Updated February 19, 2024

Or use ContractsCounsel to hire an attorney!

A prenuptial agreement is a contract made between a couple, prior to marriage, that covers the division of assets and spousal support (alimony). It becomes effective upon the divorce or legal separation of the couple.

Financial Disclosure

It is required that both spouses disclose all their assets, income, and debts prior to signing an agreement (unless the couple authorizes a waiver). If not disclosed, a prenuptial agreement can be deemed invalid by a local court.

Custody and Child Support

It is prohibited to include child support, custody arrangements, or visitation rights of children in a prenuptial agreement. The local court administers custody arrangements.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, D.C.

- West Virginia

- Wisconsin

- Wyoming

Table of Contents |

What is a Prenuptial Agreement?

A prenuptial agreement, or simply a “prenup,” allows a couple to outline the distribution of property in the event of a divorce. Full disclosure of financial assets is required to be made in the prenuptial agreement.

Uniform Premarital Agreement Act (UPAA)

The Uniform Premarital Agreement Act (UPAA) are uniform laws that have been adopted by 27 states (and the District of Columbia) to create common rules to be followed.

The following 27 states have adopted the UPAA: Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kanas, Maine, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Oregon, Rhode Island, South Dakota, Texas, Utah, Virginia, and Wisconsin.

Although the other 23 states have not enacted the UPAA, prenuptial agreements are legal and enforceable.

Is it Ironclad?

Any prenuptial agreement may be considered invalid for primarily three reasons:

- Not Disclosing All Financials – This does not mean a hidden bank account with $500. There have to be assets of a significant amount not declared by one of the parties.

- Coercion – If one of the parties was “pressured” into signing the agreement. Also known as “duress,” this would require proof such as written communication.

- Signing Requirements – Each state has its own signing requirements, and if the agreement was not authorized under the state’s statutes, it would not be considered valid.

It’s highly recommended for each spouse to have their own attorney. After the prenuptial agreement has been agreed upon, give at least one week before signing for each party to think about their decision. The spouses and their attorneys should sign the prenuptial agreement in accordance with state signing requirements.

Pros & Cons of a Prenup

| Pros | Cons | |

| Assets | Each party has full ownership rights (as stated in the prenup) after the marriage has ended. | Any help provided to the other spouse’s benefit is not accounted for. |

| Debts | Each party is responsible for the debts they incurred prior to marriage. | One spouse’s lifestyle may differ not allowing the other to pay off the other’s debts. |

| Emotions | All parties fully understand the arrangement they are entering into. | It can create a lack of trust between the parties. |

| Inheritance | It can protect the inheritance of family assets. | If death by the spouse, it can allow other family members to obtain the spouse’s property. |

| Spousal Support | If both parties want children, it allows one of the spouses to be compensated for their time, especially if a stay-at-home parent. | If no spousal support, a stay-at-home parent can be giving up a promising career path without compensation. |

What Should be Included in the Agreement?

Here are the clauses every prenuptial agreement should include:

- Disclosure of liabilities and assets – A prenuptial agreement must list the property and debts owned by each party.

- Prior to the marriage – If property accrued prior to the marriage should be kept separate, the prenup should say so.

- Accrued during the marriage – The prenuptial agreement should outline whether earnings accrued by either spouse or both spouses will belong to the individual who earned them or to the couple jointly.

- Property distribution – The agreement should specify what happens to the marital home, if there is one, and to other jointly held forms of property in the event that the marriage dissolves.

- Health insurance – In some couplings, one spouse’s health insurance covers both parties. The prenup should outline what happens to this arrangement in the event of divorce.

- Alimony – Otherwise known as spousal support, this is a regular payment from one party, typically the more financially stable party, to the other after the marriage dissolves. The prenuptial agreement should specify whether or not arrangements for alimony will be made in the event of divorce.

- Severability – A prenup can include a severability clause, which states that if one of the clauses in the prenup is found invalid, it does not void the entire contract.

- Signatures – Every prenup should be signed in accordance with the signing requirements of the state in which it’s being signed. It’s a good idea for each party to attest, in writing, that they sought independent legal advice prior to signing.

- Children – The prenup should include whether there are children from prior marriages.

- Legal counsel – The document should acknowledge that both parties have sought and received independent legal counsel.

- Duress – The form should specify that the negotiations have been conducted without duress.

How to Make a Prenuptial Agreement (6 steps)

- Discuss Each Other’s Intentions

- Determine Affordability

- Seek Legal Counsel

- Make a List of Financial Assets

- Negotiate and Agree to Terms

- Sign the Agreement (Requirements)

1. Discuss Each Other’s Intentions

The hardest step in creating a prenup is broaching the subject. In some cases, this can cause emotional fallout and lead to a lack of trust. This subject is best handled at the earliest stage possible. Attempting to have a spouse sign a prenuptial agreement days or even weeks before a wedding could be considered coercion by a court.

The hardest step in creating a prenup is broaching the subject. In some cases, this can cause emotional fallout and lead to a lack of trust. This subject is best handled at the earliest stage possible. Attempting to have a spouse sign a prenuptial agreement days or even weeks before a wedding could be considered coercion by a court.2. Determine Investment and Affordability

Prenups can range widely in cost. According to Business Insider, the average prenuptial agreement can cost $2,500. Some firms range from $2,000 to $6,000 per couple. However, it will also depend upon where the couple lives, in which state they reside, and the complexity of assets and property.

- Prenup with legal counsel – $1,000-$10,000

- HelloPrenup – $599

- eForms – $45*

*Prenuptial agreements can be created between the couple online and taken to an attorney for review, potentially saving the couple thousands of dollars.

4. Make a List of Financial Assets

After finding legal counsel, it’s time to make a full list of all financials owned by each spouse. It is a requirement for each spouse to disclose all cash, assets, debt, real estate, retirement accounts, potential funds from litigation, and any other financial information in order for a prenup to be valid.

After finding legal counsel, it’s time to make a full list of all financials owned by each spouse. It is a requirement for each spouse to disclose all cash, assets, debt, real estate, retirement accounts, potential funds from litigation, and any other financial information in order for a prenup to be valid.

The couple does not have to disclose their financials if both spouses sign a Waiver of Financial Disclosure Affidavit.

5. Negotiate and Agree to Terms

Every relationship is different, and the negotiation process varies between spouses. It’s recommended that the following topics are discussed and agreed to in full:

Every relationship is different, and the negotiation process varies between spouses. It’s recommended that the following topics are discussed and agreed to in full:

- Money and assets prior to the marriage

- Debts and liabilities prior to the marriage

- Estate planning

- Inheritance proceeds

- Adultery, cheating, “penalties”

- Alimony

Helpful Tip: The main purpose of an attorney is to give advice that is separate from the emotional part of the marriage.

6. Sign the Agreement

The couple must sign a prenup in accordance with state laws (see below). It is highly recommended that the execution of the document is completed at least 30 days before the wedding or civil union date. Both parties should receive signed original copies. If there are no laws in a specific state, it’s recommended that the prenuptial agreement is signed by both spouses in the presence of a notary public.

The couple must sign a prenup in accordance with state laws (see below). It is highly recommended that the execution of the document is completed at least 30 days before the wedding or civil union date. Both parties should receive signed original copies. If there are no laws in a specific state, it’s recommended that the prenuptial agreement is signed by both spouses in the presence of a notary public.

| State | Signing Requirements | Statutes |

| Alabama | Both spouses only. | Barnhill v. Barnhill, 386 So. 2d 749 (Ala. Civ. App. 1980) |

| Alaska | Both spouses only. | Brooks v. Brooks, 733 P.2d 1044, 1048-51 (Alaska 1987) |

| Arizona | Both spouses only. | § 25-202 |

| Arkansas | Prenuptial Agreement Acknowledgment must be attached (PDF, MS Word, OpenDocument) | § 9-11-402 |

| California | Both spouses only. | CA Fam Code § 1611 |

| Colorado | Both spouses only. | § 14-2-306 |

| Connecticut | Both spouses only. | Sec. 46b-36c |

| Delaware | Both spouses only. | § 322 Formalities |

| District of Columbia (D.C.) | Both spouses only. | |

| Florida | Both spouses only. | § 61.079 (3) |

| Georgia | A notary public and one (1) witness. | § 19-3-62 |

| Hawaii | Both spouses only. | § 572D-2 Formalities |

| Idaho | Both Spouses only. | § 32-922 – Formalities |

| Illinois | Both spouses only. | 750 ILCS 10/3 |

| Indiana | Both spouses only. | IC 31-11-3-4 |

| Iowa | Both spouses only. | § 596.4 Formalities |

| Kansas | Both spouses only. | § 23-2403 |

| Kentucky | Both spouses only. | KRS 371.010 |

| Louisiana | Both signatures must be notarized. | CC 2331 |

| Maine | Both spouses only. | § 603 |

| Maryland | Both spouses only. | Stewart v. Stewart. No. 0249, 2011) |

| Massachusetts | It must be recorded in the Registry of Deeds where the husband resides. | Part II, Title III, Chapter 209, Section 26 |

| Michigan | Both spouses only. | § 566.132, Sec. 2(1)(c) |

| Minnesota | Two (2) witnesses and a notary public. | § 519.11, Subdivision 2 |

| Mississippi | Both spouses only. | Mabus v. Mabus, 890 So.2d 806 (Miss. 2003) |

| Missouri | Both signatures must be notarized. | § 451.220 |

| Montana | Both spouses only. | § 40-2-604 |

| Nebraska | Both spouses only. | § 42-1003 |

| Nevada | Both spouses only. | NRS 123A.040 |

| New Hampshire | Both spouses only. | § 460:2-a |

| New Jersey | Both spouses only. | § 37:2-33 |

| New Mexico | Both signatures must be notarized. | § 40-3A-3 |

| New York | Both signatures must be notarized. | DRL 236B(3) |

| North Carolina | Both spouses only. | § 52B-3 |

| North Dakota | Both spouses only. | § 14-03.2-05 |

| Ohio | Both spouses only. | § 1335.05 |

| Oklahoma | Both spouses only. | § 43-121(B) |

| Oregon | Both spouses only. | § 108.705 |

| Pennsylvania | Both spouses only. | § 3106 |

| Rhode Island | Both spouses only. | § 15-17-2 |

| South Carolina | Both spouses only. | Holler v. Holler, 364 S.C. 256 (2005) |

| South Dakota | Both spouses only. | § 25-2-17 |

| Tennessee | Both spouses only. | § 36-3-501 |

| Texas | Both spouses only. | § 4.002 |

| Utah | Both spouses only. | § 30-8-3 |

| Vermont | Both spouses only. | Bassler v. Bassler, 156 Vt. 353 (1991) |

| Virginia | Both spouses only. | § 20-149 |

| Washington | Both spouses only. | Marriage of Matson, 107 Wn. 2d 479 (1986) |

| West Virginia | Both spouses only. | § 48-1-203 |

| Wisconsin | Both spouses only. | In re Marriage of Button v. Button, 131 Wis. 2d 84 (1986) |

| Wyoming | Both spouses only. | LUND v. LUND, 849 P.2d 731 (1993) |

How to Revoke

Nullifying a prenuptial agreement requires the consent of both parties. It can be revoked on a one-page agreement, notarization recommended, with the following language:

Revocation of Prenuptial Agreement

I, [Spouse’s Name] and [Spouse’s Name], hereby revoke, void, and nullify the prenuptial agreement signed on the ____ day of _________________, 20____. We, the spouses, both have agreed to execute this revocation through our own free will and not under any unlawful duress or coercion by any outside parties.

Spouse Signature ____________________ Date ___________

Print Name ____________________

Spouse Signature ____________________ Date ___________

Print Name ____________________

Sample

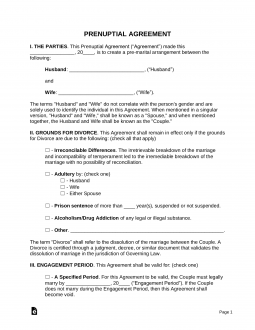

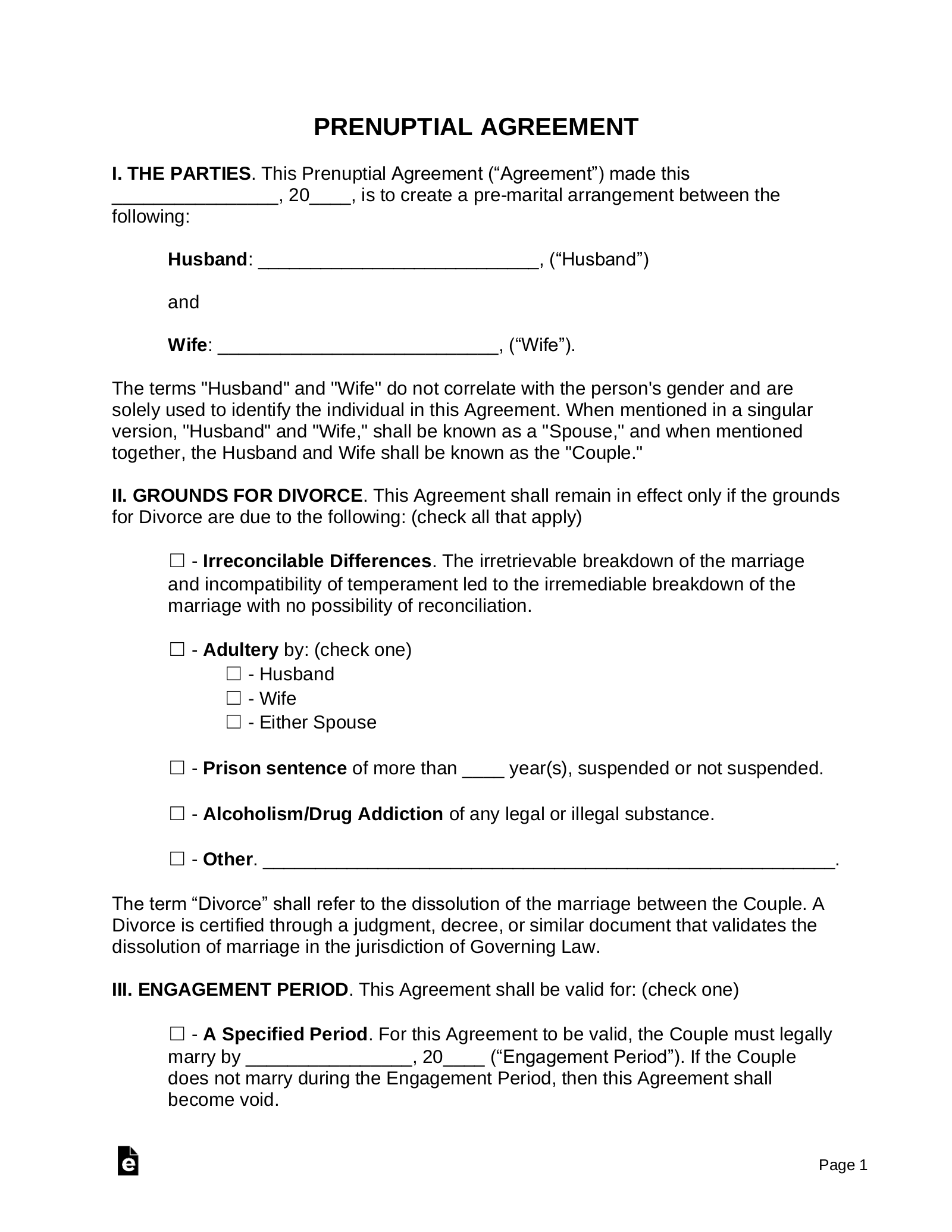

PRENUPTIAL AGREEMENT

THE PARTIES. This Prenuptial Agreement (“Agreement”) made this [DATE], is to create a pre-marital arrangement between the following:

[HUSBAND’S NAME], (“Husband”)

and

[WIFE’S NAME], (“Wife”).

SPOUSAL SUPPORT (ALIMONY). In the event of Divorce, the Couple agrees that: (check one)

☐ – There Shall Not be Spousal Support.

☐ – There Shall Be Spousal Support starting on the 1st day of the month following either Spouse filing a petition for Divorce in the state of Governing Law. The ☐ Husband ☐ Wife (“Paying Spouse”) shall pay to ☐ Husband ☐ Wife (“Receiving Spouse”): (check one)

☐ – In Perpetuity. Payments of $[AMOUNT] shall be due on the [#] of each month until either Spouse’s death, the remarriage of the Receiving Spouse, or modification or termination by further court order, whichever occurs first (“Spousal Support”).

☐ – For a Fixed Period. Payments of $[AMOUNT] shall be due on the [#] of each month: (check one)

☐ – For a period of [#] ☐ months ☐ years after the Divorce is filed. (“Spousal Support”).

☐ – Until [DATE] (“Spousal Support”).

☐ – Other. [OTHER]

MINOR CHILDREN. The Couple recognizes that there are: (check one)

☐ – No Minor Children of either the Husband or Wife are being brought into the marriage.

☐ – [#] Minor Children being brought into the marriage. The Minor Children are: (check all that apply)

☐ – From the Couple.

☐ – From either the Husband or Wife and described in Attachment E.

FINANCIAL DISCLOSURE. The Couple has: (check one)

☐ – Waived their right to view each other’s financials along with any other disclosures, forms, or discovery proceedings as by right under state law.

☐ – Disclosed the following financial disclosures in accordance with state law:

a.) [HUSBAND’S PROPERTY]

b.) [HUSBAND’S DEBTS & LIABILITIES]

c.) [WIFE’S PROPERTY]

d.) [WIFE’S DEBTS & LIABILITIES]

EFFECTIVE DATE. The effective date of this Agreement shall be the date of its execution by the second Spouse of the Couple to do so.

COURT ACTION. If a judgment for Divorce is obtained by either Spouse, the original of this Agreement shall be attached to the judgment. The court shall be requested to do the following:

a.) Approve the entire Agreement as fair and equitable;

b.) Order the Couple to comply with all of its executory provisions; and

c.) Merge the provisions of this Agreement into the judgment.

SEVERABILITY. If any term, covenant, condition, or provision of this Agreement is held by a court of competent jurisdiction to be invalid, void, or unenforceable, the remainder of the provisions shall remain in full force and effect and shall in no way be affected, impaired, or invalidated.

SIGNATURES AND DATES. This Agreement is agreed to by the Couple and signed in the presence of: (check all that apply)

☐ – Two (2) Witnesses

☐ – Notary Public

☐ – Legal Counsel (independent)

Husband’s Signature: _______________________________ Date: ______________

Print Name: _______________________________

Wife’s Signature: _______________________________ Date: ______________

Print Name: _______________________________

TWO (2) WITNESSES

Witness’s Signature: _______________________________ Date: ______________

Print Name: _______________________________

Witness’s Signature: _______________________________ Date: ______________

Print Name: _______________________________

NOTARY ACKNOWLEDGMENT

State of _________________

County of _________________

On this ____ day of _________________, 20____, before me appeared _________________ as the Husband and _________________ as the Wife of this Prenuptial Agreement who proved to me through government issued photo identification to be the above-named persons, in my presence executed foregoing instrument and acknowledged that (s)he executed the same as his/her free act and deed.

_______________________________

Notary Public

My commission expires: ___________

HUSBAND’S ACKNOWLEDGMENT OF INDEPENDENT LEGAL ADVICE

State of _________________

County of _________________

I, _________________, a licensed attorney in the state of _________________ do hereby certify on this day of _________________, 20____ that _________________, the Husband, sought and received sufficient legal consultation in reference to a Prenuptial Agreement. The Husband’s legal consultation was separate from _________________, the Wife, and acknowledge that the Husband’s rights and liabilities were explained fully and to their sole benefit. I attest under perjury that the Husband voluntarily executed this acknowledgment in my presence without any duress or undue influence.

Licensed Attorney: _______________________________ Date: ______________

Print Name: _______________________________

Husband’s Signature: _______________________________ Date: ______________

Print Name: _______________________________

WIFE’S ACKNOWLEDGMENT OF INDEPENDENT LEGAL ADVICE

State of _________________

County of _________________

I, _________________, a licensed attorney in the state of _________________, do hereby certify on this day of _________________, 20____ that _________________, the Wife, sought and received sufficient legal consultation in reference to a Prenuptial Agreement. The Wife’s legal consultation was separate from _________________, the Husband, and acknowledge that the Wife’s rights and liabilities were explained fully and to their sole benefit. I attest under perjury that the Wife voluntarily executed this acknowledgment in my presence without any duress or undue influence.

Licensed Attorney: _______________________________ Date: ______________

Print Name: _______________________________

Wife’s Signature: _______________________________ Date: ______________

Print Name: _______________________________

After discussion by both parties, spouses may want to seek legal counsel. It’s best for spouses to retain separate attorneys to avoid any conflict of interest. A cost-effective option can be to make the agreement and then bring it to a lawyer for authentication.

After discussion by both parties, spouses may want to seek legal counsel. It’s best for spouses to retain separate attorneys to avoid any conflict of interest. A cost-effective option can be to make the agreement and then bring it to a lawyer for authentication.