRS (How to Apply for an EIN)

- Cal. Corp. Code § 17701.13(d)(5)

- Cal. Corp. Code § 17702.09(a)