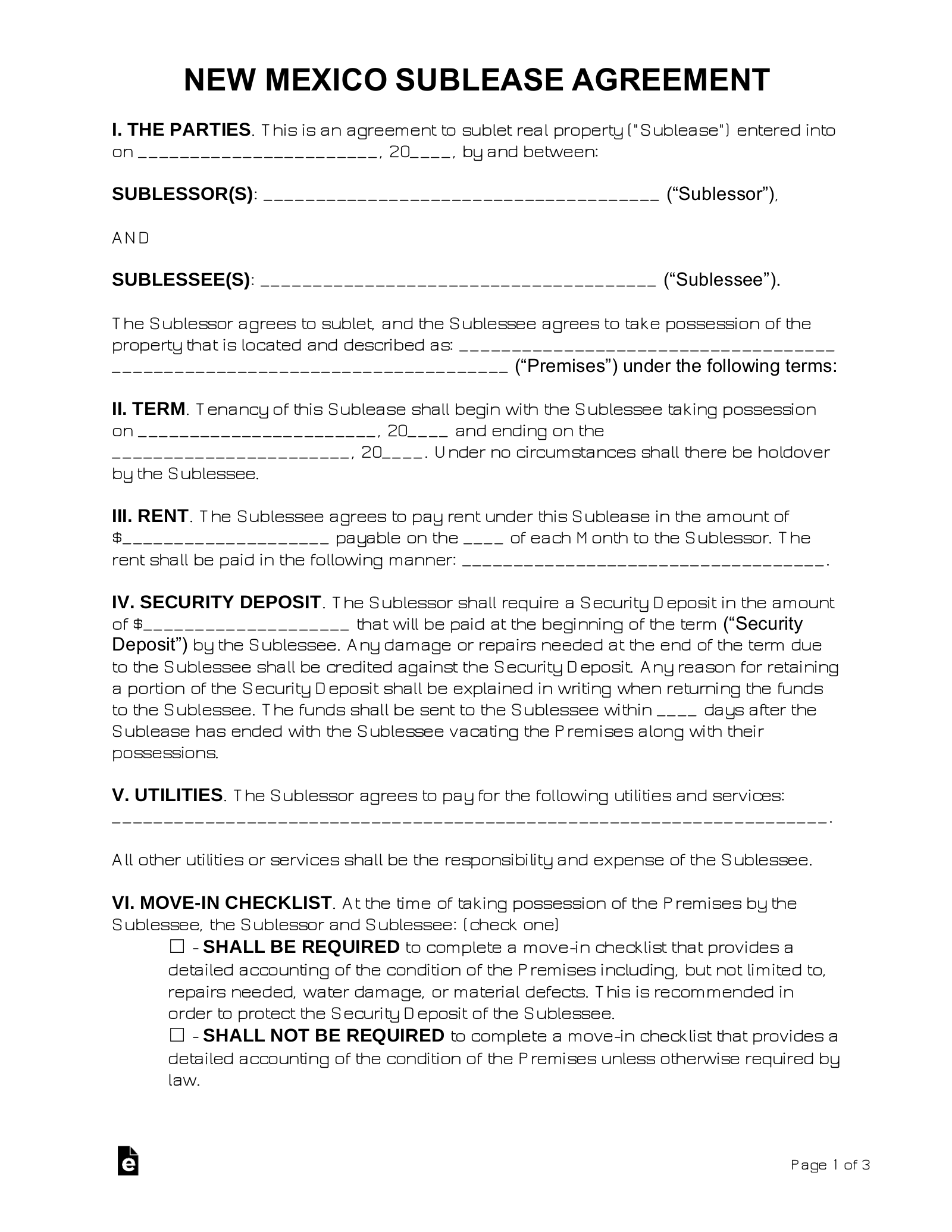

Updated March 18, 2024

A New Mexico sublease agreement is a type of rental contract in which a renter under a binding lease re-rents part or all of the premises to another individual. The sub-lessor acts as the landlord for the sub-lessee by performing the required duties, such as collecting rent and resolving issues affecting the tenancy.

Right to Sublet

New Mexico state law does not explicitly address the practice of subletting. A tenant’s lease will determine whether or not a premises may be sublet to a third party. Typically, the lease will either prohibit it entirely or it will define the conditions under which a sublease arrangement is permitted.

Open communication with the landlord is recommended if the lease is unclear or silent on the subject of subleasing. Whenever permission to sublease is desired or required, consider using a Landlord Consent Form.

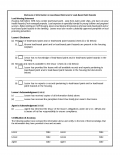

Short-Term (Lodgings) Tax

Short-term rentals (STR) in New Mexico are subject to “gross receipts tax,” which is similar to sales tax. The actual rate of this tax varies throughout the state. Additional local lodgings taxes may be levied, depending on the rental’s location.

New Mexico taxes on short-term rentals:

Some cities also require that the rental be registered/permitted. The additional cost and application process will vary by city.

Related Forms

Download: PDF, MS Word, OpenDocument

Download: PDF