How to Apply

How to Form an LLC

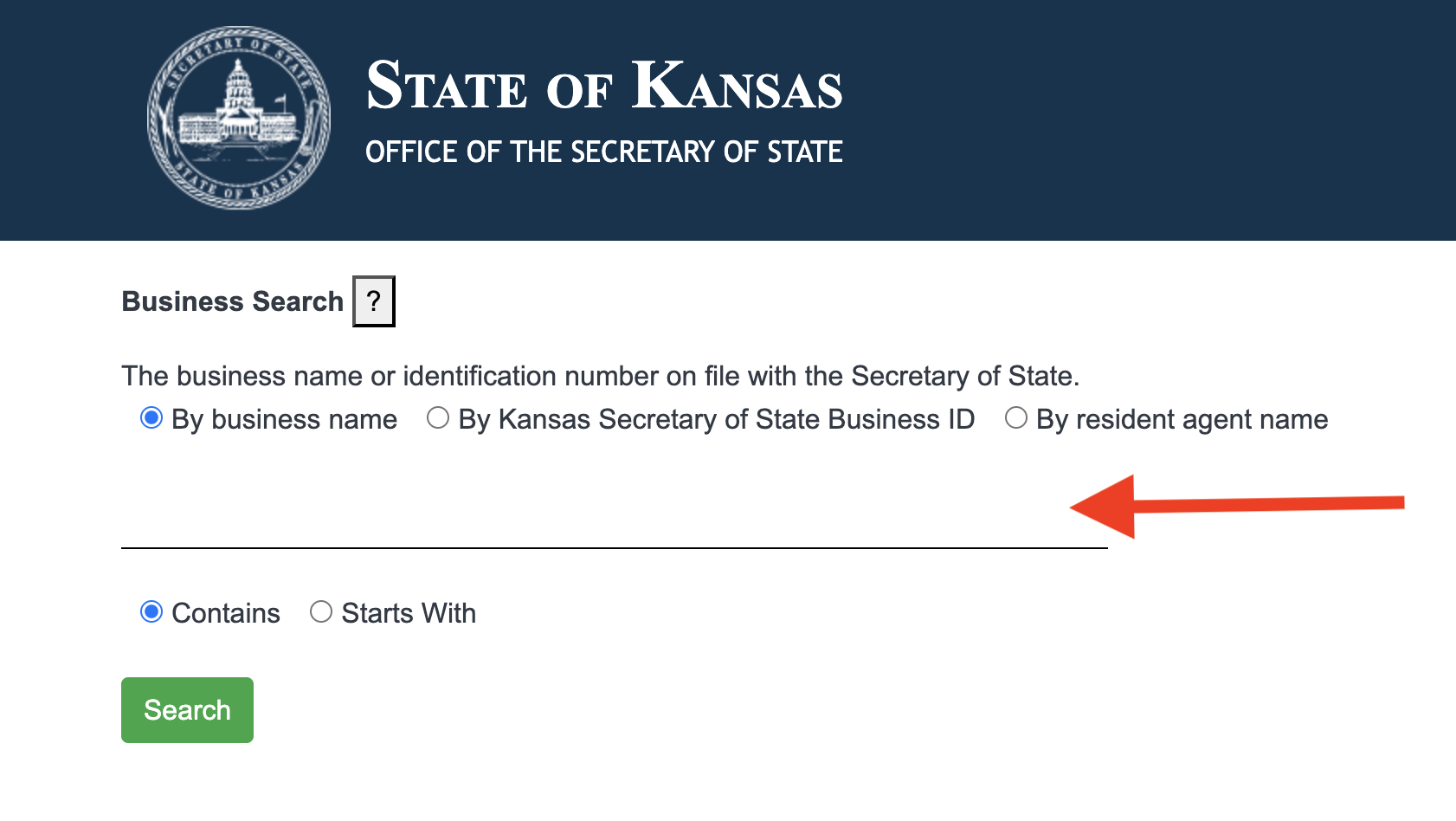

1. Find a Business Name

- Business Search: sos.ks.gov

To check whether your desired business name is available, use the Kansas Secretary of State’s business search tool. Type in your desired LLC name, and if it is available, the words “No Business Found” will appear.

The name of your business must contain one of the following phrases or abbreviations: “limited liability company,” “limited company,” “L.L.C.,” “L.C.,” “LLC,” or “LC.”[1]

2. Designate a Resident Agent

Every business entity in Kansas, including domestic and foreign LLCs, must appoint and maintain a resident agent in the state. For domestic LLCs, the resident agent must have a registered business office in Kansas. For foreign LLCs, the resident agent must be authorized to transact business in the state.[2]

3. Register the LLC

There are two ways to apply for the registration of your LLC: online or by mail.

Option 1: File Online

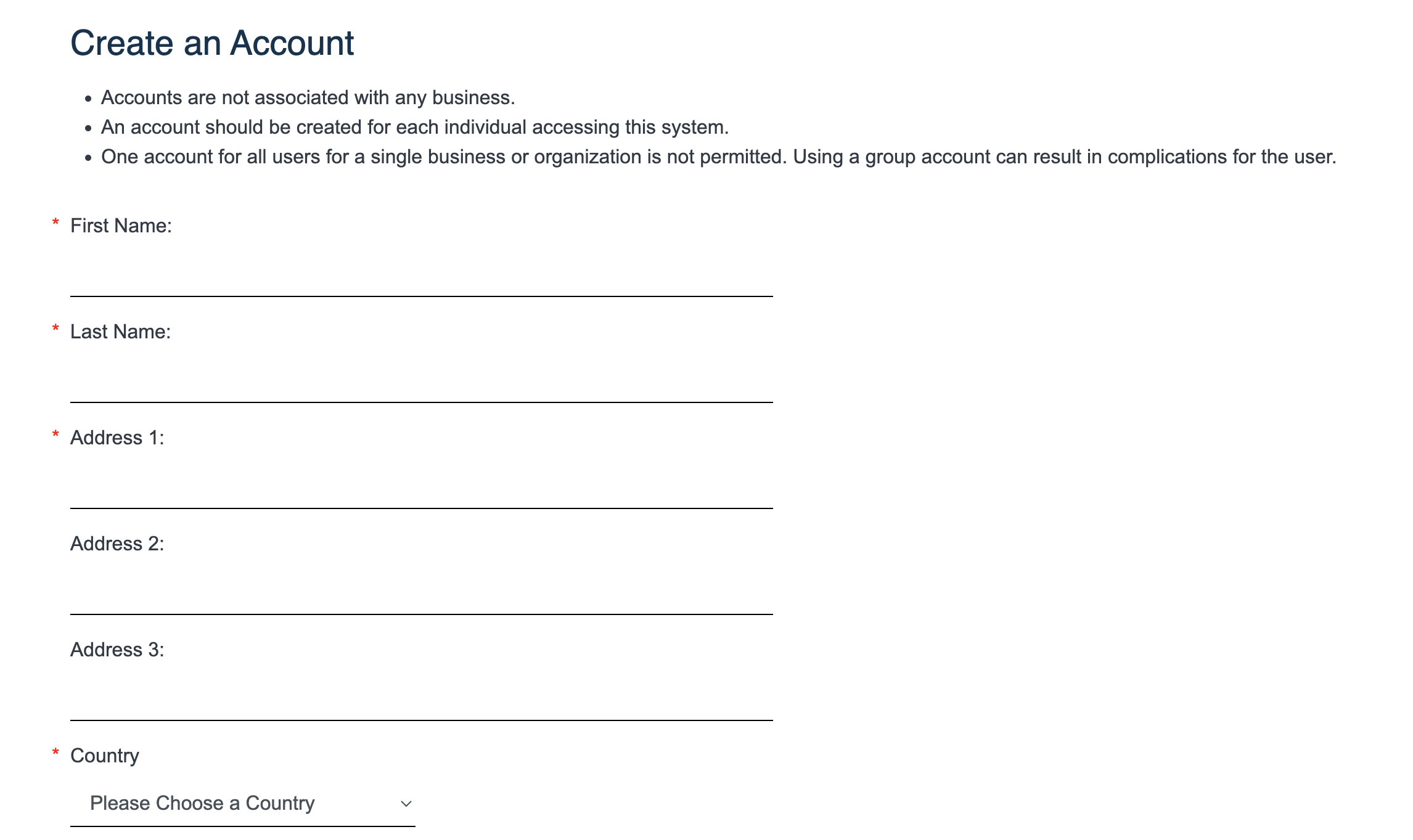

Go to sos.ks.gov to access the state’s online filing system.

Enter your name, mailing address, email address, and password. After signing up, you will receive a verification email that allows you to activate your account.

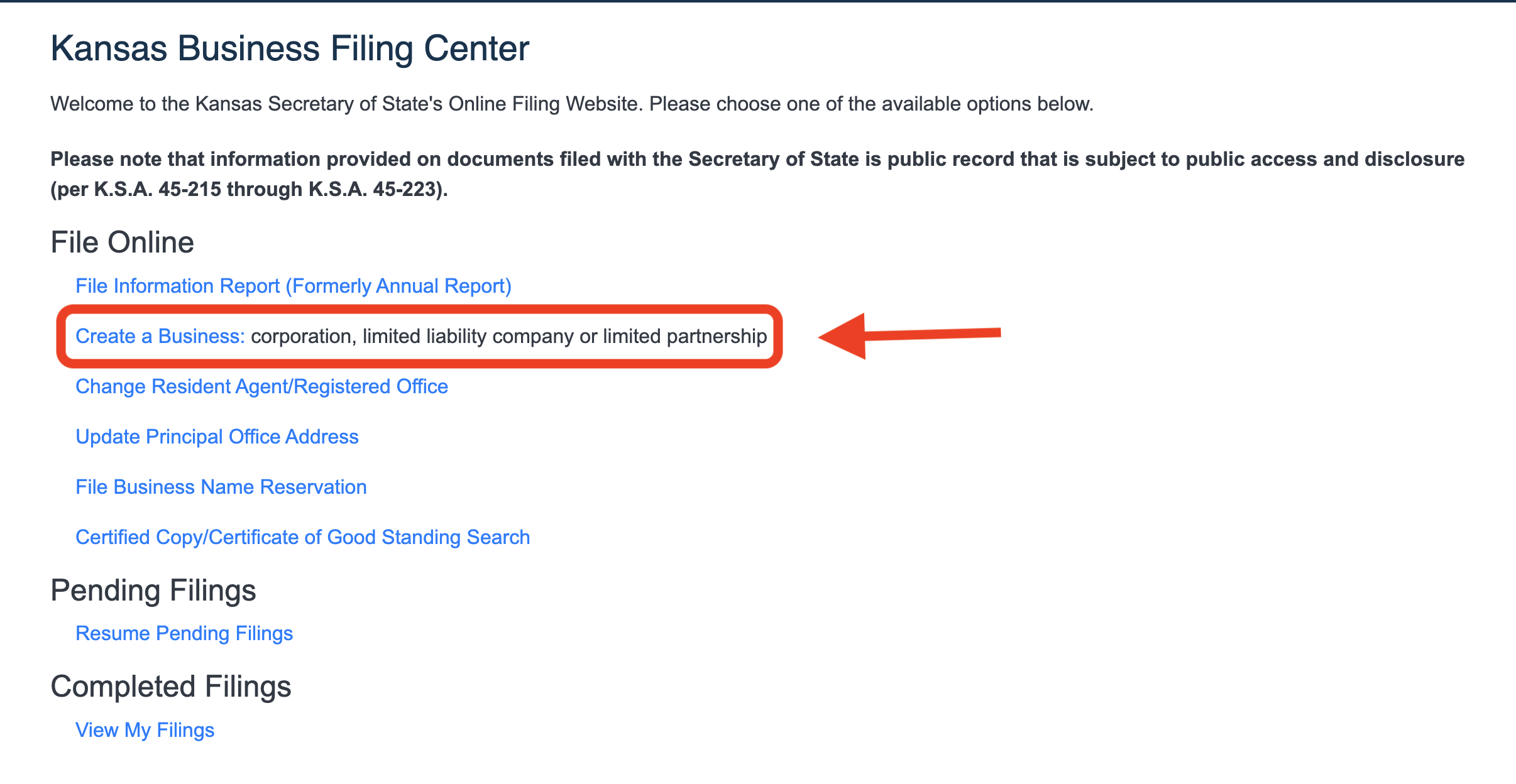

Once you are logged into your new account, you will have access to the Kansas Business Filing Center. Select the second link to form your LLC.

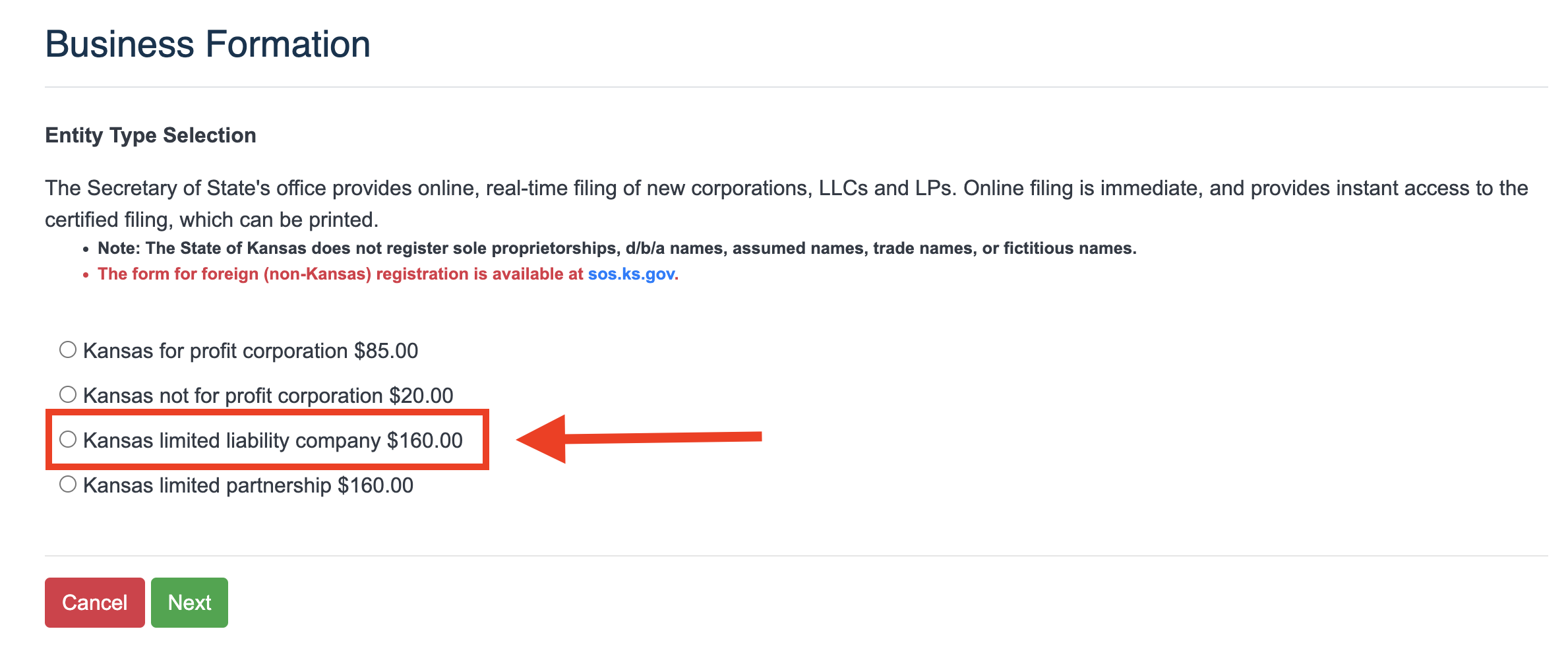

Choose “Kansas limited liability company” and click Next.

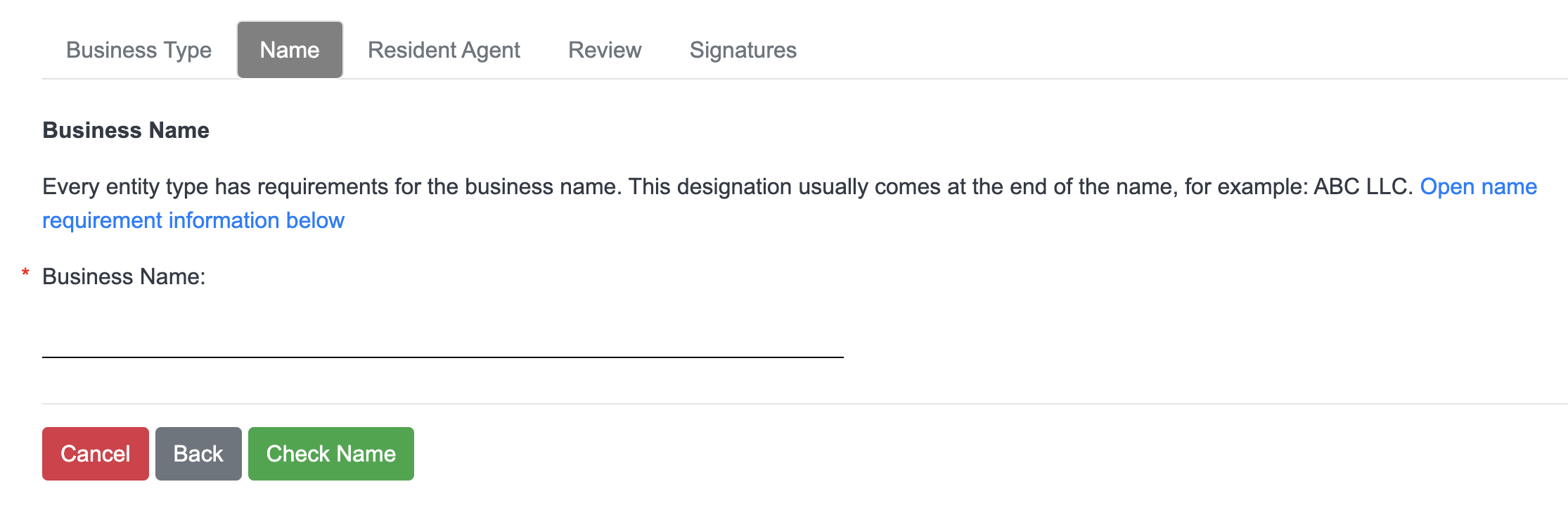

Be sure to include the required designation “LLC” in some variation.

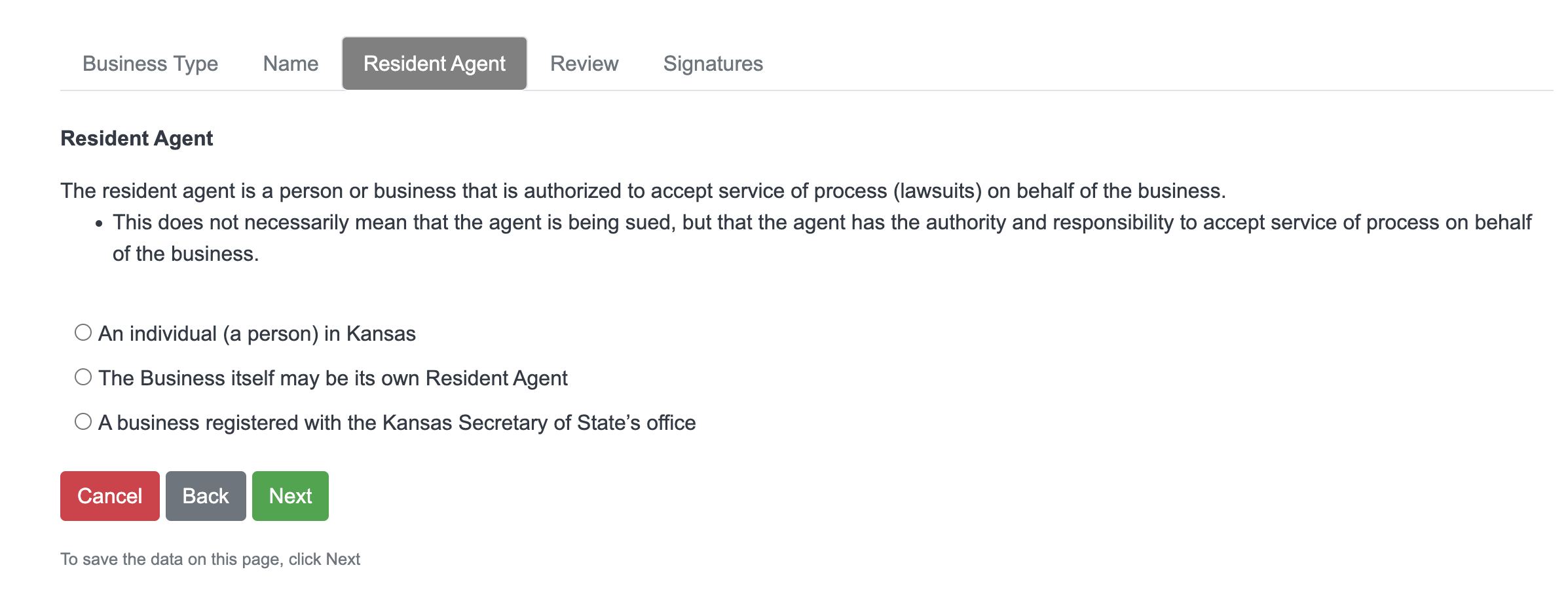

Indicate whether your resident agent is an individual or a business. You will then be prompted to enter the resident agent’s address, which must be in Kansas.

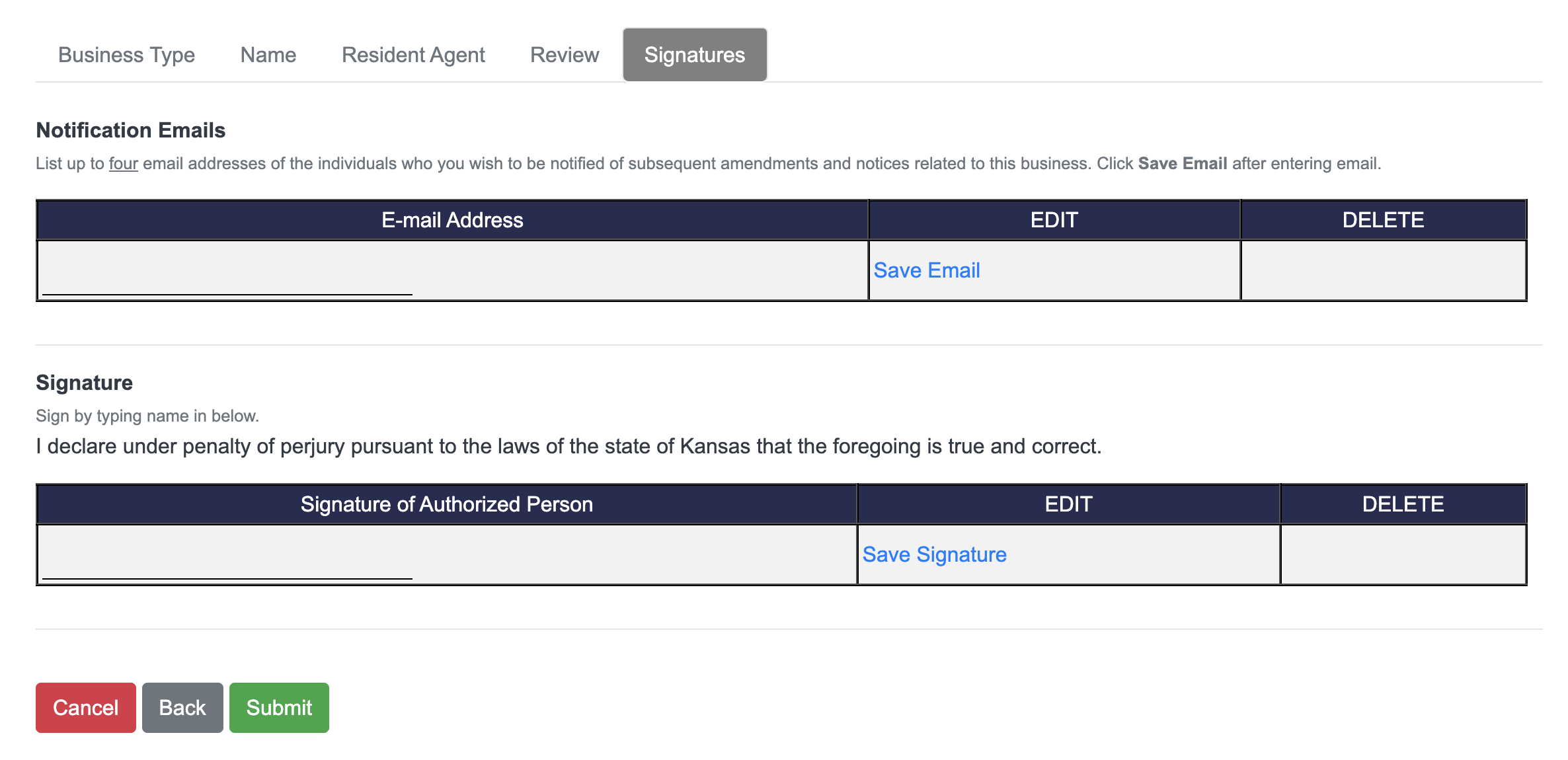

List any email addresses where you want to be notified of any amendments or notices related to the business. Provide your electronic signature by typing your name.

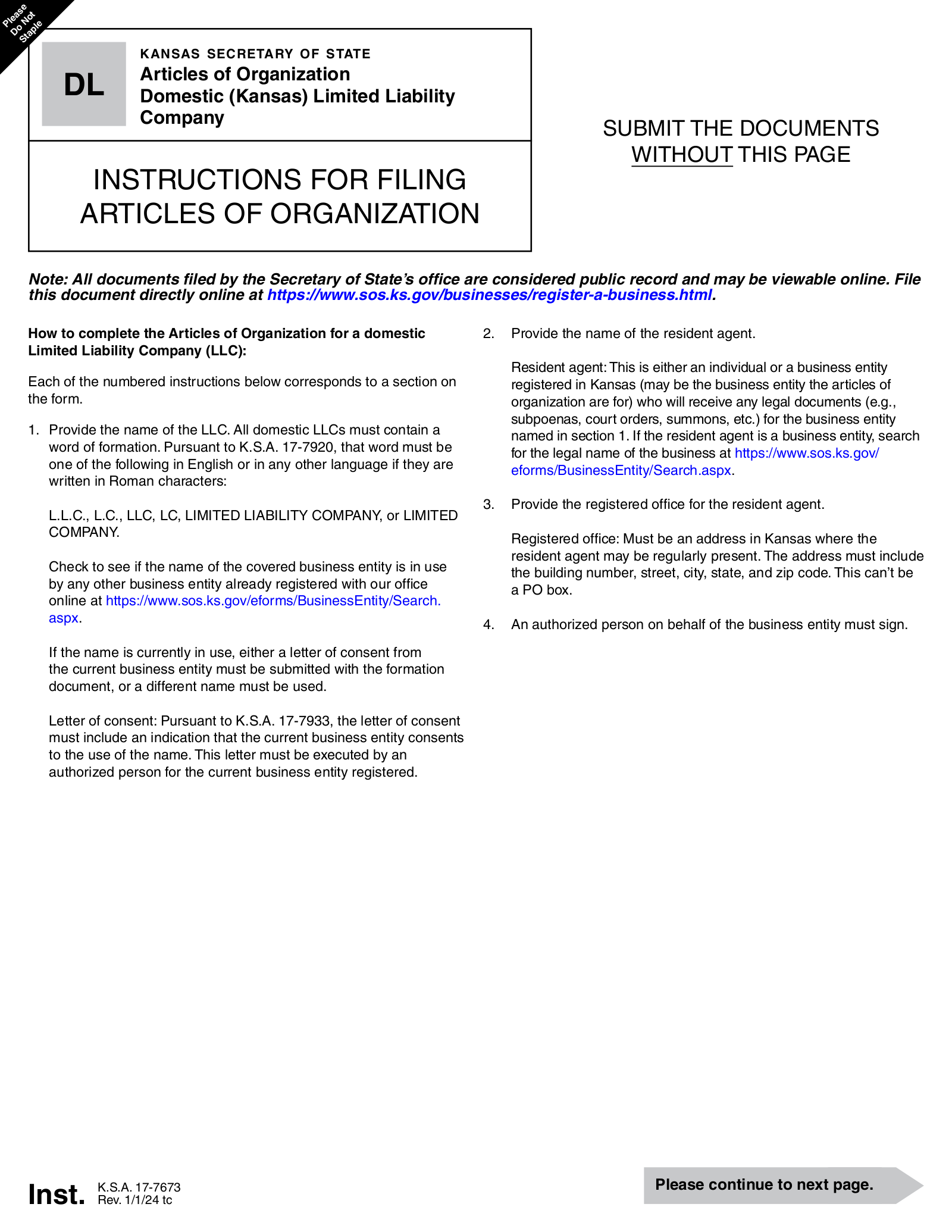

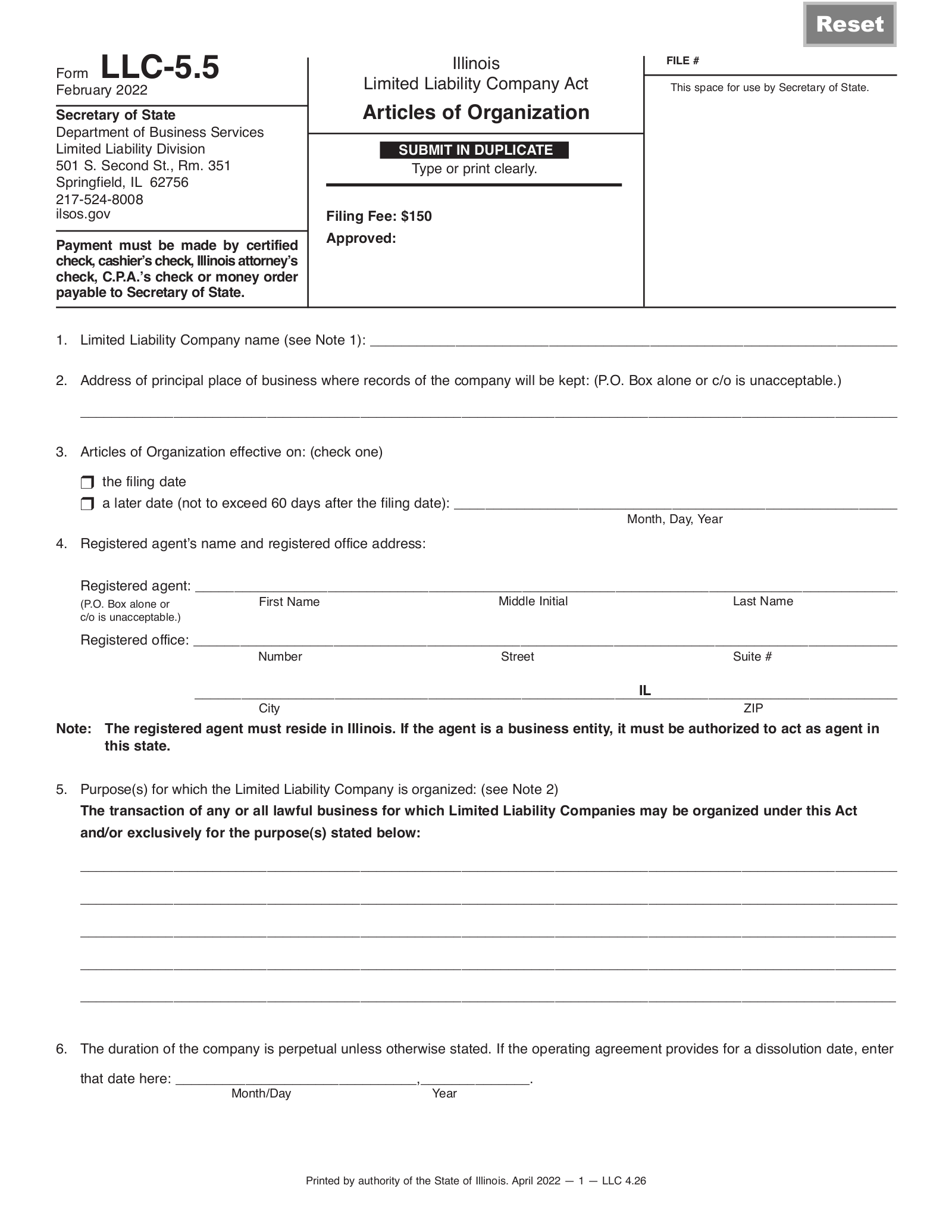

Option 2: File By Mail

Complete the appropriate form and mail it to the provided address with an enclosed payment.

Domestic LLC Article of Organization – For in-state entities.

Filing fee: $165 certified or cashier’s check made payable to the Kansas Secretary of State

Mailing address: Kansas Secretary of State Memorial Hall, 1st Floor

120 SW 10th Avenue Topeka KS 66612

Application for Foreign Registration – For out-of-state entities.

Filing fee: $165 certified or cashier’s check made payable to the Kansas Secretary of State

Mailing address: Kansas Secretary of State Memorial Hall, 1st Floor

120 SW 10th Avenue Topeka KS 66612

4. Obtain an EIN

- Apply Online: www.irs.gov

- Apply by Fax/Mail: Form SS-4

To operate as an LLC, you must apply for an Employer Identification Number (EIN) for tax identification purposes.

5. Write an Operating Agreement

The state of Kansas does not require LLCs to adopt an operating agreement. However, it can still be useful to create one.

Download: PDF, MS Word, OpenDocument

6. Choose a Tax Classification

Below are the most common types of LLC tax classification:

- LLC – By default, an LLC is either a sole proprietorship (one member) or a partnership (two or more members). This type is considered a “pass-through entity,” wherein the members/owners must pay income tax on the profits.

- S-Corporation – An S-corp is another “pass-through entity,” wherein all business profits and losses are sent to the shareholders, who must pay income tax on the profits. To file as an S-corp, an LLC must file IRS Form 2553 within 75 days of formation.

- C-Corporation – A C-corp allows taxes to be filed as a separate corporate entity. To file as a C-corp, an LLC must file IRS Form 8832 within 75 days of formation.

7. File Information Report

An Information Report must be submitted every two years by any business on file with the Kansas Secretary of State.[3]