Filing Fees

- Domestic: $110 (online); $110 (paper)

- Foreign: $220 (online); $220 (paper)[1]

How to Form an LLC

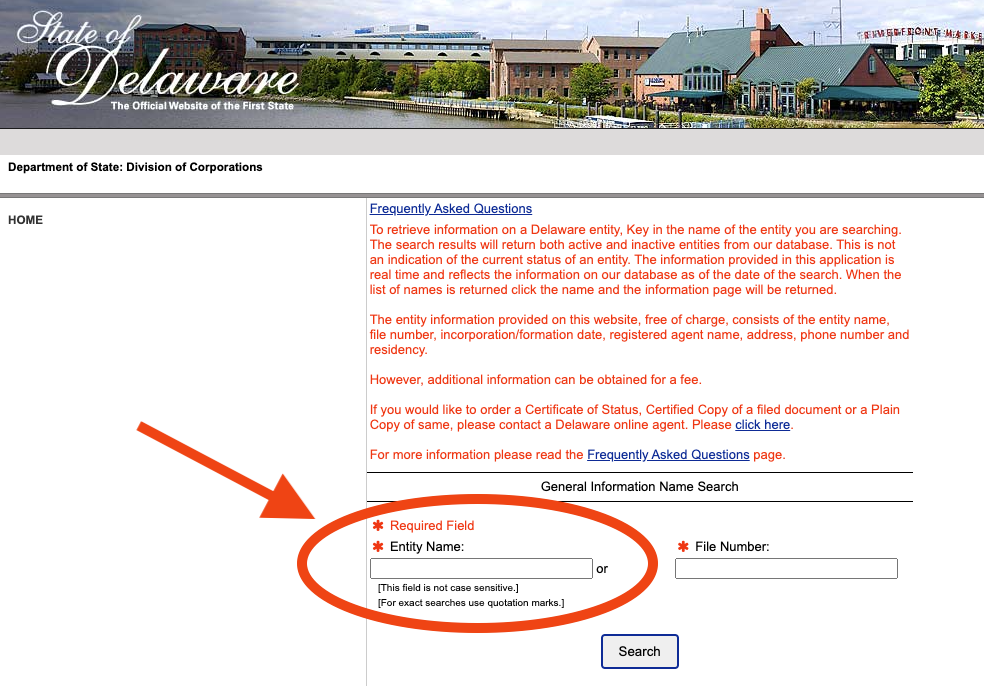

1. Find a Business Name

- Business Search: www.icis.corp.delaware.gov

Use the Delaware Department of State’s business search tool to check whether your desired business name is available. If the words “No Records Found” appear, it is available for use.

The name of your company must contain the words “limited liability company” or the abbreviation “L.L.C.” or “LLC.”[2]

2. Select a Registered Agent

Every corporation, including LLCs, in Delaware must appoint a registered agent to act as the official point of contact for legal matters. This may be an individual who resides in Delaware or a corporation.[3]

3. Register the LLC

There are two ways to apply for the registration of your LLC: online or by mail.

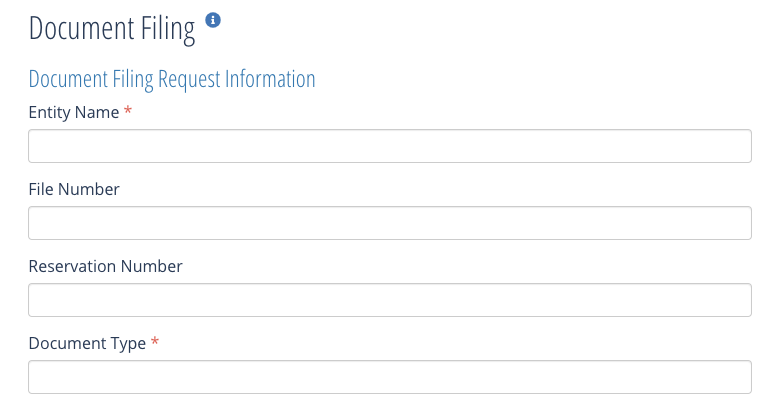

Option 1: File Online

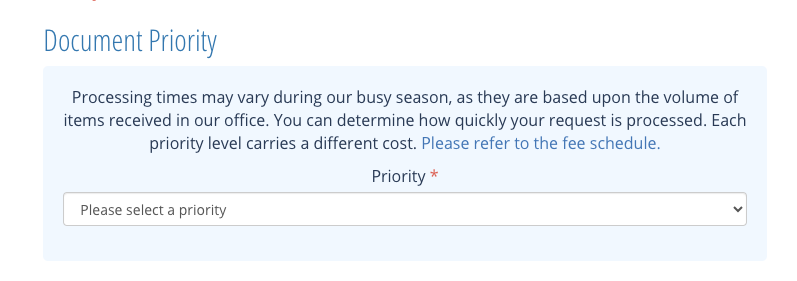

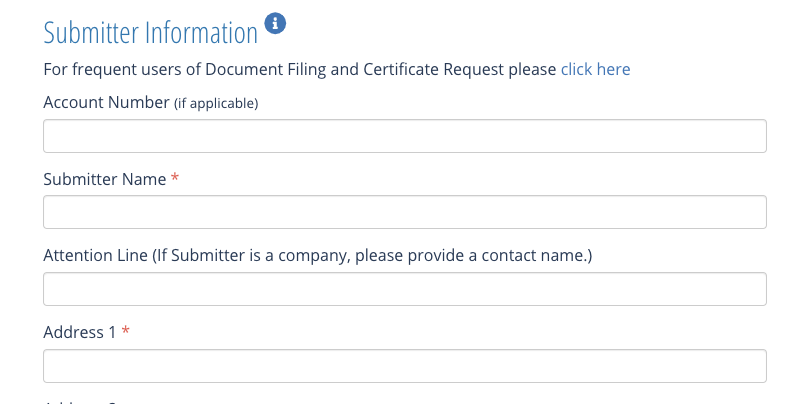

Go to www.icis.corp.delaware.gov to access the state’s e-Filing system.

As the submitter of the application, you must provide your name, address, email address, and phone number.

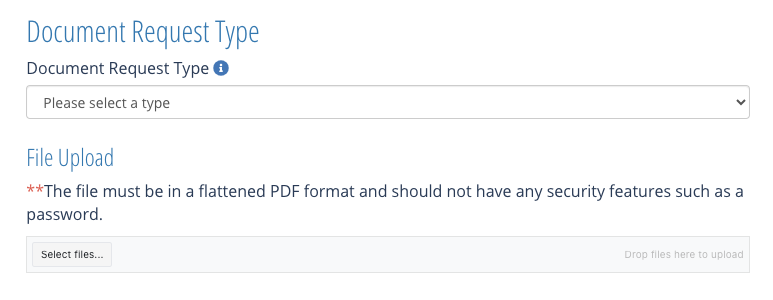

Under “Document Request Type,” select “Document Filing.” Fill out the PDF version of the Certificate of Formation and upload the completed document.

Enter your proposed LLC name under Entity Name. Write “Certificate of Formation” under Document Type. If you reserved a business name with the Department of State, enter your reservation number as well.

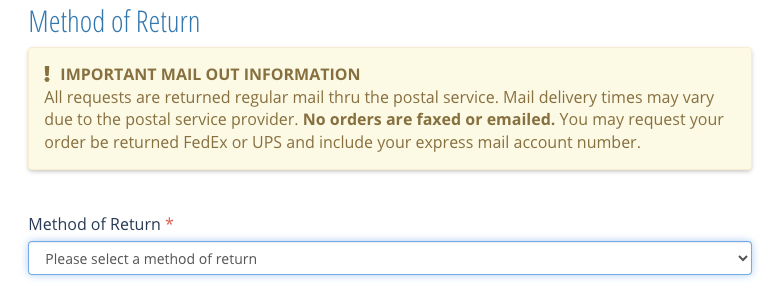

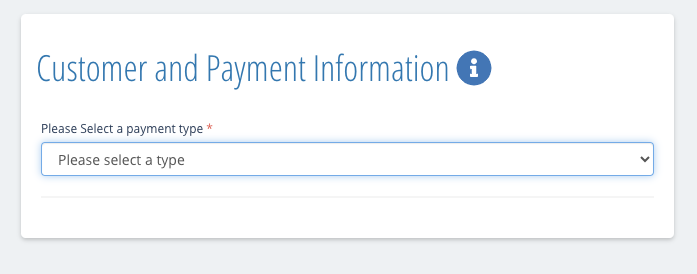

A valid payment method must be provided for the application to be submitted. Once it is processed, a filing fee of $110 (or $220 for foreign LLCs) will be charged on your provided payment account.

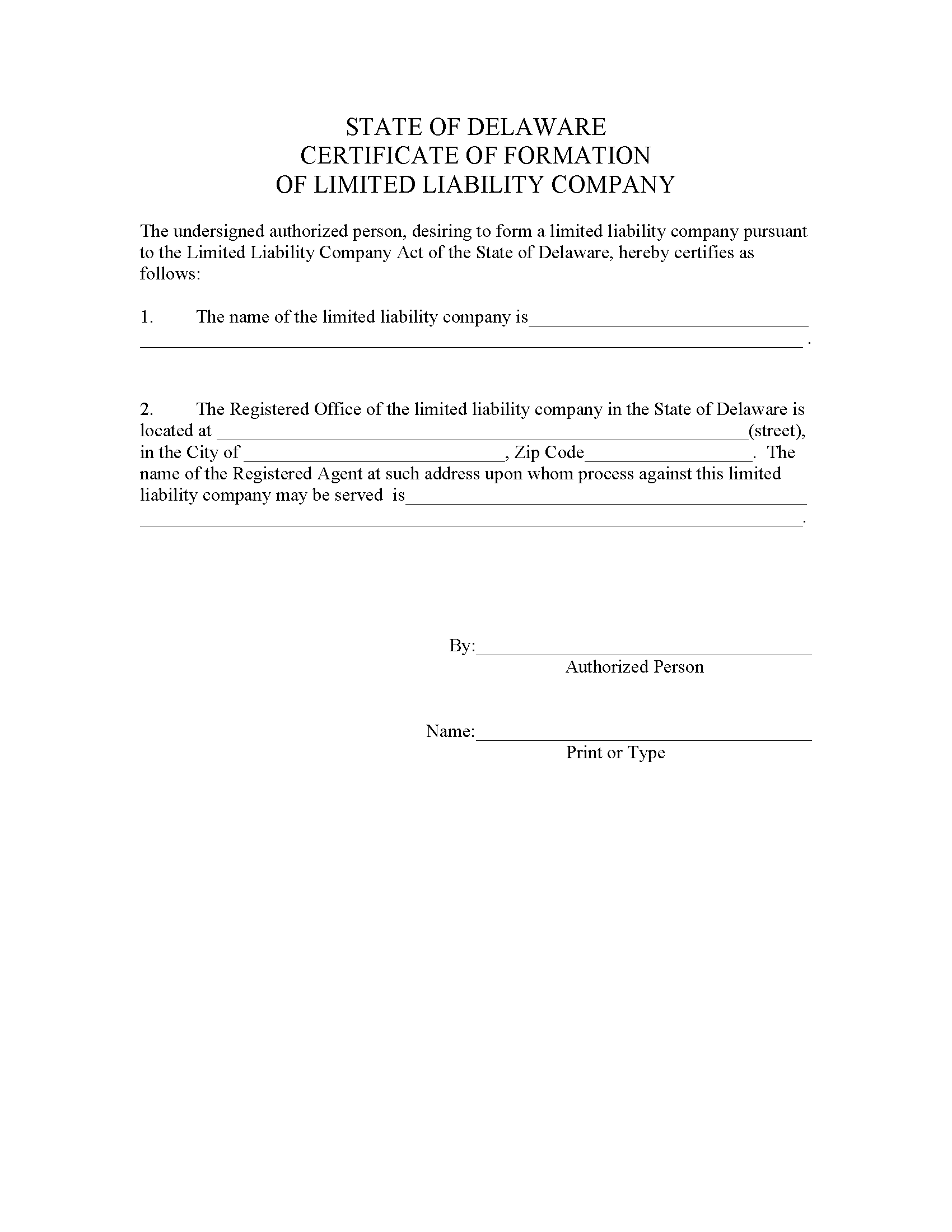

Option 2: File By Mail

Fill out one of the forms below and attach a completed Certification Memo. Mail the documents to the listed address with an enclosed payment.

Certificate of Formation of a Limited Liability Company – For in-state entities.

Filing fee: $110 check made payable to the “Delaware Secretary of State.”

Mailing address: Delaware Division of Corporations

401 Federal St., Suite 4, Dover, DE 19901

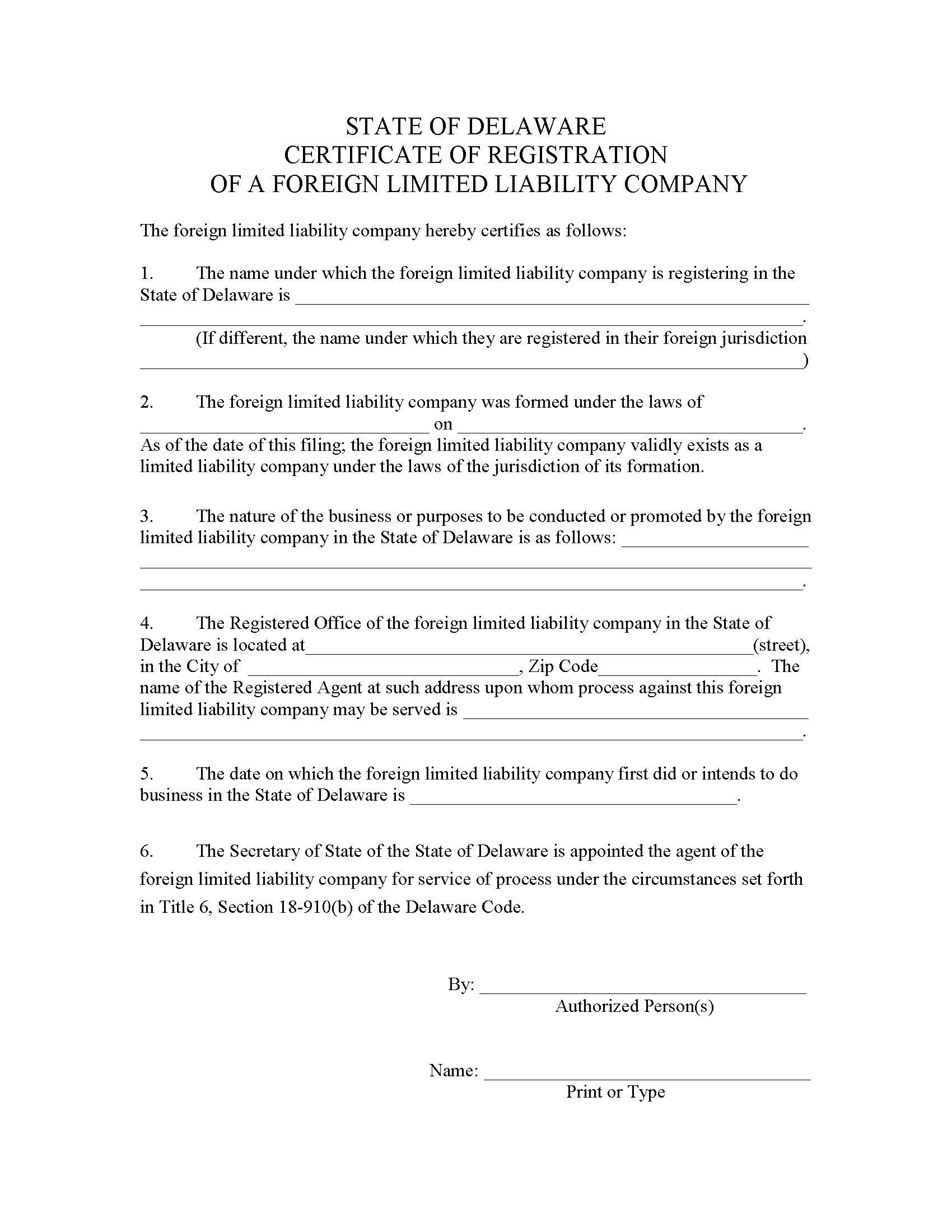

Application to Register a Foreign Limited Liability Company (LLC) – For out-of-state entities.

Application to Register a Foreign Limited Liability Company (LLC) – For out-of-state entities.

Filing fee: $220 check made payable to the “Delaware Secretary of State.”

Mailing address: Delaware Division of Corporations

401 Federal St., Suite 4, Dover, DE 19901

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

Apply for an Employer Identification Number (EIN) using one of the above methods. An EIN is a unique nine-digit number assigned to each business for tax and other purposes.

5. Write an Operating Agreement

An operating agreement is legally required for all LLCs in Delaware. It must be completed before, after, or when filing the Certificate of Formation.

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification

Below are the most common types of LLC tax classification:

- LLC – By default, an LLC is either a sole proprietorship (one member) or a partnership (two or more members). Each owner or partner must individually pay income tax on the profits.

- S-Corporation – An S-corp sends all business profits and losses to the shareholders, who must pay income tax on the profits. To file as an S-corp, an LLC must file IRS Form 2553 within 75 days of formation.

- C-Corporation – A C-corp files taxes as a separate corporate entity. To file as a C-corp, an LLC must file IRS Form 8832 within 75 days of formation.