What does it cover?

- Division of assets and debt;

- Alimony;

- Child custody; and

- Child support.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

What is a Marital Settlement Agreement?

A marital settlement agreement, or “MSA“, outlines the basic terms for a divorce between a married couple. If there is no prenuptial agreement, the partner with the higher income will be required to provide monetary assistance to the other. This comes in the form of alimony and child support.

Approval from Judge – After the marital settlement agreement has been signed by both parties, it must still be approved by the judge.

How to Negotiate a Divorce (8 steps)

- Find an Attorney

- Meet and Strategize

- Contact the Other Spouse’s Legal Counsel

- Schedule a Meeting

- Begin Negotiating

- Sign the Marital Settlement Agreement

- Go to Court

- Get a Divorce Decree

2. Meet and Strategize

Meet with the attorney and figure out the best course of action. It’s best to gather their income tax returns for the last 2 years along with a financial disclosure of the couples’ assets and liabilities.

The attorney will use the current incomes of the spouses and child custody schedules to determine how much will be paid for alimony and child support.

5. Begin Negotiating

Everything is on the table including the division of assets, debts/liabilities, spousal support (alimony), custody, and child support. The negotiating process will often be at the same time as the court proceedings. During this time, the judge may weigh in on what is delaying the proceedings from going forth.

8. Get a Divorce Decree

Once the marital settlement agreement has been filed the couples may apply for a divorce decree (or ‘divorce judgment’). The decree is often sent in the mail to both parties within 30 days of the final court hearing.

After the divorce decree is sent, the spouses may use for name change purposes or to file with any other government agency.

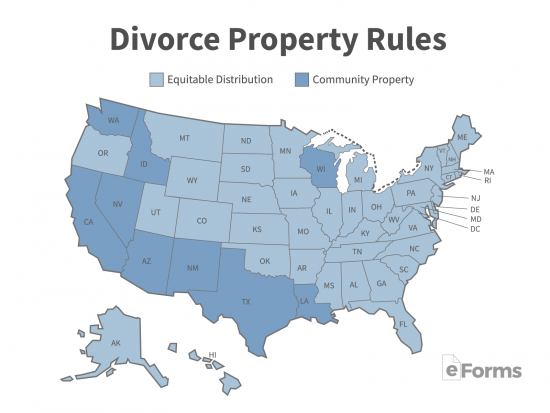

How is Property Divided?

There are two (2) ways to calculate how property is divided in the USA:

1.) Equitable Distribution Law

Equitable distribution law is the “fair” separation of assets (not equal). The court takes into a multitude of factors such as:

- How long the marriage lasted;

- Financial contributions during the marriage (who paid for what);

- Employability of each spouse; and

- Assets and debts of each spouse (or combined).

Forty-one (41) States have enacted equitable distribution laws: Alabama, Alaska, Arkansas, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Vermont, Virginia, West Virginia, and Wyoming.

Laws – Uniform Marriage & Divorce Act § 307, Barr v. Commissioner, 10 T.C. 1288 (1948), IRM 25.18.1.3.5 (Annulment)

2.) Community Property Law

Community Property law means that from the start of the marriage, all assets acquired and money earned by any of the spouses, is the property of the marriage. This also includes debt and does not matter if each spouse has their own separate credit cards or bank accounts.

Nine (9) States have enacted community property laws: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Laws – IRM 25.18.1.2.2 ( Community Property Law)

What is Alimony?

Alimony is a payment made from a spouse with a higher-income to the other spouse for a period after the marriage has ended. The amount is decided amongst the parties in the marital settlement agreement and further approved by the presiding judge.

How is Alimony Calculated?

Alimony is calculated by using the couples:

- Income of Husband;

- Income of Wife;

- Number of Dependants; and

- Length of Marriage (years)

Alimony Calculators

- Alimony Calculator #1 – Calculators.law

- Alimony Calculator #2 – MaritalLaws.com

What is Child Support?

Child support is the payment by a non-custodial parent to a custodial parent for the support and care of their children. The payments made are not tax-deductible. Support is decided either in the marital settlement agreement or by the presiding judge. The support may also include health and dental insurance, education, and additional support for other liabilities.

How is Child Support Calculated?

Child support is calculated in accordance with each State’s Child Support Guidelines by:

- Number of Children under 18 years of age;

- Income of Non-Custodial Parent;

- Income of Custodial Parent;

- Health Insurance costs

- Daycare costs; and

- Percent (%) time each parent has the Children.

Child Support Calculators

- Calculator #1 – www.AllLaw.com

- Calculator #2 – SupportPay.com

Punishment for Non-Payment

In a 2018 report, approximately 66% of all child support payments were collected. The punishment for non-payment is up to State law and commonly involves the following:

- Income withholding;

- Driver’s license suspension;

- Interest on the amount owed;

- Passport denial; and

- Jail time.

Under 18 U.S. Code § 228, if a parent who lives in another State does not pay support for a period of at least 1 year and at least $5,000 is owed, the parent may be subject to fines and up to 6 months of jail time.

If a parent commits the same offense again, they may be subject to 2 years in jail.

Why Fathers Don’t Pay

In a 1997 survey, fathers claimed they did not pay support for the following reasons:

- No money to pay: 38%

- Not visitation rights: 23%

- No control of spending: 14%

- Did not want the child: 13%

- Not the father: 12%

Child Support Guidelines (50-States)

Tax Benefits from Children

Under the Tax Cuts and Jobs Act, a custodial parent is the default beneficiary of the minor children being dependents for tax purposes. This means that a parent can save up to $2,000 per child (and $1,400 is refundable even if the parent doesn’t pay federal income tax). Only 1 parent may use the children for tax savings.

- Non-Custodial Parents – If a non-custodial parent will be the one getting the children’s tax benefits, IRS Form 8332 must be attached to the non-custodial parent’s IRS Form 1040 when filing.

Custodial vs Non-Custodial

A custodial parent is a parent that will have the children for the majority of the time after the divorce. Due to this arrangement, the non-custodial parent will most likely be obligated to pay support while having only part-time custody or visitation rights of the children.

Frequently Asked Questions (FAQs)

- Can a Marital Settlement Agreement be Changed?

- Can a Judge make a change to a Marital Settlement Agreement?

- When does a Marital Settlement Agreement need to be signed?

- How to enforce a Marital Settlement Agreement?

- How to sign a Marital Settlement Agreement?

- Does a Marital Settlement Agreement remain confidential?

Can a Marital Settlement Agreement be changed?

Yes and no. It can only be changed with the consent of both parties or there is a “substantial change of circumstance”. Such a change would have to be a job loss or if the other spouse has increased their income. Any change in the agreement would have to be approved by a court unless agreed to mutually.

Can a Judge make a change to a Marital Settlement Agreement?

Yes. In most States, the presiding Judge will look over the agreement to ensure it’s fair to both parties. If not, the Judge can request changes to be made.

If it’s after the divorce has been finalized, either spouse may request a change to the agreement which can be changed. Although, it is very difficult unless there is a substantial change in either of the spouses’ employment status.

When does a Marital Settlement Agreement need to be signed?

Before submitting the final judgment and is commonly attached to it. This is usually the last court hearing or the hearing before the divorce decree is issued.

How to enforce a Marital Settlement Agreement?

- Alimony – Requires filing a contempt case that will most likely garnish the wages of the non-paying spouse. If there are assets or property of the non-paying spouse, the court can place liens in the amount owed.

- Child Support – The spouse will need to make a complaint with the child support enforcement agency in the State. This does not usually require an attorney to file.

How to sign a Marital Settlement Agreement?

A marital settlement agreement is highly recommended to be notarized. A notary acknowledgment required the identity of both spouses and proves the spouses entered into the agreement without being forced to sign.

Does a Marital Settlement Agreement remain confidential?

It depends, each State handles the confidentiality of divorce differently. In California for example, the spouses can agree to hire a private Judge, private mediator, or file a memorandum (if the court offers).

Sample

Related Forms

Download: PDF, MS Word, Open Document

Download: PDF, MS Word, Open Document